Pharma stocks are in flavor after coming out of a long consolidation / fall. Pricing pressure and raw material cost pressure is easing making margins to grow. Ease in supply chain, falling inflation and renewed focus on health infra is giving optimism about strong revenue going forward. Being a ‘pharmacy capital’, India provide medicines to different part of the world and US, Europe is primary market for many Indian pharma companies.

Concord biotech IPO was open for subscription and received descent response from street. It opened for subscription from Aug 4 to Aug 8-23 in price band of ₹705 to ₹741. It was available for subscription in lot size of 20 shares which translates into minimum investment of ₹14100 for one lot. Stock will list on NSE,BSE on 18-aug-2023 while basis of allotment will happen on 11-aug-2023. IPO size is of 1,551 crore and it is a complete offer for sale(OFS) issue. IPO is subscribed 25x times till 5.30pm today(closing numbers may differ).

A little about company- Concord Biotech

Concord Biotech with its 3 manufacturing facility specializes in producing six fermentation based immunosuppressant APIs including tacrolimus, mycophenolate mofetil, mycophenolate sodium, cyclosporine, sirolimus and pimecrolimus. Its 3 manufacturing facilities are located in Gujarat India additionally it has 2 R&D units approved by DSIR(department of scientific and industrial research). As of March 31,2022 the company offered a total of 22 API products.

To know more about Concord Biotech watch following video:

For more information about company, click here

Concord biotech IPO details

The initial public offering of Concord bio was opened on Aug 4 and fully subscribed by investors. Until Aug 8 Concord bid have received 11x times subscription where high net worth individual(HNI) quota is subscribed 12 times and retail quota is booked 3.5 times whereas QIB quota is subscribed 35 times. The IPO is backed by late ace investor Shri Rakesh Jhunjhunwala’s RARE Trust. It is a complete offer for sale issue and Helix investment holding, a part of Quadria capital fund is completely exiting the company offering their complete stake in offer.

Company’s anchor book

Ahmedabad based company raised 465 crore from anchor investors at upper price band. Top global investors participated in the anchor book included Abu Dhabi Investment Authority, Amundi Funds, HSBC Mutual Fund, WF Asian Reconnaissance Fund, SBI Life Insurance, Motilal Oswal Mutual Fund, Aditya Birla Sun Life, Government of Singapore, and Pinebridge Global Funds.

Rare Enterprises, a key shareholder in Concord Biotech with a 24.09 percent stake will have lock-in for six months post the pharmaceutical company’s IPO listing, informed company’s management. Rare was founded by the late Rakesh Jhunjhunwala.

Concord Biotech financials

Company’s financials look healthy as company reported growth in FY-23 in all parameters. Revenue is up from 630crore in 2021 to 884crore in 2023. Net profit is up from 234 crore in 2021 to 240crore in 2023 despite facing pricing pressure in developed market.

Concord biotech- a pharma stock with lot of promise

What I like-

👍Concord Biotech pharma an India-based biopharma company and one of the leading global developers and manufacturers of select fermentation-based APIs across immunosuppressants and oncology in terms of market share, based on volume in 2022.

👍Commanded a market share of over 20% by volume in 2022 across identified fermentation-based API products, including mupirocin, sirolimus, tacrolimus, mycophenolate sodium and cyclosporine.

👍Concord launched its formulation business in India as well as emerging markets, including Nepal,

Mexico, Indonesia, Thailand, Ecuador, Kenya, Singapore and Paraguay, and have further expanded to the United States. It is expanding it’s footprints to newer unexplored territory with good expansion opportunities.

👍Concord manufacture bio-pharmaceutical APIs through fermentation and semi-synthetic processes, across the therapeutic areas of immunosuppressants, oncology and anti-infectives; and (ii) formulations, which are used in the therapeutic areas of immunosuppressants, nephrology drugs and anti-infective drugs for critical care. Some of these drugs and techniques are very hard to manufacture.

👍Concord is amongst the few companies globally that have successfully and sustainably established and scaled up fermentation-based API manufacturing capabilities, Fermentation is a challenging process as it involves working with microbial strains and culture, controlling multiple processes and performing various

purification steps. Small modifications to the process may lead to relatively large variances in the outputs.

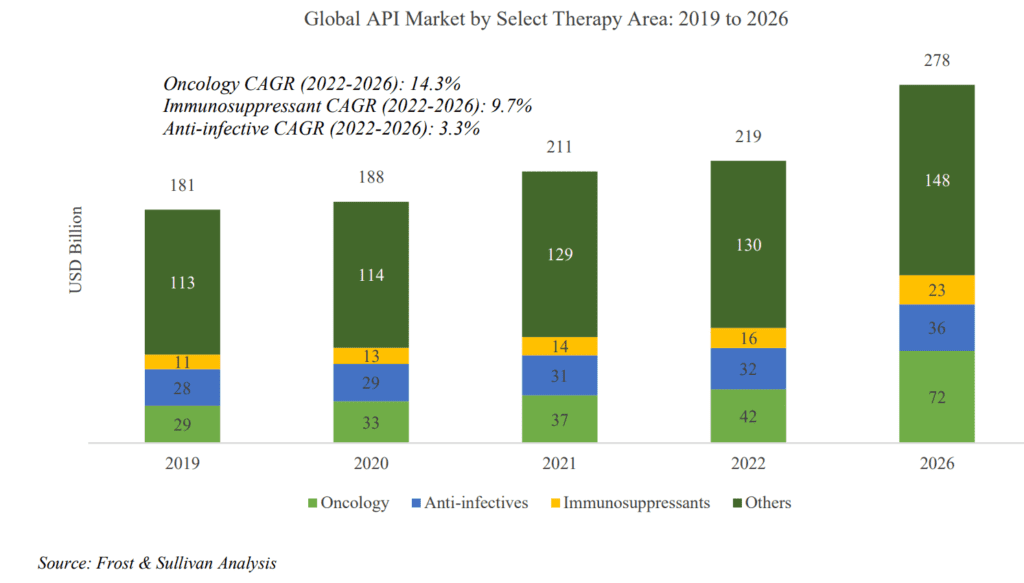

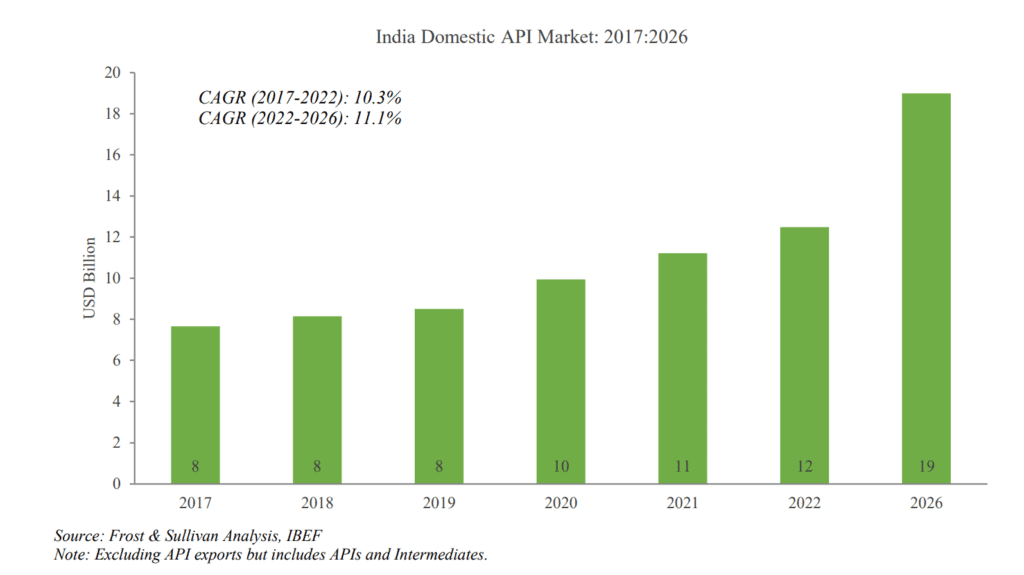

👍Concord operates in a fast growing market, many of it’s main market segments are growing as fast as 10+% CAGR.

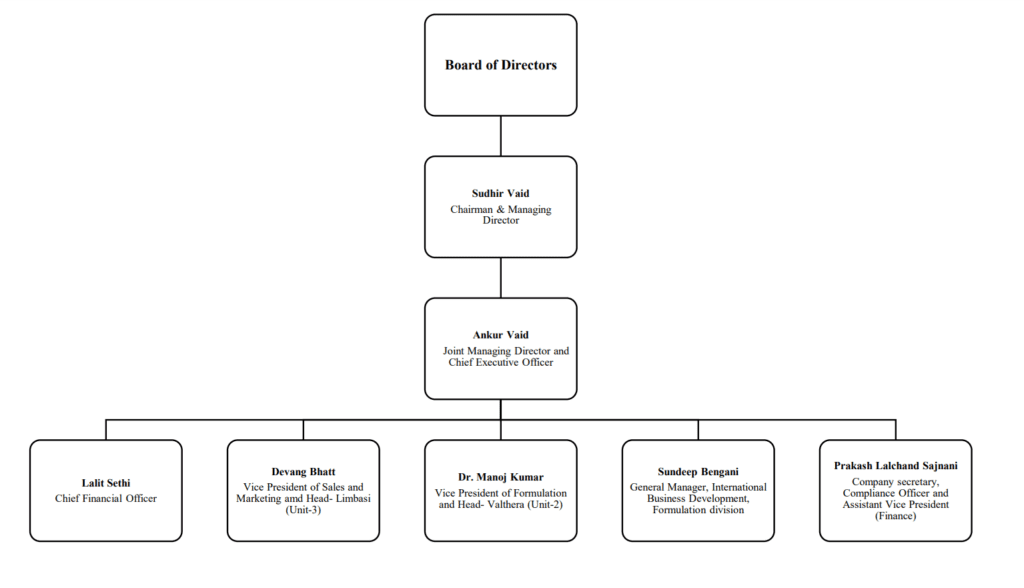

👍Very experienced management with across segment knowledge, clean track record. No litigation against management and zero criminal proceedings against company.

Risks

Apart from general risk which pharma companies face like working in very regulated environment, observation risks, policy change risk etc, we found following risks which could effect financial performance of this pharma stock.

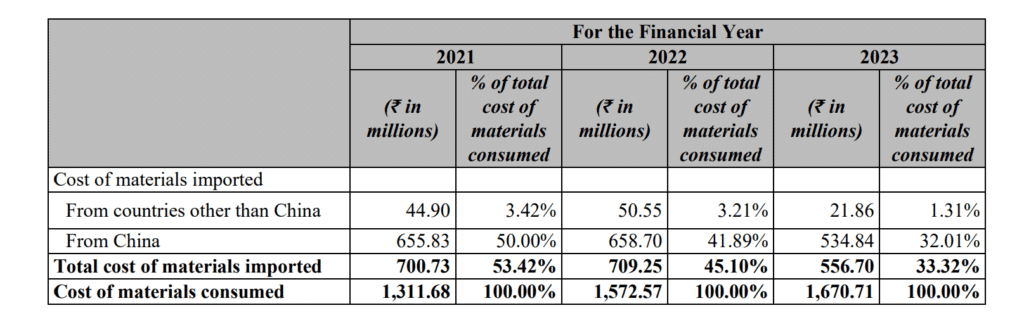

👎Higher dependency on China for raw materials, given the issues with China any uncertainty could harm company’s financial strength.

Though company is significantly decreasing it’s dependence on China for raw materials(from 50% in 2021 to 32% in 2023) and management is confidant of further reducing it in coming years but it is a risk.

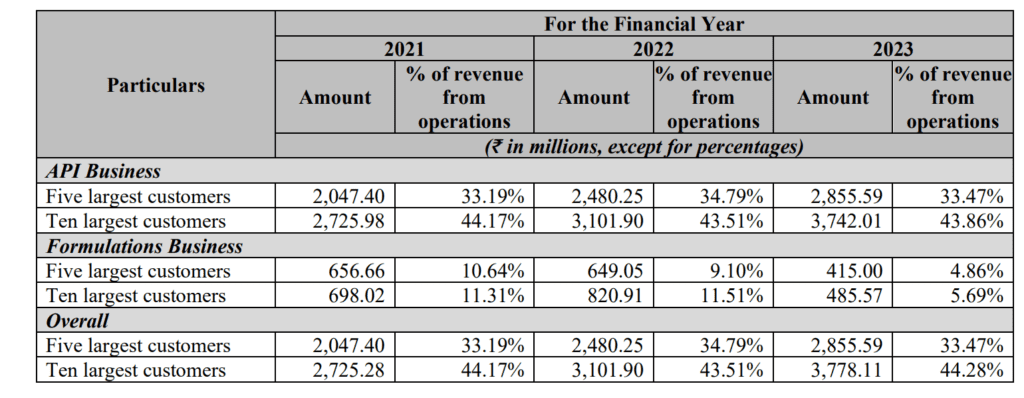

👎Higher dependence on top 10 customers, a significant portion of company’s revenue is coming from these top 10 customers and any unfavorable condition on them will affect the order flow/ revenue of concord biotech.

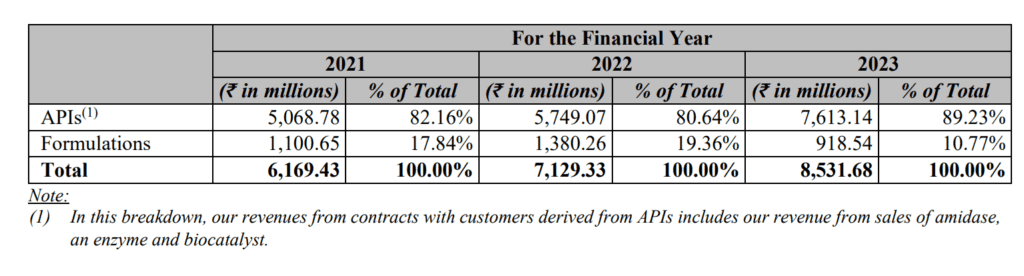

👎Company’s concentration on APIs is high, though company is significantly growing it’s formulation portfolio but still major chunk of revenue comes from API.

👎Like other pharma/R&D companies concord biotech also require huge working capital requirement so any adverse impact on cash generation capacity will dampen the revenue of company and will adversely effect its operations.

View on Concord Biotech(valuation)

Concord biotech is a leader in immunosuppressants API, it operates in segments with high entry barrier due to resources and skills needed. It competes with Chinese and Korean Peers so it is an excellent China+1 opportunity. Concord operates at an average operating margin of ~40%, which is way better than average margin of other industry Peers commanding average margin of ~24-25%. It has a PAT margin of 28.1%. Concord is a positive net cash flow company for the past two years and its cash conversion ratio improved to 71% in FY23 from 51% in FY21.

Concord biotech has aggressive plans for formulation and injectables, though presently company’s 32% of raw materials are coming from China but management is confident of significantly reducing it as most of these inputs can be made at company’s new Limbasi plant. Company have no comparable peer in Indian market. Biocon, Solara, ferments either have limited portfolio or commoditized molecules.

Conclusion

Though Concord biotech has brought its IPO at perfect to expensive valuation but looking at it’s business moat and China+1 opportunity it will remains an attractive play for long term in my view. Valued at 22.2x 12m EV/EBITDA and at a P/E of 32 at upper price band valuation vise it is priced to perfection but it can be a valuable portfolio addition to fill the gap of value API play. It has a RoCE of 24%. While the company has no leverage as D/E ratio is zero. Due to no leverage we are not concerned of it being a complete Offer for sale(OFS) issue.

Grey market premium of Concord pharma is ₹160 on Aug 13, it means if it remains same till listing day, it will debut market at 740+160(approx), Though I don’t give too much weight to Grey market premium. In my view Concord is ticking all checkmarks to be a great long term pick from API/Formulation.

Click here to read about Top pharma pick from FinNinutes

Disclaimer: Please consult your financial advisor before making any investment decision.