SWP Calculator — Step‑Up Focus

Premium FinMinutes UI. Simple inputs, step‑up, crisp charts & year-by-year table.

Inputs

Year-by-Year Summary

| Year | Opening | Total Withdrawal | Closing | Real Closing |

|---|

📤 Share your SWP plan with family or your advisor:

Try the full version → Advanced SWP Calculator

SWP calculator with step up: A Systematic Withdrawal Plan (SWP) is one of the most reliable ways to generate a steady income from your investments, especially during retirement. But as inflation increases your living expenses every year, a fixed SWP amount may not keep pace.

This is where a SWP calculator with step up becomes a powerful planning tool. A step-up SWP allows your withdrawal amount to automatically increase every year by a specific percentage. This keeps your monthly or annual withdrawals aligned with rising expenses while still aiming to preserve the longevity of your investment corpus.

To simplify this entire process, FinMinutes has developed a premium SWP Calculator with Step-Up, featuring a clean interface, clear charts, real-balance visualisation, stress-year analysis, survival rating, and safe SWP recommendations.

This tool helps you understand exactly how long your corpus will last, how step-up affects your withdrawals, and what withdrawal amount is sustainable for 20–30+ years.

What Is an SWP (Systematic Withdrawal Plan)?

A Systematic Withdrawal Plan (SWP) is a method of withdrawing a fixed amount from your mutual fund or investment corpus at regular intervals, monthly, quarterly, or annually. It is the opposite of a SIP (Systematic Investment Plan), where you invest periodically.

With an SWP:

- Your investment continues to grow.

- Withdrawals are made at predefined intervals.

- You get predictable income without redeeming your entire investment.

SWP is widely used for:

- Retirement income

- Supplementing salary or business income

- Generating passive income

- Managing cash flows for long-term goals

Why Step-Up Is Needed in an SWP

Inflation reduces the purchasing power of money every year. If you withdraw ₹40,000 per month today, the same amount may not be enough 10–15 years later. A step-up SWP solves this problem by increasing your withdrawal amount every year by a chosen percentage (for example, 5% per year).

This ensures:

- Your income adapts to inflation

- Your lifestyle is maintained

- Withdrawal planning stays realistic

A SWP calculator with step-up shows exactly how these increasing withdrawals impact your investment corpus over the years. If you want to use the advanced version of the SWP calculator, Finminutes has the exact tool.

What Is a Step Up SWP?

A step-up SWP means:

- You withdraw a fixed amount every period (month, quarter, or year)

- At the end of every year, your withdrawal increases by a step-up percentage

- Example: If your monthly withdrawal is ₹30,000 and step-up rate is 5%, then:

- Year 1: ₹30,000 monthly

- Year 2: ₹31,500 monthly

- Year 3: ₹33,075 monthly

- And so on…

Your expenses increase each year, so your withdrawals should too. A SWP calculator with step up helps find a balance between increasing withdrawals and your corpus sustainability.

Key Features of the FinMinutes SWP Calculator With Step Up

Our tool is built to give a complete and practical understanding of your withdrawal sustainability. Here are the core features:

1. Clean and Simple Input Panel

You only need to provide:

- Initial investment corpus

- Withdrawal amount

- Frequency (monthly / quarterly / yearly)

- Annual step-up percentage

- Expected return (per annum)

- Projection period (years)

- Optional: Inflation for real-value calculation

Each input field includes tooltips with guidance so even beginners understand what to enter.

2. Automatic Number Recognition (5L, 2cr, 10k)

The calculator accepts shorthand such as:

- 5L → ₹5,00,000

- 2cr → ₹2,00,00,000

- 50k → ₹50,000

This makes input extremely quick.

3. Interactive Donut and Line Charts

Charts provide a visual understanding of:

- How much was withdrawn (total SWP)

- How much corpus remains at the end

- Year-by-year closing balance

- Optional Real Corpus (inflation-adjusted value)

Charts automatically resize for mobile and desktop screens.

4. Step-Up Impact Analyzer

This unique feature calculates how much extra money you withdraw because of annual step-ups compared to a no-step baseline.

You immediately see:

“Extra withdrawn due to step-ups: ₹X lakh”

This is highly valuable for retirement planning.

5. Stress-Year Indicator

The calculator identifies the year where:

- Withdrawal-to-opening-balance ratio is highest

- Corpus is under maximum pressure

This tells you when your SWP becomes risky.

6. Safe SWP Suggestion for 30 Years

The tool runs internal simulations to recommend a safer withdrawal amount that can potentially sustain 30 years of retirement.

It shows:

“Safe SWP: ₹X per month”

This helps in setting realistic expectations.

7. Survival Rating (Excellent / Good / Moderate / Risky)

Based on how long your corpus lasts:

- 35+ years → Excellent

- 25–35 years → Good

- 15–25 years → Moderate

- Below 15 years → Risky

This rating is extremely intuitive for users.

8. Year-by-Year Table With Real and Nominal Values

The table includes:

- Opening balance

- Total withdrawal

- Closing balance

- Real (inflation-adjusted) closing value

You can download the full report as:

- CSV

9. Sharing Options (WhatsApp + Telegram)

Users can instantly share:

- Their SWP summary

- Sustainability report

- Safe SWP suggestion

Great for financial advisors, family planning, and consultation.

How the SWP Calculator With Step Up Works

The SWP calculator uses monthly compounding and applies step-up yearly:

- Investment corpus grows monthly based on expected return.

- Withdrawals happen according to selected frequency.

- At the end of every year:

- Withdrawal amount increases by step-up %

- This continues until:

- Corpus becomes zero

- Or projection period ends

The simulator runs hundreds of iterations in milliseconds to give accurate projections.

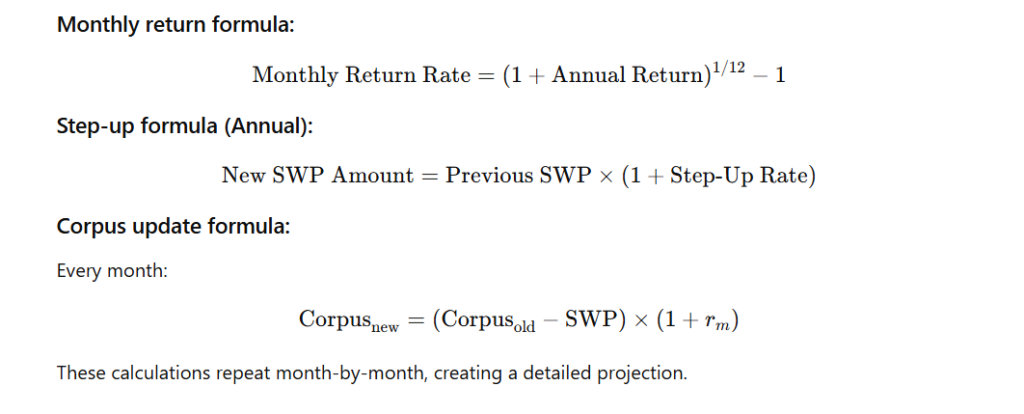

Formula Used in SWP Step-Up Calculation

Who Should Use Our SWP Calculator With Step Up?

This tool is ideal for:

1. Retirees

To plan sustainable monthly income for the next 20–30 years.

2. FIRE Community

Those planning early retirement rely heavily on SWP models.

3. Financial Advisors

To create client reports instantly.

4. Mutual Fund Investors

Anyone who wants predictable, inflation-adjusted income.

5. NRIs & Long-Term Investors

Helps estimate remittance-based withdrawals.

Benefits of Using a Step Up SWP Calculator

1. Maintains Purchasing Power

Withdrawals increase annually to offset inflation.

2. Realistic Retirement Planning

A fixed withdrawal does not reflect real-world living expenses. Step-Up fixes this.

3. Prevents Over-Withdrawal

You see exactly when your corpus could run out.

4. Helps Set a Safe Withdrawal Amount

The Safe SWP feature uses internal simulations to recommend sustainable levels.

5. Visual Insights Make Decisions Easier

Charts, stress-year, and survival rating simplify interpretation.

6. Enables Scenario Testing

Try different combinations:

- Return 8% vs 12%

- Step-Up 3% vs 7%

- SWP monthly vs yearly

How to Use the Finminutes SWP Calculator With Step-Up

1. Enter Your Initial Investment Corpus

Example: 50L, 75L, 1cr.

2. Enter Monthly Withdrawal Amount

Example: 40,000 per month.

3. Select Frequency

- Monthly (default)

- Quarterly

- Yearly

4. Enter Annual Step-Up (%)

Most retirees use 3–6%.

5. Enter Expected Annual Return (%)

Typically:

- Conservative: 7–9%

- Balanced: 9–12%

- Aggressive: 12–15%

6. Choose Projection Period

10–40 years.

7. (Optional) Add Inflation Rate

Turn on real-value toggle for inflation-adjusted balances.

8. Click “Calculate”

The tool displays:

- Total withdrawn

- Final corpus

- Corpus sustainability

- Effective yield

- Step-up impact

- Stress-year

- Safe SWP

- Survival rating

- Charts & table

Example Scenario

Let’s say:

- Corpus: ₹1,00,00,000

- Monthly SWP: ₹50,000

- Step-Up: 5%

- Return: 10%

- Projection: 30 years

- Inflation: 6%

The calculator will show:

- Total withdrawn over 30 years

- Final corpus (nominal and real)

- The year when withdrawals pressure the corpus most (stress-year)

- Whether the SWP is sustainable

- A safer recommended SWP amount

This makes it easier to refine your retirement plan.

SWP Calculator with step up: FAQs

What is a SWP calculator with step up?

It is a tool that helps you estimate how long your investment corpus will last when your withdrawal amount increases every year by a fixed percentage.

Why should I use a step-up in my SWP?

Because inflation increases expenses annually. Step-up keeps your withdrawals realistic.

What is a good step-up percentage?

Typically, 3–6% per year based on inflation expectations.

Does step-up reduce the corpus faster?

Yes. Higher step-up rates can shorten sustainability. Our SWP calculator with step up shows your optimal rate.

Can I calculate SWP monthly, quarterly, or yearly?

Yes. Finminutes SWP calculator supports all three frequencies.

What is Safe SWP shown in the results?

It is a recommended withdrawal amount that aims to sustain your corpus for 30 years, based on your returns and step-up rate.

What does the term Stress Year mean in the Finminutes SWP calculator with step up?

It is the year when the withdrawal-to-opening-balance ratio is highest, indicating peak strain on the corpus.

Can I download the SWP projection?

Yes, our SWP calculator allows CSV and PDF downloads.

Does the calculator show inflation-adjusted returns?

Yes. You can toggle “Show real balances” to see inflation-adjusted corpus values.

Is the Finminutes SWP calculator suitable for retirement planning?

Absolutely. It is designed specifically to help retirees and pre-retirees plan long-term income sustainability.

Conclusion

A SWP Calculator with Step Up is essential for anyone relying on investment withdrawals for long-term income. It gives you a realistic picture of:

- How long your corpus will last

- How inflation affects withdrawals

- Whether your step-up rate is sustainable

- What a safe SWP level should be

- How your retirement lifestyle can be supported

The FinMinutes SWP Step Up Calculator brings all of this together in a clean, modern, and intuitive interface. Use it to test different scenarios and build a safe, confident, and inflation-proof withdrawal plan for your future.