SWP Calculator — Inflation Focus

Analyse how inflation affects your withdrawal power. Real vs nominal balances, withdrawal series, stress-year and safe SWP.

Inputs

Year-by-Year Summary

| Year | Opening | Withdrawal | Closing (Nominal) | Closing (Real) |

|---|

SWP Calculator With Inflation: A Systematic Withdrawal Plan (SWP) is one of the most reliable strategies for creating a monthly cash flow from your mutual fund investments. However, the biggest blind spot for most investors is that traditional SWP calculators ignore inflation, even though inflation is the single largest threat to withdrawal sustainability in India.

This is where a modern SWP calculator with inflation adjustment becomes essential. The FinMinutes SWP With Inflation Tool is built to solve this exact problem.

It does not just estimate how long your corpus will last; it shows your real vs nominal corpus, models inflation-adjusted withdrawals, accounts for yearly step-up increases, highlights stress years, and even computes a Safe SWP (30-year) amount.

What Is an SWP Calculator With Inflation?

A standard SWP calculator tells you:

- How much you can withdraw monthly

- How long the corpus lasts

- Final balance at the end of the projection

But these values are nominal, meaning they do not adjust for rising prices. A SWP calculator with inflation goes one step further by showing:

- Real corpus (inflation-adjusted balance)

- Real withdrawal impact

- Real vs nominal yield

- Real sustainability of the corpus

This gives a far more accurate picture of how long your investments can truly support your lifestyle.

Why Inflation Matters in SWP Planning

Inflation silently but aggressively erodes purchasing power. Even at a modest 6% inflation:

- Expenses double roughly every 12 years

- A ₹50,000 monthly need today becomes ₹1 lakh in future

- Real corpus falls faster unless returns exceed inflation

- A “safe-looking” SWP amount may actually be unsustainable

For retirees who rely on monthly withdrawals, ignoring inflation can cause severe shortfalls later in life. A proper SWP calculator must therefore simulate:

- Monthly compounding

- Withdrawals as per frequency

- Yearly step-up to match rising expenses

- Real closing balance (after adjusting for inflation)

The FinMinutes SWP With Inflation Calculator does all of the above simultaneously.

How the FinMinutes SWP With Inflation Tool Works

The calculator performs a monthly simulation of your portfolio using:

- Investment corpus

- Withdrawal frequency (monthly/quarterly/yearly)

- Step-up percentage (optional)

- Expected returns

- Inflation rate

- Projection duration

It then computes:

- Nominal closing balance

- Real (inflation-adjusted) closing balance

- Year-wise withdrawals

- Total withdrawn amount

- Stress year withdrawal strain

- Safe SWP (30-year)

- Effective real vs nominal yields

This is far more sophisticated than typical SWP calculators that merely apply a withdrawal percentage on annual returns.

Key Inputs Explained

1. Initial Corpus

The total amount you are investing in the mutual fund. Supports shorthand input like:

- 50L

- 1.2cr

- 75k

2. Withdrawal Amount

The monthly, quarterly, or yearly withdrawal amount.

3. Withdrawal Frequency

Choose how often you want a payout:

- Monthly (most common for retirees)

- Quarterly

- Yearly

4. Expected Return (p.a.%)

Your assumed return before adjusting for inflation. For equity-heavy portfolios, 10–12% is typical.

5. Inflation Rate

The calculator uses this to compute real earnings. India’s long-term inflation has ranged between 5%–7%.

6. Projection Years

How long you want to simulate your retirement income.

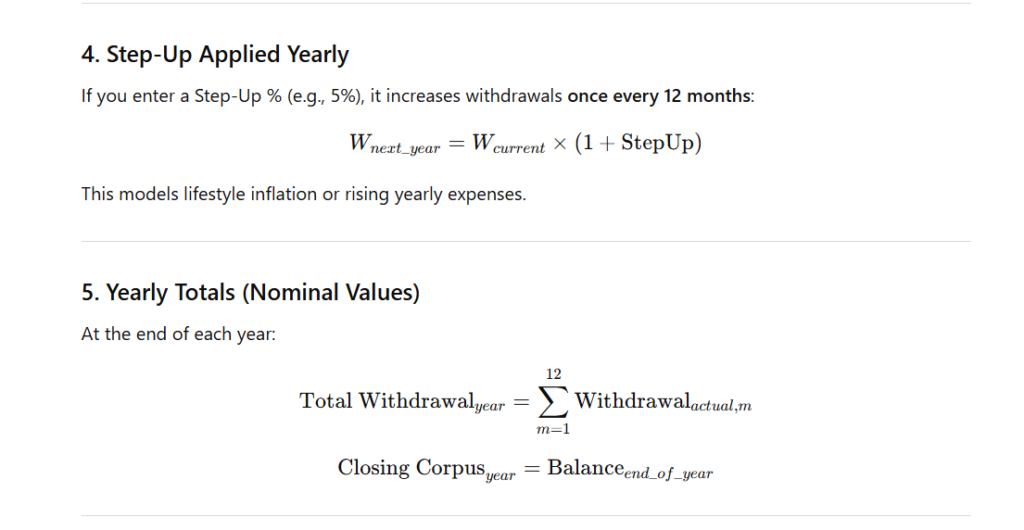

7. Annual Step-Up (%)

Optional but powerful feature: Increase withdrawals yearly to keep pace with expenses.

For example:

- You withdraw ₹30,000/month

- Expenses grow by 5% annually

- You apply a 5% step-up

- Withdrawals automatically grow each year

8. Real Value Toggle

Turns ON/OFF the display of inflation-adjusted values.

Understanding the Results & Metrics

The FinMinutes SWP Calculator doesn’t provide just a few numbers; it gives a complete financial diagnostic of your withdrawal strategy.

1. Total Withdrawn

This is the full amount withdrawn over the projection period. Example: If you withdraw ₹20,000 per month for 20 years → ₹48 lakhs total (plus step-up adjustments). The tool also shows the amount in words (e.g., 48 L).

2. Final Corpus (Nominal)

Your ending balance without adjusting for inflation. This shows how much money technically remains in the investment.

3. Final Corpus (Real / Inflation-Adjusted)

Much more important. This tells you the actual purchasing power of your ending corpus.

Example:

- Nominal corpus left: ₹50 lakh

- Real corpus: ₹18 lakh

Meaning: Your “₹50 lakh” is only worth ₹18 lakh in today’s money.

4. Corpus Sustainability (Years Before Exhaustion)

This tells you how long your money lasts before fully depleting. If it shows:

- 17 years → Your SWP is not sustainable

- 30+ years → Comfortable

- 35+ → Very strong retirement plan

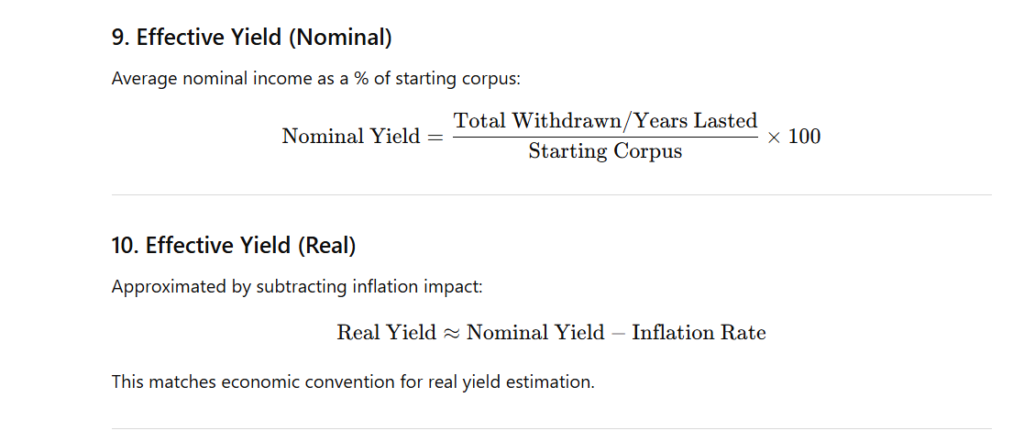

5. Effective Yield (Nominal & Real)

Nominal Effective Yield: Average annual income vs your corpus.

Real Effective Yield: Nominal yield minus inflation impact.

Example:

- Nominal yield: 8.20%

- Inflation: 6%

- Real yield: 2.20%

This is crucial because real yield is what determines long-term sustainability.

6. Step-Up Impact

Shows how much additional amount you withdrew due to annual withdrawal increases. Helps retirees analyse whether they are increasing withdrawals too aggressively.

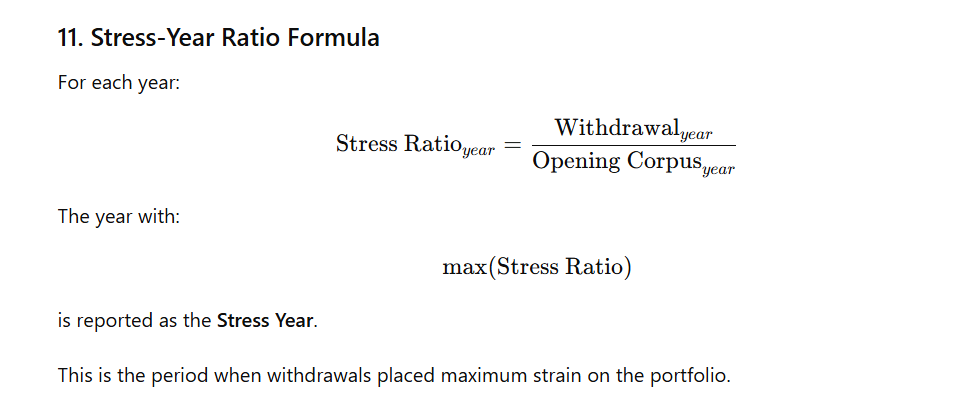

7. Stress Year Analysis

This reveals the year when withdrawals put maximum strain on the corpus. Why it matters:

- Identifies danger periods

- Helps adjust withdrawal patterns

- Avoids premature depletion

8. Safe SWP (30-Year)

This uses a binary search algorithm to compute a safe withdrawal amount for 30 years. Unlike thumb rules (like 4% rule), this:

- Considers inflation

- Considers returns

- Considers compounding

- Considers your frequency

This makes it far more accurate for Indian investors.

9. Donut Chart (Withdrawn vs Final Corpus)

A clean visualization that helps you instantly understand:

- Proportion withdrawn

- Remaining nominal value

Works beautifully for comparison with step-up ON vs OFF.

10. Advanced Line Chart (L2 Metric Set)

The line chart includes:

- Nominal Closing Balance

- Real Closing Balance

- Nominal Withdrawal Series

- Real Withdrawal Series

This allows you to see:

- When real corpus starts declining

- Whether withdrawals outrun returns

- How inflation reshapes the curve

- Whether step-ups are too aggressive

This is one of the most advanced SWP visualisations available online.

11. Year-by-Year Table

The tabular breakdown includes:

- Opening balance

- Total yearly withdrawal

- Nominal closing balance

- Real closing balance

You can also download CSV or PDF instantly.

12. Highlight Summary Box

A simple, human-readable insight: “Starting with ₹25,00,000 and SWP ₹20,000, the SWP lasts approx 17 years. Safe SWP (30y): ₹13,450.” It is perfect for sharing with financial advisors or clients.

Formulas Used in the SWP Calculator With Inflation

A professional-grade SWP calculator must simulate portfolio behaviour across time instead of using simple annual multipliers. The FinMinutes SWP With Inflation Calculator uses monthly compounding, period-based withdrawals, and inflation adjustments to compute real sustainability. Below are all the formulas that power the tool.

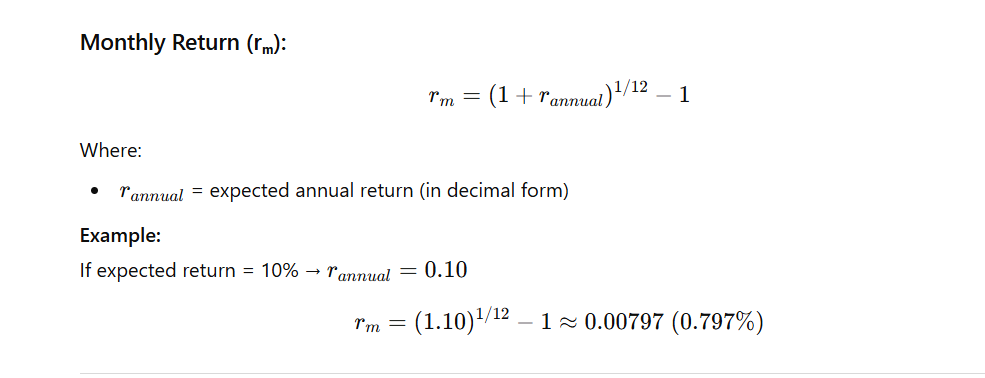

1. Monthly Compounding Formula

The expected annual return you enter (e.g., 10% p.a.) is converted into an equivalent monthly return using:

2. Monthly Balance Growth Formula

Each month, before withdrawals, the corpus grows:

This tool models monthly compounding properly.

3. Withdrawal Application Formula

Depending on your frequency:

- Monthly → withdraw every 1 month

- Quarterly → withdraw every 3 months

- Yearly → withdraw every 12 months

Whenever a withdrawal month is reached:

Prevents corpus from going negative.

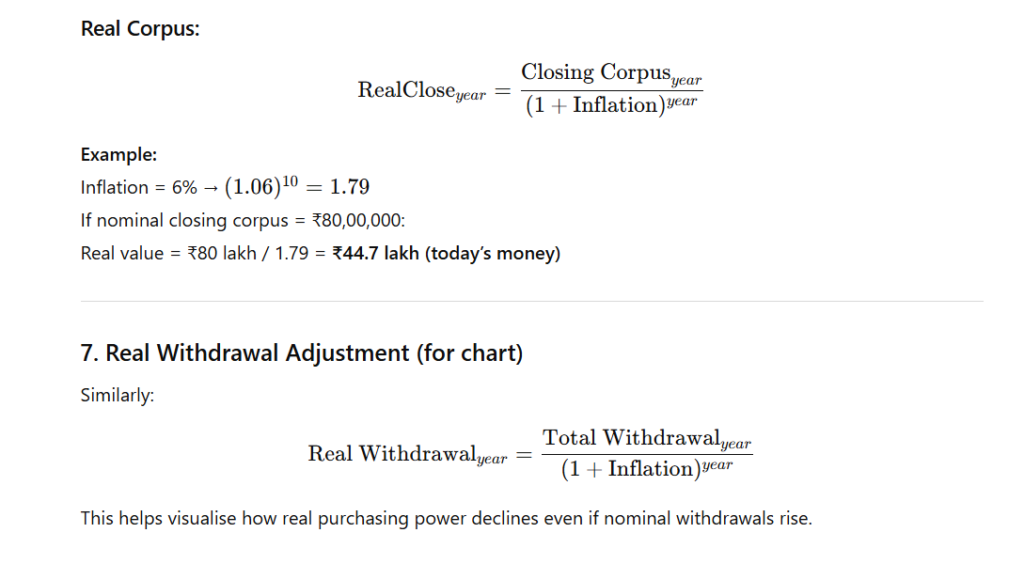

6. Real (Inflation-Adjusted) Corpus Formula

To determine true purchasing power, the nominal closing balance is adjusted for inflation:

8. Corpus Sustainability Formula

The tool checks year-by-year until:

The last year with a positive balance = Corpus Sustainability (in years).

Why an SWP Calculator With Inflation Is Better Than a Regular SWP Calculator

1. Realistic retirement planning

Nominal values are misleading. Real values tell the truth.

2. Helps protect purchasing power

A 6% inflation wipes out half of your corpus’s real value every 12 years.

3. Avoids income shortfall in later years

Shows you exactly when withdrawals become unsustainable.

4. Allows safe, inflation-adjusted withdrawal planning

Especially useful for:

- Senior citizens

- FIRE community

- SWP-dependent investors

- Anyone planning early retirement

5. Supports step-up withdrawals with sustainability checks

Most tools completely ignore this.

Who Should Use the SWP With Inflation Calculator?

- Retirees who depend on monthly withdrawals

- Investors planning FIRE

- Anyone shifting from accumulation to income generation

- Investors wanting inflation-protected cash flow

- Mutual fund advisors & financial planners

- Investors looking to run scenario analysis

Tips for Using the SWP With Inflation Calculator Effectively

1. Pick realistic return assumptions

10–12% for long-term equity

6–7% for hybrid

4–6% for debt-oriented

2. Don’t underestimate inflation

Use at least 5–6% for long-term planning.

3. Test multiple withdrawal strategies

Try:

- Fixed withdrawal

- Step-up withdrawal

- Safe SWP mode

4. Pay attention to the Stress Year

This is where portfolios often break.

5. Use Safe SWP as a boundary

If your withdrawal > safe SWP → adjust downward.

Finminutes SWP Calculator with Inflation: FAQs

What makes this SWP calculator different?

It adjusts every year’s balance for inflation and provides real corpus value, real yield, and stress-year analysis, something most calculators do not include.

How accurate is the Safe SWP calculation?

It uses binary search across thousands of simulations to find the exact withdrawal amount that sustains 30 years. This method is more accurate than percentage rules.

What inflation rate should I use?

For Indian conditions, 4-6% is recommended.

Should I use a step-up percentage?

Yes, if your expenses rise yearly. But check sustainability using this calculator.

What happens when the real corpus becomes negative?

It means inflation has eroded purchasing power significantly, even if the nominal value remains.

Can this calculator model early retirement plans (FIRE)?

Yes. Simply increase projection years to 40–50 years.

Why does the real closing balance drop faster than nominal?

Because inflation compounds annually, the nominal value is not inflation-adjusted.

Does the tool support Indian number formats?

Yes, it supports lakh, crore, and even shorthand inputs like 5L, 1.2cr, 75k.

Conclusion: The Most Advanced SWP Calculator With Inflation for Indian Investors

If you are planning retirement or long-term withdrawals, an inflation-adjusted SWP calculator is not optional; it is essential. The FinMinutes SWP Calculator With Inflation gives you:

- Inflation-adjusted corpus analysis

- Real vs nominal projections

- Withdrawal sustainability

- Step-up modelling

- Stress-year identification

- Safe SWP simulation

- Rich charts & downloadable reports

This tool offers one of the most complete SWP planning experiences available online, designed specifically for Indian financial realities. Whether you are a retiree, advisor, or long-term wealth planner, this calculator gives you clarity, confidence, and control over your withdrawal strategy.