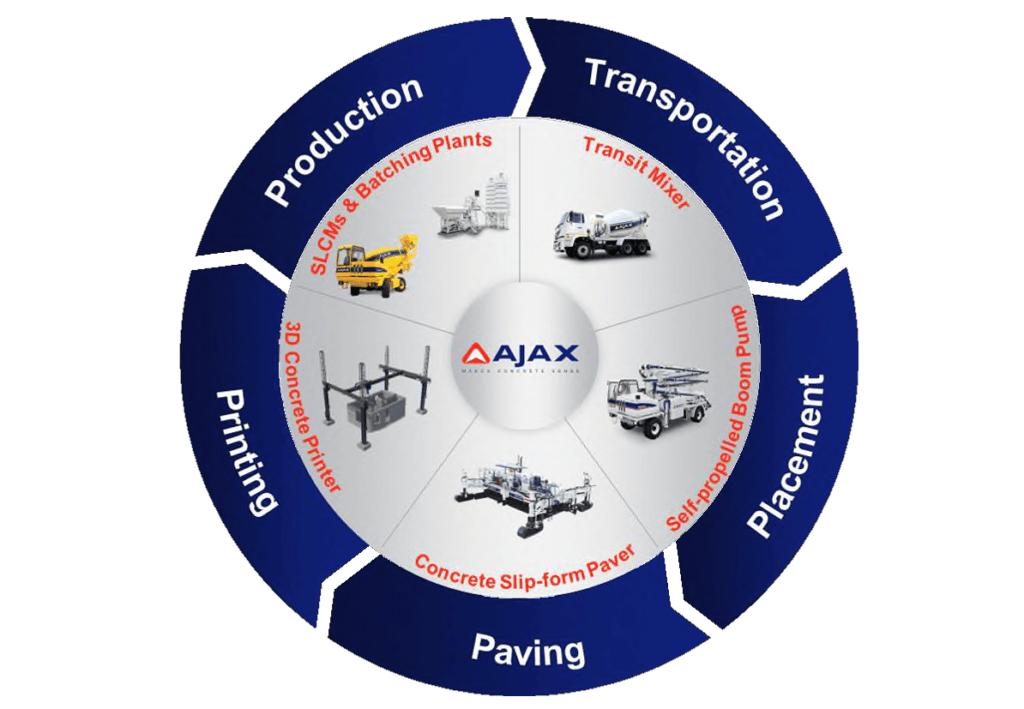

Ajax Engineering is a leading player in India’s concrete equipment industry, holding a 75%+ market share in the Self Loading Concrete Mixer (SLCM) segment. It has a comprehensive range of concrete equipment,

services and solutions across the concrete application value chain, and its product portfolio contains batching plants, transit mixers, concrete pumps, and slipform pavers, playing a key role in India’s infrastructure growth.

As of September 30, 2024, the company has developed over 141 concrete equipment variants catering to the concrete application value chain, and over the last ten years, the company has sold over 29,800 concrete equipment units in India. The company’s near monopoly in SLCMs, which accounted for 14% of India’s concrete production in FY24, highlights its dominance and critical role in on-site concrete production.

Ajax Engineering IPO GMP

Ajax Engineering IPO GMP made a high of ₹60 on 6th February but gave up gains and is now trading at a low of ₹15 on 12th February. So, Ajax Engineering IPO Expected Returns are 2% on listings.

Ajax Engineering IPO details

| Industry | Construction Equipment |

| Open Date | Feb 10, 2025 |

| Close Date | Feb 12, 2025 |

| Price Band | INR 599 – 629 |

| Issue Size (INR cr) | 1,269 |

| QIB Share (%) | ≤ 50% |

| Non-Inst Share (%) | ≥ 15% |

| Retail Share (%) | ≤ 35% |

| Post Issue Market Cap (in cr) | 7,196 |

| Face Value INR | 1.0 |

More about Ajax Engineering

AEL operates four manufacturing facilities in Karnataka, supported by technology-driven processes that enhance product quality and efficiency. It has 51 dealerships across 23 Indian states and 25 international dealers across South & Southeast Asia, the Middle East, and Africa, ensuring widespread distribution and after-sales support. With a focus on customer service, AEL provides spare parts, servicing, and equipment maintenance, strengthening its long-term customer relationships.

Click here to read the full offer document

The company is a leading manufacturer of SLCMs in India, with an approximately 77%, 75%, 77% and 86% market share in the SLCM market in terms of number of SLCMs sold during the six months ended September 30, 2024, and FY 2024, 2023, and 2022, respectively.

Moreover, during Financial Year 2024, 12% of the concrete production in India was through its SLCMs. The company also continues to assist customers throughout the life of the equipment, and with that aim, the company provides spare parts for the equipment sold by the company and facilitates the provision of after-sales service by its dealers. The company’s concrete equipment has diverse use cases and is deployed across:

- transportation projects such as roads, railway lines, underground tunnels, elevated tracks, flyovers and bridges,

- irrigation projects such as reservoirs, canals, check dams and aqueducts, and

- infrastructure projects involving landscaping, drainage, and/or construction of airports, power plants, factories, oil and gas

terminals, among others.

Objects of the Issue

The Company will not receive any proceeds of the Offer. Each of the Selling Shareholders will be entitled to the respective proportion of proceeds of the Offer for Sale after deducting its portion of the Offer-related expenses and the relevant taxes thereon.

Industry Overview

Concreting Equipment Market in India

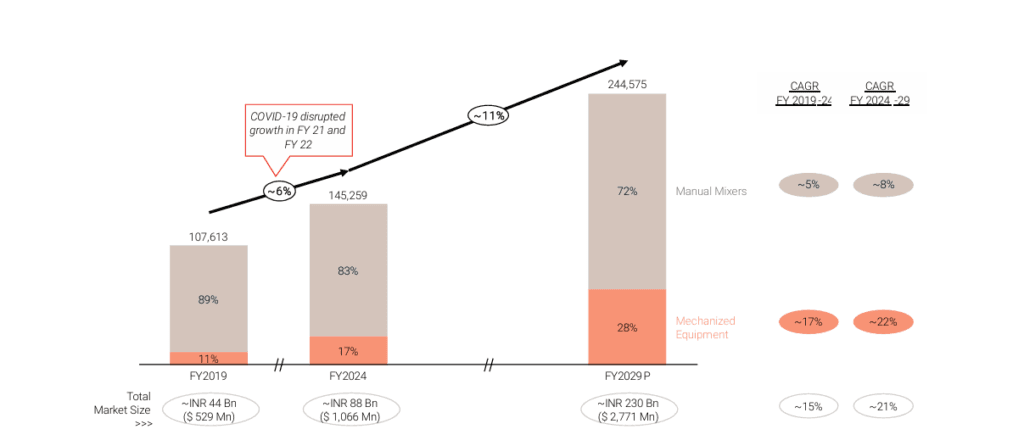

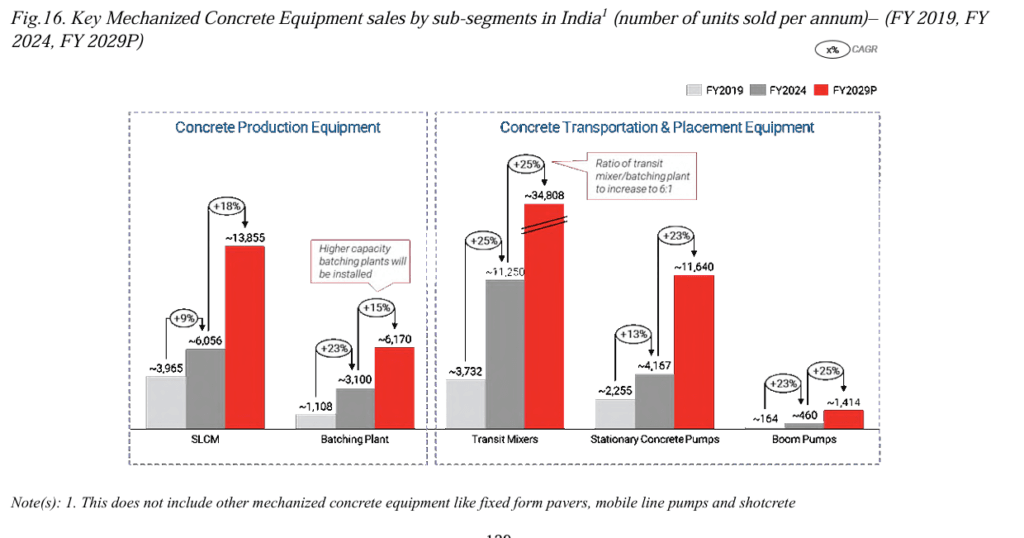

An increase in the mechanized production of concrete is leading to an increase in the demand for concreting equipment in India. Currently, ~25% of the concrete produced is via mechanized concreting equipment, which is likely to increase in the coming years to reach ~41% by FY 2029.

Given the multi-fold benefits of mechanized concreting equipment over manual methods, the market is projected to grow at a CAGR of ~22% by volume, and ~24% by value till FY2029, representing an opportunity of ~INR 191 billion (US$2.3 billion).

The market for concreting equipment in India is projected to grow at a CAGR of ~11% (in volume terms) and ~24% (in value terms) till FY 2029, given the increasing penetration of mechanized concreting equipment such as SLCMs, Transit Mixers, and Batching Plants.

Peer comparison

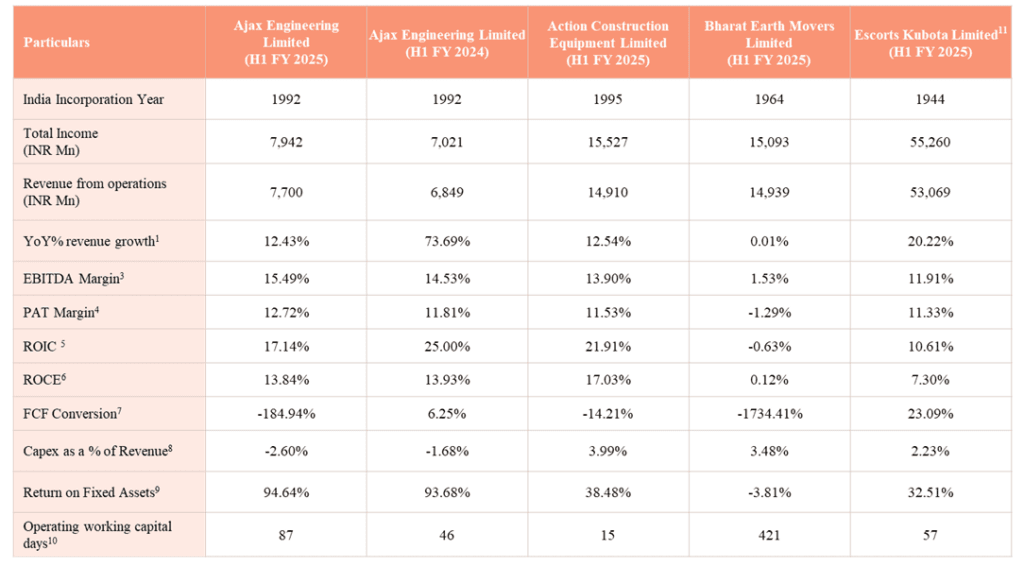

Ajax Engineering has emerged as the second-largest mechanized concreting equipment manufacturer in India as of the Financial Year 2024 by volumes. Ajax Engineering has a substantial market share of ~20%, by volume, as of FY 2024, which has increased from 14% in FY 2022.

Within the SLCM segment, Ajax Engineering has been a pioneer in the Indian market and has a market leadership capturing a share of ~75%, by volume, as of FY2024 and ~77%, by volume, as of H1 FY2025. Ajax Engineering has also been growing faster than the market in stationary concrete pumps and boom pumps from FY 2022 to FY 2024.

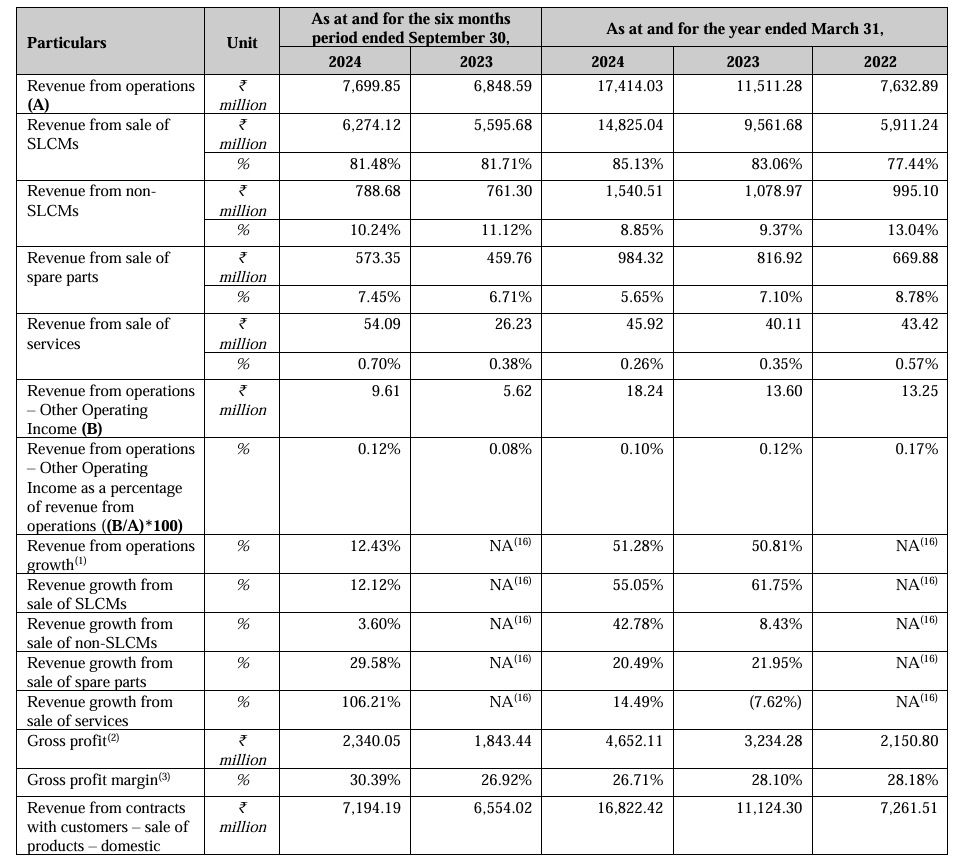

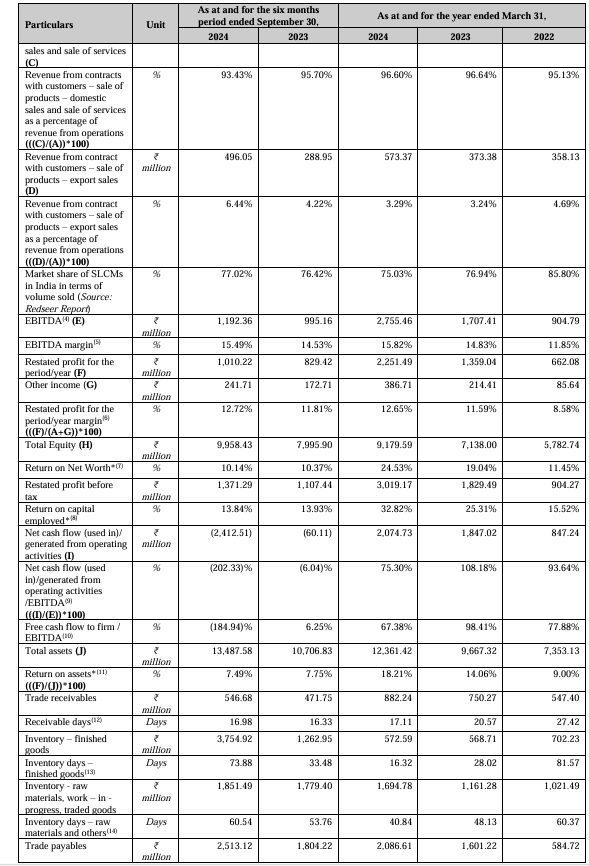

Ajax Engineering Financials

The company has seen robust financial growth in the last few years.

Positives

Market leader in a large and fast-growing SLCM market

The company is a leading manufacturer of SLCMs in India, with an approximately 77%, 75%, 77% and 86% market share in the SLCM market in terms of number of SLCMs sold during the six-month period ended September 30, 2024, and Financial Years 2024, 2023, and 2022, respectively. The company’s SLCMs have a diverse range of applications and end-uses and are used pan-India.

Large dealer network with widespread distribution model and 51 dealerships across 23 states in India, as of September 30, 2024

Company have utilized a dealer-led distribution and service model over the past three Financial Years and as of September 30, 2024, company’s dealer network comprised of 51 dealerships across 23 states in India, and is accessible to its customers through 114 touchpoints, which comprise 51 dealer headquarters and 63 branches (of which, 34 also act as service centers) managed and operated by its dealers.

Diversified customer base with longstanding relationships in the concrete equipment market

As of September 30, 2024, the company has sold concrete equipment and spare parts to, and maintains relationships with, over 19,000 customers, from over 15,700 customers as of March 31, 2024, over 12,100 customers as of March 31, 2023, and over 11,100 customers as of March 31, 2022. During the Financial Years 2024, 2023, and 2022, no single end-customer contributed to more than 5.00% of the company’s total revenue from operations.

VALUATION

At a price band of Rs 599-629 per share and at a p/e multiple of 30x on FY25 EPS basis, IPO’s valuation looks reasonable. The company is the market leader in a large and fast-growing SLCM market with approximately 77%, 75% market share.

In terms of the number of SLCMs sold during the six months ended September 30, 2024, and FY 2024, respectively. Also, the company is a leading concrete equipment company with a comprehensive range of concrete equipment, services, and solutions across the concrete application value chain and over 141 concrete equipment variants as of September 30, 2024.

Our View

The issue is reasonably priced, given its fast growth and market leadership position in some segments, the issue is at a discount in terms of PE, EV/EBITDA, EV/SALES, etc, compared to peers. Looking at the growth opportunities in the sector Ajax Engineering operates in and its leadership position, we assign a “subscribe” rating on the issue with a long-term view in mind.