If there is one segment of market which haven’t provided much return to investors in last few years, it is NBFCs (non banking finance company) particularly companies focused on housing finance and this Aadhar housing ipo is also from the same segment. The 3,000cr issue was opened for subscription on May, 8 and will close on today May, 10. The IPO is fully subscribed now, on the first day it was subscribed 44%, on 2nd day it was subscribed 1.48 times showing lackluster response from investors. Retail investors quota is yet to get fully subscribed as it is filled only 94% till 2nd day of subscription.

While one can blame choppy market in past few days for this lackluster response but one also should ask what differentiators does Aadhar housing finance have over its listed Peers to attract investors. To ease your task of going through the tedious RHP, I am presenting here the key points that differentiate Aadhar housing ipo to its competitors and also its key strengths and weaknesses so that you can make informed decision, read along-

Aadhar Housing IPO: A little about the company

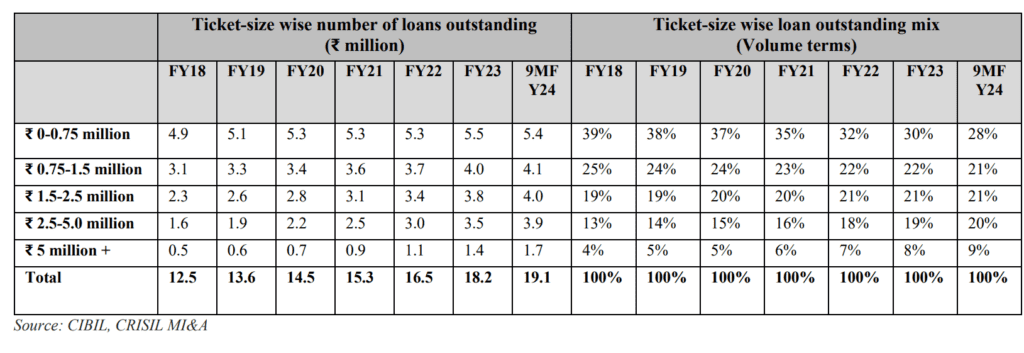

Aadhar housing finance is a HFC (housing finance company) focused on the low income housing segment (ticket size less than ₹1.5 million- up to 15 lacs) in India and it had the highest AUM and net worth among the analyzed peers in FY2021, FY2022, FY2023 and nine months ended December 31, 2022 and December 31, 2023. It is a retail-focused HFC focused on the low income housing segment, serving economically weaker and low-to-middle income customers, who require small ticket mortgage loans.

The average ticket size of Aadhar housing finance loans was ₹0.9 million and ₹1.0 million with an average loan-to-value of 57.7% and 58.3%, as of December 31, 2022 and December 31, 2023, respectively. Company offers a range of mortgage-related loan products, including loans for residential property purchase and construction; home improvement and extension loans; and loans for commercial property construction and acquisition.

An industry overview

Over the past three Fiscals, Indian economy has outperformed its global counterparts by witnessing a faster growth. Going forward as well, IMF projects that Indian economy will remain strong and would continue to be one of the fastest growing economies. The economic development in India is different for urban and rural part specifically for housing segment. India’s urban population has been rising consistently over the decades, As per the 2018 revision of World Urbanization Prospects, it was estimated at 34.9% for India. According to the World Urbanization Prospects, the percentage of population residing in urban areas in India is expected to increase to 37.4% by 2025.

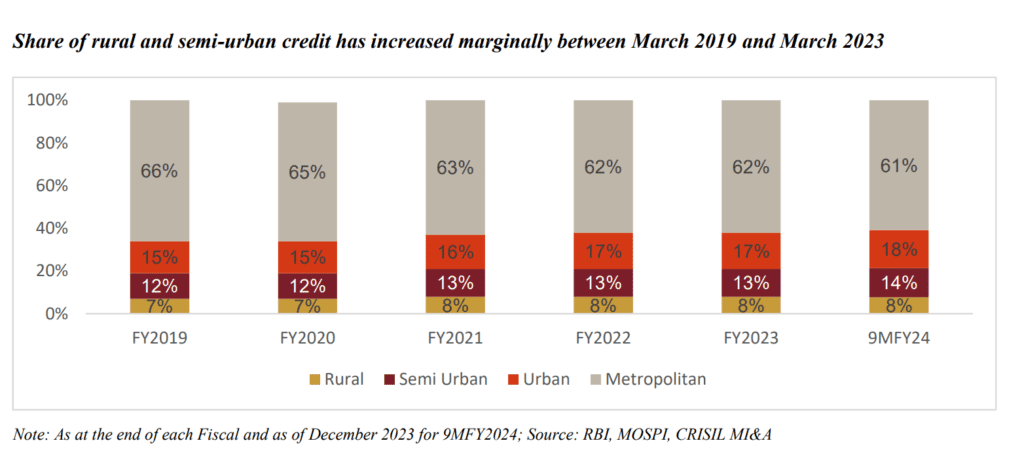

But for a low ticket HFC company like Aadhar housing finance, the key strength lies in rural part. Credit to metropolitan areas has decreased over the past few years with its share decreasing from 66% as of March 31, 2019, to 61% as of December 31, 2023. Between the same period, credit share has witnessed a marginal rise in rural and urban areas. For semi-urban areas, credit share has gone up from 12% as of March 31, 2019, to 14% as of December 31, 2023.

As of March 31, 2023, rural areas, which accounted for 47% of GDP, received just 8% of the overall banking credit, which shows the vast market opportunity for banks and NBFCs to lend in these areas. With increasing focus of government towards financial inclusion, rising financial awareness, increasing smartphone and internet penetration, delivery of credit services in rural area to increase. Further, usage of alternative data to underwrite customers is expected to also help the financiers to assess customers and cater to the informal sections of the society in these regions.

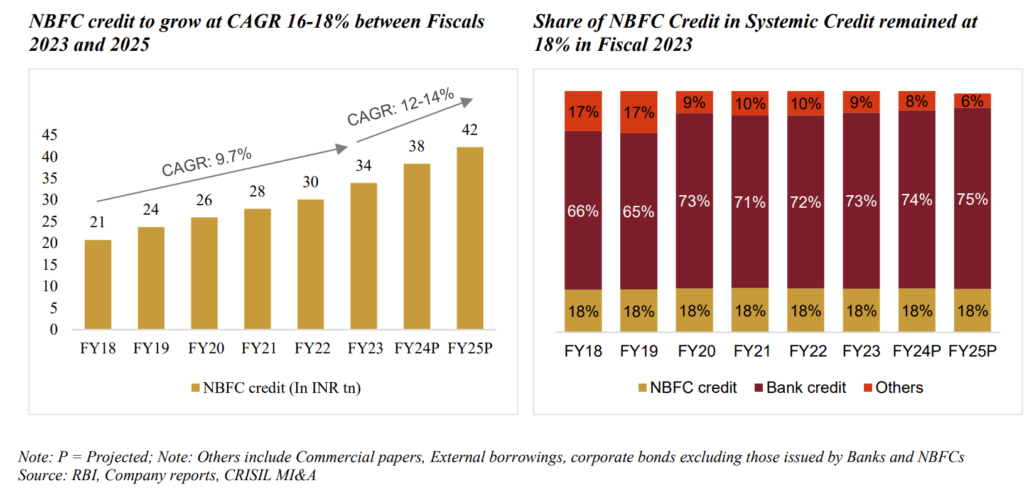

• The above graph shows that NBFC lending (credit) to grow at a CAGR of 12-14% in coming 2 years and Housing loans accounts for 46% of overall retail loans as of March 31, 2023.

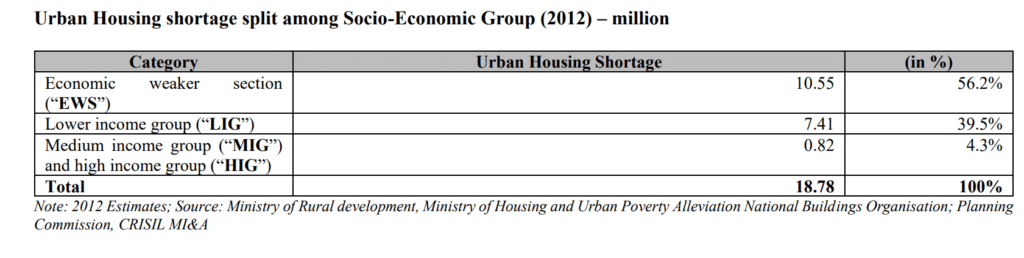

• Housing shortage in India is a big trigger for HFC companies.

As per the report of RBI-appointed Committee on the Development of housing finance securitization market (September 2019), the housing shortage in India was estimated to increase to 100 million units by 2022. Majority of the household shortage is for LIG and EWS with a small proportion of shortage (5-7%) of the shortage coming from MIG or above.

Total incremental housing loans demand, if this entire shortage is to be addressed, is estimated to be in the region of ₹ 50 trillion to ₹ 60 trillion, as per the Committee report. In comparison, the overall housing loans outstanding (excluding Pradhan Mantri Awas Yojana (“PMAY”) loans) as of March 2023 was around ₹ 31.1 trillion. This indicates the immense latent potential of the market, in case, a concrete action is taken for addressing the shortage of houses in India.

• Housing Finance to log a CAGR of 13-15% in the long term between fiscal 2023 and 2026 and Majority of the market dominated by lower ticket size loans in volume terms.

• HFCs have highest market share in low ticket size lending, 35%, 35% and 25% for 0-0.75mn, 0.75-1.5mn, 1.5-2.5mn respectively. The low to mid income lending HFC industry is expected to see a moderate growth with a CAGR of 8-10% between Fiscals 2023 and 2026.

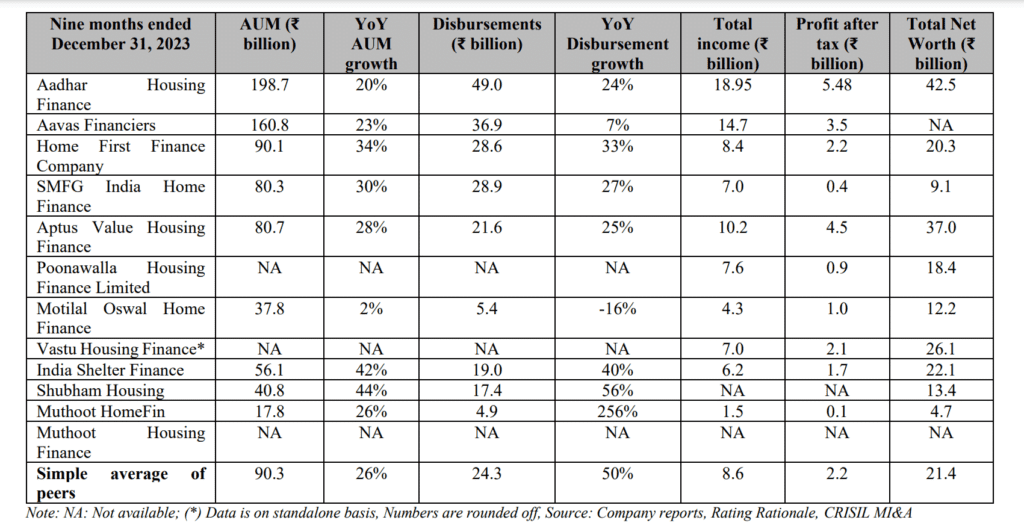

Peer analysis, where Aadhar housing finance stands

• In terms of AUM Aadhar housing finance is the largest HFC in the segment it works.

• Aadhar housing finance has a presence in 20 states and UTs which is highest among the peers. Let’s take a look at other key parameters and a peer comparison to clear the picture.

| Co. Name | AUM (₹ bn) | states present | ROE(%) | NIM(%) | ROA(%) | GNPA(%) | NNPA(%) | P/E | P/BV |

| Aadhar housing | 172 | 20 | 18.4 | 7.3 | 4.2 | 1.4 | 0.9 | 17.5 | 1.9 |

| Aavas fin | 141 | 13 | 13 | 6.6 | 3.5 | 1.1 | 0.8 | 25 | 5.1 |

| Aptus value | 67 | 5 | 17 | 11.7 | 7.7 | 1.2 | 0.9 | 32.6 | 5.04 |

| Home first | 72 | 13 | 15.4 | 6.6 | 3.8 | 1.7 | 1.2 | 26.3 | 4.1 |

| India Shelter | 43.6 | 15 | 13.1 | 7.5 | 4.5 | 1.1 | 0.9 | 25.6 | 2.86 |

Key strengths

- HFC focused on the low income housing segment (ticket size less than ₹1.5 million) in India with the highest AUM and net worth among our analyzed peers in Fiscal 2021, Fiscal 2022, Fiscal 2023 and nine months ended December 31, 2022 and December 31, 2023.

- Seasoned business model with strong resilience through business cycles

- Extensive branch and sales office network, geographical penetration and sales channels which contribute significantly to loan sourcing and servicing;

- Robust, comprehensive systems and processes for underwriting, collections and monitoring asset quality;

- Access to diversified and cost-effective long-term financing with a disciplined approach to asset liability and liquidity management;

- Social objectives are one of the core components of our business model; and

- Experienced, cycle-tested and professional management team with strong corporate governance.

Key Strategies

- Expand company’s Distribution Network to Achieve Deeper Penetration in key states,

- Continue to focus on the target customers and grow Aadhar housing finance’s customer base,

- Continue to invest in and roll out digital and technology enabled solutions across business to improve customer experience and improve cost efficiency.

- Optimize borrowing costs and reduce operating expenses further.

Key Risks

- The company is vulnerable to the volatility in interest rates and may face interest rate and maturity mismatches between assets and liabilities in the future which may cause liquidity issues.

- Company is required to comply with regulations and guidelines issued by regulatory authorities in India, including the NHB and RBI, which may increase the compliance costs, divert the attention of the management and subject us to penalties, this the key risk with NBFCs and fin institutions these days.

- Any increase in provisioning in the future due to the increase NPAs or the introduction of more stringent requirements in respect of loan loss provisioning, may reduce profit after tax and adversely impact results of operations.

Conclusion

Aadhar housing finance has its focus on low income segment and it stands to leverage it due to governments increased focus on affordable housing specifically in rural, semi urban areas. The Aadhar housing ipo is offered at a very reasonable valuation compared to industry Peers, while most of its Peers trade at a P/E range of 30-31 and P/BV range of 4.5-5x (P/BV is more suitable to value a HF company), at upper price band, Aadhar housing finance is valued at 17.5 times P/E and 1.9x P/BV.

While there is no such business moat in these companies but its strong parentage of “blackstone” at the helm of business should be kept in mind. Aprt from having highest AUM among Peers, the company is also a leader in state presence, ROE, NIM, ROA and have a robust asset quality (GNPA below 1.5% and NNPA below 1%) due to better underwriting.

The only thing that is troubling for me is that market is not keen in buying housing finance companies and all of the listed Peers have given no return in last 2-3 years (home first being the only exception). But market cycle for HFCs may be about to change due to approaching favorable economic conditions emerging from the beginning rate cut cycle. Aadhar housing finance promoter “Blackstone” must had these things in mind while planning for an IPO.

Given the discount in valuation compared to Peers, the investors can think of bidding in the issue, chances are discount will be covered with listing gains, that’s what the current GMP of 20-25% is suggesting.

Read more about our IPO coverage, click here

Know more about the Aadhar housing finance, click here