SGB INTELLIGENCE TERMINAL™

Secondary Market Scanner • 2026 Tax Regime (12.5% LTCG)

Yield is too low. Wait for price drop.

SGB Trader Academy (2026 Rules)

Budget 2026 removed tax-free status for secondary buyers. If you buy on the exchange, you pay 12.5% tax on maturity profits.

Paying ₹500 extra/gram kills your returns. Use the "Net Yield" metric to check if the 2.5% interest is enough to cover this extra cost.

Beware of "Zombie Bonds" (low volume series). Always check the "Traded Volume" on the NSE website link provided before placing an order.

If SGB premium > 6%, ETFs often win because they track spot price perfectly. SGBs win only if bought at Fair Value or Discount.

FinMinutes SGB Intelligence Terminal: Gold has been the bedrock of Indian household wealth for millennia. However, the transition from physical “Locker Gold” to digital “Paper Gold” has brought about a level of complexity that traditional investors often find daunting.

Among the various digital avenues, Sovereign Gold Bonds (SGBs) emerged as the undisputed champion due to their unique dual-benefit structure: gold price appreciation plus a fixed annual interest.

But as we navigate the financial landscape of 2026, the rules of the game have fundamentally changed. The Union Budget of 2026 introduced pivotal shifts in the taxation of these bonds, effectively creating two distinct classes of SGB holders: those who buy in the primary market and those who trade on the secondary market.

The FinMinutes SGB Intelligence Terminal was engineered specifically for this “New Normal.” It is a professional-grade strategic engine designed to help investors, traders, and financial planners make data-driven decisions rather than relying on outdated “thumb rules”.

Understanding the 2026 Tax Regime: Why Your SGB Strategy Must Change

Before using any tool, one must understand the “why” behind its logic. The 2026 tax amendments are the driving force behind the Terminal’s engine.

The Death of Universal Tax-Exemption

Historically, SGBs were marketed as “Tax-Free at Maturity.” In 2026, this is a half-truth.

- Primary Holders: If you subscribe to a bond directly from the RBI and hold it for the full 8-year term, your capital gains remain exempt from tax.

- Secondary Market Buyers: If you purchase an existing bond on the NSE or BSE (which is how most investors now acquire SGBs), you are no longer eligible for that 100% exemption upon maturity.

The 12.5% Flat LTCG Rule

For secondary buyers, any profit made on the redemption or sale of an SGB is now classified as a Long-Term Capital Gain (if held for more than 12 months) and is taxed at a flat rate of 12.5%. This change alone can reduce your effective CAGR by 0.5% to 1.5%, depending on the premium you paid at the time of purchase.

The Interest Slab Trap

The 2.5% annual interest (calculated on the Face Value) remains fully taxable under “Income from Other Sources”. For an investor in the 30% or 39% tax bracket, the “real” interest earned is significantly lower than the headline rate. The FinMinutes Terminal is the only tool that allows you to input your specific tax slab to see the True Post-Tax Yield.

Features of Finminutes Smart SGB Calculator: The “Sniper” Advantage

The Terminal isn’t just a simple SGB calculator; it’s a suite of diagnostic tools designed to reveal “hidden” risks in the secondary market.

Intrinsic Value & Fair Value Monitor

The most common mistake in secondary market SGB investing is ignoring the Premium. Because SGBs are traded like stocks, their price is driven by demand and supply, not just the gold price.

- The Logic: FinMinutes SGB Intelligence Terminal fetches (or allows you to input) the live 999 purity spot price. It then calculates the Intrinsic Value of the bond.

- The Gauge: The Fair Value Monitor provides a visual representation of the price deviation. If a bond is trading at a 15% premium, you are essentially paying for gold that doesn’t exist yet. The terminal flags this as a “Premium Risk”.

The 9% Hurdle Rate Advisor

Why 9%? In the 2026 economic context, with inflation hovering around 4-5% and equity markets delivering 12-14%, a “Safe” asset like gold needs to net at least 9% post-tax to be worth the capital lock-in.

- Reverse Calculation: If the current yield is 7%, the Terminal doesn’t just tell you that you’re missing the target; it tells you exactly what the market price needs to be for you to hit that 9% mark. This allows you to set precise “Limit Orders” on your trading platform.

The Year-Wise Yield Breakdown (XIRR Table)

Wealth doesn’t grow linearly in SGBs. Because the interest is paid on the Face Value (which is fixed) but you buy at a Market Price (which is fluctuating), your yield changes every year.

- The FinMinutes SGB Intelligence Terminal generates a table showing your projected wealth year-by-year.

- It highlights the Break-Even Point, the year when your accumulated interest finally offsets the premium you paid at the start.

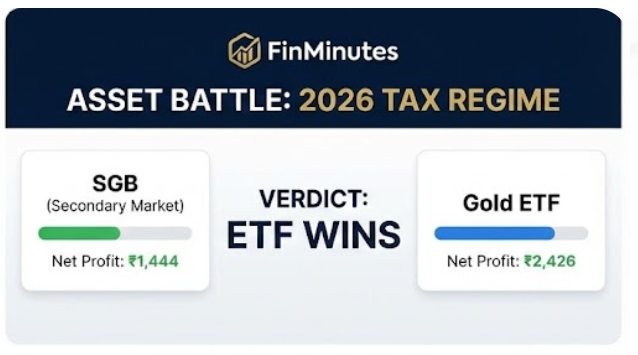

The “Asset Battle”: SGB vs. Gold ETF

One of the most requested features in version 9.0 is the head-to-head comparison with Gold ETFs. Many investors assume SGBs are always better because of the interest. In 2026, with the tax introduction, that is a dangerous assumption.

When the Gold ETF Wins:

- High SGB Premiums: If you buy an SGB at a 10% premium, you have an immediate “yield drag”. A Gold ETF, which tracks the spot price with nearly zero premium, might outperform the SGB over a 3-year horizon because it doesn’t have that initial cost barrier.

- Liquidity Needs: If you might need your money in 2 years, the SGB’s poor liquidity on the exchange might force you to sell at a “distress discount”. Gold ETFs offer near-instant liquidity at fair market prices.

When the SGB Wins:

- Low Premiums or Discounts: If the Terminal identifies an SGB trading at a Discount (below spot price), it becomes an absolute “no-brainer.” You get the gold, you get the interest, and you get a capital gain “bonus” as the price reverts to mean.

- Long Holding Periods: Over 5-8 years, the 2.5% annual interest usually compounds enough to overcome even a moderate initial premium.

Operational Guide: How to Master the FinMinutes SGB Intelligence Terminal

To get the most out of the FinMinutes SGB Intelligence Terminal, follow this professional workflow:

Step 1: Market Intelligence

Before opening the tool, check a reliable source (like IBJA or your broker) for the current 24K gold rate. Enter this into the Live Spot Gold field.

Step 2: The Search Phase

Use the dropdown menu to select the SGB series you are interested in. Look for series maturing in 3-5 years if you are a medium-term investor.

Step 3: CMP (Current Market Price)

Enter the “LTP” (Last Traded Price) from the NSE.

Pro-tip: Don’t use the LTP if the volume is low; use the “Ask” price from the market depth, as that is the price you will actually pay.

Step 4: Personalization

Adjust the Gold CAGR. While the 10-year average is around 11-12%, a conservative investor might use 9%, while a bull might use 13%. Set your Tax Slab in the Gold ETF tab to ensure the comparison is accurate for your income level.

Strategic Profiles: Who Should Use This Tool?

The “SGB Sniper” (Active Trader)

This user isn’t looking for a long-term bond. They are looking for mispriced securities. They use the Terminal to scan multiple series, looking for the highest “Instant P&L” (deepest discount). They buy the discount and sell when the market realises its mistake and the premium returns.

The “Goal-Based Planner” (Conservative)

This user is saving for a specific event, perhaps a child’s education or a house down payment in 2030. They use the Year-Wise Table to ensure that their “Net Wealth” at the end of their specific tenure meets their goal, after accounting for the 12.5% LTCG tax.

The “Tax Optimiser” (HNI)

For an investor in the highest tax bracket, the 2.5% interest is heavily diluted. This user uses the Gold ETF vs. SGB tab to see if the “Expense Ratio” of a Gold ETF (0.5%) is actually cheaper than the “Tax Leakage” of an SGB.

Finminutes SGB Trader Academy: Lessons from the 2026 Market

Lesson 1: The “Zombie Bond” Trap

Some SGB series have virtually zero liquidity. The Finminutes Smart SGB Calculator provides a link to NSE to check volume. If a bond hasn’t traded in 3 days, it doesn’t matter how high the yield looks; you won’t be able to buy it at that price, and you certainly won’t be able to sell it.

Lesson 2: Understanding “Yield Drag”

Yield drag is the reduction in your CAGR caused by paying a premium. If Gold grows at 12%, but you paid a 6% premium, your growth is effectively capped at around 10.5%. The Terminal quantifies this so you don’t have to guess.

Lesson 3: The 12.5% Tax Impact

In the pre-2026 era, SGBs were 10-15% more efficient than ETFs. With the new tax, that lead has shrunk to roughly 4-6%. This makes the Buy Price more important than ever before.

Finminutes Smart SGB Calculator: FAQs

Is it better to buy SGBs in the secondary market or wait for a new RBI issue?

RBI issues are infrequent now. If you can get a secondary bond at a Discount or Fair Value, it is almost always better than waiting, because you get the “Instant P&L” which an RBI issue (always at market price) doesn’t offer.

Why does the terminal show a negative yield for Year 1?

If you pay a high premium (e.g., 10%), your investment is “underwater” on day one. It takes time for the 2.5% annual interest to “earn back” that premium. Our smart SGB calculator table shows exactly when you cross back into the green.

Does the 12.5% tax apply if I sell before maturity?

Yes. If you hold for more than 12 months, the LTCG is 12.5%. If the holding period is less than 12 months, it is STCG and taxed at your slab. The terminal is designed for the long-term holding logic (LTCG).

Are SGBs still tax-free if I hold them for 8 years?

Only if you are the original subscriber who bought them during the RBI’s primary issuance window. If you bought them from a stock exchange (secondary market), you must pay 12.5% tax on the gains at maturity.

Why does the FinMinutes SGB Intelligence Terminal show a “Premium Risk”?

SGBs often trade at a price higher than the actual gold value on exchanges due to high demand or low supply. If you pay a 10% premium today, you are essentially starting your investment with a 10% loss relative to gold. Our smart SGB Calculator quantifies this “Premium Penalty”.

Can I exit an SGB before 8 years?

Yes, you can sell an SGB on the exchange anytime if you hold them in Demat form. However, doing so will attract Short-Term Capital Gains (STCG) if held for less than 12 months, or LTCG (12.5%) if held longer than 12 months.

Is the 2.5% interest earned from Sovereign Gold Bonds tax-free?

No. The interest is credited semi-annually and is fully taxable as “Income from Other Sources” at your applicable slab rate.

Conclusion: Data is the New Gold

In the volatile financial world of 2026, intuition is a liability. Successful gold investing requires a blend of macroeconomic understanding and granular mathematical analysis. The FinMinutes SGB Intelligence Terminal provides that bridge, turning complex tax codes and market fluctuations into actionable “Buy” or “Wait” signals.

Whether you are protecting your family’s future or looking for a tactical trade, remember: Don’t just buy gold. Buy value.