FinMinutes Gold Terminal™

Calculate Import Parity • Spot Arbitrage • Sourcing Logic

For Traders

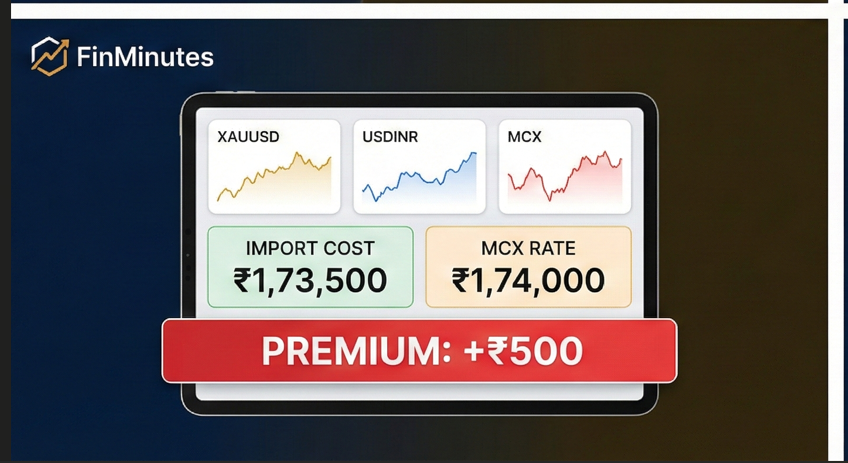

Use the Gap to find arbitrage. If Gap > ₹500, Short MCX. If Gap < -₹500, Long MCX.

For Jewellers

Decide daily sourcing. If MCX is cheaper than Import Cost (Parity), buy local stock to save money.

For Buyers

Check if you are paying a "Panic Premium". Only buy when the status is DISCOUNT.

Disclaimer: The data provided by the FinMinutes Gold Terminal™ is for informational and educational purposes only. It is not financial advice. Prices sourced from widgets may have a delay. Import duties are subject to change. Consult a financial advisor.

The Only Tool That Reveals the “True Price” of Gold

FinMinutes Gold Terminal™: Stop Guessing. Start Calculating. The First Professional-Grade Gold Sourcing Terminal for Indian Traders, Jewellers, and Smart Investors.

In the Indian bullion market, there is a secret that big banks and refineries don’t tell you: The price you see on MCX is not always the real price of gold. Every day, the price of gold in India swings between being “Overpriced” (Premium) and “Undervalued” (Discount) compared to the international market. If you don’t know the difference, you are flying blind.

- For Jewellers: You might be losing ₹5,000 per 10g by sourcing from the wrong place.

- For Traders: You are missing guaranteed arbitrage profits when the gap widens.

- For Buyers: You might be paying a “Panic Tax” during wedding season without realizing it.

Welcome to the FinMinutes Gold Terminal™. We have built the first public terminal that mathematically calculates the Import Parity Price (The Real Cost) and compares it live with the MCX gold price. It tells you one simple thing: Is Gold Cheap or Expensive right now?

Why FinMinutes Gold Terminal™ is a Gamechanger

Most “Gold Rate” websites just show you a static number: Today’s Rate: ₹1,65,000. That is useless data. It tells you the price, but it doesn’t tell you the TRUE Value. The FinMinutes Gold Terminal™ is different. It is an Arbitrage Engine.

1. It Exposes the “Hidden Gap”

Gold in India is imported. Its price should logically be:

But in reality, local demand and supply distort this.

- When demand is high (Diwali, Wedding Season), MCX gold price trades at a Premium (Higher than Import Cost).

- When demand is low (Pitru Paksha), MCX gold price trades at a Discount (Lower than Import Cost); it happens every other day for some reason. Our terminal calculates this Gap instantly.

2. Live “Sourcing” Logic

We don’t just give you data; we give you a decision.

- Should a jeweller import via a bank or buy from the local refinery?

- Should a trader Short MCX or go Long? The terminal analyses the math and gives a clear Signal: PREMIUM or DISCOUNT.

3. Future-Proof (Budget 2026 Ready)

Government regulations change. Import duties shift from 15% to 6% overnight. Most calculators break. Ours comes with a “Duty Settings” panel that lets you tweak the Basic Customs Duty, Cess, and Bank Premium instantly. You are always in sync with the Finance Ministry.

How to Use FinMinutes Gold Terminal™: A 3-Step Guide

Using professional-grade tools doesn’t have to be complicated. We have designed the interface to be as intuitive as a smartphone app.

Step 1: Check the Live Markets

At the top of the terminal, you will see three live widgets powered by TradingView:

- XAUUSD (Global Spot): The price of gold in Dollars per ounce.

- USDINR: The currency conversion rate.

- MCX Gold Price: The local futures price in Rupees.Tip: These charts are live. Glance at them to get the market pulse.

Step 2: Input the Data

Enter the values from the top widgets into the input fields.

- Spot Gold ($): e.g., $5170

- USDINR (₹): e.g., 91.92

- MCX Live (₹): e.g., ₹1,69,500. Note: We have pre-filled these with the latest market averages to get you started. You can edit according to the latest price.

Step 3: Select Your “Persona”

This is the magic button. The terminal changes its advice based on who you are:

- Trader: Looks for Arbitrage (Gap > ₹500).

- Jeweller: Looks for Sourcing Profit (Import vs. Local).

- Buyer: Looks for Valuation (Wait vs. Buy).

Who Is This Tool For? (And How It Makes You Money)

We built the FinMinutes Gold Terminal™ for three specific masters of the market. Find your profile below to see how to use it.

1. The Commodity Trader (The Arbitrageur)

Your Goal: Risk-free profit from market inefficiency.

How to Use: Watch the “Gap”. The market is like a rubber band; it eventually snaps back to the “True Price.”

- The Signal: If the terminal shows a Premium of +₹800, it means the MCX gold price is overpriced. The math suggests it must fall or Spot must rise.

- The Trade: This is a classic Short Opportunity on MCX (or a “Sell Future / Buy Spot” hedge).

- The Win: When the gap narrows back to zero (Neutral), you pocket the difference.

2. The Jeweller & Bullion Dealer (The Sourcer)

Your Goal: Reduce procurement costs to increase net margin.

How to Use: You have to buy gold daily. The question is where to buy it.

- Scenario A (Discount Mode): The terminal shows that MCX is ₹400 cheaper than Bank Import Cost.

- Action: Stop your bank import. Lift stock from the local MCX delivery or local refinery. You save ₹40,000 on a 100g bar instantly.

- Scenario B (Premium Mode): The terminal shows MCX is ₹600 expensive.

- Action: Don’t buy locally. Place an order with your bullion bank for official import. You avoid paying the local “hype tax.”

3. The Retail Investor (The Smart Buyer)

Your Goal: Don’t get ripped off.

How to Use: You are planning to buy jewellery for a wedding.

- Check the Status: If the terminal says “PREMIUM (Red)”, wait! You are paying extra just because everyone else is buying. Wait a while for the premium to cool off.

- The Green Light: If the terminal says “DISCOUNT (Green)”, it’s a sale! Gold is effectively selling below its international cost. Buy your coins or jewellery immediately.

The “Bargain Hunter” Feature: Calculate Your Reverse Target

This is a favourite among our power users. Often, you have a price in mind: “I want to buy Gold when it falls to ₹1,65,000.” But you don’t know what Global Spot price matches that level. Open the “The Bargain Hunter” section at the bottom of the tool.

- Enter your Target MCX Price (e.g., ₹1,65,000).

- The tool calculates backward, removing Duty, Cess, and USD conversion.

- Result: It tells you, “Wait for Spot Gold to hit $5,035.”

Now, you can set an alert on your trading app for $5,035. precise, mathematical, and effective.

FinMinutes Gold Terminal™: FAQs

How accurate is the “True Price” calculation?

It is mathematically precise. We use the official formula used by Customs India:

(Spot Price + Bank Premium) * USDINR * (1 + Basic Duty + Cess).

However, market prices change every millisecond. The tool provides a “Theoretical Fair Value.” Real-world physical delivery premiums may vary slightly by city (Mumbai vs. Delhi rates).

Why is there a difference between MCX and the True Price?

This difference is called the “Basis” or “Spread.” It exists because of local supply-demand mismatches.

– Import Ban/Delay: Supply drops, Premium rises.

– Wedding Season: Demand rises, Premium rises.

– Dull Market: Dealers sell stock at a loss, creating a Discount.

Can I use this for Silver?

Currently, this terminal is calibrated for Gold (995/999 Purity) import metrics. Silver has a different duty structure and premium calculation. We are working on a Silver Terminal, stay tuned!

What is the “Bank Premium” in the settings?

When banks import gold, they charge a small fee over the international spot price (usually $1.5 to $4.0 per ounce) for logistics and insurance. We have set a default of $2.5, but you can adjust this if your specific bank charges more or less.

Is the data real-time?

The charts at the top are live (delayed by a few seconds/minutes depending on the data feed). The calculation happens instantly as you type the numbers. This ensures you are calculating based on the exact numbers you see, giving you total control.

Does this include GST?

No. The “True Price” and MCX Price are calculated Ex-GST. When you buy physical jewellery, you must add 3% GST on top of the final value. This tool compares the Base Trading Price to help you time your entry.

Ready to Master the Gold Market?

The difference between a gambler and a professional is data. Don’t buy gold because you “feel” it will go up. Buy it because the math says it’s undervalued.

Scroll Up and Use the FinMinutes Gold Terminal™ Now.