India Post Savings Hub

Calculate returns for every Government Savings Scheme with our premium, updated tools.

PLI Calculator

Highest Bonus (₹76/1000). For Govt Employees & Professionals.

Launch ToolRPLI Calculator

Gram Suraksha (₹60/1000). Low premium, high return for Rural India.

Launch ToolPPF Calculator

Public Provident Fund. Tax-free returns with 15-year lock-in.

Sukanya Samriddhi

Build a tax-free corpus for your daughter's education & marriage.

Mahila Samman (MSSC)

Exclusive 2-year scheme for women with 7.5% fixed interest.

Senior Citizen (SCSS)

Quarterly payouts for retirees. Highest interest rate safety.

Monthly Income (MIS)

Earn a fixed monthly salary from your lumpsum deposit.

National Savings (NSC)

5-Year tax saver. Interest compounds and is paid at maturity.

Kisan Vikas Patra

Double your money in approx. 115 months. Sovereign guarantee.

Post Office FD

Secure Time Deposits for 1, 2, 3, or 5 years.

Recurring Deposit (RD)

Save small monthly amounts for 5 years to build a habit.

India Post Savings Hub: The Ultimate Calculator Dashboard (2026 Edition)

Decode Every Government Savings Scheme (Post office investment schemes, small savings schemes) in One Place. In the chaotic world of personal finance, where new crypto coins and complex mutual funds pop up daily, there remains a fortress of stability: India Post Investment Schemes.

For over 150 years, the Department of Posts has been the silent guardian of Indian household savings and investments. From the bustling streets of Mumbai to the quietest village in Himachal, “Post Office Schemes” are synonymous with Trust and Sovereign Guarantee.

But there is a problem.

With over 9 different schemes, ranging from Sukanya Samriddhi for your daughter to SCSS for your parents, it is impossible to keep track of the interest rates, maturity rules, and tax benefits in your head. The official websites are often cluttered with PDFs, and bank agents might push products that earn them a commission, not you the best return.

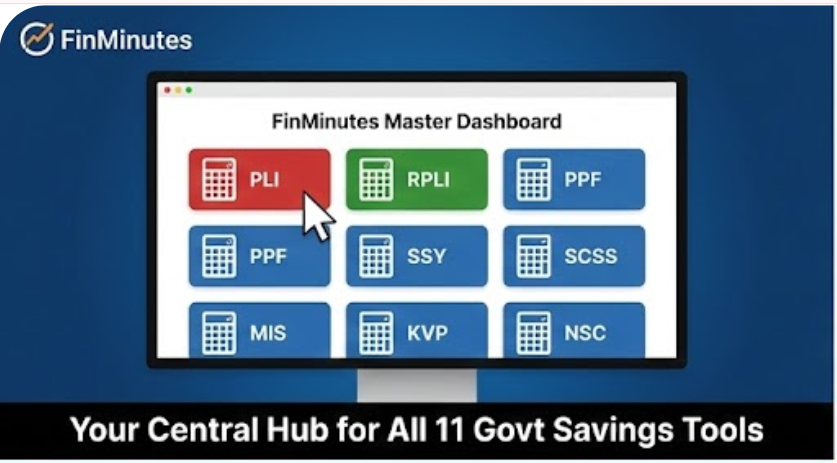

Welcome to the FinMinutes India Post Investment Schemes Hub.

We have built the most advanced, user-friendly, and mathematically precise suite of calculators for every single Government Small Savings Scheme. Whether you are a 25-year-old planning your first tax-saving investment or a 60-year-old securing a monthly pension, this dashboard is your command centre.

Why Use the FinMinutes Post Office Investment Schemes Dashboard?

Most financial websites offer generic “FD Calculators” that use a simple compound interest formula. That doesn’t work for Post Office schemes.

- Scheme-Specific Logic: Our PLI Calculator knows the difference between “Suraksha” and “Santosh” bonus rates. Our SSY Calculator knows that you only pay for 15 years, but the policy matures in 21 years. We don’t use generic math; we use the official rules.

- 2026 Updated Rates: All our tools are calibrated with the latest interest rates and bonus figures declared by the Ministry of Finance for the January – March 2026 quarter. No more guessing with outdated 2023 data.

- The “Inflation Reality” Check: Almost every calculator in our suite comes with an Inflation Toggle. We don’t just tell you that you will get ₹50 Lakhs. We tell you what that ₹50 Lakhs will actually buy in the future.

Explore the Tools: A Guide to Every Scheme

Not sure which calculator to click? Here is a breakdown of every tool on our dashboard to help you find your perfect match.

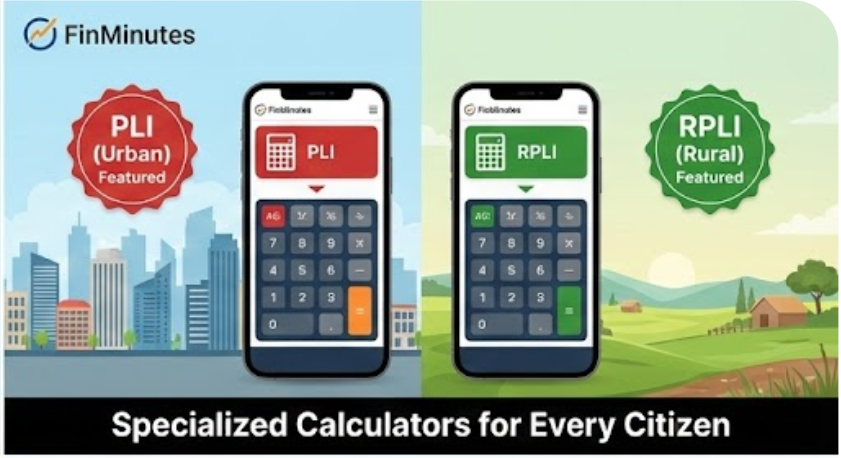

1. Postal Life Insurance (PLI) Calculator

The “Hidden Gem” for Employees. If you are a government employee, professional (CA, Doctor, Engineer), or work for a listed company, stop looking at private term plans. PLI offers the highest bonus rates in the industry because it is non-profit.

- What it does: Calculates maturity for Suraksha (Whole Life) and Santosh (Endowment) plans.

- Why use it: To see how a small premium of ₹3,000 can turn into a corpus of ₹50+ Lakhs.

- Key Feature: The “Deep Dive” section shows your exact monthly rebate and net premium.

2. Rural Postal Life Insurance (RPLI) Calculator

The “Rural Lifeline“: Living in a village? You have access to Gram Suraksha, a scheme with premiums so low and bonuses so high (₹60/1000) that it beats most urban investment options.

- What it does: Tailored specifically for rural residents with a ₹10 Lakh limit.

- Why use it: To ensure you aren’t paying high premiums for private policies that offer half the returns.

3. Public Provident Fund (PPF) Calculator

The “Tax-Free Millionaire” Maker PPF is the king of debt investments. It offers EEE Status (Exempt-Exempt-Exempt), meaning your investment, interest, and maturity are all 100% tax-free.

- What it does: Shows how your ₹1.5 Lakh annual investment compounds over 15 years.

- Why use it: To visualise the power of compounding. The calculator reveals how extending your PPF in “5-year blocks” after maturity can exponentially grow your wealth.

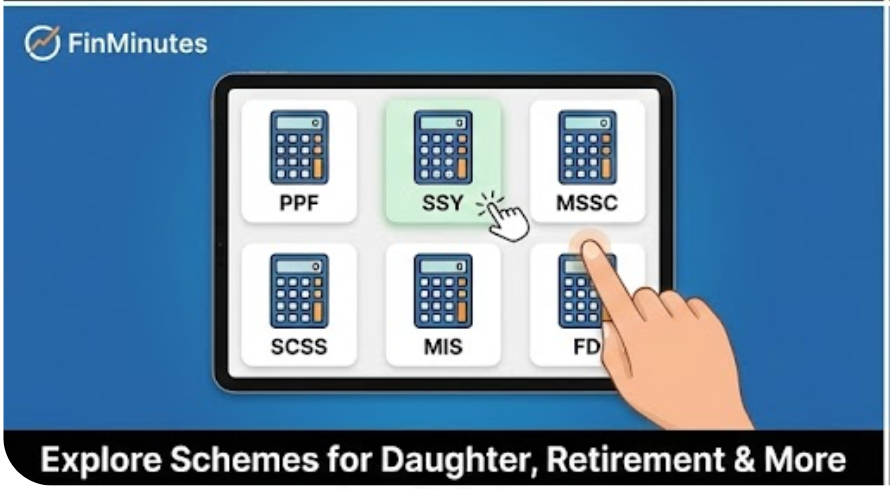

4. Sukanya Samriddhi Yojana (SSY) Calculator

The “Daughter’s Future” Secure Offering the highest interest rate among all small savings schemes, SSY is a must-have for parents of a girl child (below 10 years).

- What it does: Maps out the 21-year journey of the scheme. You pay for 15 years; the money grows for 21.

- Why use it: To calculate exactly how much you need to save today to fund her higher education or marriage at age 21.

5. Mahila Samman Savings Certificate (MSSC) Calculator

The “Women’s Power” Scheme A specialized 2-year scheme launched to empower women financially. It offers a fixed 7.5% interest rate.

- What it does: Tells you the exact maturity value after 2 years for a deposit up to ₹2 Lakhs.

- Why use it: Perfect for housewives or working women looking to park short-term funds safely with returns better than a savings account.

6. Senior Citizen Savings Scheme (SCSS) Calculator

The “Retiree’s Paycheck” For those over 60, capital protection is priority number one. SCSS offers the highest safety with regular quarterly income.

- What it does: Calculates your Quarterly Payout.

- Why use it: If you have received a retirement lump sum (Gratuity/PF), use this to plan your monthly household budget. It tells you exactly how much cash will hit your account every 3 months.

7. Post Office Monthly Income Scheme (POMIS) Calculator

The “Monthly Salary” Engine is similar to SCSS but open to everyone, not just seniors. You deposit a lump sum, and the Post Office pays you interest every single month.

- What it does: Calculates the monthly income for a deposit up to ₹9 Lakhs (Single) or ₹15 Lakhs (Joint).

- Why use it: Great for generating passive income or pocket money for students/dependents.

8. National Savings Certificate (NSC) Calculator

The “Tax Saver” Bond is a 5-year fixed instrument. The interest accrues annually but is paid at the end. Importantly, the accrued interest is deemed “re-invested” and qualifies for tax deduction under Section 80C.

- What it does: Shows the final maturity value after 5 years.

- Why use it: To plan your 80C tax deductions for the next 5 years efficiently.

9. Kisan Vikas Patra (KVP) Calculator

The “Money Doubler” is the simplest scheme in the book. You invest ₹X, and the government guarantees to give you ₹2X after a specific period (currently approx. 115 months).

- What it does: Tells you the exact date your money will double based on the current interest rate.

- Why use it: For users who hate complex products and just want a straightforward “Double my money” guarantee.

10. Post Office Time Deposit (TD) Calculator

The “Better FD“ is the Post Office version of a Bank Fixed Deposit. It is available for 1, 2, 3, or 5 years.

- What it does: Compares returns across different tenures.

- Why use it: Post Office TD rates often beat major banks like SBI or HDFC. Use this tool to check if moving your idle cash to the Post Office yields better returns.

11. Post Office Recurring Deposit (RD) Calculator

The “Habit Builder” The RD is designed for small savers. You commit to saving as little as ₹100 per month for 5 years.

- What it does: Shows how small monthly drops fill a large bucket over 60 months.

- Why use it: To plan for short-term recurring goals, like buying a bike or a vacation, without taking market risk.

Why We Built This Ecosystem

At FinMinutes Research, we noticed a gap. Information about these schemes is technically “public,” but it is hidden inside complex government notifications and confusing PDF tables.

- A farmer in a village shouldn’t have to decipher a gazette notification to know his Gram Suraksha bonus.

- A father shouldn’t have to manually calculate compound interest to know if SSY covers his daughter’s MBA fees.

Our mission was to democratise this data. We wrote thousands of lines of code to bake the complex actuarial tables, compounding logic, and tax rules into simple, beautiful interfaces. We did the hard math so you don’t have to.

Post Office Investment Schemes: FAQs

Are the results from the Finminutes Post Office savings scheme calculators guaranteed?

The logic uses the current official interest rates. For fixed-rate schemes (like FD, KVP, NSC, MSSC), the calculated return is guaranteed if you lock it in today. For variable-rate schemes (like PPF, SSY), the government updates rates quarterly. Our tools give you the most accurate projection based on the current rate holding steady.

Is my money safe in these Post Office schemes?

Yes. Post Office Investment Schemes are the safest asset class in India. All “Small Savings Schemes” (PPF, SSY, SCSS, etc.) and Postal Life Insurance are backed by a Sovereign Guarantee from the Central Government. Your money is safer here than in any private bank.

Do I need to be a government employee to use these post office schemes?

– PLI: Yes, restricted to Govt/Semi-Govt employees and professionals (Doctors/Engineers/CAs/Bankers, etc.).

– RPLI: Restricted to rural residents.

– All Other Schemes (PPF, SSY, NSC, KVP, etc.): Open to ALL Indian citizens. You do not need a government job.

How often are the interest rates updated in these small savings schemes?

The Ministry of Finance reviews and declares rates for Small Savings Schemes every Quarter (April, July, Oct, Jan). PLI/RPLI bonus rates are declared annually. We update our algorithms within 24 hours of any official announcement.

Can I open these accounts online?

Yes! While you may need to visit the Post Office or a Bank for the initial KYC and account opening, most schemes (PPF, SSY, NSC, FD) can now be managed and funded online via the India Post Payments Bank (IPPB) app or net banking of authorised banks. PLI/RPLI also has a robust online portal for premium payments.

Why do you have a separate calculator for PLI and RPLI?

They have completely different Bonus Rates and Limits. Using an Urban PLI calculator for a Rural policy would give you a dangerously wrong estimate (over-promising the return). We separated them to ensure 100% accuracy for both user groups.

Ready to Secure Your Future?

Don’t let inflation eat your savings. Whether you have ₹500 or ₹50 Lakhs, there is a Government-backed scheme designed for you.

Select a tool from the grid above and start planning today.