RPLI Calculator (Rural Postal Life)

Calculate Returns for Gram Suraksha & Gram Santosh.

Policy Deep Dive

Growth Schedule

| Year | Age | Bonus Added | Total Value |

|---|

Gram Suraksha & Gram Santosh: The “Gold Standard” of Rural Investment. To understand the scheme, use the Finminutes RPLI Calculator.

In 1995, the Government of India launched a revolutionary scheme with a goal to bring the safety and high returns of Postal Life Insurance (PLI) to the rural masses. This scheme is RPLI (Rural Postal Life Insurance).

Unlike the standard PLI (which is restricted to government employees), RPLI is open to anyone with a permanent residence in a rural area. Whether you are a farmer, a small business owner, or a self-employed professional in a village, you are eligible.

Why is RPLI viral in 2026? Because it offers a Bonus Rate (₹60 per ₹1,000) that crushes every private insurance policy in the market.

Welcome to the FinMinutes RPLI Calculator. This dedicated tool is calibrated with the latest 2026 Bonus Rates for Gram Suraksha and Gram Santosh. It helps you calculate your maturity value, estimated premium, and inflation-adjusted returns in seconds.

What is RPLI? (The “Gram” Series)

RPLI is the rural brother of PLI (Postal Life Insurance). It operates on the same principle: Low Premiums and High Bonuses. Because the scheme is backed by the Sovereign Guarantee of the Government of India, your money is safer than in any private bank.

Key Features:

- Eligibility: Any Indian citizen residing in a rural area.

- Maximum Sum Assured: ₹10 Lakhs (per individual).

- Minimum Sum Assured: ₹10,000.

- Gender: Open to men, women, and even children (Bal Jeevan Bima).

Detailed Eligibility: Who is “Rural”?

The definition of “Rural” is specific to RPLI. You are eligible if your permanent residence is in an area where:

- The population is less than 5,000.

- The density of population is less than 400 per sq. km.

- More than 25% of the male working population is engaged in agriculture.

Note: Even if you work in a city, if your permanent address (Aadhaar) is in a village, you can buy RPLI. This is a huge loophole for migrants to access better rates.

Top Two Plans: Gram Suraksha vs Gram Santosh

Just like PLI, RPLI has two flagship plans that account for 90% of all policies sold.

1. Gram Suraksha (Whole Life Assurance)

The Wealth Builder.

- Concept: You pay premiums until a certain age (55, 58, or 60), but the policy covers you until age 80.

- Bonus Rate: ₹60 per ₹1,000 Sum Assured.

- Why choose it? This plan generates the highest corpus. If you start young, the compounding bonus can turn a small monthly savings into a massive retirement fund.

- FinMinutes Tip: Even though it matures at 80, you can surrender it after 3 years if you need money urgently.

2. Gram Santosh (Endowment Assurance)

The Goal Achiever.

- Concept: You pay premiums for a fixed term (e.g., 15 or 20 years). You get the full money immediately when the term ends.

- Bonus Rate: ₹48 per ₹1,000 Sum Assured.

- Why choose it? Best for short-term goals like a daughter’s marriage or building a house.

Deep Dive: The 6 RPLI Plans Explained

While most people only know about Suraksha and Santosh, RPLI actually offers 6 distinct plans tailored to different life stages. Choosing the right one can save you lakhs.

1. Gram Suraksha (Whole Life Assurance)

The “Legacy Builder”

- How it works: You pay premiums until a chosen age (55, 58, or 60). However, the policy covers you until age 80 (or death, whichever is earlier).

- Bonus Rate: ₹60 per ₹1,000 Sum Assured (Highest in the category).

- Best For: Young earners (20s and 30s) who want to leave a massive corpus for their children. The long tenure allows the high bonus to compound into a large amount.

- Loan: Available after 4 years.

- Surrender: Allowed after 3 years.

2. Gram Santosh (Endowment Assurance)

The “Goal Achiever”

- How it works: You pay premiums for a fixed term (e.g., 15 or 20 years). You get the full money (Sum Assured + Bonus) immediately when the term ends.

- Bonus Rate: ₹48 per ₹1,000 Sum Assured.

- Best For: Mid-term goals like a daughter’s marriage, children’s higher education, or building a house in the village.

- Loan: Available after 3 years.

3. Gram Suvidha (Convertible Whole Life)

The “Flexible Choice”

- How it works: You buy it as a Whole Life policy (low premium). After 5 years, you have the option to convert it into an Endowment policy (Gram Santosh) if you decide you want the money earlier.

- Why choose it? If you are unsure about your long-term income, start here. It gives you the safety of Whole Life with an exit option.

4. Gram Sumangal (Anticipated Endowment)

The “Money Back” Policy

- Concept: Instead of waiting 20 years for the money, you get payouts during the term.

- 15-Year Term: You get 20% back after 6 years, 20% after 9 years, 20% after 12 years, and 40% + Bonus at maturity.

- 20-Year Term: Similar payouts at 8, 12, and 16 years.

- Best For: Farmers or businessmen who need periodic cash flow for equipment, seeds, or expansion.

5. Gram Priya (10-Year RPLI)

The “Short Term” Specialist

- How it works: A strict 10-year endowment policy.

- Bonus: ₹45 per ₹1,000.

- Best For: People who want a quick, guaranteed return in a decade.

6. Gram Bal Jeevan Bima (Children’s Policy)

The “Future Securer”

- How it works: Insurance for the children of RPLI policyholders.

- Limit: Max ₹1 Lakh or equal to parent’s Sum Assured.

- Benefit: No premium is required if the parent passes away; the child still gets the full sum assured at maturity.

Comparison: RPLI vs Private Rural Insurance

Why should a villager choose the Post Office over a private agent? The math speaks for itself.

| Feature | RPLI (Gram Suraksha) | Private Rural Policy | Bank FD (Taxable) |

| Premium Cost | Very Low (Non-profit) | High (Includes commissions) | N/A |

| Bonus Rate | ₹60 / ₹1000 | ₹30 – ₹40 / ₹1000 | ~6.5% Interest |

| Guarantee | Sovereign (Govt of India) | Company Solvency | Deposit Insurance (up to 5L) |

| Tax Benefit | 100% Tax-Free (Sec 10(10D)) | Tax-Free | Interest is Taxable |

| Accessibility | Every Village Post Office | City Branches only | Bank Branches |

| Agent Trust | The Local Postman (GDS) | Unknown Agents | Bank Manager |

The Verdict: Private insurers have “Loading Charges” and high operational costs. RPLI uses the existing postal network, keeping costs near zero. That saving is passed to you as a higher bonus.

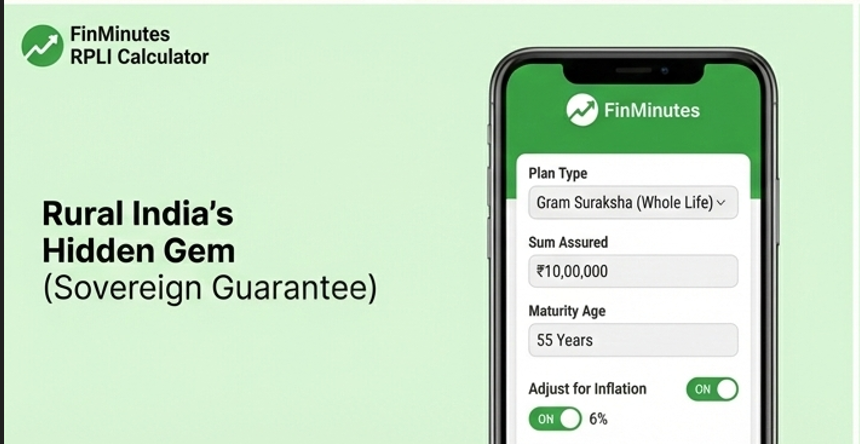

How to Use the FinMinutes RPLI Calculator

We built the Finminutes Rural Postal Insurance Calculator because most online calculators confuse PLI with RPLI, giving you wrong (inflated) numbers. Our tool is RPLI-Specific.

Step 1: Select Your Plan

Choose between Gram Suraksha (High Bonus) and Gram Santosh (Early Maturity). Watch the “Badge Rate” update instantly (₹60 vs ₹48).

Step 2: Enter Sum Assured

This is the insurance cover you want.

- Max Limit: ₹10 Lakhs.

- Note: You do not pay this amount. You only pay a small monthly premium to get this cover.

Step 3: Check the “Deep Dive”

Look at the “Policy Deep Dive” section.

- ROI (CAGR): See the exact percentage return you are getting. RPLI often delivers a 4.5-6% Tax-Free Return, which is a good return for an insurance scheme.

- Net Monthly Premium: We calculate the Rebate (Discount) you get for high-value policies (₹1 discount for every ₹20,000 Sum Assured).

Step 4: The Inflation Reality

Switch on the “Adjust for Inflation” toggle.

- A maturity of ₹20 Lakhs in 30 years might only be worth ₹4 Lakhs in today’s money. This feature helps you decide if a ₹10 lakh cover is enough or if you need to buy multiple policies.

PLI vs. RPLI: What is the Difference?

Many people get confused. Here is the cheat sheet:

| Feature | PLI (Postal Life Insurance) | RPLI (Rural Postal Life) |

| Eligibility | Govt Employees & Professionals | Rural Residents (Anyone) |

| Max Sum Assured | ₹50 Lakhs | ₹10 Lakhs |

| Bonus (Whole Life) | ₹76 per ₹1,000 | ₹60 per ₹1,000 |

| Bonus (Endowment) | ₹52 per ₹1,000 | ₹48 per ₹1,000 |

| Plans | Suraksha, Santosh, etc. | Gram Suraksha, Gram Santosh |

Verdict: If you are eligible for PLI, buy PLI (higher bonus). If you are not eligible for PLI but live in a village, RPLI is your best bet.

Service Guide: Loans, Revivals, and Claims

Investing is easy; getting money back is where trust matters. RPLI is handled by the Department of Posts, known for reliability.

1. Taking a Loan

Need money for a crop cycle or wedding? You don’t need to break the policy.

- Gram Santosh: Loan available after 3 years.

- Gram Suraksha: Loan available after 4 years.

- Process: Submit your passbook and policy bond at the Post Office. The loan is sanctioned quickly, often at ~10% interest (cheaper than local moneylenders).

2. Policy Revival (If you stop paying)

In rural areas, income can be irregular. If you miss premiums:

- < 6 Months: You can pay pending premiums with a small fine at the Post Office.

- > 6 Months: The policy lapses. You can revive it by submitting a “Good Health Declaration” and paying arrears.

- Pro Tip: Never let a policy lapse for more than 5 years, or it may be permanently closed.

3. Claim Settlement (Death or Maturity)

- Maturity: Simply visit the Post Office with your Policy Bond and ID. The amount is credited to your Post Office Savings Account or Bank Account.

- Death Claim: The nominee must submit the Death Certificate and Claim Form. Since it is government-run, the process is strict but 100% guaranteed. There is no risk of the “Company running away.”

Frequently Asked Questions (FAQs)

Can a person living in a city buy an RPLI Policy?

No. You must have a permanent address proof in a rural area (village/panchayat) to buy RPLI. However, if you buy it while living in a village and later move to a city, the policy remains valid.

Is the maturity amount tax-free?

Yes. Just like PLI, RPLI returns are fully exempt from tax under Section 10(10D).

How do I pay the premium?

– Cash/Cheque: At your local Branch Post Office (BPO) or Sub-Post Office.

– Online: Using the PLI Customer Portal.

– The “Postman” Method: In many villages, the Gram Dak Sevak (Postman) collects the premium directly from your doorstep.

Can I take a loan against RPLI Policies?

Yes. Loan facility is available after 3 years for Endowment (Gram Santosh) and 4 years for Whole Life (Gram Suraksha).

What if I miss a premium payment?

If you miss a payment, the policy lapses. However, you can revive it by paying the pending premiums with a small fine/interest.

The FinMinutes Verdict

RPLI is the financial lifeline of Rural India. It provides the safety of a government bond with returns that can beat inflation. If you are a rural resident, do not put your hard-earned money into risky chit funds or low-interest savings accounts.

Use the calculator above to plan your Gram Suraksha policy today. A small monthly saving of ₹500 can grow into a life-changing corpus for your family.