Advanced SWP Calculator

Plan a Systematic Withdrawal Plan (SWP) with return, inflation, step-up and LTCG tax impact.

Understand how long your retirement corpus can last.

SWP Inputs

Tax Settings (LTCG) Defaults: 12.5% after ₹1.25L yearly exemption

This is an illustrative planner. Actual tax depends on holding period, asset mix, set-off of losses and future law changes.

FIRE Target Helper

Monte Carlo Simulation

Randomised return paths (500 runs) around your expected return to estimate SWP survival.

SWP Survival Heatmap

Years your SWP survives for different return % and SWP amounts (colour = years).

Year-by-Year SWP Summary

| Year | Opening Balance | Total Withdrawal | Realised LTCG | Tax Paid | Closing Balance | Real Balance |

|---|

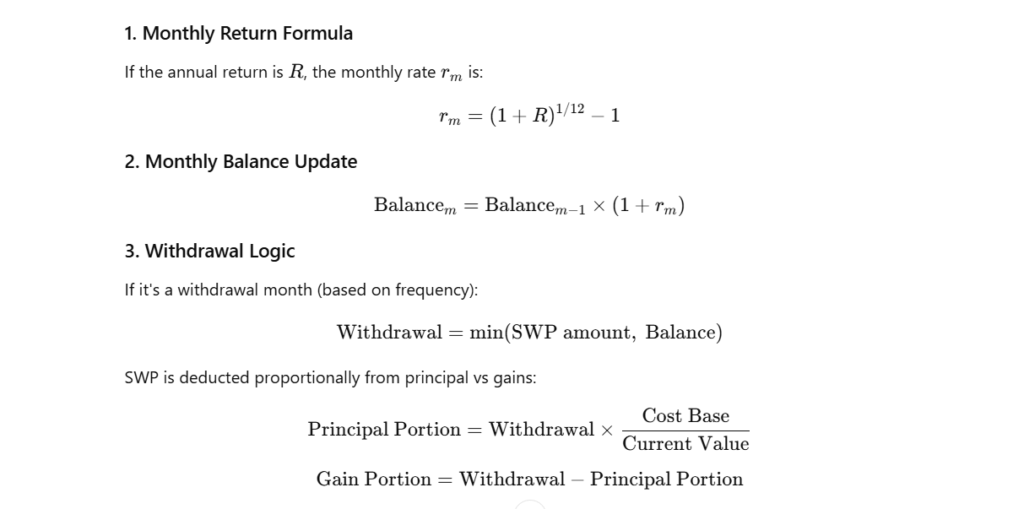

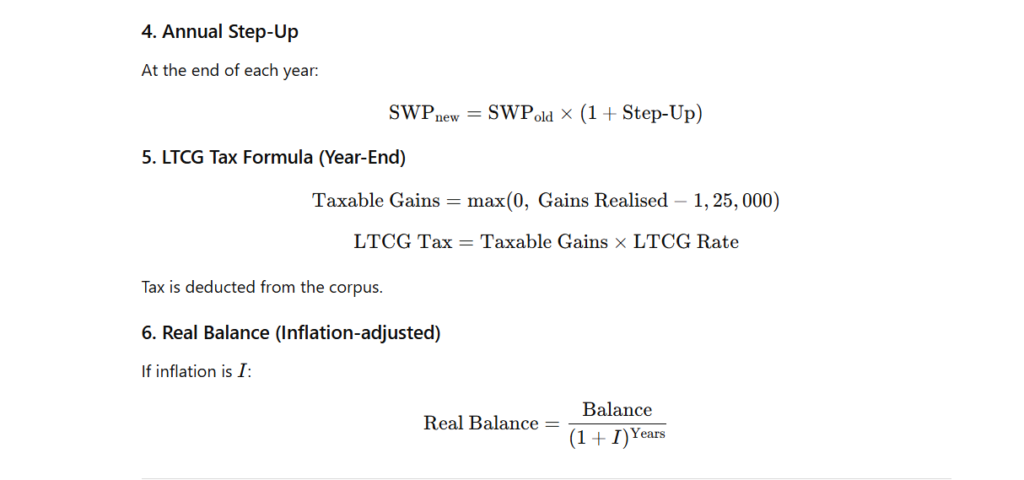

Formula & Methodology (expand)

Simulation engine (FinMinutes): month-by-month SWP with proportional principal vs gains split and yearly LTCG with exemption. Real (inflation-adjusted) balances are also computed.

- Return: monthly rate

r = (1+R)1/12 − 1from annual returnR. - Withdrawals: at your chosen frequency; SWP amount steps up once every 12 months.

- Principal vs gain: each withdrawal split using

costBase / currentValueproportion. - LTCG: yearly realised gains minus exemption taxed at given rate and debited from corpus.

- Real balance: nominal balance divided by

(1 + inflation)years elapsed.

Planning a predictable and inflation-proof income post-retirement is a challenge for most investors. Mutual funds offer a flexible solution through Systematic Withdrawal Plans (SWP), where a fixed amount is withdrawn at regular intervals while the remaining corpus continues to grow.

But simple SWP calculators only show basic projections, and often ignore inflation, taxation, market volatility, and sustainability risk. To solve this, FinMinutes has built one of the most advanced SWP calculators in India, designed for users who want realistic, research-driven insights into how long their corpus will last.

What Is an SWP (Systematic Withdrawal Plan)?

An SWP allows you to withdraw a fixed amount (monthly/quarterly/yearly) from your mutual fund while the remaining balance stays invested. Unlike FD interest, SWP is more flexible and can help manage taxes, cash flow, and longevity risk better.

Key characteristics of SWP:

- You decide the withdrawal amount

- The rest of the money keeps compounding

- Withdrawals consist of both principal and gains

- Tax applies only to capital gains, not the principal component

- Ideal for retirement income, monthly expense planning, or FIRE lifestyles

However, the real challenge while planning retirement is:

Will your corpus last long enough?

This is where the FinMinutes Advanced SWP Calculator becomes extremely useful.

What Makes FinMinutes SWP Calculator Different

Most calculators only show simple projections. The FinMinutes tool models real-world behaviour, including:

1. Inflation-adjusted “real” corpus

Shows the buying power of your money, not just nominal values.

2. LTCG tax simulation

Applies yearly long-term capital gains based on:

- 12.5% LTCG tax rate

- ₹1.25 lakh annual exemption

- Proportionate principal vs. gain withdrawal logic

3. Step-up SWP

Allows your withdrawal to increase every year (e.g., 5% yearly to beat inflation).

4. Retirement Mode

Helps you see:

- At what age the SWP begins

- Till what age the money will last

- Whether it meets your life expectancy target

5. Heatmap Visualisation (Unique Feature)

Shows how long your corpus lasts under different:

- Expected returns

- SWP withdrawal percentages

Colours range from deep red (danger zone) to green (highly sustainable).

6. Monte Carlo Simulation (500 randomised return paths)

Shows success probability based on uncertain market returns, not just averages.

7. FIRE Target Helper

Tells you the corpus required based on:

- Your monthly expenses

- Your chosen Safe Withdrawal Rate (SWR)

8. Download Options

- CSV report

- PDF report

- Heatmap PNG

SWP Calculator Formula (FinMinutes Engine)

The calculator runs a month-by-month simulation, which is more accurate than yearly approximations.

How to Interpret the Calculator Results

The output is designed to give you a complete picture of your withdrawal plan’s sustainability.

1. Total Withdrawn (Income)

Shows how much income you received via SWP over the entire period. Useful for evaluating:

- Lifestyle funding

- Long-term FIRE planning

- Pension replacement

2. Total LTCG Tax Paid

Shows the cumulative tax outgo. Since SWP taxation is proportional and partly exempt, SWP often proves more tax-efficient than traditional income sources.

3. Final Corpus (Nominal)

The remaining money at the end of the projection. If this value is zero, your corpus has been fully exhausted.

4. Real Corpus (Today’s Value)

Inflation erodes buying power; this number shows what the final balance is worth in present terms.

5. Effective Income Yield

A higher yield means the SWP is aggressive; a lower yield means safer withdrawals.

6. Corpus Sustainability (Years Lasted)

Indicates how long your money lasts. This is one of the most important metrics for retirement planning. You also see:

- Approx exhaustion date

- Age till which money lasts (in Retirement Mode)

7. SWP Success Meter

A visually intuitive meter that compares your SWP sustainability against a 30-year comfort horizon. Ranges:

- Green (Safe) → lasts 30+ years

- Yellow (Moderate)

- Orange (Borderline)

- Red (Risky) → may run out early

8. Suggested Safe SWP

The calculator reverse-computes a safe withdrawal amount that aims to survive a 30-year horizon, based on:

- Your corpus

- Return

- Inflation

- Taxation

This helps you adjust your SWP amount to safe levels.

Heatmap Interpretation (One of the Most Powerful Tools)

The heatmap shows sustainability (years your money survives) for combinations of:

- Expected Return % (x-axis)

- SWP as % of base amount (y-axis)

Green = Long sustainability

Red = Very short duration or exhaustion

The highlighted BEST cell indicates the optimal combination in your region. The heatmap also includes:

- Rotated axis labels

- Legend showing risk → safety gradient

- Tooltip on hover

- Percentile overlay showing how your current SWP compares statistically

This allows deep scenario analysis, making the calculator far more insightful than traditional tools.

Monte Carlo Simulation: Why It Matters

Markets don’t give fixed returns every year. So the calculator runs 500 simulated return paths, adding realistic variability around your chosen expected return. The output includes:

- Success Probability

- P10 (bearish), Median, and P90 (bullish) survival years

This is essential for:

- Retirement planning

- SWP risk management

- Corpus drawdown strategies

FIRE Target Helper

If you’re planning for Financial Independence (FIRE), this tool is invaluable. You enter:

- Monthly expenses

- Safe Withdrawal Rate (SWR, usually 3.5–4%)

The calculator instantly shows:

Plus:

- Indian short notation (Lakhs, Crores)

- INR formatting

Exportable Reports

You can download:

- SWP yearly table CSV

- Detailed PDF report

- Heatmap PNG

The downloadable PDF includes:

- All metrics

- Summary highlight

- The table

- Clean report formatting

Is SWP better than FD for retirement income?

Often yes. SWP provides:

– Tax advantage

– Potentially higher returns

– Flexibility to adjust withdrawals

But it carries market risk.

How much can I safely withdraw each month?

For long retirement horizons (25–30 years), a 3–4% yearly withdrawal rate is generally safe, but it depends on:

– Corpus

– Expected returns

– Inflation

– Taxation

The calculator’s Suggested Safe SWP feature gives an accurate number.

Will SWP affect my mutual fund returns?

Withdrawals reduce the corpus, but only the withdrawn units stop compounding.

The remaining units still grow normally.

How is SWP taxed?

SWP withdrawals are not fully taxed. Only the gains portion is taxed under LTCG. The principal part is always tax-free.

Why does the inflation-adjusted corpus fall faster?

Inflation reduces purchasing power, so even if your nominal balance is rising, the real value might decline.

What does Monte Carlo success percentage mean?

It shows the probability that your SWP will survive 30 years under varying market conditions. Higher percentage = safer withdrawal.

Why does the heatmap show different results for small return changes?

Small changes in expected return can drastically affect sustainability, reflecting real-world compounding sensitivity.

Can I use this calculator for FIRE planning?

Yes. The FIRE helper calculates the exact corpus needed for a chosen SWR.

Conclusion

The FinMinutes Advanced SWP Calculator goes far beyond traditional tools. It doesn’t just show numbers; it shows risk, longevity, tax impact, inflation damage, and scenario variations, helping you make smarter retirement and income decisions. Whether you’re:

- Planning a comfortable retirement

- Evaluating corpus longevity

- Exploring FIRE independence

- Analyzing SWP sustainability under different return scenarios

This calculator gives you a research-grade, highly accurate projection of your financial path.