- Infosys share buyback announcement lifted the IT index sentiment as the index gained more than 5% in the last few days.

- Infosys announced, “The Board of Directors of the Company, at a meeting held on September 11, 2025, has considered and approved a proposal to buyback equity shares for an amount of ₹ 18,000 Crore.

- The price of buyback is ₹1,800 per Equity Share, payable in cash, comprising a purchase of 10,00,00,000 fully paid-up equity shares of the Company of face value of ₹ 5 each, representing up to 2.41% of the total number of equity Shares.

- The buyback will come at a 19% premium over the stock’s closing price on the day of the announcement.

- As of June 30, 2025, Infosys had cash & equivalents of ₹42,000–₹45,000 crore and free cash flow of over ₹20,000 crore.

- Record date to be announced later. The buyback will be done via the tender offer route.

After Infosys announced its largest buyback program, investors anticipated similar moves by other large, cash-rich IT companies. This lifted the sentiment of the entire IT pack, which was otherwise tepid due to many reasons, including a slowdown in the US economy, the US tariff war, and the evolving AI situation.

Infosys’ stock closed at 1525, up 1% today, and many are asking, Is it okay to buy the stock for now to tender in buyback? Are other IT stocks attractive to add? Is the worst over for the Indian IT pack?

If you also have similar questions, then you are in the right place. I will try to answer these questions by exploring certain scenarios, e.g.,

- Infosys Buyback Play from Short-Term Angle

- Infosys as an Investment Beyond Buyback from a Medium-Term Angle

- Peer IT Stocks: Are They Attractive?

- Macro / Sector Outlook: Is the Worst Over?

Infosys share buyback from a short-term angle

Arbitrage Opportunity:

- Current price: ₹1,525

- Buyback price: ₹1,800, close to 18% premium.

- But actual gains depend on acceptance ratio (AR).

- If AR is high (say 25–40%), the upside could be attractive.

- If AR is low (say 5–10%), retail investors may not benefit much unless the stock rallies further.

What is Acceptance Ratio (AR)?

- In a tender offer buyback, which Infosys announced on September 11, the company sets a maximum size for the buyback.

- Shareholders can tender (offer) their shares to the company at the buyback price.

- But, not all shares get accepted; the Acceptance Ratio (AR) = (No. of shares accepted / No. of shares tendered).

- For retail investors, there is a special quota: shareholders holding should be ≤ ₹2,00,000 worth of shares on the record date; those that fall into the retail category often get a higher AR than institutional investors.

Historically, Infosys has done 3 buybacks in the last decade, and retail AR for Infosys has hovered in the range of 30–40%. For large investors (non-retail), AR was much lower (sometimes <10%).

| Year | Buyback Size | Price (₹) | Mkt Price Pre-Buyback | Retail AR (approx.) | Remarks |

|---|---|---|---|---|---|

| 2017 | ₹13,000 Cr | 1,150 | ~930–950 | ~30–40% | Retail investors tendered heavily, and acceptance was decent. |

| 2019 | ₹8,260 Cr | 800 | ~700 | ~30–35% | Similar to 2017, meaningful acceptance. |

| 2022 | ₹9,300 Cr | 1,850 | ~1,500 | ~30–35% | Acceptance has improved since retail participation was lower than expected. |

Let’s understand it with a case study. Assume an investor, Ramesh, is planning to take advantage of this arbitrage opportunity in Infosy; the following scenarios can happen-

Case Study: Ramesh (Retail Arbitrage Investor)

Assumptions:

- Ramesh wants to play the buyback arbitrage.

- Maximum investment in retail = ₹2,00,000 worth of shares.

- Current market price = ₹1,525, assuming the buy range for Ramesh is anything between 1,500 and 1,550.

- Buyback price = ₹1,800.

- Max shares he can hold for retail eligibility =

2,00,000 / 1,525 ≈ 130-131 shares. - So Ramesh buys 131 shares at ₹1,525 each (₹1,99,775 investment).

Scenario 1: AR = 30%, Base case (based on past average)

- Shares accepted =

131 × 30% ≈ 39shares. - Accepted shares sold at ₹1,800 =

39 × 1,800 = ₹70,200 - Cost of those shares =

39 × 1,525 = ₹59,475 - Profit on accepted shares = ₹70,200 – ₹59,475 = ₹10,725.

- Remaining 92 shares (not accepted) = stay in demat, value fluctuates with market.

- If the price stays near ₹1,525, Ramesh still holds ₹1,40,300 worth of stock.

Scenario 2: AR = 40% (best case)

- Accepted shares =

131 × 40% ≈ 52. - Profit on those 52 =

(1,800 – 1,525) × 52 = ₹14,300. - Leftover 79 shares = worth ₹1,20,475 at the current market price.

Scenario 3: AR = 20% (Worst case)

- Accepted shares = 131 * 20% = 26.

- Profit on accepted shares = (1,800 − 1,525) × 26 = ₹7,150 (cash realized when buyback pays).

- Unaccepted shares = 131 − 26 = 105 shares– these are credited after settlement, and Ramesh can sell them in the market at whatever price prevails.

Historically, Infosys’ share price hovered between -10 to +10% for one month after the buyback concludes. So, I’m building a case for the combined profit/loss for Ramesh for both accepted and unaccepted shares. Here, I’m assuming that this time the acceptance ratio will be between 32 and 35%, and the price of Infosys remains in positive territory (+1 to 10%) for one month of buyback.

- Shares bought = 131 @ ₹1,525 = ₹199,775 invested.

- Accepted shares = 131 × 35%, 46 shares.

- Accepted profit = (1,800 − 1,525) × 46 = ₹12,650.

- Unaccepted = 85 shares.

| Price 1 month | Unaccepted P/L (85 shares) | Total P/L | ROI (vs ₹199,775) |

|---|---|---|---|

| −10% (₹1,372.50) | −₹12,912.50 | −₹262.50 | −0.13% |

| −5% (₹1,448.75) | −₹6,462.50 | ₹6,187.50 | 3.10% |

| 0% (₹1,525.00) | ₹0.00 | ₹12,650.00 | 6.33% |

| +5% (₹1,601.25) | ₹7,231.25 | ₹19,881.25 | 9.95% |

| +10% (₹1,677.50) | ₹14,462.50 | ₹27,112.50 | 13.57% |

Takeaways for AR = 35%:

- Break-even happens around ₹1,522.10 (−0.2% move), meaning if the stock just stays flat or better, Ramesh profits.

- Much better downside cushion vs AR of 20% (worst case). Even if the stock falls ~5% in a month, he still makes close to 3% return.

- If stock rises 5–10%, ROI jumps to +10–14% in just one month.

Break-Even for different scenarios

- Break-even (overall P/L = 0) for AR = 20%: ₹1,456.90, the stock can fall up to −4.5% in one month, and Ramesh still breaks even.

- When AR = 30% (accepted 39 / unaccepted 92; accepted profit ₹10,725), the Break-even price is ₹1,408.42 (i.e., can tolerate ≈ −7.6% drop). At 0% price move, total P/L, ₹10,725 (≈ 5.37% ROI).

- If the AR is 40% (accepted 52 / unaccepted 79; accepted profit ₹14,300), the Break-even price is ₹1,343.99 (i.e., can tolerate ≈ −11.8% drop). At 0% price move, total P/L of ₹14,300 (7.16% ROI).

Infosys from a Medium to long term vs peer IT stocks

For the past few years, IT companies have been struggling to maintain growth. Once upon a time, these companies were growing 20+% YoY, but now even a low single-digit growth seems miraculous. For Infosys, revenue growth has slowed to low single digits YoY, due to weak global IT spending (especially in BFSI and retail).

In Q1 FY26, the company saw $4.1 bn in large deal wins, but revenue conversion was lagging. Infosys cut FY25 growth guidance earlier, but analysts expect FY26 recovery if US/Europe client budgets stabilize. For the company, operating margin is under pressure from wage hikes, higher subcontracting, and weak pricing power.

Infosys expects a recovery owing to automation, GenAI efficiencies, and a higher offshore mix, but margin recovery is only possible when demand normalises and cost levers kick in. In FY25, the company saw just a modest growth of 1.6% in EPS For FY26, I am assuming three scenarios to play out: bear, base, and bull cases.

- FY25 actual EPS = ₹64.50

- Growth bands: Bear 3–5%, Base 8–10%, Bull 14–16%, and

- P/E ranges (reasonable historical/peer bands): Bear 18–19x, Base 22–23x, Bull 25–27x. (Current P/E is 23)

- Current price = ₹1,525.

| Scenario | FY26 EPS (range) | P/E used | Fair value range (₹) | Implied % vs ₹1,525 |

|---|---|---|---|---|

| Bear | ₹66.44 – ₹67.73 | 18 – 19x | ₹1,195.83 – ₹1,286.78 | −21.6% → −15.6% |

| Base | ₹69.66 – ₹70.95 | 22 – 23x | ₹1,532.52 – ₹1,631.85 | +0.5% → +7.0% |

| Bull | ₹73.53 – ₹74.82 | 25 – 27x | ₹1,838.25 – ₹2,020.14 | +20.5% → +32.5% |

Infosys Vs peer IT stocks

- Infosys trades at 22–23x forward P/E (as of the current stock price of ₹1,525, P/E is 23x).

- TCS trades at 26–27x, but currently, TCS is also trading at a P/E of 23x. But challenges are equal for TCS too, though TCS earnings are less volatile and deal wins are predictable.

- Historically, HCL Tech trades at a P/E of 20–21x, but the current P/E of HCL is close to Infosys and TCS.

- Wipro & TechM are cheaper, but due to weaker fundamentals. Tech Mahindra experiences wide fluctuations in performance, so its valuation is also volatile. The company has a vision in place, but it is in the early phase of implementation.

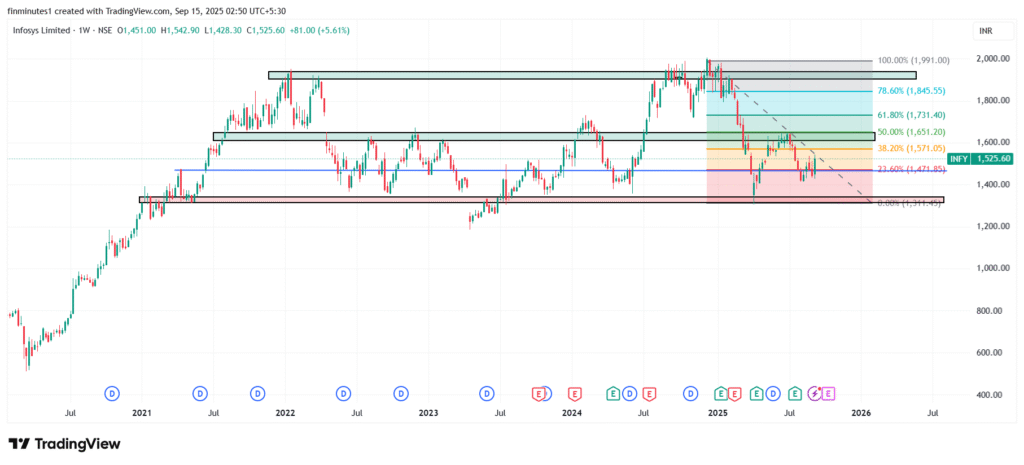

Infosys Technicals

- Current Zone: Price at ₹1,525 is struggling near the 38.2% retracement (₹1,571). This is the first real test of resistance.

- Upside Path: If it breaks 1,571 convincingly, next levels = ₹1,651 (50% Fib + resistance), then ₹1,731 (61.8%).

- Downside Path: If it fails here, watch support at ₹1,471 (23.6%) and ₹1,310 (Fib 0%).

IT Sector Macro

Headwinds: Global IT spending remains sluggish, GenAI is disrupting traditional outsourcing, and currency volatility persists. US tariff policies are a big overhang for the sector, as long as there is a clear roadmap on the tariff front, volatility in Indian IT stocks will persist.

Tailwinds: Stabilizing US/Europe economy (Some stability is there, but experts are not ruling out a recession), AI/digital transformation spending, and a rate cut cycle reviving discretionary budgets. The rate cut cycle can lift the sentiments in IT stocks, experts are betting on at least 3-4 rate cuts in the next few months.

Conclusion

A balanced approach and a close watch on these headwinds and tailwinds are needed for Indian IT stocks. If headwinds persist, these stocks are trading at a fair valuation; further re-rating will be tough.

Infosys Buyback 2025: FAQs

What is a share buyback?

A buyback is when a company repurchases its own shares from existing shareholders, reducing the number of shares in circulation. It’s typically done to return surplus cash, improve EPS, and signal confidence in prospects.

Why is Infosys doing a buyback?

Infosys is highly cash-rich, and it is generating strong free cash flows each year. The buyback is a way to:

– Return capital to shareholders,

– Improve per-share earnings (EPS) and return ratios,

– Support the stock price during uncertain demand cycles (which the company is currently facing).

What is the Infosys buyback price and size?

Price: 1,800

Total Size: 18,000 crore

Premium from last closing price: 18%

What is the record date for the Infosys buyback?

The record date will be announced by the company soon.

How can retail investors participate?

Investors holding shares worth up to ₹2 lakh (based on market price on record date) fall under the retail category.

– They can tender their shares through their broker during the buyback window on the exchange platform.

What is the acceptance ratio (AR)? What will be the Acceptance Ratio for Infosys share buyback this time?

The acceptance ratio is the percentage of tendered shares that the company accepts.

– In past Infosys buybacks, retail AR has ranged from ~30% to ~70%, depending on participation.

– Final AR depends on how many shareholders tender vs. the reserved portion for each category.

Will Infosys ADR holders (US investors) be eligible for the buyback?

No, typically Infosys ADRs (traded on the NYSE) are not eligible to participate directly in the Indian buyback process, as Indian regulations restrict participation to shares listed domestically.

– ADR holders would need to convert their ADRs into underlying equity shares in India before the record date to become eligible.

– This involves additional costs, time, and procedures with custodians, which may not be practical for small investors.

What is the rule for US-based investors in Infosys?

US investors holding Infosys stock via ADRs generally cannot tender in buybacks.

If they hold direct Indian-listed Infosys equity shares (through permitted routes like PIS/NRI accounts), they may be eligible, subject to SEBI rules.

– Always check with your broker/custodian before the record date.

When will shareholders get buyback proceeds?

Once the tendering window closes and acceptance is finalized:

– Accepted shares are debited, and proceeds are credited directly to the shareholder’s bank account within a few working days.

– Unaccepted shares are returned to the demat account.

How does the buyback impact Infosys’ stock price?

– In the short term, the buyback usually provides support due to arbitrage opportunities.

– Medium term: stock performance will still depend on Infosys’ earnings growth, demand outlook, and sector recovery.

Disclaimer: Not a trade call or advice, please consult with your investment advisor before making any buy/sell decision.