IPO GMP of INR 60 suggests Borana Weaves is up for a decent listing on D-street with a close to 25% listing gain over the issue price. At a time when companies are avoiding doing IPO due to market volatility, Borana Weaves’ primary issue is attracting a good response.

At the time of writing, the issue has been oversubscribed more than 29 times, with the retail quota being oversubscribed by 76x, followed by the NII quota of 51x. Borana Weaves IPO is a public issue of 0.37 Cr equity shares. The company offers 0.07 Cr shares to retail investors, 0.20 Cr shares to qualified institutional buyers, and 0.10 Cr shares to non-institutional investors.

About Borana Weaves

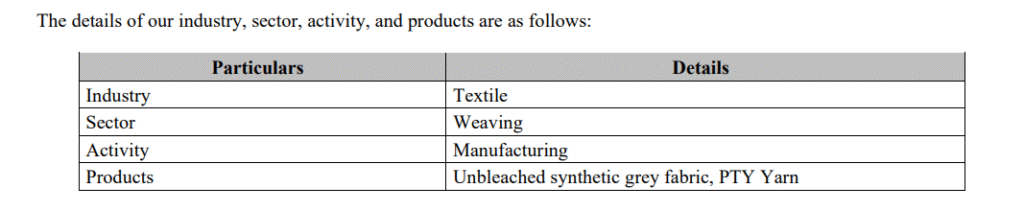

The company is a textile manufacturer based in Surat, specializing in the production of unbleached synthetic grey fabric. This fabric serves as a fundamental material for further processing, such as dyeing and printing, in various industries, including fashion, traditional textiles, technical textiles, home décor, and interior design. The versatility of grey fabric allows it to complement a wide range of unbleached fabrics across different styles, making it a valuable resource in the textile supply chain.

The company commenced its operations in 2020, and the production from our first unit, Unit 1, located at Plot No. AA/93/P, Hojiwala Industrial Estate, SUSML, Surat, Gujarat, was subsequently started in 2021. As of this date, the company operates three manufacturing units in Surat, Gujarat, equipped with textile manufacturing technologies for, inter alia, texturizing, warping, water jet looms, and textile folding.

Most of the manufacturing and processing in their units are carried out using textile manufacturing technologies, pollution-light machinery and tools which are supplied by domestic and global players in the synthetic fiber industry. As of December 31, 2024, the Company had a total of 15 texturizing machines, 6 warping machines, 700 water jet looms, and 10 folding machines active at its three units.

Borana Weaves: Business updates and Financials

The Indian market is experiencing a notable shift towards synthetic textiles, driven by their affordability, durability, and ease of maintenance. Current demand for polyester in India stands at approximately 4 million tonnes and is projected to rise to 6.7 million tonnes by 2025, indicating a growing consumer preference for synthetic materials.

Further, evolving fashion trends, particularly the rise in brand consciousness and rapidly changing styles, are increasing the appeal of synthetic textiles. With the global end-use market for man-made fibers expected to expand by 3.7% by 2025, the Indian synthetic textile industry is well-positioned to benefit, with growth opportunities in both domestic consumption and Exports (Source: D&B Report).

Borana Weaves’ majority customer base (comprising wholesalers) in Gujarat has contributed to the company’s growth. With its office, manufacturing units, and operational activities also based in this state, it endeavors to foster strong connections with customers.

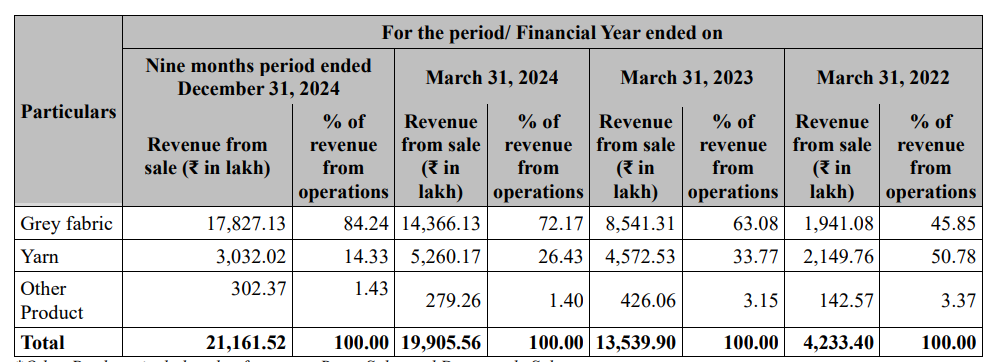

During the Fiscal Years 2024, 2023, 2022, and the nine-months ending December 31, 2024, the company catered to 170, 177, 65, and 204 customers, respectively, and our revenue from sales stood at ₹19,9.05 crore, ₹ 13,5.39cr, ₹ 4,2.40 cr, and ₹ 21,1.61 crore, respectively, translating to average compounded annual growth rate of 116.84% for the last three Financial Years.

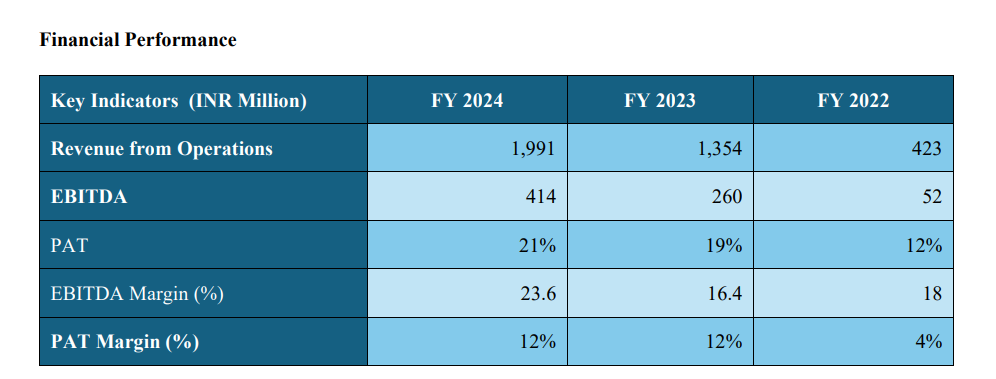

Though still small in size, Borana is growing very rapidly with good improvement in EBITDA and PAT margin.

Borana Weaves: what we like in the company

- Location advantage: Situated in Surat, a major textile and apparel manufacturing hub in South Gujarat, Borana Weaves benefits from its strategic location, which provides easy access to raw materials, particularly POY Yarn. The concentration of the company’s registered office, corporate offices, manufacturing units, and suppliers within the region enables effective responses to regional market dynamics and challenges.

- Technological Advancements: Borana Weaves has invested significantly in state-of-the-art textile manufacturing technologies, including 700 high-tech water jet looms. This enables high production efficiency and superior quality, positioning the company as a technological leader in the industry.

- The adoption of water jet looms presents significant benefits in the production of synthetic grey fabric. These machines offer greater precision in the weaving process, resulting in fabric that exhibits uniform texture and consistent quality.

- Unlike traditional power looms, which may require more mechanical components and labor-intensive setups, water jet looms can operate at higher speeds with reduced downtime. This efficiency enhances the ability to meet larger production demands without compromising on quality.

- Additionally, the water jet technology places less tension on the polyester textured yarn, decreasing the likelihood of breakage during weaving. This results in fewer interruptions in the production cycle, lower waste generation, and a more streamlined manufacturing process compared to traditional methods.

- Furthermore, the reliance on water as a propulsion method lessens energy consumption, and the absence of harmful chemicals associated with conventional fabric treatments promotes a more sustainable approach to textile manufacturing.

- Vertical Integration: Borana Weaves has integrated key operations, such as spinning and texturizing, within its manufacturing process. This vertical integration improves control over the supply chain and enhances production efficiencies.

- Niche Product Portfolio: The company primarily focuses on a single product line, offering grey fabric exclusively. This specialization enables the company to concentrate its efforts within a specific market segment, catering to niche customer needs with a focused approach.

- Growing Demand for Sustainable Textiles: With increasing awareness of environmental concerns, there is a growing demand for sustainable and eco-friendly textiles. Borana Weaves’ commitment to high-quality, grey fabric positions it well to capitalize on this trend.

- Opportunity in the International market: Exploring export opportunities and expanding its presence in international markets could provide Borana Weaves with access to larger consumer bases and new revenue streams, particularly in regions where Indian textiles are in high demand.

Negatives in the company

- Intense Competition and operational challenges: The Indian textile industry is highly competitive, with both established players and new entrants vying for market share. The competition from both domestic and international textile manufacturers could exert pressure on pricing and market positioning. Also, fluctuations in the prices of raw materials, such as cotton and synthetic fibres, could impact production costs and margins, especially in times of economic uncertainty.

- Higher Operating Costs: While the investment in advanced machinery increases production efficiency, it also adds to the company’s operational costs, which could impact profitability, especially during periods of fluctuating demand.

- Limited domestic presence and no global presence: Borana Weaves operates exclusively in the domestic market, but as the company was founded just a few years back, it has limited working experience. Borana has no presence internationally. Expanding into global markets could open up significant growth opportunities.

- Dependence on Technological Upgrades: The company’s heavy reliance on machinery means it must continuously invest in the latest technology to stay competitive. This can strain financial resources, especially in the face of rapid technological changes.

Valuation and peer comparison, Is IPO GMP justified?

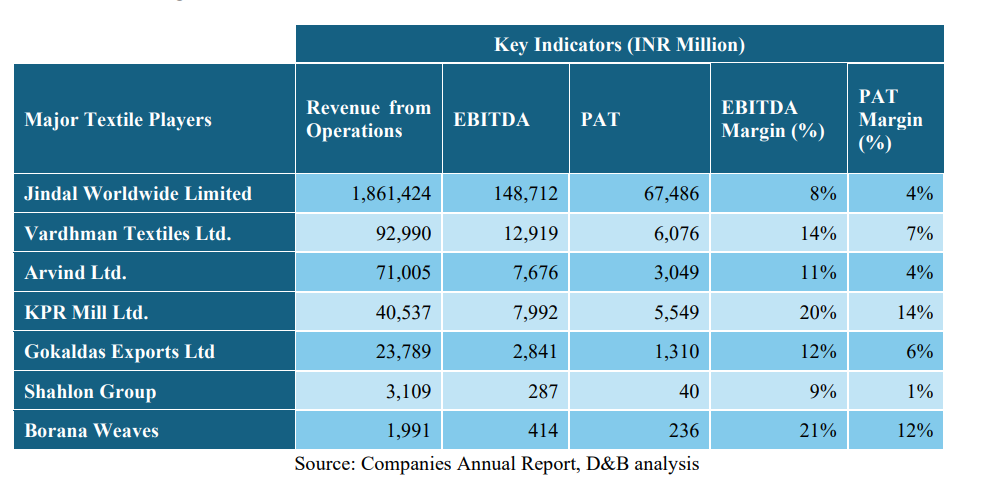

The industry trend highlights varying levels of operational efficiency, as seen in the EBITDA margins. Companies like KPR Mill Ltd. (20%) and Borana Weaves (21%) demonstrate strong operational efficiency, significantly outperforming peers in EBITDA margin, reflecting their ability to manage costs effectively while driving profitability. In comparison, larger firms like Jindal Worldwide Limited (8%) and Arvind Ltd. (11%) operate on thinner margins, possibly due to higher costs associated with their extensive operations.

Evidently, Borana Weaves is able to fetch better margins (both EBITDA and PAT) compared to its peers due to its niche market focus and focused cost structure. However, to scale the topline, Borana may have to diversify and aggressively spend, and to gain market share in the future, it may have to compromise on margins.

At the upper end of the price band of INR 216, the stock is valued at a P/E and a P/B ratio of nearly 24.5 and 2.6 times, respectively. Whereas other comparable peers are trading at a higher P/E, e.g., KPR mill at a P/E and P/B of 50 and 8.18, Gokaldas exports at a P/E and P/B of 49.6 and 3.81, and Arvind Ltd at a P/E and P/B of 28.1 and 2.62.

So, there is a good possibility that Borana Weaves may witness a 20-25% listing gains. Interesting? read our research report on Protean EGOV to find out if further falls are possible in this stock.

Conclusion

Borana Weaves is a cash-generating company (net cash positive since FY23). Post IPO, the promoter’s stake will be 65%, and it has no promoter pledge. Demand for synthetic textiles is booming in India, led by rising apparel consumption, urbanization, and export-driven garment production. Borana is well placed to benefit from the booming synthetic fabric market. Its B2B nature of business makes its cost structure light, giving it an advantage over peers in maintaining margins.

But IPO applicants should keep in mind that Borana Weaves is a recently formed company (though the promoters are experienced), it has no brand value as it is not a direct seller of products in the market, and its revenue comes from a highly commoditized product with no long-term contracts in place with clients. It has no business moat as its largest selling product, grey fabric, is crowded, as many reputed products make it in huge quantities.

Borana Weaves IPO is a completely fresh issue IPO, so 50% of the money raised will be used in capex. As the trend suggests, the company can remain net cash positive since FY23, it will have an upper hand in business, as it will not rely on external funds, thus better managing its debts. Investors should keep these facts in mind before betting on this IPO.