Reliance share price fall is a worrying sign for overall market breadth as the largest Indian stock in terms of market cap holds maximum weightage in Nifty 50 (one of India’s flagship indexes). In today’s trading session, the stock of Reliance Industries is trading at 1,165/share, down 3% from the previous close.

The stock touched an all-time high of 1,610 in July 2024, and from the top, the stock is down close to 30% underperforming benchmark Nifty 50. In the last one year, Nifty Fifty is down close to 1.16%, but Reliance Industries is down close to 22%.

Reliance share price fall: Why the underperformance

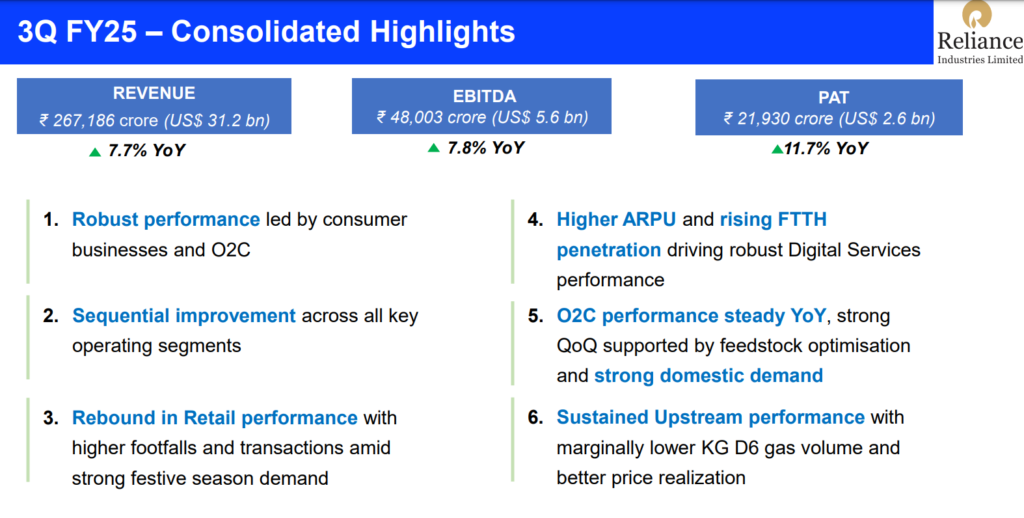

In Reliance Industries, FII ownership was close to 21.75% in the Jun 2025 quarter, which now stands at 19.16%, a dip of more than 2%. So FII selling was one of primary reason behind such fall in the stock. Sales and PAT of the company fell in the June and September quarters both sequentially and YoY, but in the December quarter, Reliance Industries posted a strong set of numbers.

- Revenue growth of 8% and EBITDA growth of close to 8%.

- Profit After Tax (PAT) growth of approximately 12%.

At the peak, the share price of the company was trading at P/E of 31, which historically have been a P/E top for the company, and now the stock is trading at a P/E of 22.5 (Considering a 10% growth in Q4 FY25 EPS, and at full year EPS of 52), which is historically close to a P/E bottom for the company. Not just that, another key indicator, Market cap to sales, at the top the mcap/sales for Reliance Industries was at 2.4x, which is now sitting at 1.6x.

Business outlook going ahead

Management is optimistic of sustained growth across industries, e.g., oil and gas, chemical, retail and FMCG, and telecommunication services. Management pointed out that-

- The focus will be on operational streamlining and productivity improvements yielding positive results.

- Anticipation of continued strong demand in domestic markets, especially in consumer and energy sectors.

- Management acknowledges mixed trends in global margin environments but emphasizes resilience and adaptability in operations.

Reliance share price: Technical outlook

With today’s fall, the stock of Reliance Industries is down 28% from the top, and today, it fell below the 200-week moving average (WMA). Last, the stock slipped below this level was in the fall of the Covid pandemic. The relative strength indicator at 34.42 suggests that the stock’s setup is very bearish. A weekly close below the 200 weekly moving average can increase the selling pressure.

The immediate support for the stock is in the 1140-1150 range, and 1200-1210 will work as the next resistance. The 1090-1100 zone is a big support for stock, and if the stock reverses, the upside 1370-1400 will work as a big supply zone.

Conclusion

Being India’s most valuable company, the stock of Reliance Industries is trading at a very attractive valuation. As discussed above, the stock is near P/E and sales to mcap bottom. Investors with a long-term view in mind can average or add new quantities either by buying in a staggered way (on the above-mentioned support levels) or by adding the stock at current levels for a 3 to 5-year timeframe.

Historically, buying great stocks in panic always creates wealth in the long run. To echo our view, Brokerages and analysts have zero sell calls and multiple ‘buy’ calls on the stock with a median target price of 1,572, suggesting a 35% upside from here in next 12 months.

The risk-reward ratio is at an attractive level for the stock, and it should attract smart money. Always remember, the right time and the right price will never come together, and bargains are only available when there is a panic on the street. Not a piece of trading advice or a buy/sell recommendation; please contact your registered IA for such help.