Polycab share price cracked more than 15%, not just Polycab, stocks of all other leading wire and cable companies are down in a similar fashion. Kei Industries share price is down more than 20%, Havells share price is down more than 5%, the stock of RR Kabel is down more than 16%, and the stock of Finolex Cable is down more than 6%. Cumulatively these companies have lost more than 40,000cr (including Ultratech) in market cap in one single day.

Reason, India’s leading building material company Ultratech, a flagship of Aditya Birla Group is entering cable and wire space with its plans to build a cable and wires plant in Gujarat’s Bharuch by end of December 2026, and to target demand across all segments – be it residential, commercial, or industrial. So, Aditya Birla Group’s foray into the cable and wires business through Ultratech, with an investment outlay of Rs 1,800 crore, is weighing on the share prices of the leading players in the industry.

Aditya Birla Group was able to successfully disrupt the paint market when it launched Birla Opus paint and invested 10,000cr to this purpose. Now the street fears that the group’s foray into the wire and cable business will hurt already-established players in case UltraTech chooses to be aggressive with pricing in the cable and wire foray, to corner greater market share.

Polycab share price

With today’s fall, the stock of Polycab turned negative in terms of return in the last 12 months. YTD stock is down more than 35%, so a question is obvious: Should investors now look at the stock? To answer this question, we will take the help of both technical and fundamental scenarios to come at a most favorable outcome.

Fundamental View

With annual sales of 21,000+ cr in FY 25 and a PAT of approximately 2,000 cr, Polycab is a leader in C&W space, the company enjoys a market share of 25-26% in domestic organised W&C business. In terms of revenue mix, close to 80% of the company’s sales is from the C&W segment, 8% from FMEG (fast moving electrical goods), and the rest 11% is from others (mainly EPC business).

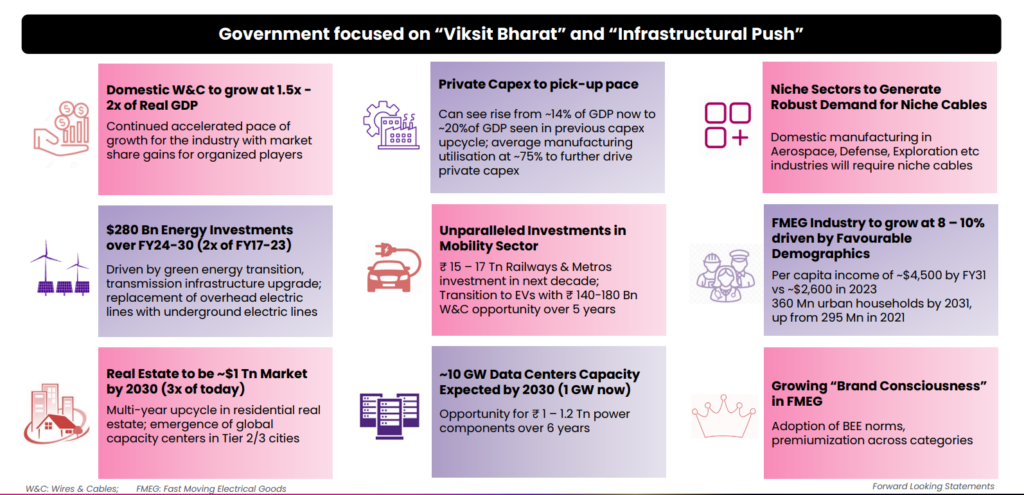

Company launched project spring for the next 5-year guidance till FY30, focusing on six strategic pillars:

- Solidifying Market Leadership in B2B business.

- Propelling Expansion of B2C business.

- Ramping up the International Business.

- Innovation and Automation-led Holistic Development.

- Nurturing talent and capabilities.

- Growing ESG integration.

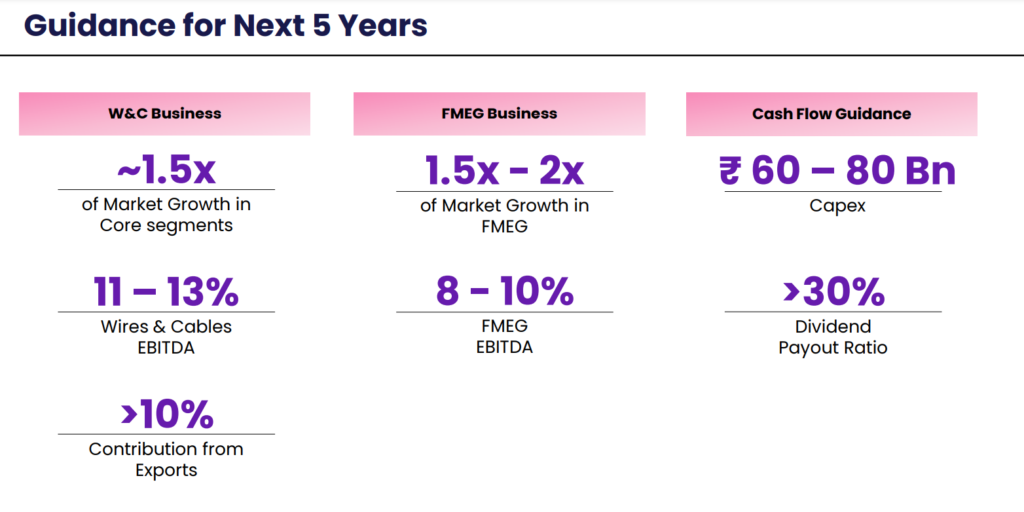

- Objective to grow Wires and Cables business at ~1.5x the market growth with sustainable EBITDA margins of 11% to 13%.

- Targeting international business to contribute over 10% of overall revenue.

The company has a robust cash position with net cash of 1,700cr, and the company plans to utilize it to fund the capex of the company. The company plans to incur a capex of Rs. 1000 Crs -1100 Crs per year in FY25 and FY26. Two-thirds of the CapEx would be directed towards the C&W segment, mainly towards setting up a new extra high voltage manufacturing plant, maintenance, and greenfield/brownfield projects, while the balance is likely to be directed towards the FMEG business for maintenance and backward integration, among others.

The Indian wires and cables market size was valued at USD 9.32 billion in 2024. The market is projected to grow from USD 10.01 billion in 2025 to USD 17.08 billion by 2032, exhibiting a CAGR of 7.94% during the forecast period. Polycab plans to increase its market share in India’s organized C&W market (both B2B and B2C).

Polycab has a solid guidance for the next 5 years. The company planned to achieve Rs. 20,000cr revenue by FY26, and it completed it before schedule (CY 25 revenue surpassed Rs. 200bn or 20,000cr revenue).

In my view, industry leaders like Polycab will be least affected by any new player entering cable and wire market, unlike paint industry where Aditya Birla group invested 10,000cr to aggressively to foray into the sector, here in a similar industry size (paint and C&W both are a $10 bn industry in India with a similar projected growth of 7+% till FY30), here it is investing only 1,800cr.

With Polycab investing Rs. 6,000 to 8,000 cr in the next few years in capex, they will not be much affected by a new player entering the market. Plus, unlike the paint industry, where the Aditya Birla group had the advantage of having already established a supply chain network ( through Ultratech and other building material products), here, the supply chain and sales network will be different for wire and cables. Polycab is already an established player, and it will keep benefitting from its already strong market leadership position.

Another key worry of the street was Ultratech; with its foray into the C&W segment, it may push products in discount compared to industry peers to gain market share and in the process disrupting the margin of other players, but I don’t think with an investment of Rs. 1,800cr over two years, Ultratech will be able to build enough capacity to disrupt market, instead it will be wise for it to silently settle in Rs. 1,00,000cr+ C&W market (expected market size till FY27).

Worried about how BSE Midcap will perform going forward? Click here to know

Technical view

There is strong support for the stock in the Rs. 4,550 – 4,600 zone, it also coincides with 78.6% Fib retracement of the current rally. If the stock does not stop there, there is a high probability of it testing Jan 24 lows of Rs. 3,700-3800. On the upside, the stock will face strong resistance in the Rs. 5,500 – 5,550 range.

Valuation and outlook going ahead

At the current price of 4,680, the stock of Polycab is trading at a P/E of 38.3 (taking a conservative FY25 EPS estimate of 122) against the median P/E of 40. It is also at a discount to industry peers. Given the growth prospects of the company, most analysts assign a P/E of 50+ for FY25, giving it a target price of 6,100. My view is that investors should wait until the dust settles on the stock and it shows proper sign of reversal.

Until then, investors should keep in mind the above levels and whether it is taking support or falling below it. This is not buy/sell advice, and investors are always requested to accept the help of SEBI-registered professionals before making any buy/ sell decisions. For more of our stock coverage, click here