Axis Bank Burgundy Account is a premium, feature-packed bank account offered by one of India’s leading private banks, renowned for delivering various financial products and services. The bank provides various banking services and solutions such as savings accounts, loans, debit cards, credit cards, rewards & investment options.

With its strong presence nationwide, Axis Bank is trusted by millions for its incredible and efficient banking services.

Axis Bank understands its customers’ lifestyles and needs, and therefore, the bank offers a range of personal banking experiences created to deliver seamless, consistent & rewarding experiences at every touchpoint.

Burgundy Membership Eligibility Criteria

(Any of the below, as applicable):

- Average Quarterly Balance of ₹ 10 lakhs (in Savings Account)

- Average Quarterly Balance of ₹ 10 lakhs (in Savings & Current Account)

- Minimum Total Relationship Value of ₹30 lakhs

- Minimum Total Relationship Value of ₹1 crore (including Demat holdings)

- Net salary Credit over ₹3 lakhs/month (in the salary account of Axis Bank)

- For NRIs, Foreign Inward Remittance of at least ₹40 lakhs through wire transfer in the last 12 months

How to Open an Axis Bank Burgundy Account

A Burgundy savings account can be opened either offline or online.

Offline:

One can open a Burgundy savings account offline by visiting a branch and collecting the application form. Applicants can also download the form from the bank’s website.

To open an Axis Bank Burgundy account, you’ll need to:

- Enter your name, address, phone number, and preferred branch (near your residence) in the application form.

- Submit your KYC documents and recent passport-size photographs with the form to the branch.

- Wait for the bank to verify your application.

- Receive a notification on your registered mobile number once the user’s account is activated.

- Also receive a welcome kit with your debit card, passbook and cheque book.

You’ll need to provide the following documents:

Identity Proof: Voter’s ID card, Aadhaar card, Passport, or Driving License

Address Proof: Aadhaar card, Voter’s ID card, or Utility Bills (telephone, water, electricity)

Form 16 If you don’t have a PAN card

Online/Digitally:

One can open his Burgundy savings account through the digital medium (online) by following these four steps. These are as follows:

Step 1) Go to the Axis bank account opening page, select Burgundy bank account

Step 2) Complete the PAN & Aadhaar verification

Step 3) Fill in your personal details

Step 4) Complete the KYC verification through a video call

Step 5) Deposit funds into your account

Basic requirements while opening a Burgundy Digital Saving Account:

- A phone/laptop with a working camera to complete the KYC verification video call ( e-KYC)

- Permission to access camera & location of customer’s device

- Need to deposit opening funds through debit card/ internet banking or UPI

- Account holders will not be able to use a credit card to make the initial deposit. Please keep your debit card / UPI handy

Eligibility & Documents Required for Axis Bank Burgundy Digital Saving Account

To open an Axis burgundy account, the Bank requires customers to fulfill the following eligibility criteria:

- The person applying for a Burgundy account should be an Indian citizen

- Should have the valid PAN & Aadhaar card

- PAN & Aadhaar should be linked

Balance Requirement & Charges for Burgundy Digital Account Opening

- Initial Funding of ₹5 lakh

- Average Quarterly Balance (AQB) of ₹10 lakh

- Issuance of primary Debit Card/Annual Fees is Nil

Axis Burgundy account features

Axis Burgundy account features are numerous, some key ones are listed below-

- Account holders can extend burgundy privileges to up to 3 additional family members & can get 10% off on lockers in addition to a complimentary burgundy debit card and exclusive Burgundy credit card for each member.

- Account holders will enjoy 96 complimentary movie & event tickets per annum via BookMyShow with a ‘Buy 1 Get 1’ offer exclusive to Axis Bank burgundy customers.

- Burgundy account also includes Air Accident Insurance of ₹1 crore & Personal Accident Insurance of ₹15 lakhs.

- Account holders will enjoy special golf privileges of up to 4 complimentary rounds of green fees & 12 complimentary rounds of golf lessons per calendar year.

- Users will enjoy a 60% flat discount on locker rent to secure their life savings.

- Enjoy travel benefits with travel & medical insurance along with up to 32 complimentary airport lounge access.

- Account holders will get 1% cashback on online purchases via E-Debit cards.

- They will also earn 10% cashback every time on Amazon & Flipkart shopping through grab deals.

- With an Axis Burgundy account, customers will get the best of the best financial experts for managing their investment portfolios through in-depth market research.

- Enjoy high daily cash withdrawal & purchase limit, for burgundy customers it is ₹ 3 lakh & ₹ 6 lakh respectively (it is subject to the balance held in the account).

- Avail of business & financial solutions to facilitate business growth, meet personal needs & assist capital-related investments.

- Use the benefit of 24X7 burgundy exclusive support service with no IVR (Interactive Voice Response).

- Get a dedicated relationship manager assigned to you with your Burgundy Digital Savings Account.

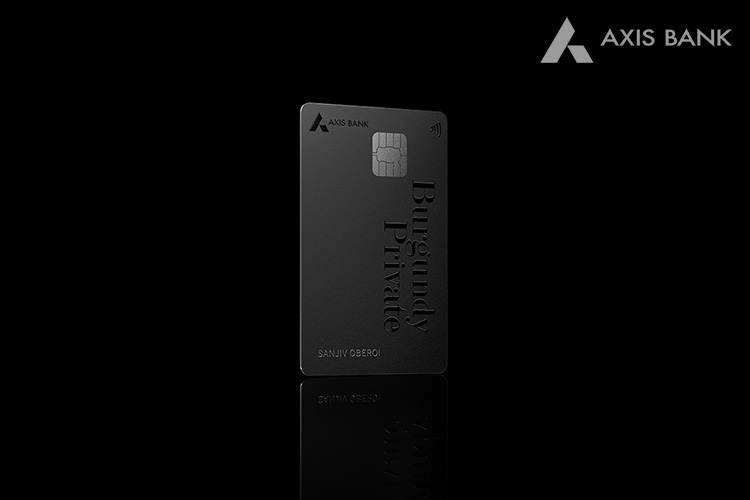

Axis Bank Burgundy Debit Card

The benefits of Axis Bank burgundy debit card allow confident card users to experience the best of all the world, they enjoy a bunch of bonanzas such as:

- Annual charges are waived on burgundy debit cards.

- Axis Bank Burgundy debit card holders enjoy the convenience of Contactless Payments with an increased payment limit of up to ₹ 5,000.

- Easy generation of Debit Card PIN anytime by the cardholder at his convenience at the nearest Axis Bank ATM, Axis Mobile App, Internet Banking, or by calling Axis Bank Phone Banking.

- Enhanced daily cash withdrawal limit of up to ₹3 lakhs & purchase limit of ₹ 6 lakh on the burgundy debit card. In the case of the burgundy minor account (account holder below 18), the maximum daily cash withdrawal limit of ₹1,500 & purchase limit of ₹1,000 only.

- Account holders will enjoy free ATM withdrawals from any bank’s ATMs in India & abroad (a foreign currency mark-up fee of 3.5% will be applicable in case of withdrawal from a foreign country).

- Enjoy an unforgettable dining experience with ₹1,000 off and more through the Axis Bank Dining Delights Program with EazyDiner.

- All consumer durable goods purchased using this debit card are insured against fires, natural disasters, burglary & housebreaking for up to 90 days from the purchase date, making you eligible for purchase protection of up to ₹50,000.

- Loss/Delay in baggage & personal documents: 500 USD

- Purchase protection: ₹ 50,000

- Users will enjoy 3 complimentary visits quarterly at specific airport lounges. This offer is based on a minimum eligible spend of ₹ 5,000 in the previous 3 calendar months. If the debit card is newly issued, the minimum spend criteria are waived for the month of issuance as well as for the following 3 months.

- EDGE REWARDS Points for transactions & 500+ rewards & offers to redeem these collected points. Get points for these transactions, as:

- 2 points for each ₹ 200 spent, domestically

- 6 points for each ₹ 200 spent, internationally

Fees & Charges for Burgundy Debit Card

The Burgundy Debit Card fees include annual charges, which are waived. The customized card design fee is not applicable to this card. The fees & charges for the Burgundy Debit Card are listed below:

| Types of Charges | Amount |

|---|---|

| Joining/Issuance Fee | Nil |

| Annual Fee | Nil |

| Card Replacement Fee | Nil |

| ATM Withdrawal Limit (Per Day) | ₹ 3,00,000 |

| POS Limit Per Day | ₹ 6,00,000 |

| Personal Accident Insurance Cover | ₹ 15,00,000 |

| Airport Lounge Access | Yes |

| Foreign Currency Mark-Up Fee | 3.5% levied in case of all international transactions |

| Dynamic Currency Conversion (DCC) Mark-Up Fee | 1% +GST will be applicable |

| Annual Fee for Non-Maintenance of Burgundy Status | INR 1500 + TAX applicable on non-maintenance of burgundy status |

| NetSecure with 1 Touch Issuance Fee | ₹ 1,000 |

| My Design Card Issuance | Charges may vary as per image selected |

| Chequebook Issuance | Unlimited & free |

| NEFT Transaction Limits | Unlimited & free |

| Monthly Cash Transaction/No. of Transactions/Limits | ₹ 15 lakhs/10 free transactions/whichever is breached earlier |

| Charges Beyond Free Limits | ₹ 5 per ₹ 1,000 or ₹ 150, whichever is higher |

FAQs

The average quarterly balance (AQB) required for this account is ₹ 10 lakh.

One-time Locker registration charge, ₹1,000 + GST (Not applicable for Burgundy / Burgundy Private customers). Number of free locker visits – 3 per calendar month, post which ₹ 100 + GST applicable per visit (Not applicable for Burgundy / Burgundy Private customers).

Employees with a net monthly salary credit of a minimum ₹3 lakhs per month will be eligible.

The monthly interest rates are calculated per existing savings account norms & regulations & paid out every quarter.