MobiKwik IPO will open for subscription on Wednesday, December 11, 2024, and close on December 13. 2024. The 572 crore IPO is a completely fresh issue of 2.05 crore equity shares, which means the total money raised will go to the company.

The fintech company has set a price band of ₹265 to ₹279 per share, and the IPO lot size is 53 shares. SBI Capital Markets and Dam Capital Advisors Ltd are the book-running lead managers of the Mobikwik IPO, while Link Intime India is the IPO registrar.

Shares of MobiKwik are trading at a premium of 130 points in the grey market, indicating a listing at a 40% premium.

MobiKwik IPO: Issue details

| IPO Open Date | December 11, 2024 |

| IPO Close Date | December 13, 2024 |

| Face Value | ₹2 / Equity Share |

| IPO Price Band | ₹265 to ₹279 Per Share |

| Issue Size | ₹572 Crores |

| Fresh Issue | ₹572 Crores (no offer for sale) |

| Issue Type | Book Built Issue |

| IPO Listing Date | December 18, 2024 |

| Retail Quota | Not more than 10% |

| QIB Quota | Not more than 75% |

| NII Quota | Not more than 15% |

Mobikwik IPO subscription details:

Total (at 5 pm) – 7.31 times

Qualified Institutional Buyers (QIBs) – 0.02 times

Non Institutional Investors(NIIS) – 8.97 times

Retail Individual Investors (RIIs) – 26.71 times

About the company

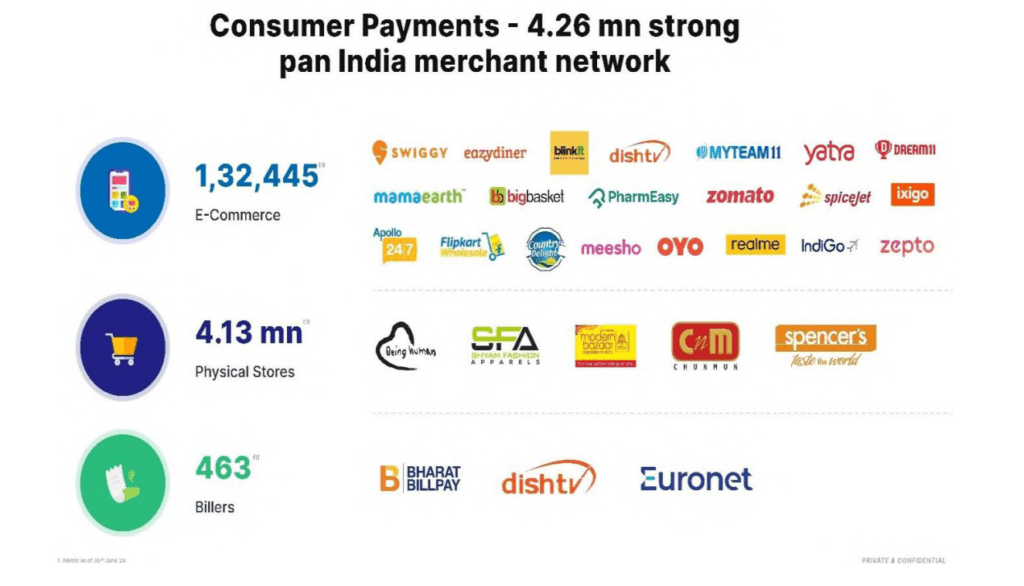

MobiKwik is a platform business with a two-sided payments network, consisting of consumers and merchants. The company was founded by Bipin Preet Singh and Upasana Taku in 2009 to leverage technology as the primary factor to facilitate financial inclusion for the underserved population in India. The company has acquired 161.03 million Registered Users and enabled 4.26 million Merchants to make and accept payments online and offline, as of June 30, 2024.

For its consumer base, the company’s application, the MobiKwik App, provides access to various payment

use cases and financial products in the Digital Credit, investments, and insurance verticals. MobiKwik payment services products for consumers are (via UPI, MobiKwik Wallet, Pocket UPI, cards, and pay-later).

On the app, consumers can make recharge and bill payments, payments at online e-commerce merchants, payments at offline merchants like organized retail and fuel pumps, and transfer money to any other phone number, contact, UPI ID, or bank account.

- The MobiKwik app also offers pocket UPI to make UPI payments through the MobiKwik Wallet without linking a bank account. Apart from that, it also provides investment products to consumers. They are- Lens: Personal financial management product using banking data,

- lens.ai– AI-powered chatbot that allows users to have a conversation to provide insights on their bank accounts and other financial data

- Xtra: A peer-to-peer lending product offered by MobiKwik’s NBFC – P2P partner

- Fixed deposits with RBI-registered NBFCs and banks, and Distribution of Mutual funds and Digital Gold

Under its two-sided payment network, the company empowers businesses and merchants across the country with its vast payment and financial services offerings. The products include the following:

- Online checkout for e-commerce merchants: This enables merchants to accept payments through all major modes such as UPI, wallet, cards and pay-later;

- Scan and pay with Kwik QRs: This enables retail merchant partners to accept payments through all major modes such as UPI, wallet, cards and pay-later;

- MobiKwik Vibe (Soundbox): This is the Company’s QR-enabled payment announcement device;

- MobiKwik EDC Machine: This is a point-of-sale machine that enables the merchants to accept all modes of in-person payment such as credit cards, debit cards, UPI, etc;

- Merchant Cash Advance: This is the Company’s flagship credit product which provides accessible and affordable credit to its Merchants, who use payment solutions for their business requirements.

Industry Overview

India’s fintech industry is one of the fastest-growing in the whole world, with a large space to grow. According to the RedSeer Report, the financial services space in India is highly underpenetrated (across segments including lending, insurance, and mutual funds), representing a big opportunity for a technology-first company like MobiKwik to capture a large market share.

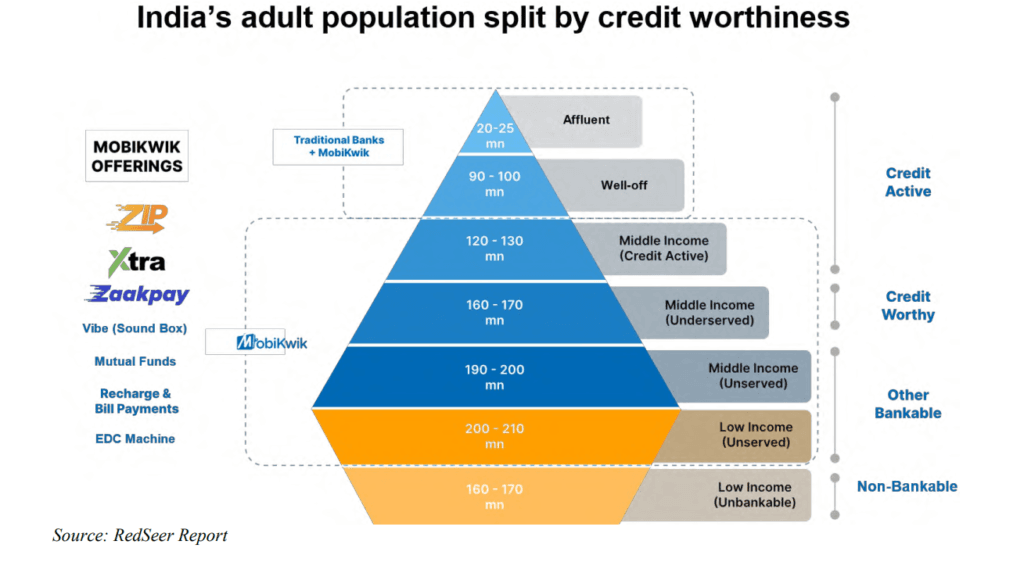

MobiKwik’s target market is the bankable middle-India population. According to a RedSeer Report,

presently, traditional market players usually serve the 20 – 25 million affluent and 90 – 100 million well-off

individuals in the country. However, there exists a substantial untapped market of more than 500 million

individuals in the “middle India population”, who are not actively addressed by the traditional market players.

Among these, 120-130 million individuals are credit active, presenting a considerable opportunity. Additionally, there are more than 400 million consumers who are not currently engaged in credit activities but require access to financial products. Leveraging payment data and facilitating smaller loans enables Mobikwik to establish credit histories for these individuals, thereby contributing to increased financial inclusion.

For MobiKwik, the second and third categories of credit-worthy and other bankable populations are the target market; the first and second sub-segments of middle-income consumers comprise 120-130 million credit-active consumers and 160-170 million underserved consumers.

The third sub-category of middle-income consumers consists of 190-200 million unserved consumers. These sections of the population typically have higher-volume and lower-value ticket sizes of transactions. These characteristics make them highly servable by a technology-first service provider like MobiKwik.

The digital financial product & services market is currently estimated to have a GMV in Fiscal 2023 at USD 996 billion (₹ 80 trillion), which is expected to reach USD 2.5 billion – 3 billion (₹ 200 trillion – 250 trillion) by Fiscal 2028. The overall market is poised to grow at a rate of 21% CAGR from Fiscal 2023 to Fiscal 2028 (Source: RedSeer Report).

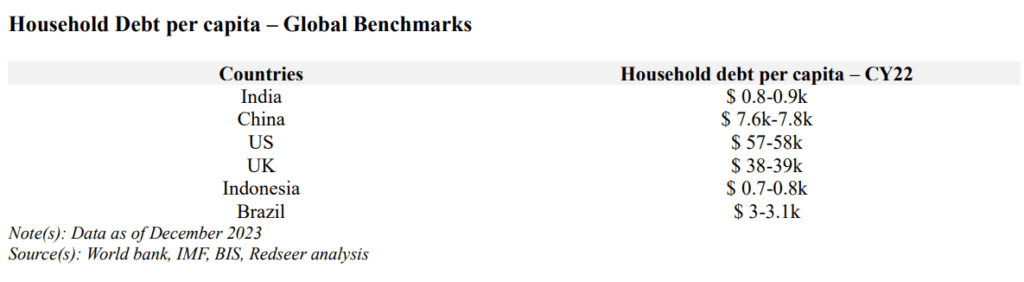

The above data shows how underpenetrated household credit is in India. This presents a large headroom for players like MobiKwik to grow.

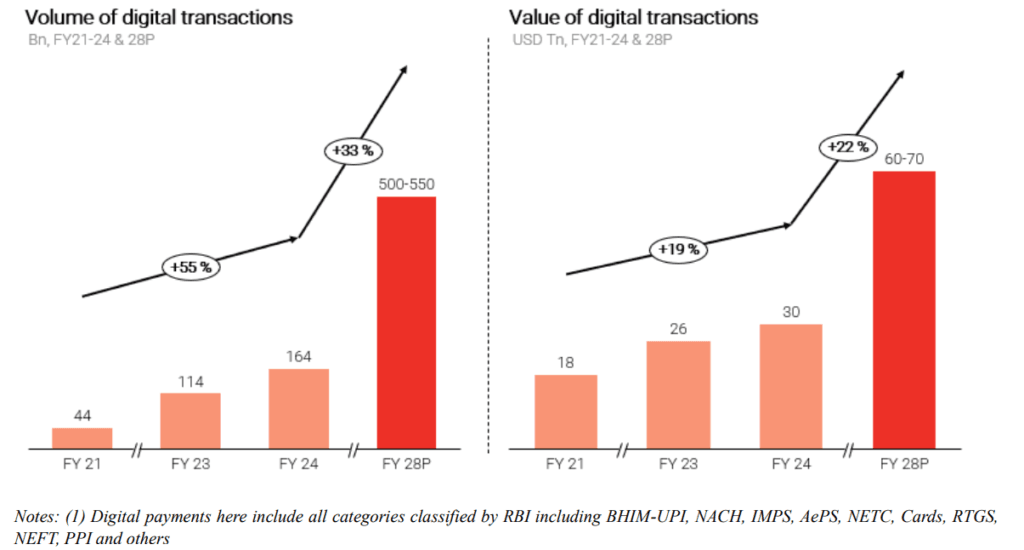

Similar to financial services, payment services have a vast headroom to grow. Based on Redseer analysis, digital payments are on a growth trajectory, and in FY28, the expected volume of digital transactions is projected to be in the range of 500-550 Bn, with an estimated value of USD 60-70 Tn.

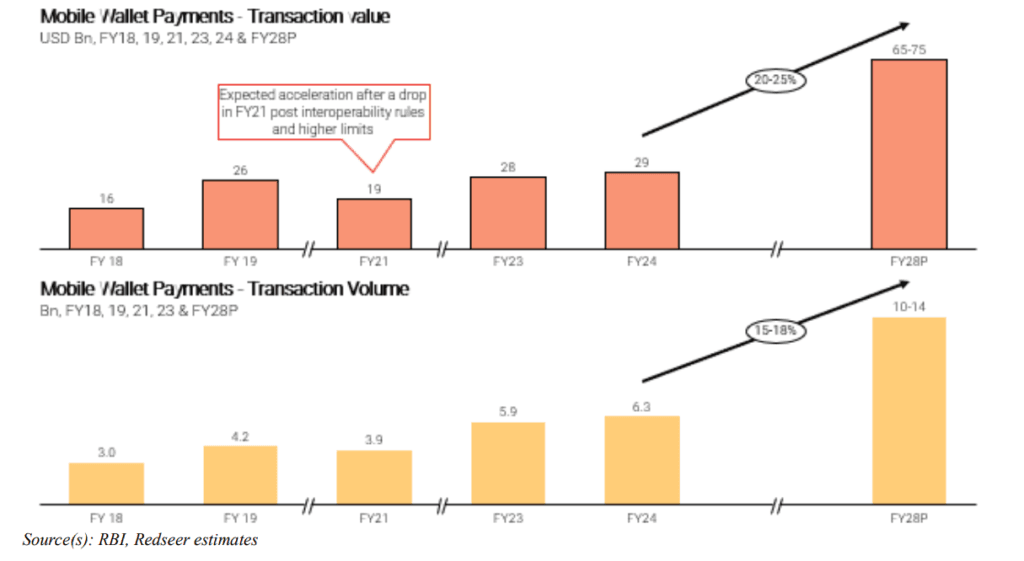

Mobile wallets will also continue to see consistent growth, and mobile wallet-led transactions have increased from USD 16 Bn in FY18 to USD 29 Bn in FY24. Years FY20 and FY21 did see a drop in overall wallet transaction value due to the interoperability rule. Based on Redseer’s estimates, the wallet transaction value will reach approximately 65-75 Bn in FY28P.

MobiKwik’s overview

Strength

- Established Brand and User Base: MobiKwik is one of the largest digital financial product and services platforms in India by registered users as of FY23 with 140 Mn registered users.

- Experienced Management: MobiKwik’s founders (both engineers) have vast experience in fintech and they are very clear on their thoughts on how to grow the company without raising much capital and on the path to profitability.

- Diverse offerings: It provides a wide range of services, including digital payments, ZIP credit, ZIP EMI, insurance, and investments, catering to various customer needs.

- Understanding of the Indian market: MobiKwik is a pioneer of many products, and services it offers so they understand the Indian market very well. This enables them to further experiment and disrupt the market through new techs (MobiKwik plans to use a part of proceed in tech investment like AI/ML)

- Large, engaged consumer base acquired with low CAC: MobiKwik has demonstrated its ability to acquire users efficiently with a low CAC per new registered user of INR 33.5/user as on FY24.

- Tech-Driven Growth and Scalable Solutions: MobiKwik leverages technology and innovation to drive growth, promote financial inclusion, and provide a scalable platform for digital payments and financial services.

- MobiKwik is the first large fintech company in India to become profitable on both EBITDA and PAT levels.

Weakness

- Dependence on Third party lenders: It relies on partnerships with third-party lenders for its credit products, exposing it to potential risks associated with these partnerships.

- Significant dependence on a few products: MobiKwik’s financial services business heavily relies on its ZIP and ZIP EMI products, creating a concentration risk if these products face challenges.

Threats

- Cybersecurity risks: As a digital platform handling sensitive financial information, MobiKwik is exposed to cybersecurity threats that could compromise data security and damage its reputation.

- Intense Competition: The company faces stiff competition from established players like Paytm, PhonePe, Google Pay, and others in the fintech space.

- Higher promotional expense: Chance of slowdown if the company reduces its promotional spends, currently promotional expenditure is high.

- Prone to disruption: The fintech sector is very competitive and tech-driven so prone to further disruption from existing or new players.

- Policy changes, restrictions, and law enforcement: Mobikwik’s revenue has a higher share from financial services but it is a space with the highest policy restrictions. Like its listed peer Paytm, MobiKwik may also face policy changes, restrictions post listings. The company has received two directives with requests for information from the ED.

Valuation and our view

At the upper band of 279, MobiKwik’s market cap will be at 2,167cr post-listing, bringing sales to mcap to 3 times. At FY24 EPS, the company is at a P/E of 155 post listing, which is at a discount compared to listed peers.

MobiKwik’s three-year average ROE and ROCE were nearly -32 and -18 percent, respectively. In FY24, its ROE and ROCE were almost 9 and 5 percent, respectively, and a negative cash flow in 2 of 3 years. It is valued at a P/B ratio of over 3 times compared to Paytm’s 4.3 times.

Our view is that MobiKwik’s revenue growth has remained at 20+%, and it is profitable in FY24 on the EBITDA and PAT level. Investors can apply for this IPO from a long-term perspective, though a good listing gain is possible; keeping it for the long term can be a good option given the growth prospects in the sector it operates in. With the rate cut cycle about to start in India, we will keep a close watch on these companies on how it impacts them.