SBI NRE fixed deposit rates start at 6.25% and can reach 6.60% (Amrit Vrishti scheme) if the invested amount is below 3 crore for a tenure of 1 year to 10 years. If the invested amount is more than 3 crore, then the interest rate is between 6.00%-6.25%.

Now, let us understand what NRE accounts are, who can open them to fulfill FD and for other banking needs with SBI, and is NRE FD is a good choice for NRIs.

About SBI

A Fortune 500 company, an Indian multinational public sector banking and financial services statutory body headquartered in Mumbai. It is also the largest and oldest bank in India, with over 200 years of history.

The bank has a market share of 22.84% in deposits and a 19.69% share in advances in India, with a strong customer base of close to 50 crore customers. Presently, the bank operates a network of approximately 22,500 branches and 63,000 ATMs and close to 71,968 business correspondent outlets across India.

The bank has a global footprint with a network of close to 250 branches/offices in 32 countries. It has a presence in the USA, Canada, Brazil, Russia, Germany, France, Turkey, Australia, Bangladesh, Nepal, Sri Lanka, and other countries. Being the largest public sector bank and with global exposure, it is one of the preferred banks for NRIs (Non-resident Indians)

About SBI NRE accounts

NRE (non-residential external) accounts allow account holders to safely and conveniently deposit funds from foreign earnings or transfer foreign earnings to India. All funds coming into an NRE Account, whichever currency they may be in, are converted into INR or Indian currency, hence allowing an NRI to maintain foreign currency earnings in Indian Rupees.

The funds collected, as well as the interest earned on NRE accounts, are exempt from tax, and account holders can repatriate the money at any time.

Features of SBI Non-Resident External (NRE) Account

- To park users’ overseas earnings remitted to India and converted to Indian Rupees

- NRE Account can be opened either individually or jointly with other NRIs / PIOs / OCIs

- Account can be withdrawn for making local payments in Rupees

- Interest earned on NRE accounts is exempt from Indian Income tax

- Rupee loan available against NRE Deposits

- Tenor Of Deposits (TDR/STDR/RD) Minimum period of 1 year, and a maximum period of 10 years

- The flexibility of having any account type, e.g., Savings Bank, Current Account, Term Deposit, Special Term Deposit, Recurring Deposit

SBI NRE fixed deposit

SBI NRE FD is a good option for NRIs (Non-Resident Indians) seeking to invest their foreign earnings in India. As it is a tax-free investment option that offers full repatriation of both the principal and interest amount and a facility to take a loan against the FD amount, the SBI NRE fixed deposit is one of the top choices for NRIs.

Account holders can also benefit by getting exclusive Credit cards against FD, but they need to check the availability and other criteria at the time of opening the account.

The key highlight of this FD is the tax-free interest in India and the Loan Facility ( though the account holders should also prepare themselves with the tax regulations in their country of residence. If they are in a low-tax-rate country, then this can be one of the best options.

Repatriation is another key highlight; this means that NRIs can seamlessly transfer the funds back to their foreign account without any hindrances.

SBI NRE fixed deposit rates

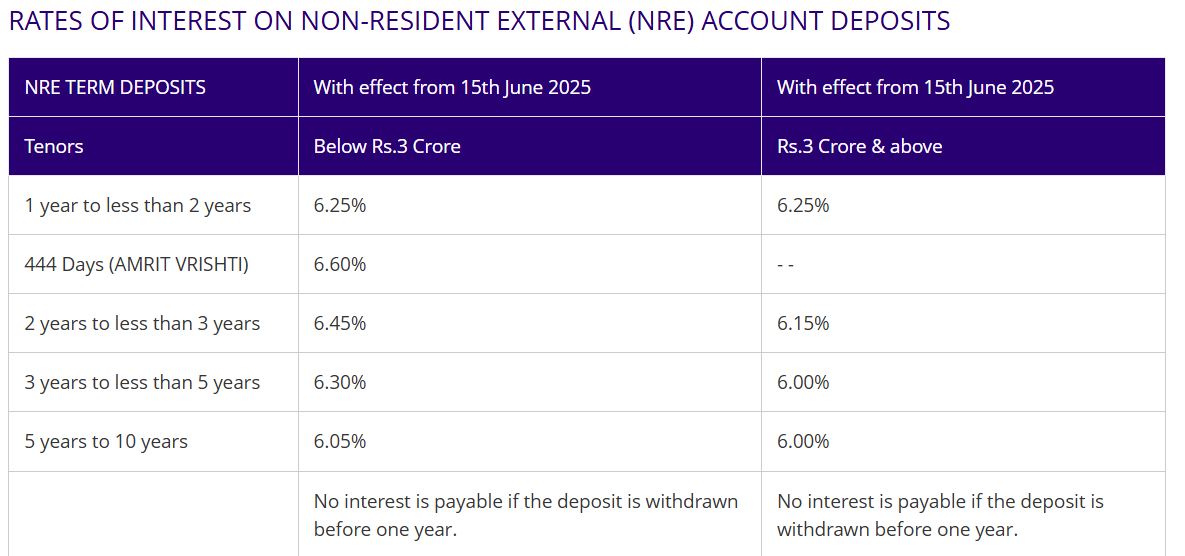

SBI NRE fixed deposit rates are one of the best in class among peers. The FD rates are subject to the deposit’s tenure and are periodically updated by the bank according to the current economic conditions and RBI rates. On the date of writing, the SBI NRE FD rates are as below-

| NRE TERM DEPOSITS With effect from 15 July 2024 | |||

|---|---|---|---|

| Tenors | Below Rs.3 Crore | Rs.3 Crore & above | |

| 1 year to less than 2 years | 6.25% | 6.25% | |

| 400 Days (AMRIT KALASH) (valid till 30.09.2024 only) | 6.60% | – – | |

| 444 Days (AMRIT VRISHTI) | 6.60% | — | |

| 2 years to less than 3 years | 6.45% | 6.15% | |

| 3 years to less than 5 years | 6.30% | 6.00% | |

| 5 years to 10 years | 6.05% | 6.005 | |

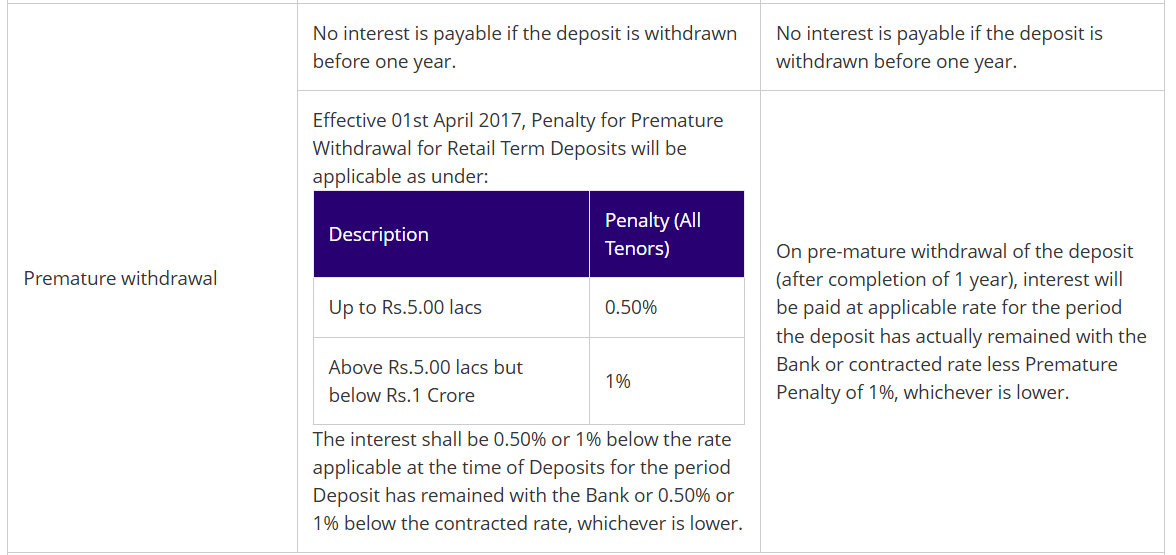

| Premature withdrawal | No interest is payable if the deposit is withdrawn before one year. | No interest is payable if the deposit is withdrawn before one year. | |

| Effective 01st April 2017, Penalty for Premature Withdrawal for Retail Term Deposits will be applicable as under: Description Penalty Up to Rs.5.00 lacs 0.50% Above Rs.5.00 lacs but below Rs.1 Crore 1% | On pre-mature withdrawal of the deposit (after completion of 1 year), interest will be paid at applicable rate for the period the deposit has actually remained with the Bank or contracted rate less Premature Penalty of 1%, whichever is lower. | ||

Processes to follow to open an SBI NRE account

- NRIs can open SBI NRE accounts online; to do so, they need to fill out the account opening application carefully according to the instructions provided by the bank.

Click here to go to the official page to fill out the application form for the SBI NRE savings account.

- NRIs looking to open an SBI NRE account can click here to download the account opening application, fill it out manually, and send it to their preferred home branch in India along with the attested copies of proofs & documents selected for KYC in the application.

- The account can also be opened by filling out and submitting the application form along with proofs & documents selected for KYC in the application by visiting the SBI branch in India or overseas.

- NRIs will need a valid proof of status (Visa, work permit, job contract etc), proof of identity (relevant pages of passport), Current Address document (Overseas only, e.g. Govt IDs, driving license, utility bill etc), Proof of Permanent Address (Overseas / Indian e.g. voter ID card, AADHAR card etc) and some additional documents in the case of online application.

Click here to know the complete list of documents that are required to open an SBI NRE account.

Types of SBI NRE Deposits

SBI NRE Term Deposits

SBI NRE Term deposits are to be opened by NRIs wishing to deposit their foreign earnings in Indian banks in INR. Both the principal and interest components of these deposits are completely repatriable. The interest component for SBI Term Deposits is paid quarterly and credited to the NRE savings account at the depositor’s request.

Depositors can deposit a minimum amount of Rs 1,000 in general branches. In personal banking branches, the minimum deposit balance should be Rs 1 lakh for metro/urban areas and Rs 50,000 for semi-urban/ rural areas. Depositors can also avail of the SBI loan facility or SBI overdraft facility against deposits.

SBI NRE Special Term Deposits

SBI also offers Special Term Deposits to NRE depositors, wherein the interest component is compounded quarterly and paid on maturity with the principal amount.

The minimum deposit balance for Special Term Deposits is at least Rs 1,000 in general banking branches, and in personal banking branches, the minimum deposit is Rs 1 lakh for metro/urban areas and Rs 50,000 for semi-urban/ rural areas. The bank also offers an overdraft or loan facility against the deposits.

FAQs

Any NRI/PIO/OCI desirous of opening an NRE savings account with any branch of the State Bank of India can apply for this account.

Yes, up to 2 applicants can open an NRE savings account.

Yes, KYC documents will be mandatory for both joint account holders.

Yes, the application, along with documents for KYC, should reach the advised global NRI center within 45 days of submitting the information online, or else the application will be rejected and have to be fulfilled out again.

A minor may submit information online for opening a savings bank account, provided he/she is more than 10 years old and can sign uniformly.

Applicant can get his application documents attested from-

– Authorized official at the SBI foreign office

– Notary Public

– Indian embassy and high commission

When the NARN/NCRN is generated, it is sent to the applicant’s email address provided by them. If the email is somhow lost, apllicant needs to regenerate NARN/NCRN

SBI NRE FD interest rates got updated on 15 June 2025, now they stand at as shown in picture-

Yes, SBI provides an option to avail a loan against NRE FD. It is to ensure that users can get funds in emergencies without having to make a premature withdrawal. The loan amount can be up to 90% of the total FD amount, depending on the bank’s current terms and conditions.

No, the interest earned on SBI NRE FD is exempted from any taxes in India. This makes the NRE FD a lucrative investment option for NRIs. Though NRIs should keep in mind that interest earned on NRE FD may be taxed in their current country of residence according to their tax laws

Yes, there is a penalty for premature withdrawal of an SBI NRE FD. Penalty comes in terms of reduced interest rates. The exact penalty is revised by the bank from time to time.

Conclusion

The SBI NRE Fixed Deposit is an excellent option for NRI/PIOs as it is a risk-free, tax-free investment that provides a competitive return in terms of FD interest.