Waaree Energies IPO will open for bidding on October 21, 2024. The 4,321 crore issue will remain open for subscription till October 23rd. The IPO is a mix of fresh issue and offer for sale, but a majority of the money raised will go to the company. GMP of Waaree energies indicates a strong listing on the bourses.

At the time of writing, the shares of the company were trading at a 89% premium in the unlisted market, indicating approximately 2x return on the listing day.

Key details of the Issue

| Key details | Points to note |

|---|---|

| Date of Opening | 21st October 2024 |

| Date of Closing | 23rd October 2024 |

| Price Band (Rs) | 1,427 – 1,503 |

| Fresh Issue (Rs cr) | 3,600 |

| Issue Size (Rs cr) | 4,321 |

| Face Value (Rs) | 10 |

| Post Issue Market Cap (Rs cr) | 41,177 – 43,179 |

| Bid Lot | 9 shares minimum and in multiple thereof Minimum investment Rs.13,527 (at upper P.B) |

| QIB shares | 50% |

| Retail shares | 35% |

| NII shares | 15% |

| Grey Market premium | ~90-95% |

Waaree Energies IPO: About the company

Waaree Energies is the largest manufacturer of solar PV modules in India, with an aggregate installed capacity of 13.3 GW as of Sept 30, 2024. For Fiscal 2024, the company had the second-best operating

income among all the domestic solar PV module manufacturers in India.

Waaree Energies commenced operations in 2007, focusing on solar PV module manufacturing to provide quality, cost-effective sustainable energy solutions across markets, and aid in reducing carbon footprint, paving the way for sustainable energy, thereby improving quality of life.

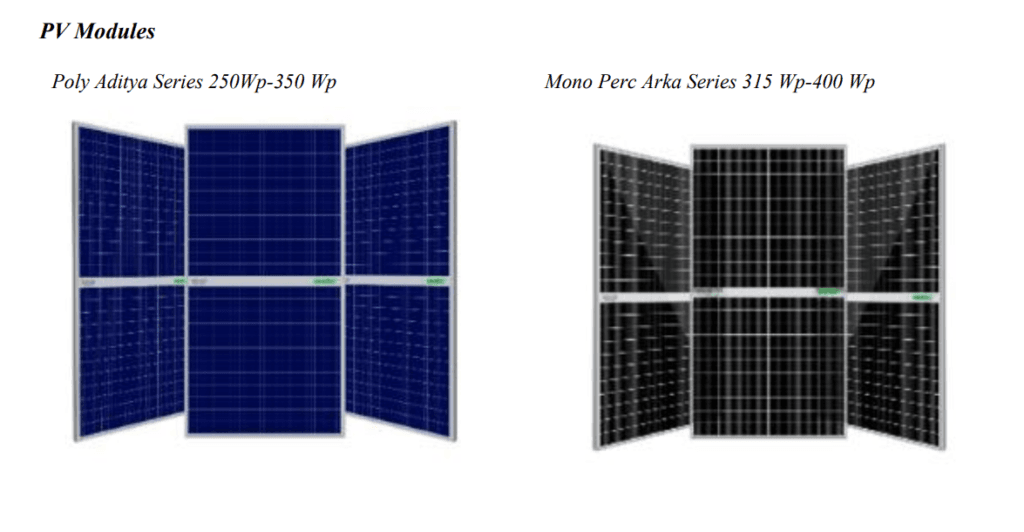

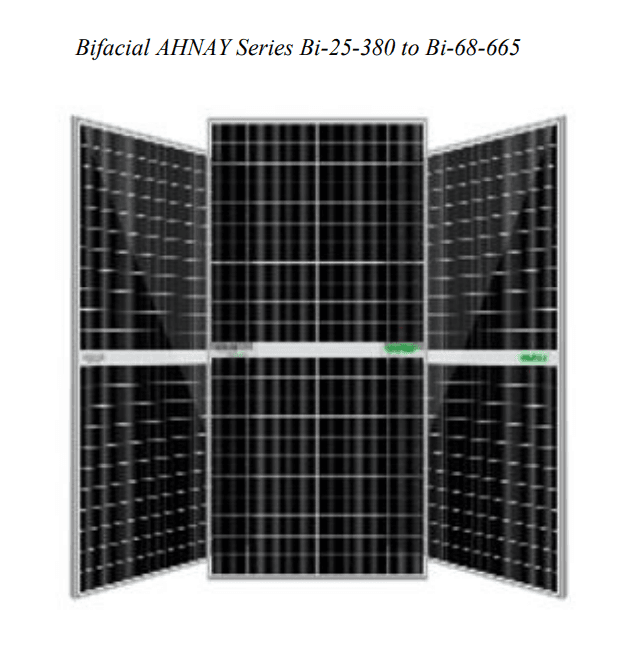

The company’s solar PV modules are currently manufactured using multi-crystalline cell technology, monocrystalline cell technology, and emerging technologies such as Tunnel Oxide Passivated Contact (‘TopCon’), which helps reduce energy loss and enhances overall efficiency.

The portfolio of solar energy products consists of the following PV modules: (i) multi-crystalline modules; (ii) monocrystalline modules; and (iii) TopCon modules, comprising flexible modules, which include bifacial modules (Mono PERC) (framed and unframed), and building integrated photo voltaic (BIPV) modules.

The company operates five manufacturing facilities in India spread over an area of 143.01 acres. It operates one factory each located at Surat (“Surat Facility”), Tumb (“Tumb Facility”), Nandigram (“Nandigram Facility”), Chikhli (“Chikhli Facility”) in Gujarat, India, and the IndoSolar Facility, in Noida, Uttar Pradesh.

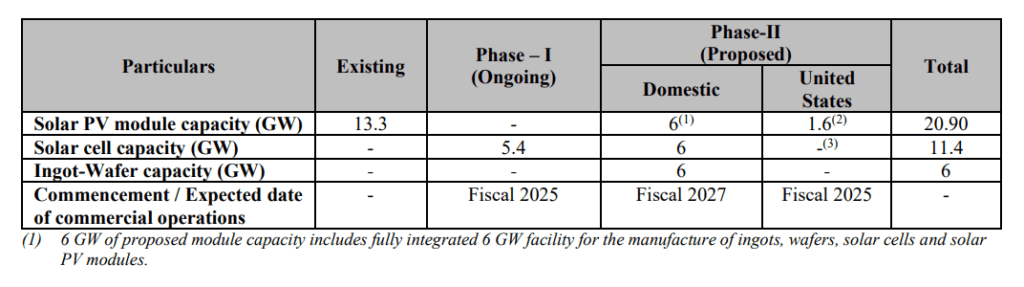

In terms of capex plans, in addition to 13.3 GW, the company plans to set up a 5.4 GW solar cell manufacturing facility by FY25. Additionally, there are plans for a fully integrated 6 GW manufacturing facility to start operations by FY27. The company is also setting up a 1.6 GW plant at its US facility in FY25, with potential expansions to 3 GW by FY26 and 5 GW by FY27, depending on market conditions.

Industry Overview

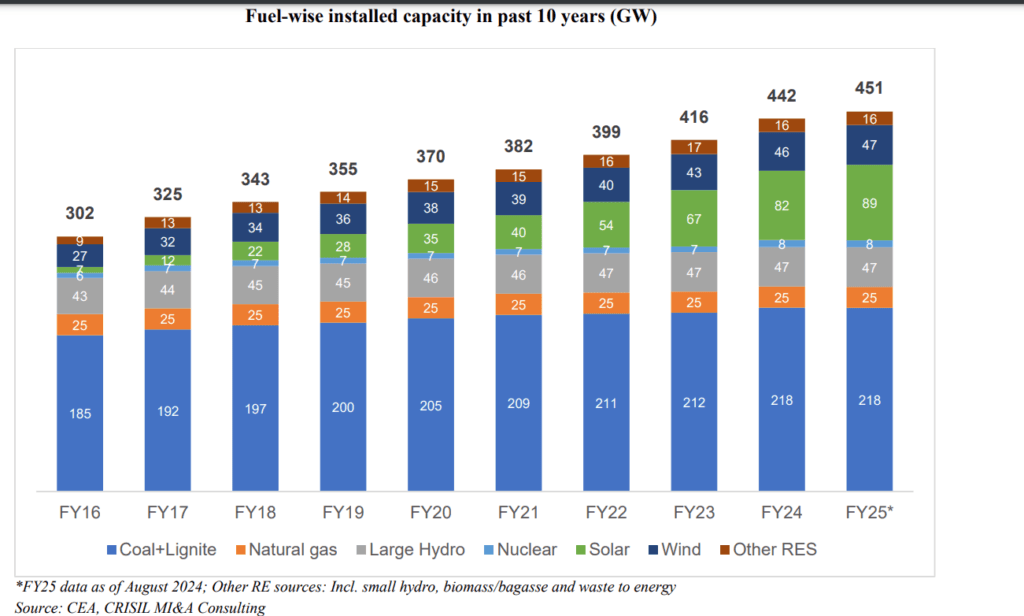

The total installed generation capacity at the end of August 2024 was 451 GW, of which approximately 99 GW of capacity was added over Fiscals 2018 to 2024. The overall installed generation capacity has grown at a CAGR of 6.0% over Fiscals 2014 to 2024.

India’s electricity requirement has risen at a CAGR of approximately 5.0% between Fiscal 2018 and Fiscal 2024, while power availability rose at approximately 5.1% CAGR on the back of strong capacity additions, both in the generation and transmission segments.

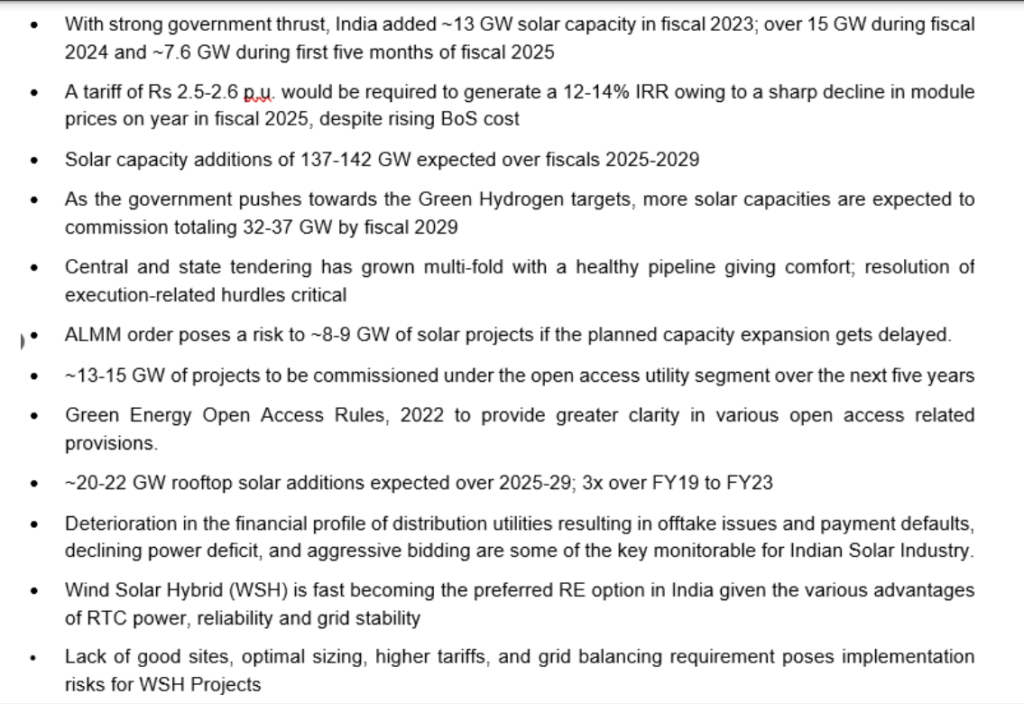

In all forms of capacity additions in the past 8-10 years, maximum capacity addition came from solar power, from just 7 GW to 89 GW, the capacity rose more than 12x in the last 8 years. India is forecast to almost double its renewable power capacity from 2022 to 2027, with solar PV accounting for three-quarters of this growth.

At COP26, India announced its targets of achieving net zero by 2070 and 500 GW of non-fossil installed capacity by 2030. The country also mandated higher RPO in July 2022 for discoms. India is also focusing on domestic manufacturing of solar PV and aims to expand its module manufacturing capacity to approximately 70 GW by 2030.

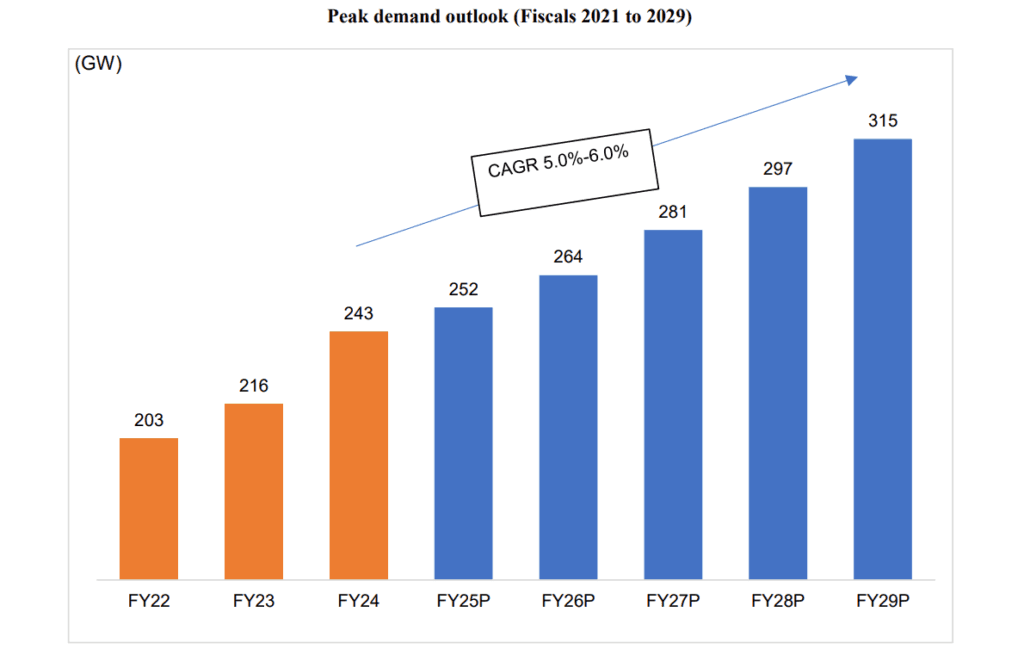

In the demand-supply scenario, Peak demand touched record high levels of 250 GW in Fiscal 2025 during May 2024, attributed to an increase in cooling demand as intense summers scorched several regions of the country. During Fiscal 2023, generation has struggled to keep up with the rise in demand, resulting in an increase in peak deficit to 4.2% as compared with 1.2% for the same period in Fiscal 2022.

The peak demand in India is expected to grow at a CAGR of 5.0-6.0% in the next 5 years and the power deficit is expected to be in the range of 0.2-0.3% with peak deficit expected to remain below 1% in the same period.

INDIAN SOLAR POWER MARKET

Waaree Energies Business strengths

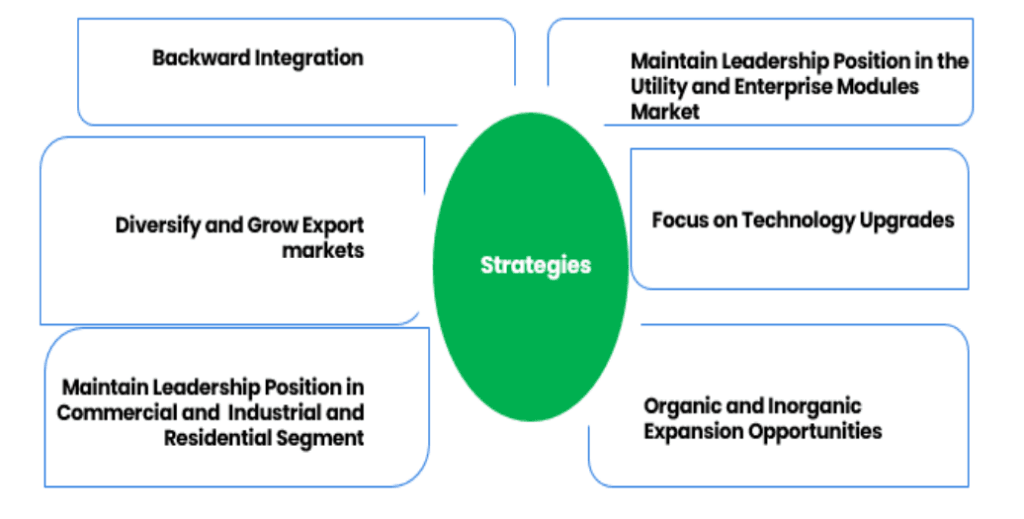

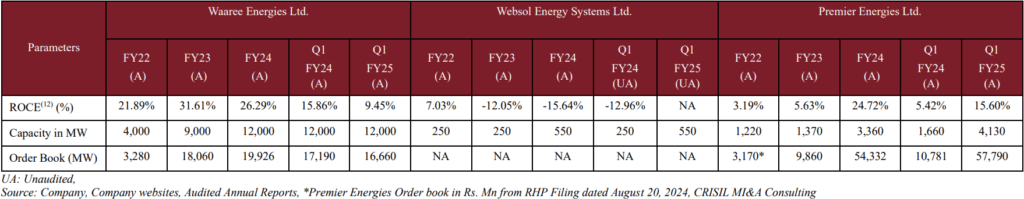

- Waaree Energies is India’s leading solar PV module manufacturer, with an installed capacity of 13.3 GW (1.3 GW capacity commenced at Indosolar facility post-Jun’ 24), up from 4 GW in FY22. It is aggressively expanding its operations to target new segments and cater to a larger number of clients.

- Waaree Energies has a huge customer base and its leadership position enables it to have substantial pricing power compared to its peers, on top of that company has the right mix of domestic and export sales enabling it to easily overcome challenges in either market.

- In addition, the company has a substantial order book of solar PV modules, and as of June 30, 2024, our Company’s pending order book of solar PV modules was 16.66 GW which included domestic orders, export orders, and franchisee orders and 3.75 GW of orders for its Subsidiary, Waaree Solar Americas Inc. located in the United States.

- The company’s focus on maintaining leadership positions is focused and for that, it is following a well-structured plan.

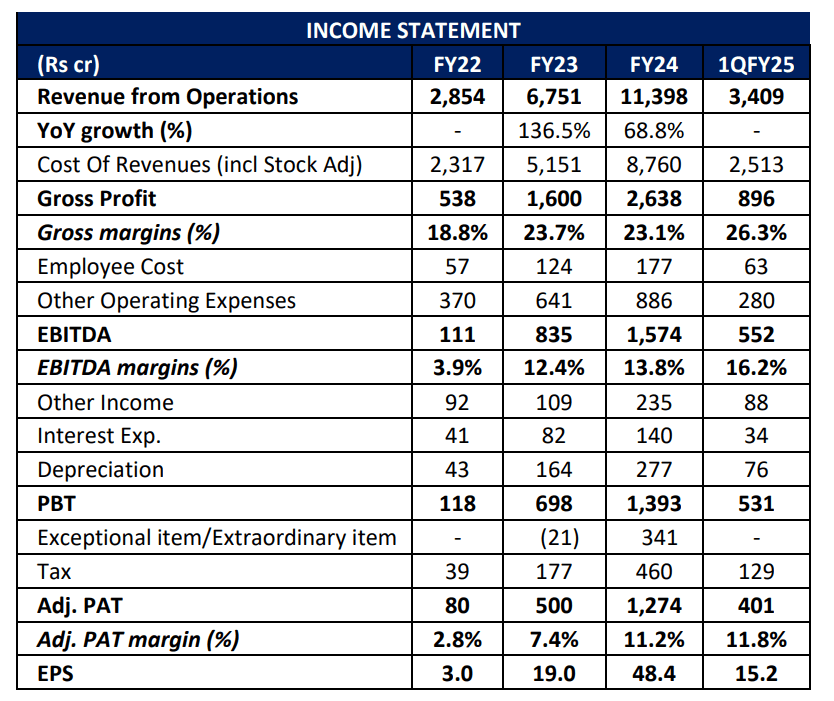

Financial snapshot

Waaree Energies Financials grew at a fast pace in the last few years due to new capacities coming in, It saw a continuous improvement in its top and bottom line, and margins also grew in the same manner as it has one of the highest margins compared to industry peers. The company’s gross margin improved from 18.8% in FY-22 to 23.1% in FY-24, similarly, its PAT margin improved from 2.8% in FY-22 to 11.2% in FY-24.

Peer comparisons and valuations

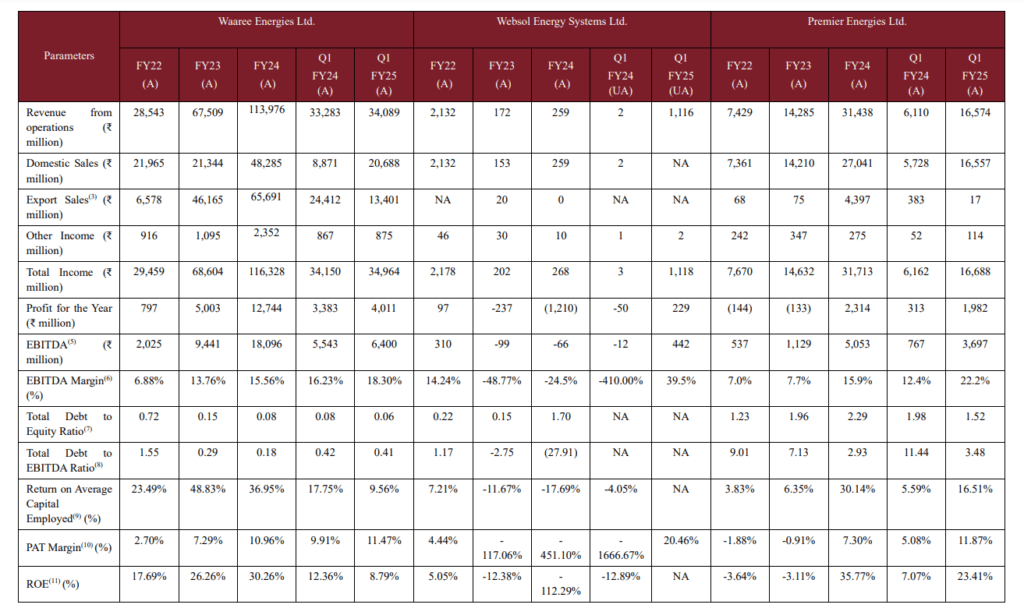

Compared to peers, Waaree Energies is standing tall in almost all comparisons. In terms of valuation, Waaree Energies is offering its share at a p/e of 23 to 25 (considering FY25 EPS of 60-63 for the company and taking a forward P/E for FY-25) compared to a FY-25 forward P/E of 50-55 for other comparable industry peers.

Conclusion

The IPO of Waaree Energies is a very good opportunity for investors to make a quick buck. The company has everything in its favor, be it growth, valuations, or prospects. In terms of risks company’s revenue is a little concentrated in the top few customers, and its revenue mix fluctuates between domestic and exports.

Apart from that price of raw materials and products it offers is also fluctuating, so any big jump in either of these could play a spoilsport for the company.

The company is the largest manufacturer of solar PV modules in India, with an aggregate installed capacity of 13.3 GW. Going ahead, the company will set up a 5.4 GW solar cell manufacturing plant (likely to commence production by FY25), a 6 GW fully-integrated manufacturing facility (likely to commence production by FY27), and a 1.6 GW plant in the USA (further scalable up to 5 GW by FY27) to capitalize on the strong industry growth.

Historically, Waaree Energies recorded a CAGR of 99.8%/276.7%/300.0% in Revenue/EBITDA/PAT, respectively, during the FY22-FY24 period, showcasing the company’s robust financial performance. In my view, the company will be a great option for both short and long-term investors.

Those who want a quick return can bid for the issue and exit after listing, and those who want to play India’s solar power growth story can stay invested in Waaree to reap the future benefits.

Read Company’s RHP, click here