In best IPO to invest now, one is Bajaj Housing Finance. BHFL is a non-deposit-taking Housing Finance Company (HFC), registered with the National Housing Bank (NHB) since September 24, 2015, and engaged in mortgage lending since Fiscal 2018. The company has been identified and categorized as an “Upper Layer” NBFC (“NBFC-UL”) in India by the RBI since September 30, 2022, as part of its “Scale Based Regulations (SBR): A Revised Regulatory Framework for NBFCs” dated October 22, 2021.

The company is a part of the Bajaj group, which was founded in 1926 and is a diversified business group with interests across various sectors. As at June 30, 2024, it had 323,881 active customers, 83.2% of whom were home loan customers. The overall loan disbursements were ₹120,03.51 cr, ₹103,82.52 cr, ₹446,56.24 cr, ₹343,33.63 cr and ₹261,75.24 cr in the three months ended June 30, 2024 and June 30, 2023 and Fiscals 2024, 2023 and 2022, respectively, which demonstrates a growth in business and market reach.

Key details of the IPO: Bajaj housing finance

Best IPO to invest now: Bajaj housing finance issue snapshot

| Issue Open | September 09 – September 11, 2024 |

| Price Band | Rs. 66 to Rs. 70 |

| Issue Size | Up to Rs 6560cr (including Fresh issue of upto Rs 3560cr + Offer for sale of upto Rs 3000cr) employee reservation of upto Rs 200cr and shareholder’s reservation of upto Rs 500cr) |

| Bid Lot | 1 lot of 214 Shares or ₹14,980 (min) ₹1,94,740 (max) for retail |

| IPO Process | 100% Book Building |

| Face Value | Rs. 10.00 |

| Exchanges | NSE & BSE |

| Registrar | Kfin Technologies Ltd |

| Event | Indicative Date |

| IPO Open Date | 9th September 2024 |

| IPO Close Date | 11th September 2024 |

| Allotment Date | 12th September 2024 |

| Initiation of Refunds | 13th September 2024 |

| Credit of Shares to Demat | 13th September 2024 |

| Listing Date | 16th September 2024 |

Industry overview

According to CRISIL MI&A, the housing shortage in India was expected to rise to 100 million units by

2022, with an estimated demand for housing loans between ₹50 trillion to ₹60 trillion to address this issue. As of March 2023, the total overall outstanding housing loans (excluding Pradhan Mantri Awas Yojana loans) were approximately ₹28.7 trillion, highlighting the significant market potential if measures are implemented to address this shortage.

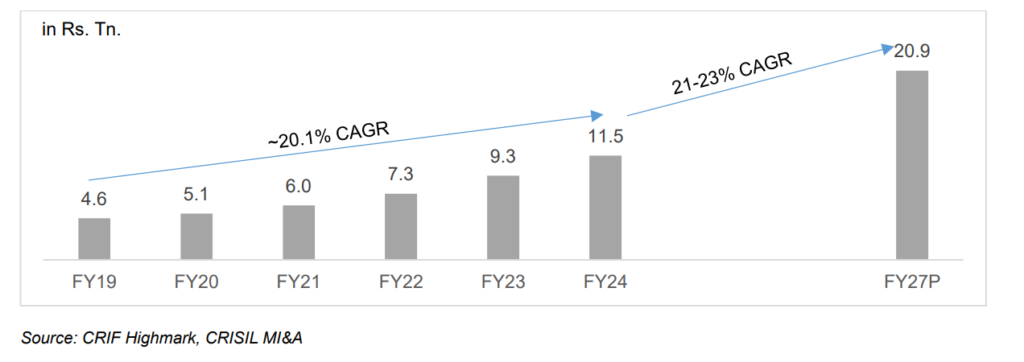

Bajaj Housing Finance primarily lends money to prime housing customers ( customers with loan requirements of more than 50 lakh are prime customers) and Prime Housing Finance Market in India stood at ₹ 11.5 trillion as of Fiscal 2024, witnessing a CAGR of approximately 20.1% from Fiscal 2019 – Fiscal 2024, the growth witnessed by prime housing finance market during the Fiscals has been faster than the growth in overall housing finance market of India, during Fiscal 2019 – Fiscal 2024, overall housing witnessed a CAGR of 13.1%.

Best IPO to invest now: Company’s operations

The company offers financial solutions tailored to individuals and corporate entities for the purchase and renovation of homes and commercial spaces. Their mortgage product suite is comprehensive and comprises (i) home loans; (ii) loans against property (“LAP”); (iii) lease rental discounting; and (iv) developer financing. Key points about Bajaj housing finance are:

- Largest non-deposit taking HFC (in terms of AUM) in India within seven years of commencing mortgage operations;

- second largest HFC in India with an AUM of ₹970,713.3 million;

- eighth largest NBFC-ULs (in terms of AUM) in India as at March 31, 2024;

- second most profit making HFC in India with strong return on average assets and return on average equity

for Fiscal 2024 and three months ended June 30, 2024; - one of the fastest growing among other HFCs/ NBFCs-UL based on AUM CAGR from Fiscal 2022 to 2024;

- most diversified HFC in India offering full suite of mortgage lending products;

- highest salaried customer mix in home loan portfolio amongst large HFCs;

- focused on prime housing with higher average ticket size amongst large HFCs;

- lowest GNPA ratio of 0.28% and NNPA ratio of 0.11%, among large HFCs in India;

- highest possible credit ratings in India for both the long-term as well as short-term borrowings programme;

- second highest loan disbursement by HFCs in India amounting to ₹446.6 billion for Fiscal 2024 and ₹120.0

billion for three months ended June 30, 2024; and - second highest AUM per branch and AUM per employee amongst large HFCs in India.

To oversee the operations co had a network of 215 branches as of June 30, 2024, spread across 174 locations in 20 states and three union territories, which are overseen by six centralized hubs for retail underwriting and seven centralized processing hubs for loan processing. Its diversified reach helps it to meet the specific needs of target customers across geographies, in urban as well as upcountry locations.

Company’s Financials

The company has seen robust growth in top and bottom line over the years, In fact, one of the best in the industry, revenue rising from ₹3,767.1cr in FY22 to ₹7,617.7cr in FY24, marking a robust growth of about 102.2% over two years. The year-over-year growth from FY23 to FY24 was 34.5%, accelerating revenue generation.

The profit after tax (PAT) figures underscore the company’s dramatically improving profitability. The PAT rose from ₹709.6cr in FY22 to ₹1,731.2cr in FY24, representing an extraordinary growth of about 143.9% over two years. The year-over-year growth from FY23 to FY24 was 37.6%, showing that the company has not only maintained but accelerated its profit growth.

| Particulars (₹ in Cr) | FY24 | FY23 | FY22 |

| Assets | 81,827.0 | 64,654.1 | 48,527.0 |

| Revenue | 7617.7 | 5665.4 | 3767.1 |

| Profit After Tax | 1731.2 | 1257.8 | 709.6 |

| Net Worth | 12,233.5 | 10,503.1 | 6741.3 |

| Reserves and Surplus | 5521.3 | 3791.0 | 1858.0 |

| Total Borrowing | 69,129.3 | 53,745.3 | 41,492.3 |

Special: How to apply under shareholder’s quota

Bajaj Housing Finance has announced that it has reserved a portion of equity shares aggregating up to ₹500 crore under the shareholders’ quota. Bajaj Finance owns 100% stake in Bajaj housing finance and Bajaj Finserv is a promoter of Bajaj Finance so both of these companies are shareholder of this company. This means that shareholders who hold even a single share of Bajaj Finance or Bajaj Finserv are eligible to apply for shares under the shareholders’ quota for the Bajaj Housing Finance IPO.

Was there any record date for determining eligible shareholder?

According to guidelines issued by the market regulator Securities and Exchange Board of India (SEBI), the filing date of RHP was the record date for this issue to become the eligible shareholder. Thus till Aug 30, 2024, those who held shares of Bajaj Finance and Bajaj Finserv in their demat accounts are eligible to apply under the shareholders’ quota of the Bajaj Housing Finance IPO.

What can be the bid size in the shareholders’ quota? Can one apply under multiple quotas like retail, shareholder and employee?

Bids in the Bajaj Housing Finance IPO can be made for a minimum of 214 equity shares and in multiples thereafter, but the total bid amount under the reserved portion for shareholders should not exceed ₹2 lakh. Max limit is 2 lakh under both shareholder quota and retail quota.

Further, eligible shareholders bidding in the shareholders’ reservation portion can also bid in the retail or non-institutional portion and the employee reservation portion (if eligible and subject to applicable limits), and such bids will not be treated as multiple bids. What it means is an investor eligible under the shareholder quota can bid separately under the retail/NII quota.

Under which quota the chances of allotment will be higher in Bajaj Housing Finance IPO, retail or shareholder

It will completely depend on demand dynamics, shareholder’s reservation of up to Rs 500cr or approx 7cr shares is reserved for shareholders of the parent company eligible under shareholder’s quota and approx 29cr shares are reserved for retail investors so it will depend on the number of subscriptions that will come under these quotas.

What is the GMP (grey market premium) of Bajaj Housing Finance IPO?

The current GMP is Rs.56 over the upper price band of Rs.70 indicating an 81% listing gain (indicative listing at Rs.126).

Click here for detailed IPO review and FinMinutes research opinion.