Baazar style IPO review: The issue opened for subscription on August 30 and will close on Sept 3, Tuesday. The Baazar Style IPO aims to raise 835cr at the upper end of its 370-389 Rs. per share price band. This pricing reflects the company’s post-listing valuation at 2,900cr. The IPO is a mix of fresh issues of 148cr and the rest an offer for sale, which means part of the money will go to the company, while some will go to existing shareholders selling their stakes.

According to the data, the investors made bids for 5,23,82,050 equity shares, or 3.49 times, compared to the 1,50,30,116 equity shares offered for the subscription, non-institutional investors (NIIs) quota was booked 8.10 times, while the portion reserved for retail investors saw a subscription of 3.04 times. Employee portion was booked about 16.25 times. However, the quota set aside for qualified institutional bidders (QIBs) was subscribed just 0.71 times.

Baazar style retail: About the company

Kolkata-based Baazar Style is a value fashion retailer with a market share of 3.03% and 2.22%, respectively in the organized value retail market in the states of West Bengal and Odisha, respectively. The company was the fastest-growing value retailer between 2017 to 2024, in terms of both store count and revenue from operations, when compared to V2 Retail Limited and V-Mart Retail Limited (“Listed Value Retailers”) as per the Technopak Report.

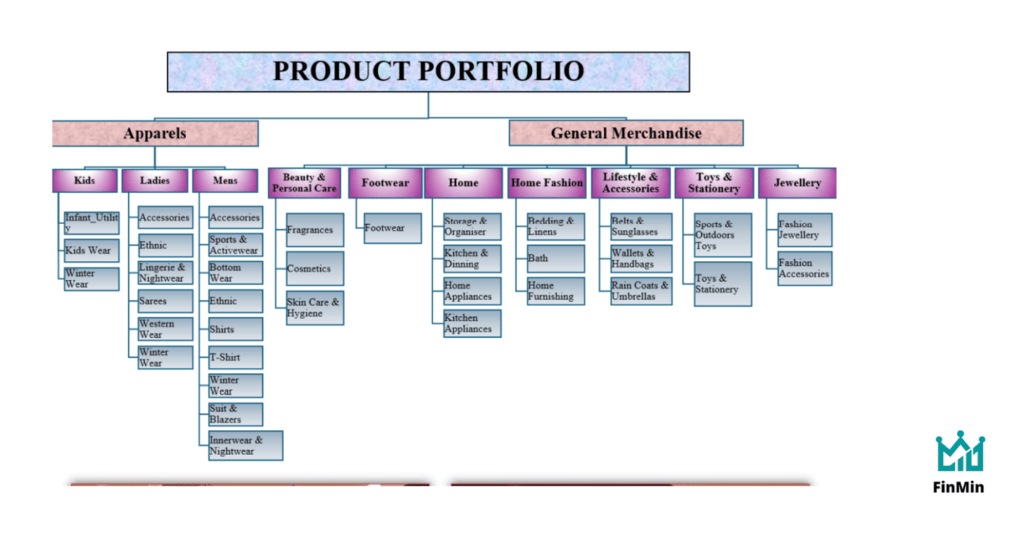

As of March 31, 2024, the company operated 162 stores spread across over 1.47 million square feet and located in 146 cities. Its offerings are bifurcated under the apparel and general merchandise verticals. Within the apparel vertical, they offer garments for men, women, boys, girls and infants, whereas the general merchandise offerings include both non-apparel and home furnishing products. Baazar style focus on providing a family-oriented shopping experience, offering quality products and striving to offer every Indian stylish merchandise at an affordable price.

Baazar Style financials

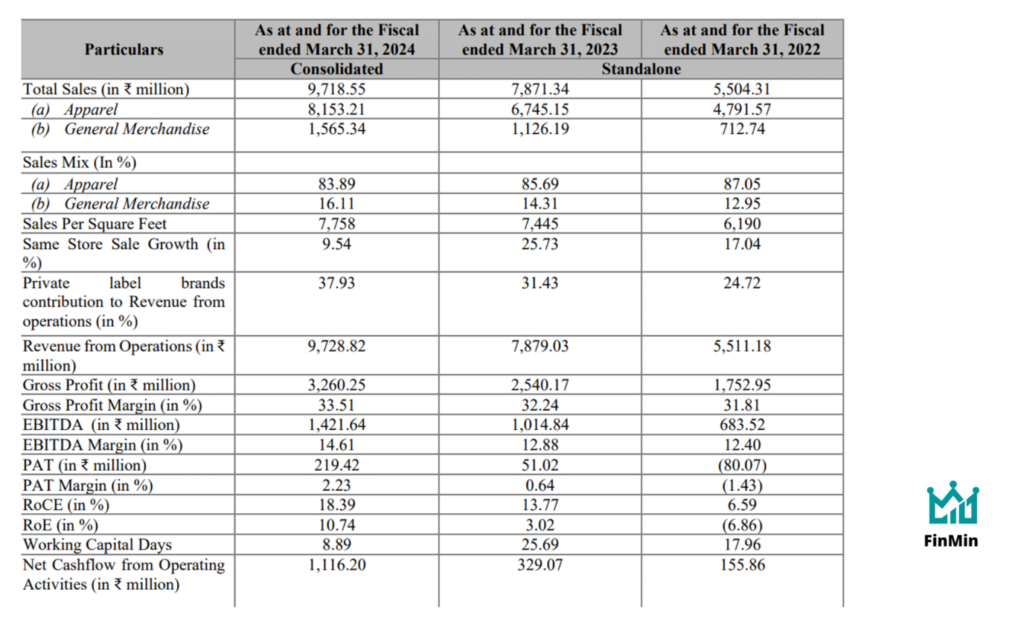

Looking at Baazar Style’s financials, the company has shown steady growth over the past few years. Its revenue has been increasing at a compound annual growth rate (CAGR) of more than 25%, with profits following a similar trajectory. This growth is primarily driven by the expansion of its store network and the company introducing new product lines. Baazar style became profitable in 2023 and improved it further in 2024.

Compared to listed peers, Baazar style is well placed in terms of financials as most of its parameters are seeing constant improvement. Even though there were some troubles in terms of consumption in semi-urban, rural economies in the past few years due to various factors, the company was able to maintain its margins and improved its PAT margin, which is a positive sign going ahead as the signs of improvement are there in tier 3,4, semi-urban cities.

Baazar style IPO: What we like

Baazar style IPO is backed by legendary investor Late Rakesh Jhunjhunwala, now his wife Rekha Jhunjhunwala owns more than 7% stake in the company, What caught our attention is company’s focus area and business model. Company caters the aspiring middle class comprising of households with an average annual income of less than 5,000 USD, comprising of fashion conscious, value and quality seeking youth and young families, which forms the bulk of purchasing power of the Indian population.

Baazar style has strategically located stores with its attractive layout coupled with diverse and affordable product offerings allowing it to successfully cater to the demands of this growing segment of its population. The Company’s stores are operated on a cluster-based expansion model in which a new store is opened and operated within the same or nearby districts in which it operates its existing stores.

This enables it to increase efficiencies in supply chain and inventory management processes, strengthen its brand visibility in local markets, optimize its marketing expenditure, efficient utilization of human resources and provides BSRL with an incisive understanding of customer preferences at a micro market level.

BSRL provides a modern shopping experience to its target customers with all its stores being air conditioned and having an appealing store layout, trial rooms, wide range of quality products, ambience and merchandising, quality assurance, which enhances the shopping experience for its customers and its ability to offer quality products at affordable prices under an upscale retail environment. For low ticket customers often shopping in unorganized stores these are a great features to have so organized retail market is expanding swiftly.

The growth drivers

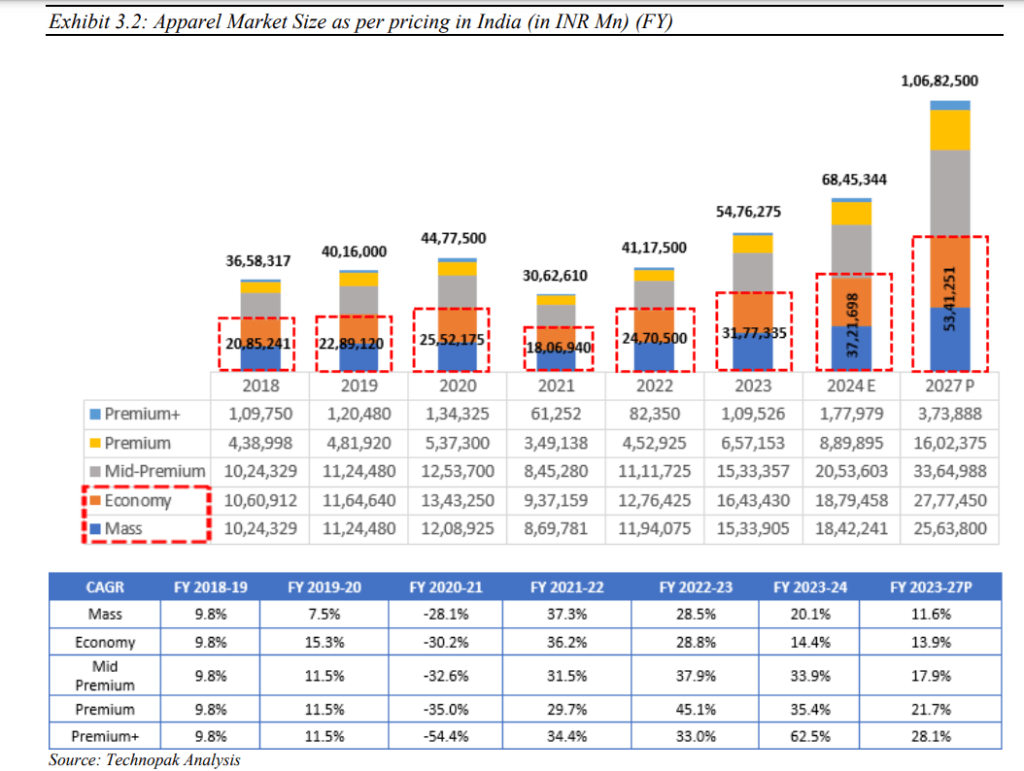

- The Apparel market in India was valued at INR 54,76,275 Mn in FY 2023 and is expected to grow at a CAGR of ~18.2% between FY 2023 and FY 2027 to reach INR 1,06,82,500 Mn by FY 2027 on the back of factors like higher brand consciousness, greater purchasing power and increasing urbanization. The market is estimated at INR 68,45,344 Mn for FY 2024 growing at a CAGR of ~25% from FY 2023.

- Mass and economy segments of apparel are projected to grow at a CAGR of 11.6% and 13.9% to reach 25,63,800 and 27,77,450 Mn INR respectively between 2023-2027.

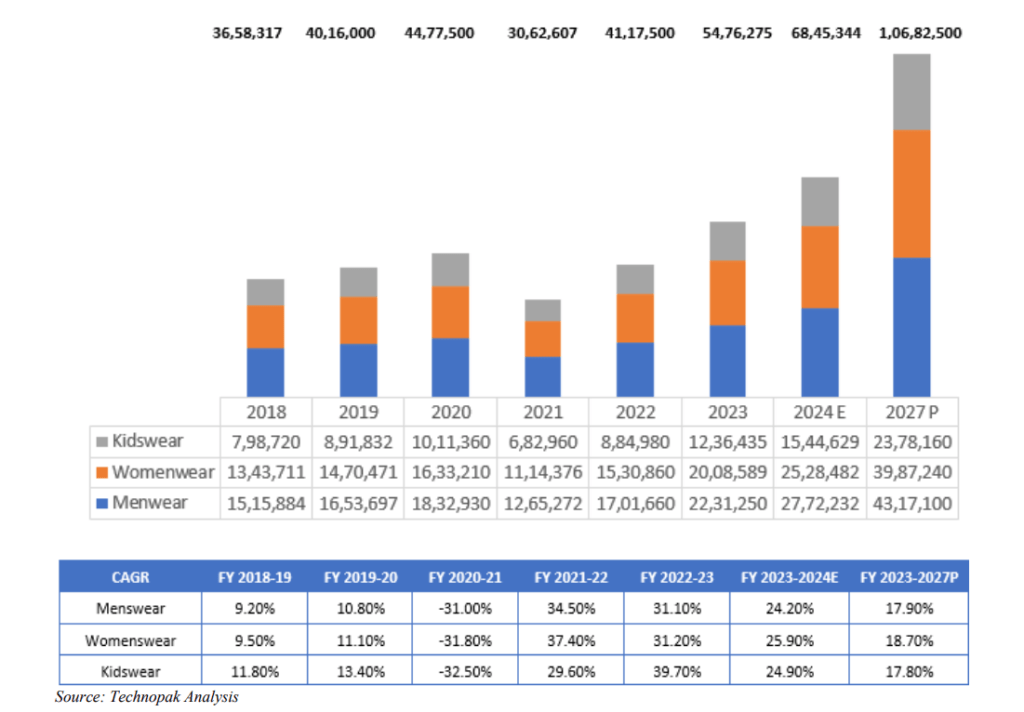

- Men’s Apparel constituted ~40% and Women’s Apparel share was estimated to be ~37% of the total Apparel market in FY 2024, the balance of ~23% was contributed by kids’ Apparel. Out of the total Apparel market, Ethnic wear accounted for ~30% or INR 20,40,743 Mn (FY 2024) and the balance ~70% of the market comprised western wear at INR 48,04,601 Mn.

- The high share of Ethnic wear in the total Apparel is a unique feature of the Apparel market in India. In the women’s wear market, Ethnic wear contributed ~67% (FY 2023) to the total market and is expected to be the fastest-growing segment in the Ethnic Apparel market.

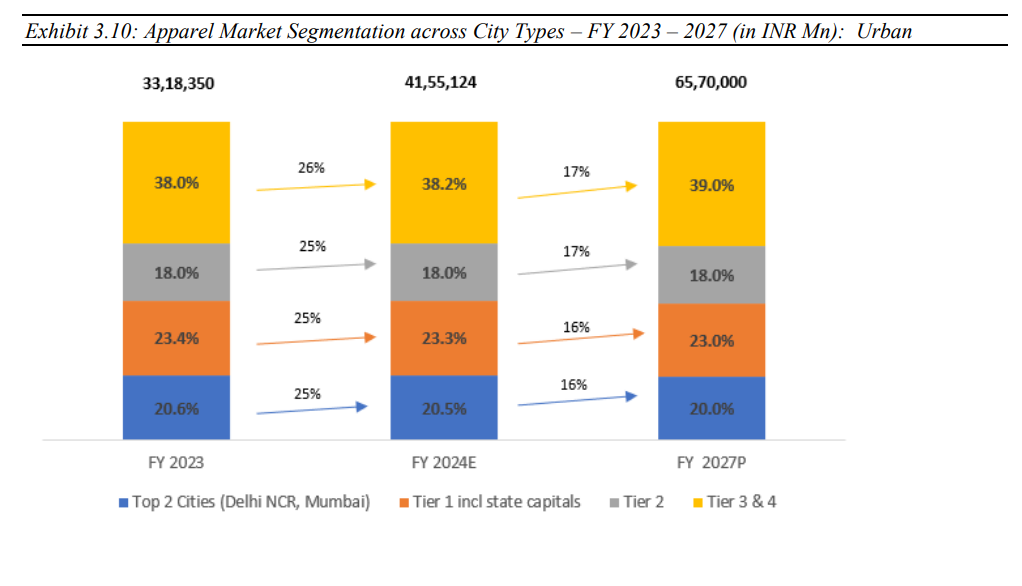

- The Urban Apparel market had a share of ~61% of the total market compared with a share of ~39% contributed by Rural India in FY 2023. Almost 21% of the Urban Apparel demand can be attributed to Delhi NCR and Mumbai making these cities the largest consumers of Apparel in India.

- However, there has been distributive growth across the country, with demand from Tier 2, 3 & 4 cities increasing significantly. These cities, which are Value retail-focused, currently account for 56% of the Urban Apparel market, and are expected to grow at a CAGR of 21.0% from FY 2023 to FY 2027.

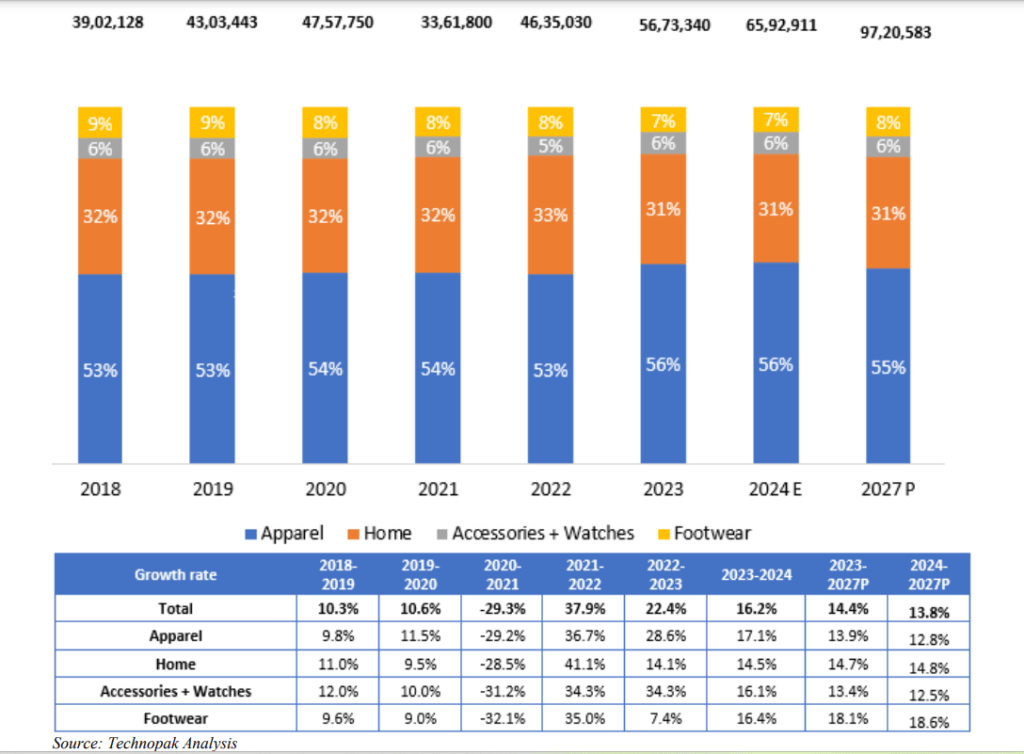

- The overall Lifestyle and Home Value retail market in India was valued at INR 65,92,911 Mn for FY 2024E, which was 54% of the total market in these categories of Lifestyle & Home. The market is expected to reach INR 97,20,583 Mn by FY 2027, growing at a CAGR of 13.8% from FY 2024-27.

- Value retail in the Apparel segment in India is estimated at INR 37,21,698 Mn for FY 2024. In FY 2023 (INR 31,77,335 Mn), this segment accounted for ~58% of the overall Apparel retail market, and is expected to reach INR 53,41,250 Mn by FY 2027, growing at a CAGR of 13.9% from FY 2023-27.

Expansion through Clustered approach and regional nuances

Unlike the premium and super-premium segments, wherein the offering is designed in agreement with the global and macro fashion trends, the Value segment needs consideration for heterogeneity to accommodate the nuances of the regional requirements and sensibility. Through a clustered approach, top retailers have been able to add more value to their offerings. The cluster-based approach also helps the retailers in exhausting the opportunity in that cluster by operating a large number of stores in that area thereby creating an entry barrier for the other competitor brands.

Growth in Tier 3 & 4 cities

Focusing on Tier 3 and 4 cities has aided top retailers in unlocking the consumption potential of these cities. Approximately 23% of the total demand for Apparel is estimated to come from these cities, ~60% of which is currently estimated to be within the Value segment. The organized Value retailers have led the transition of the Value Apparel segment in these cities from being largely unorganized to being somewhat organized.

Focus on Private Labels

BSRL has a healthy mix of both private label and third-party brands that are offered in its stores including fashion apparel of brands such as Killer and Sparky in select stores with potential for sales based on its deep understanding of customer preferences. Its private label brands have enabled it to exercise higher quality control, create differentiation and enable greater control on overall product assortment.

Its top three private labels contributed 25.21%, 21.18% and 16.68% to its total revenue from operations for Fiscals 2024, 2023 and 2022, respectively. The Company’s revenue from operations from its private labels have clocked ₹3,689.95 million in Fiscal 2024.

Strengthen market position by increasing penetration in existing clusters

Expand footprint in the Focus Markets, increase focus on customer retention and garnering brand loyalty: BSRL intends to focus on penetrating further in existing clusters including those located in its Core Markets and Focus Markets, with an appetite for increased demand and high growth potential. It has been expanding its presence in terms of store count in target markets at a CAGR of 23.62% between the Fiscals 2022 and 2024 which is attributable to its growth in the Core Markets and Focus Markets at a CAGR of 17.88% and 65.14%.

Baazar style IPO review: Some risks

- Stores are concentrated in the eastern parts of India and any adverse developments affecting operations in this state could have an adverse impact on the revenue and results of operations.

- Business is concentrated on sale of apparel and merchandise products and subject to the unpredictability of changing customer preferences.

- If any new private labels, including under existing products verticals, that BSRL launches are not as successful as it anticipates, its business, results of operations and financial condition may be adversely affected.

- Some of the products are subject to seasonal customer demands.

Valuation and Conclusion

Compared to peers Baazar style is offering the issue at a discount despite standing better in terms of growth and margins. Baazar style has huge opportunity to expand in focus areas while strengthening its foothold in core areas. With its cluster based expansion plans and asset light model, co became profitable in early age of operations, expectations are that post issue the profitability and margins will improve further due to reduction in debt.

At the upper price band of 389 and FY24 EPS of 3.14, the issue is offered at a p/e of 123 while average industry p/e is 138. The issue is cheaper compared to peers in other key terms like price to book value, EV/EBITDA, return on net worth, RoE and working capital days. Our view is Baazar style will double its EPS in FY26 as the company’s focus will be on profitability post-listing. So at an FY-26 projected EPS of 6.4 the issue is offered at a p/e of 61. Investors should keep the stock for long term to be a part of the rapidly growing value retail journey.

Baazar style has ample growth opportunities in states like Uttar Pradesh, Andhra Pradesh, Bihar, Jharkhand etc as the organized retail penetration in these states is low and the number of tier 2,3,4 cities are high, with rising disposable income and growing brand consciousness, players like Baazar style will have a large room to grow. Click here to check the live GMP of Baazar style IPO.