IREDA (Indian Renewable Energy Development Agency), IRFC (Indian Railway Finance corp), RVNL (Rail Vikas Nigam ltd), SJVN (Sutlej Jal Vidyut Nigam) and Mazagon dock shipbuilders are one of the top PSU stocks in terms of providing returns in 2024 but the common question among investors is, Will the outperformance continue going ahead? So we are taking a close look for factors that will drive stock price of these companies and target price for next 12-18 months e.g. 2025.

IREDA

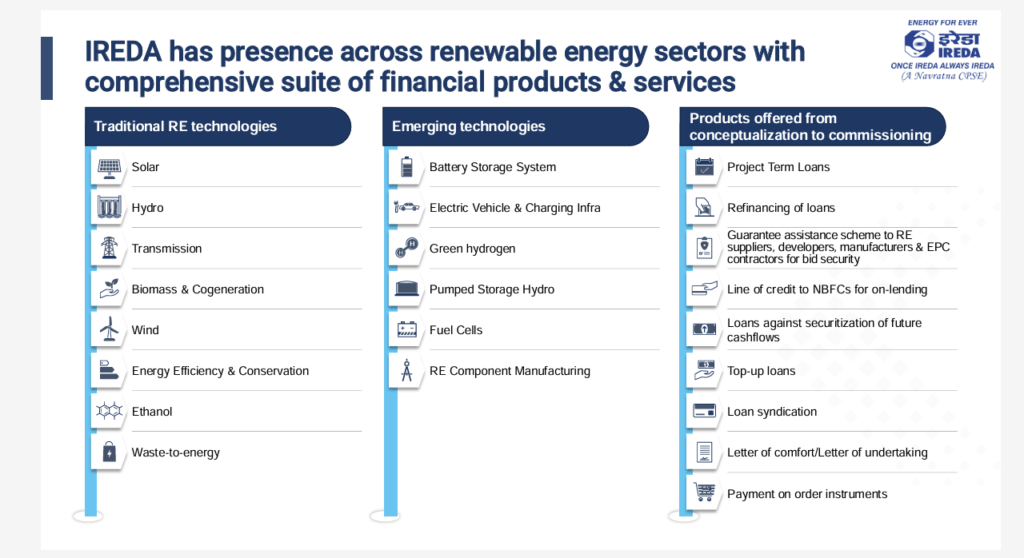

Indian Renewable Energy Development Agency, India’s largest pure-play green financing NBFC is a ‘Navratna’ Government of India Enterprise under the administrative control of Ministry of New and Renewable Energy (MNRE). IREDA is a Public Limited Government Company established as a Non-Banking Financial Institution in 1987 engaged in promoting, developing and extending financial assistance for setting up projects relating to new and renewable sources of energy and energy efficiency/conservation with the motto: “ENERGY FOR EVER”.

The main objectives of IREDA are :

- To give financial support to specific projects and schemes for generating electricity and / or energy through new and renewable sources and conserving energy through energy efficiency.

- To maintain its position as a leading organisation to provide efficient and effective financing in renewable energy and energy efficiency / conservation projects.

- To increase IREDA`s share in the renewable energy sector by way of innovative financing.

- Improvement in the efficiency of services provided to customers through continual improvement of systems, processes and resources.

- To strive to be competitive institution through customer satisfaction.

Stock Price performance and other key highlights

- Since its listing in Nov 23, stock is up more more than 4x providing a robust returns this year. In the same period company’s revenue is up 43% and PAT is up 44%,Net interest income (NII) is up 38% and IREDA’s outstanding loan book grew 45%.

- Company’s gross NPA is down to 2.19% from 3.08% yoy at the end of quarter 1 similarly net NPA is down from 1.61% to 0.95% yoy at the end of Q1.

- Company’s cost of borrowing is low at 7.78% down 50bps yoy while net interest margin improved 50bps to 3.29% yoy.

- Debt to equity ratio at 5.83, CRAR at 19.52%.

Valuation, outlook and Target price

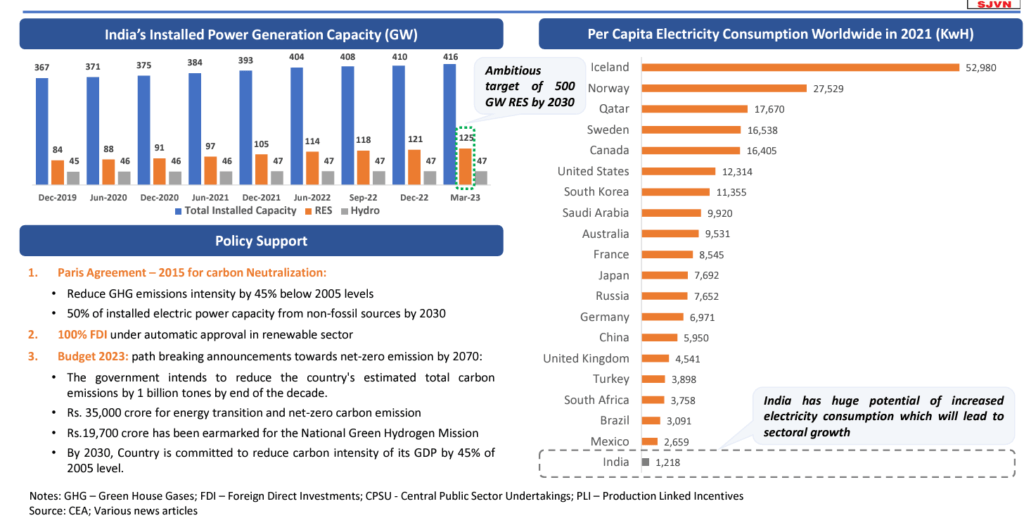

Outlook for IREDA is great as focus on renewable energy is going to grow in coming years. Many countries at COP28 including India pledged to triple its Renewable capacity by 2030, India aims to triple its current RE capacity from current 194GW to 500GW by 2030. Solar power, wind energy and hydropower will lead this capacity addition. As the result, large funding (more than 24 trillion rupees) will be required to fulfil these projects presenting IREDA a great opportunity to thrive.

Current Valuation of the stock is on ‘expensive’ side as it is trading a book value of more than 8 times and at a p/e of 52 compared to industry median of 25. Stock may keep trading at an expensive valuation given the growth in renewable sector and IREDA being the preferred lending partner in such projects. Both top and bottom-line of the company is projected to grow at a CAGR of 25-30% over next 5-6 years.

Moreover company’s borrowing cost is low compared to peers giving it a competitive advantage, 84% of co’s borrowing is from domestic avenues and rest is from foreign sources so rate fluctuation will not have much effect on its borrowing cost and higher credit ratings that co enjoys will help it maintain the borrowing cost in long term. IREDA’s AUM is also projected to grow at a CAGR OF 25+% for next 4-5 years.

Due to all these positives, stock will remain a preferred choice for investors and ‘buy on dips’ strategy should be used to accumulate the stock, ICICI Direct have a ‘buy’ rating on the stock with a target price of 330 in next 12 months, suggesting a 20% upside from CMP. In 2025, our view is similar, stock may touch 330-350 zone in next 12-18 months but instead of chasing price, investors should deploy buy on dip strategy to buy the stock.

IRFC

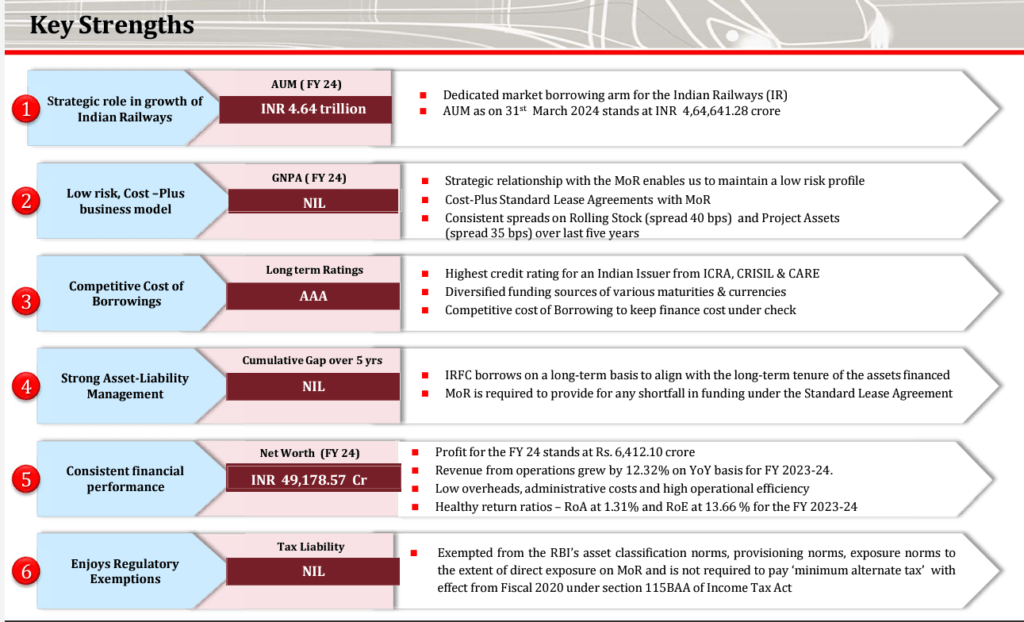

IRFC is the dedicated market borrowing arm for the Indian Railways with businesses spanning to financing the acquisition of rolling stock assets, leasing of railway infrastructure assets and national projects of the Government of India and lending to other entities under the Ministry of Railways. it is also registered with RBI as a systemically important NBFCND-IFC, Majorly owned by the GoI acting through Ministry of Railways.

Stock Price performance and other key highlights

- Stock of the IRFC is almost 4x with in a year, on Aug 21, 2023 it was trading at Rs. 50 and recently it made the high of 220 while currently trading at 183. In the same period, revenue of the company is up 12.3% and PAT is up just 4%.

- Reason for such jump in stock price is broad based rally in public sector stocks due to govt’s focus on capex, IRFC being the only financial company funding railway projects like rapid electrification of railway line, railway infra development etc. Also these stocks were under owned and available at a cheaper valuation.

- FY-24 saw a minor dip in IRFC’s total AUM, while NII remained almost flat, net interest margin remained stable at 1.38%.

- Company is exploring more opportunities to fund the projects beyond Indian Railways with backward and forward linkages.

- The company raises funds at the lowest possible cost among the Term Lending Institutions in India. It charges a minimal spread of 0.4% on rolling stock and 0.35% on project assets to MoR.

Valuation, outlook and Target price

Though opportunity in hand for the company is immense as Indian railway is planning to lay about 40,000 kilometers of new track over the next six to eight years, numerous new semi and high speed railway corridors, freight corridors, multi-modal logistics parks, and non-conventional energy sources for the railway network will also be built along with other railway infra. Moat of these projects will be funded by IRFC.

But going by the valuation IRFC is not as attractive as other similar peers like REC, PFC. IRFC’s disbursement of new loans in FY24 and Q1 FY25 was zero as no target has been assigned in the Union Budget for FY24 and FY25. The peak disbursement happened in FY21 for Rs 1,04,369 Cr. Company’s NIM is also on lower side and its dependance on railway projects is very high. At CMP, the stock is trading at a 5 times book value and at a p/e of 37 which is very high.

Investors should approach the stock with caution. No brokers actively cover the IRFC stock but technically stock looks week and probability of it to reversing back to 61.8% on Fibo retracement is high. Even then the stock may remain rangebound due to its elevated valuations until new triggers emerge. For IRFC 180-200 range is strong resistance zone and 150-160 should work as support so the may remain in this range for the time being.

RVNL

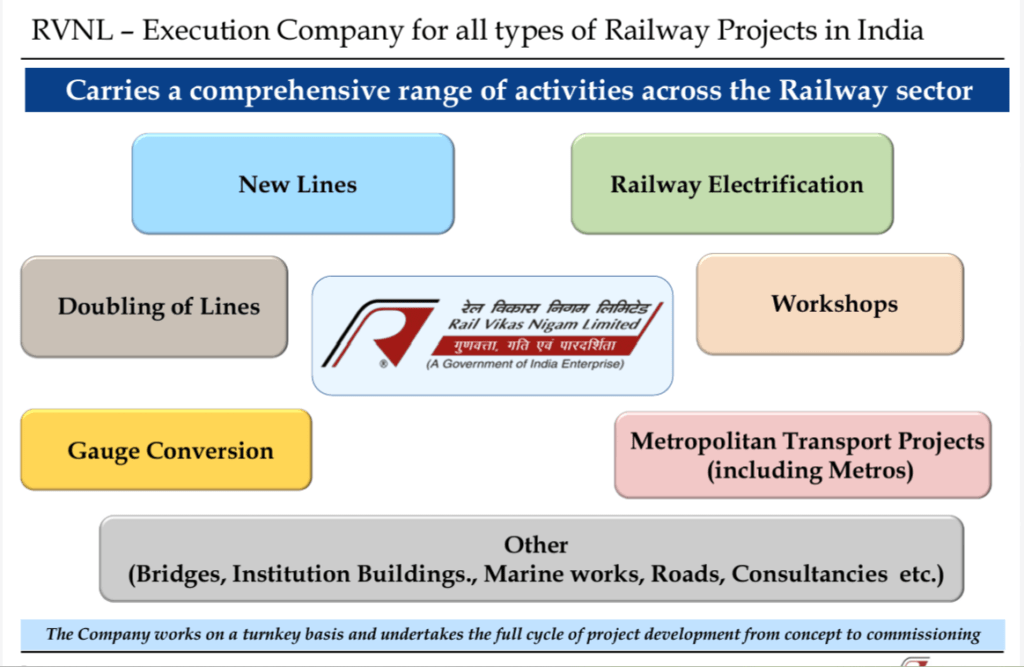

Rail Vikas Nigam Ltd was Incorporated in 2003 by the Govt. of India, it is engaged in the business of implementing various types of Rail infrastructure projects assigned by MoR including doubling, gauge conversion, new lines, railway electrification, major bridges, workshops, Production Units and sharing of freight revenue with Railways as per the concession agreement entered into with Ministry of Railway.

Stock Price performance and other key highlights

- Stock of the RVNL is up more than 4x in last one year, on Aug, 29,2023 it was trading at 130, recently it made a high of 630 and currently it is trading at 572. In the same period, revenue of the company is up 7.1% and PAT is up 15.3%.

- Apart from overall rally in PSU pack the reason behind such relentless rally in stock is heavy capex in railway sector and company’s orderbook which stands at more than 83,000 crores and visibility of revenue for at least next 4 years.

Valuation, outlook and Target price

RVNL had a challenging first quarter, Co saw dip in both top and bottom-line and had one of the lowest operating margin of just 4%. Management cited elections and geopolitical issues in Maldives as primary reason and commented that as elections are over, the projects will happen at previous pace but geopolitical issues may keep troubling as issues in Bangladesh are not completely resolved. On low margins, management said that company execute market orders on variable margin but railway orders are mostly fixed margin, further some projects may not have margins at all.

Execution is a key challenge for RVNL, despite its robust order book of more than 83,000 crores, growth in top and bottom-line is lagging with continuous dip in margins. We are not predicting much growth in topline and chances are it to be in the range of 22,00-24,000 crore over next five years, what investors must watch is ‘execution capabilities’ and margin expansion.

For FY-25 particularly, RVNL expects revenue to increase by 5% in FY25, & focus will be on bottom line with expected growth of 10-15% & will target bidding projects to improve the EBITDA margins. Order inflow guidance is Rs200250bn in FY25E and target order book of Rs1t i.e. ~4x the annual revenue. In FY24, RVNL bided for project of Rs650bn and success rate was 20%+.

EPS of RVNL for FY-24 was 7.02, even after taking best case growth projection of management of 15%, EPS in FY-26 will be 9.3 so the stock of RVNL is trading at a p/e of 61.5 (FY26 E*), which is at expensive side. We will keep monitoring the for top and specially bottom-line growth and on execution part but will make a distance from stock for now. The fall can be significant so investors holding it should keep holding the stock with a strict stop loss of 520-525 while 620-630 will be a key resistance to cross for further upside.

SJVN

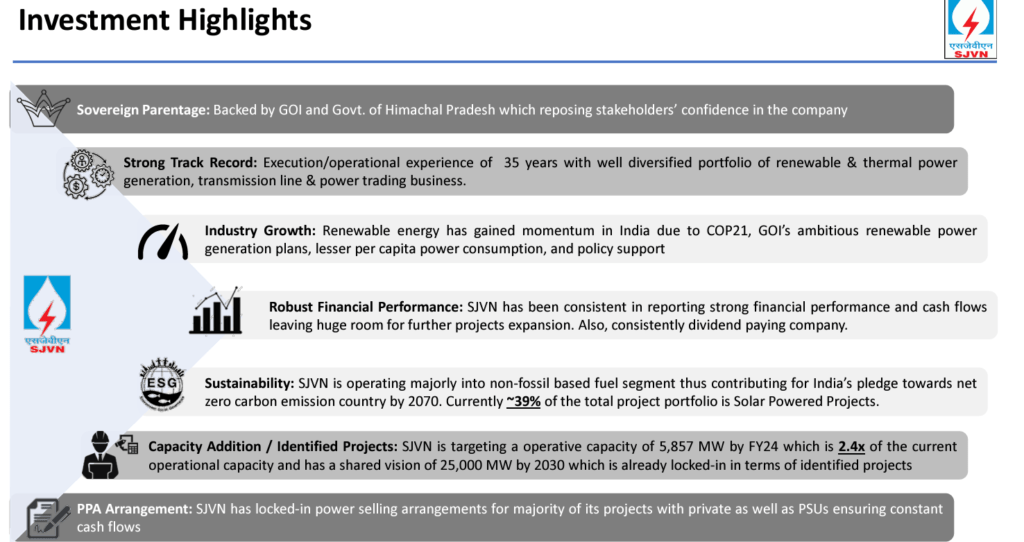

Sutlej Jal Vidyut Nigam is a Mini Ratna, Category I and Schedule A CPSE Declared as ‘Most Efficient and Profitable Mini Ratna’ in the PSU Award of the Year 2020 by The Dalal Street Investment Journal. SJVN is engaged in the business of Electricity generation. The company is also engaged in the business of providing consultancy for hydro-power projects.

Presently, the company has 6 main operation electricity projects across India with a total capacity of over 3,000 MW.

- Nathpa Jhakri Hydro Power – 1500 MW – Himachal Pradesh

- Rampur Hydro Power – 412 MW – Himachal Pradesh

- Khirvire Wind Power – 47.6 MW – Maharashtra

- Charanka Solar Power – 5.6 MW – Gujarat

- Sadla Wind Power – Gujarat – 50 MW

- Grid connected Solar Plant at NJHPS – 1.3MW

Stock Price performance and other key highlights

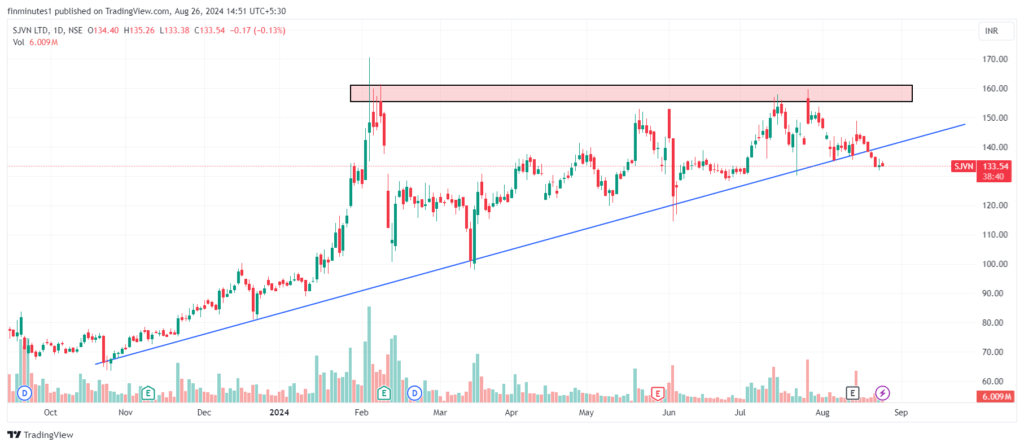

- Stock of the SJVN is up more than 2x in last one year, on Aug, 28, 2023 it was trading at 60 and the stock recently made a high of 160 while currently trading at 133. In the same period company’s revenue is down by more than 10% and PAT is down by more than 30%.

- After few dull quarters, company presented robust set of Q1 numbers recently with strong jump in revenue and end profits. Revenue guidance for FY25 is approximately ₹3,200 crores, predicting a 24% growth yoy which shows the confidence of the management going ahead.

Valuation, outlook and Target price

By the end of FY25 company’s total capacity is expected to reach 5,000MW which it wants to grow multifold to reach 25,000MW by FY-2030. To support it SJVN is taking huge capex each year and till 2030 the company plans to have a capex of more than 90,000cr, Projects financing will happen with equity participation of SJVN (20-30%) and debt financing (70-80%). Company already took a capex of 8,240cr and more than 10,000cr in FY23 and FY24 which is almost 2x of capex done in FY22.

Company has its projects in renewables like hydro, wind, solar power so it is well poised to capture the the growth of renewable power generation in India. Projects worth 39,262.9 MW capacity are under survey & investigation phase; 4,438 MW under construction& 3,081 MW under pre-construction phase, which shows how well prepared the company is to capture this growth.

In terms of valuation, company trades at p/e of 56.8, going by the management guidance of 20+% growth in top and bottom-line, the stock is trading at a p/e of 35 which is reasonable given the growth prospectus. Consistent reduction in debtor days and cash conversion cycle is a positive sign. Technically stock is weak as it broke its long term support line on high volume and trading below it. Stock could fall to 115-120zone so staying away from will be a wise move for now.

Stock has faced resistance multiple times in 155-165 zone and our view will remain negative on the stock as long as it is trading below it. Once this resistance is crossed sharp up move will follow. We will keep the stock on our radar.

Mazagon dock Shipbuilders

Mazagon Dock Shipbuilders Limited, Mumbai, is one of the leading shipbuilding yard in India. After its takeover by the Government in 1960, Mazagon Dock grew rapidly to become the premier war-shipbuilding yard in India, producing warships for the Navy and offshore structures for the Bombay High. It has grown from a single unit, small ship repair company, into a multi-unit and multi-product company, with significant rise in production, use of modern technology and sophistication of products. The company’s current portfolio of designs spans a wide range of products for both domestic and overseas clients.

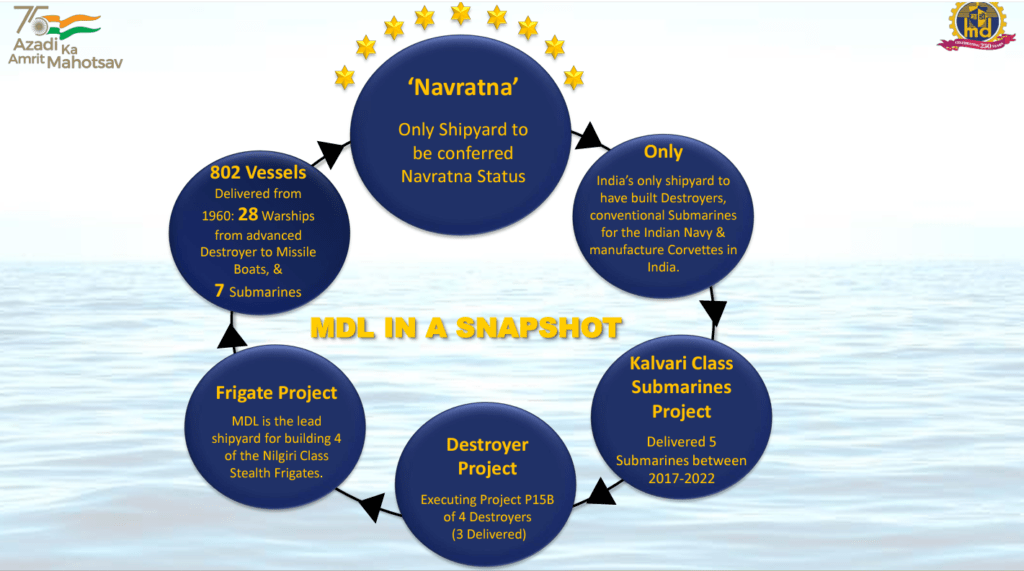

Since 1960, MDL has built total 802 vessels including 28 warships, from advanced destroyers to missile boats and 7 submarines. MDL had also delivered cargo ships, passenger ships, supply vessels, multipurpose support vessel, water tankers, tugs, dredgers, fishing trawlers, barges & border out posts for various customers in India as well as abroad. MDL have also fabricated and delivered jackets, main decks of wellhead platforms, process platforms, jack-up rigs etc.

Stock Price performance and other key highlights

- Stock of Mazagon dock rose more than 3x to an all time high of 5780, on August 29, 2023 it was trading at 1,800 against CMP of 4,307. Since its listing Oct 2020 stock is up more than 25x. In the same period company’s revenue is up 20.8% and PAT is up 73.3%.

- Government’s focus on indigenously developed defense products specially for Indian navy was the primary reason behind such robust rally in the stock. Co achieved a 75% indigenization level, with 20-25% of components still imported.

Valuation, outlook and Target price

Mazagon dock, being the only shipbuilder with ‘Navratna” status stands tall to benefit from ‘Made in India’ and ‘Make in India’ opportunities in defense sector. Company’s order book of 40,000cr+ gives visibility of revenue for next few years. End margins are improving continuously and management is confident that this will sustain going ahead due to growing efficiency and before time delivery.

The company is targeting three deliveries in FY25. One frigate (targeting to deliver before the contractual timeline), one destroyer (on contractual timeline) and last submarine (contractual timeline). In next three years, company have many important deliveries scheduled (delivery of merchant ship, fast patrol vessel and a frigate etc) which will further set the tone for the company.

Mazagon dock is planning to take the capex of 4,000-5,000cr in next 3-4 years to upgrade the existing infra and capacity. Many were doubting that defense orders will dry once they reach saturation but we don’t see it, NAVY has a huge requirement that it will fulfill over the years, plus commercial ships, cruises are becoming popular with each passing day and recently Mazagon dock launched SaurShakti, the nation’s fastest solar-electric boat developed through a ground breaking collab between Mazagon dock Shipbuilders Limited and M/s NavAlt.

MDL launched 24 PAX Hydrogen fuel cell boat on May 14, 2024, with these innovations a huge order book can come to company as fuel charge and cost efficiency used to be a challenge for cargo and cruise ships but with solar and H2 powered ships will be cost efficient. Recently, ICICI sec gave a sell call to stock predicting more than 70% downside using DCF model but our view is different, discounted cash flow model does not capture the full picture here.

Currently the stock trades at a p/e of 42, going by the median growth guidance provided by company, it will do an EPS of 150 in FY26 so its estimated FY26 p/e is at 29 which is reasonable compared to industry peers. Technically stock is weak as it is making lower high and lower low formation, 3800-4100 is strong support zone for the stock and we will keep looking for a reversal signal on the charts, if stock falls below 3800, then the decline could continue to 3200-3400 (chances are low), but then stock will be a ‘value’ buy.

Conclusion

Among PSU Stocks some are overvalued but there are still some with good value in store, now we need selective picking in them instead of basket buying. Among PSU pack REC, PFC is still one of our preferred pick due to the value they have in store and growth prospectus in power sector. We will keep looking for opportunities in PSU pack and will keep updating our readers about the same, so turn on notifications and stay tuned for further high quality research work on opportunities in PSU pack.