The recent news of Ultratech Cement acquiring India Cements has garnered significant attention in the business world. This acquisition is set to create ripples in the cement industry, impacting stakeholders, investors of both companies and the market at large. In this detailed article, we explore the intricacies of this acquisition, its potential impact, and what it means for investors and the industry.

Overview of both the companies

Ultratech Cement is a Aditya Birla Group company and one of India’s leading cement producers. With a well-established presence across the country, Ultratech has been a major player in the cement industry for years. India Cements, on the other hand, is a prominent cement manufacturer with a strong foothold in the Southern region of India. This acquisition marks a strategic move by Ultratech to consolidate its position and expand its market presence.

Though India cement diversified its business by venturing into sectors like shipping, captive power and by owning famous IPL franchise Chennai Super Kings but still majority of its revenue (more than 90%) comes from its core (cement) sector. The co has 8 operating units in Tamil Nadu, Telangana, Andhra Pradesh and Rajasthan with a capacity of 15.55 million tones per annum. Apart from this it has 2 cement grinding plants – one in Tamil Nadu and other in Maharashtra.

Ultratech Cement is the largest cement company in India and 3rd largest cement company in the world and also the largest cement manufacturer in India. Co. has an installed capacity of 150 mtpa with a capacity utilization of 85%. It has 23 integrated plants and 27 grinding units, seven bulk terminals, two white cement and putty plants and over 100 ready mix concrete plants. Its operations span across India, the UAE, Bahrain, Bangladesh and Sri Lanka.

Key Facts About the Acquisition

- Announcement Date: The acquisition was officially announced on 28th July, 2024, earlier Ultratech cement purchased 22.77% equity in India cements at a price of Rs 268 per share in June 2024.

- Deal Value: The deal is valued at approximately 3,954cr at Rs. 390/ share for buying 32.72% stake in India Cements from the promoters & their associates. This will trigger a mandatory open offer, at Rs 390/ share. The open Offer will be done subsequently after obtaining all regulatory approvals.

- Market Expansion: The acquisition will enable Ultratech to penetrate deeper into the Southern markets, where India Cements has a strong presence. A report from Emkay global suggests that market share of Ultratech to more than double in the South, to around 25 per cent by FY27,” and new projects coming to Andhra Pradesh post union budget 2024 bodes well for the company.

- Enhanced Production Capacity: The combined production capacities of Ultratech and India Cement will be more than 165mtpa and it will enable more efficient operations and better resource utilization. Aditya Birla Group Chairman, Kumar Mangalam Birla, told company shareholders that the ambition was to hit a capacity of 200 mtpa.

- Geographical Diversification: India Cement’s strong presence in Southern India complements Ultratech’s established markets in other regions, ensuring a more balanced geographical footprint. Group chairman, Kumar Mangalam Birla said “UltraTech Cement’s investments over the years, both organic and inorganic, have been designed to propel India to become a building solutions champion globally. The India Cements opportunity is an exciting one as it enables UltraTech to serve the southern markets more effectively”

- Synergies and Cost Efficiencies: The integration of India Cement’s operations with Ultratech’s is expected to yield substantial synergies, leading to cost savings and operational efficiencies. Cost savings and operational efficiencies were a challenge for India cement and co’s investors pointed it out many times now with Ultratech’s acquiring controlling stake in the company, hopes are high that things will improve drastically.

Implications for Investors

The acquisition presents both opportunities and challenges for investors. It is crucial to assess the potential impact on Ultratech Cement’s financial performance, market position, and growth prospects.

Financial Performance

Investors should closely monitor Ultratech Cement’s financial statements post-acquisition. Key metrics to watch include:

- Revenue Growth: The acquisition is likely to drive revenue growth due to increased production capacity and expanded market reach. In FY24 ultratech’s revenue was 70,908cr and revenue growth was at 12.13% while India cement’s revenue was at 5,112cr in FY24 with a revenue growth of (-)8.84%, For investors it will be key to watch, how India cement’s is performing post acquisition as earlier capacity was key constraint for India cement and it was not able to control cost or dictate price but with Ultratech’s entry, this will significantly ease.

- Profit Margins: Cost efficiencies and synergies should positively impact profit margins. However, initial integration costs may temporarily affect profitability. Investors should keep an eye on how margin is expanding for India cements. Operating profit margin for India cement was very low (about 2-3% in past few years due to high costs and interest payment).

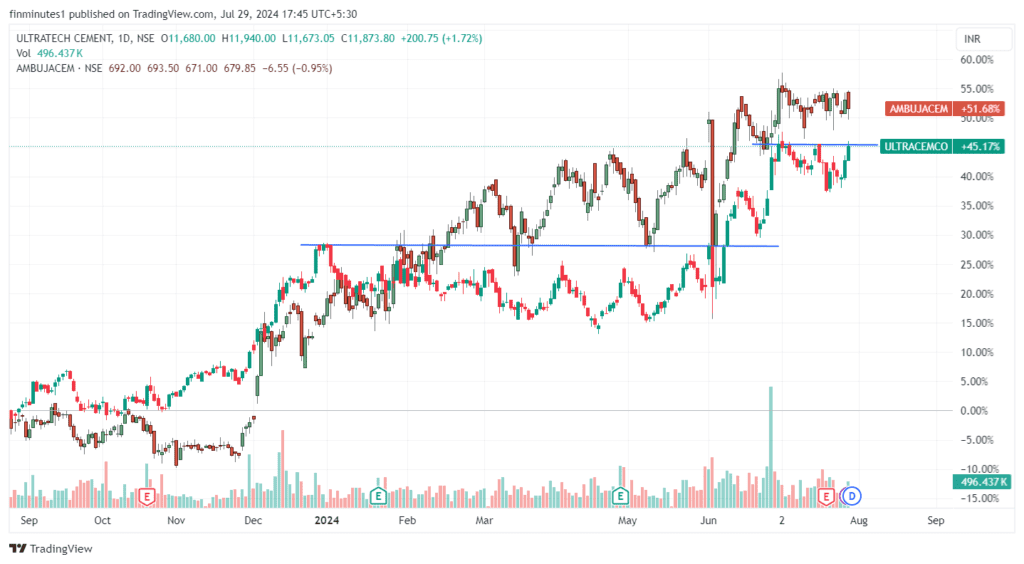

- Stock price movement: Stock of India cements is almost 2x in last few months since Ultratech first purchased ace investor Radhakishan Damani’s stake in the company. Now after such steep jump price should consolidate in a range and 390 (the price at which Ultratech acquiring stake recently) should work as a key level for investors to watch. Any further developments in terms of regulatory or shareholders approval will further drive the price so investors should keep an eye on news flows to get a cue.

The war for Market leadership

Adani group is having ambitious targets to have leadership position in Indian Cement market. Post the group acquired Acc and Ambuja cement it is aiming to grow its capacity to 140 MTPA till 2028 from current 80 (approx figure) million tonnes per annum (MTPA). In terms of market share Adani Cement currently holds around 14% of the Indian cement market share and aims to grow it to 20% by FY28. Adani group recently acquired Penna Cements, Sanghi industries to consolidate its market position and also showing interest in acquiring cement assets of Jaiprakash Associates and Saurashtra cement.

On the other hand, Ultratech cement is already the market leader of Indian cement sector and further wants to grow its capacity to around 214 MTPA by FY27, and thus market share will rise to approximately 32%.

Conclusion

While Investors should keep an eye on India cement stock but should refrain from buying at these levels, company has negative p/e ratio, very low ROCE, very high EV/EBITDA and negative return on asset. That may be the reason behind many industry veterans calling this deal (Ultratech paying 390/share to India cement) an expensive one. But for acquiring company often pay higher prices in their own interest and here gaining market share in fast growing southern market is the main reason behind Ultratech acquiring India cement.

Instead of buying in a hurry, investors should watch key corporate developments and how India Cement’s financials are improving. The acquisition of India Cement by Ultratech Cement marks a significant milestone in the Indian cement industry. For investors, this development offers a mix of opportunities and challenges. By carefully monitoring financial performance, integration progress, and market dynamics, investors can make informed decisions to capitalize on the potential benefits of this acquisition.

For more information on stocks, click here