Bengaluru-headquartered IT major Infosys ltd today reported its Q1 numbers after market hours, so now the question is, should you buy Infosys shares or should you wait for some cool-off after some decent run? The company was reporting subdued numbers from the last few quarters and had negatively revised its revenue growth guidance 4 times, but yesterday it reported Q1 numbers above street estimates. Surprisingly, Infosys raised its FY25 revenue growth guidance to 3-4% from the earlier given 1-2%, largely because analysts were expecting it to maintain the same guidance.

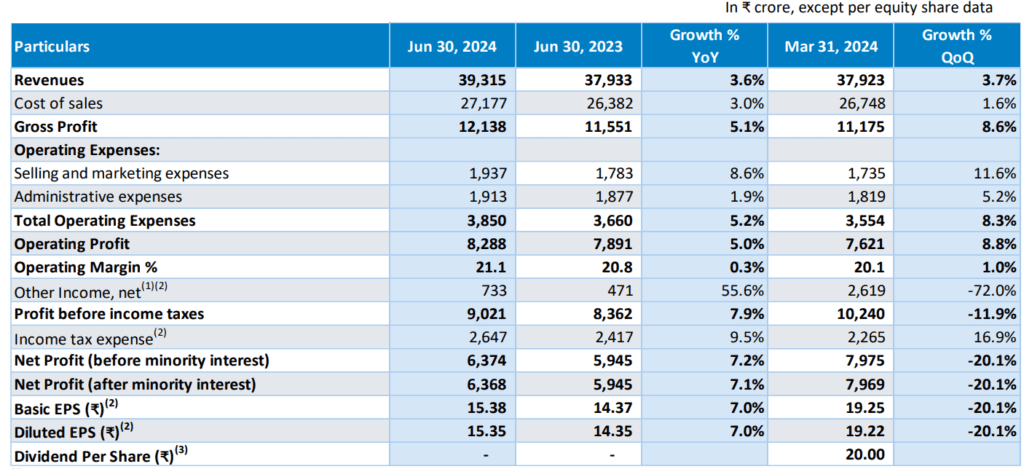

Infosys Q1 numbers, key highlights

Likes of Tata Consultancy services, HCL Technologies among IT large caps presented Q1 numbers better than street estimates so the expectations from Infosys were also to beat the analyst estimates and Infosys did the same.

Infosys, a global leader in next-gen digital services and consulting, delivered $4,714 million or 39,315 cr in Q1 revenues with a sequential growth of 3.6% and year on year growth of 2.5% in constant currency. Operating margin was at 21.1%, a sequential expansion of 1%. Free cash flow was highest ever at $1,094 million, an increase of 56.5% year over year. Number of large deal wins were highest ever at 34 with TCV of $4.1 billion, 57.6% being net new.

Key highlights:

- Revenue at 39,315cr, in CC (constant currency) terms grew by 2.5% YoY and by 3.6% QoQ,

- Operating margin at 21.1%, growth of 0.3% YoY and 1.0% QoQ,

- Basic EPS at ₹15.38, increase of 7.0% YoY,

- FCF at ₹9,155 crore, growth of 59.2% YoY; FCF conversion at 143.6% of net profit. In dollar terms FCF at $1.1bn and TCV at $4.1bn, both at highest level ever,

- In terms of guidance for FY25, Infosys surprised experts by revising it to 3-4% from earlier given 1-3%,

- Guidance for operating margin of 20%-22%.

“We had an excellent start to FY25 with strong and broad-based growth, operating margin expansion, robust large deals, and highest ever cash generation. This is a testimony to our differentiated service offerings, enormous client trust, and relentless execution”, said Salil Parekh, CEO and MD. “With our focused approach for generative AI for enterprises working with their data sets on a cloud foundation, we have strong traction with our clients. This is building on our Topaz and Cobalt capabilities” he added.

What we liked in the result

The company was struggling with poor performance from last few quarters largely due to macro concerns like uncontrolled inflation in west (a key market for the company) but as inflation is declining and macro picture is getting clearer everyone was waiting to see green shoots in IT company’s numbers. With TCS starting the Q1 result session with a bang it raised the hope of investors, later HCL tech reported its Q1 earnings, though market reacted positively to the number but they were mostly below par and beat was due to a one time gain from sub co divestment.

Yesterday, Infosys came out with its Q1 numbers in after market hours and it positively surprised most experts. Here are the factors that impressed us most-

- Good growth in revenue in cc terms and improvement in margins in QoQ and YoY. Though there was a dip in Net income QoQ but last quarter Infosys had some one time interest income, leaving that even net income is up sequentially.

- Last FY company reducing its revenue guidance multiple times was a key concern so this time expectations were that company will at least maintain the past guidance and will not further reduce it, to everyone’s surprise co revised it revenue guidance upwards and maintained the margin guidance.

- Segment wise company’s key segment like energy, manufacturing and hi-tech showed good growth and geography wise Europe and India showed strong growth which is a positive for the company.

- Company’s large deal TCV at $4.1bn, highest ever and it won some high quality large deals from clients like Telstra, ABB and Formula E.

- Company completed the acquisition of in-tech, a leading Engineering R&D services provider focused on German automotive industry. This follows the announcement the company made on April 18, 2024. Headquartered in Germany, in-tech, is one of the fastest growing Engineering R&D services providers that shapes digitization in the automotive, rail transport and smart industry sectors. in-tech develops solutions in e-mobility, connected and autonomous driving, electric vehicles, off-road vehicles and railroad.

- In-tech brings to Infosys, marquee German original equipment manufacturers, deep client relationships, and an extensive industry expertise with a multidisciplinary team of 2,200 people across locations in Germany, Austria, China, UK, and nearshore locations in Czech Republic, Romania, Spain, and India. The entire shareholding in in-tech Group India Private Limited, a step-down subsidiary of in-tech Holding GmbH, will be acquired by Infosys Limited.

- Why we are highlighting the In-tech acquisition is because digitization in automotive industry will keep growing with the advancement of EVs and autonomous vehicles and with In-tech’s acquisition Infosys will strong its footing in key automotive market of Europe. The kind of run up tech-automotive companies like KPIT Tech, Tata tech had in last few years, shows the enthusiasm of the market around it so in-tech will be a valuable asset for Infosys.

Key concerns and risks

- like other IT majors, Infosys’s key segment of BFSI and healthcare is still showing de-growth, though there are early signs of recovery but inflation in its key market Europe is not coming down as in US and other geopolitical risks, election in US and policy shifts many delay the recovery further.

- Though all major IT companies pointed that FY25 will be better than FY24 but none commented on when discretionary spending will be back in its key markets. A lot of performance upgrades will depend on these parameters as, if the clients are negotiating hard for the deal it will be hard for IT companies to expand margin in a meaningful way and without that re-rating of the IT sector is tough.

- Except TCS all other major IT companies that reported their Q1 are still loosing employees and that is a bad sign as manpower is like a key raw material for IT companies and it shows that they are still expecting a tepid order flow and low margin deals, that’s why they are very conservative in recruiting.

How brokerages reacted to co’s Q1 numbers and should you buy Infosys share?

Most of the brokerages reacted positively to Infy’s Q1, leading brokerage firm Bernstein said that it sees the beginning of an upcycle trend for the company as the growth recovers, BFSI segment inflects and the AI deals scale up. Bernstein maintained “buy” rating and increased the target price to 2,100 from 1,650 earlier.

Brokerage firm JP Morgan maintained its “overweight” stance on Infosys and raised the price target to ₹1,950 from ₹1,750 earlier. It pointed that the growth recovery was supported by a recovery in short-cycle deals but also called its large deal wins “impressive”. JPM also said that its new revenue guidance of 3% to 4% parses out as a 2.3% to 3.3% organic growth, which maintains the context of “no improvement” in macro and the usual first half seasonality.

Goldman Sachs while maintaining the “buy” rating and raising the target price to ₹1,870 from ₹1,680 earlier, said that the financial year 2025 revenue growth for the company will be 400 basis points higher than that in financial year 2024, adding that the highest ever large deals in number will continue to aid revenue growth.

Brokerage firm Jefferies sees Infosys stock crossing 2,000 mark in next 12 months, it raised the target price to 2,040 from earlier given 1,630. Jefferies said that there are initial signs of recovery within the BFSI segment, strong deal wins and an all-round improvement in operating performance indicates that the worst is behind the company. It also has raised its estimates by 3% to 4% and expects the Earnings Per Share (EPS) of co to grow at a CAGR of 10% over FY24-27.

| Brokerage | Rating | Target price | Potential upside/(downside) |

| Bernstein | Outperform | 2,100 | 17% |

| JP Morgan | Overweight | 1,950 | 8.5% |

| Morgan Stanley | Overweight | 2,050 | 14.5% |

| Jefferies | Buy | 2,040 | 13.9% |

| Goldman Sachs | Buy | 1,870 | 4.6% |

| Citi | Neutral | 1,850 | 3.1% |

| Nomura | Buy | 1,950 | 8.5% |

| HSBC | Hold | 1680 | (-)6% |

| CLSA | Hold | 1747 | (-)2.8% |

| Average | 1,915 | 6.6% |

Valuation and our take-

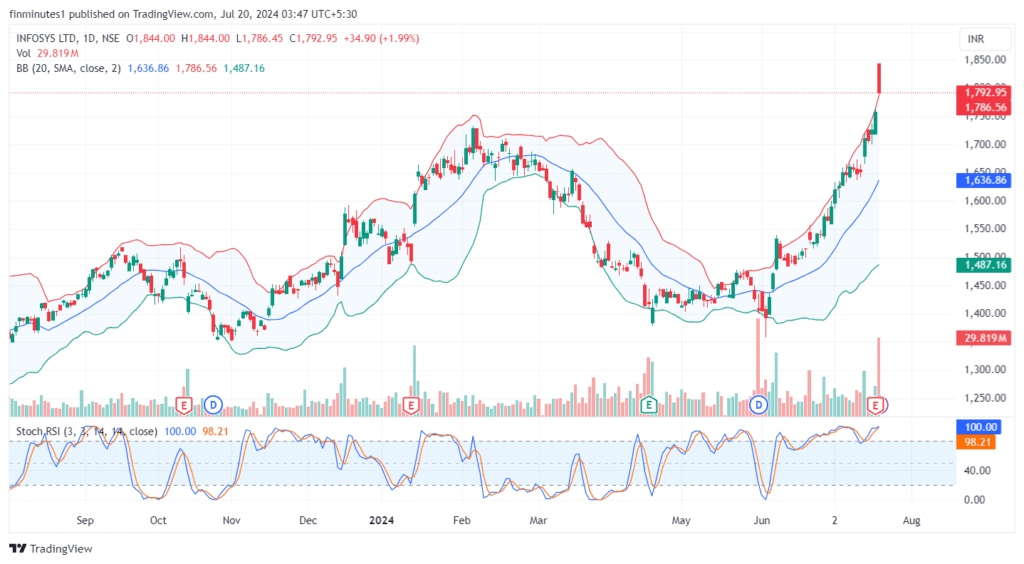

Currently Infosys is trading at a P/E of 28.38 against it 5 year average P/E of 19-39. Our forecast suggests that Infosys will do an EPS of 65-66 in FY25 so at one year forward valuation, it is trading at a FY25E* P/E of 27.1. Even our valuation model suggest very limited upside in Infosys from here in next 12 months. (In optimistic case we are assigning a P/E of 30 to Infosys on our forecasted EPS of 66 in FY25, giving a target price of 1,980-2,000, note- optimistic case scenario based on management guidance)

So even on the optimistic scenario Infosys is very close to its consensus target and in fact it made an high of 1,840 in Friday’s trading session almost touching its next 12 month target, so one should remain careful in taking new entry in the stock and should wait for some cool off for fresh entry. Technically too stock is in highly overbought zone and it crossed the upper range of BB, historically whenever this happened stock immediately reversed to its base.

Note- Do your own research and do take advice from a registered investment advisor before making any investment decision.