REC, PFC, IREDA stocks fell more than 10% in early trading hours of Monday due to RBI bringing some guidelines about increased provisioning requirements on new loan assigned to projects. Stocks of these companies are up as much as 60% in past six months. Today (at the time of writing)-

• Stock of REC is down 6.7% intraday and trading at ₹520, it made a high of ₹540 and low of ₹481.

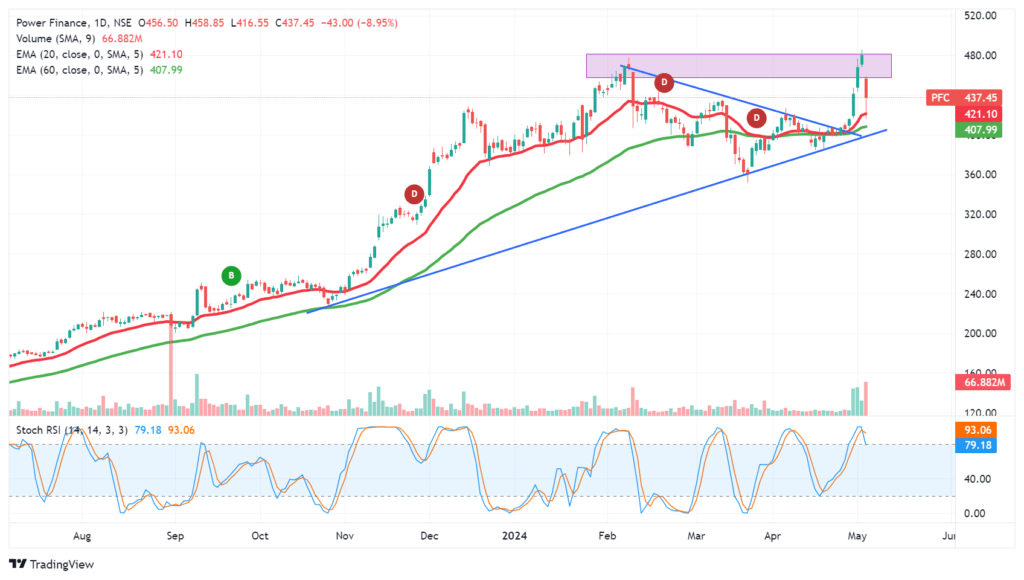

• Similarly stock of PFC is down 8.1% and trading at ₹441, it made a high of ₹458 and a low of ₹416 intraday. Let’s have a reality check on these new regulations and are they going to make any significant impact on REC, PFC’s financials also a check on technical setup of these stocks and valuation. Read along-

What are these new Regulations introduced by RBI?

Reserve Bank of India (RBI) recently released guidelines and directed all Scheduled Commercial Banks (including Small Finance Banks but excluding Payments Banks, Local Area Banks and Regional Rural Banks), Non-Banking Financial Companies (NBFCs), Primary (Urban) Cooperative Banks and All India Financial Institutions (AIFIs) to maintain a general provision of 5% of the funded outstanding on all existing as well as fresh exposures on a portfolio basis for construction phase.

Once the project reaches the ‘Operational phase’, the 5% provision can be reduced to 2.5% of the funded outstanding. This can be further reduced to 1% of the funded outstanding provided that the project has (a) a positive net operating cash flow that is sufficient to cover current repayment obligation to all lenders, and (b) total long-term debt of the project with the lenders has declined by at least 20% from the outstanding at the time of achieving DCCO (Date of Commencement of Commercial Operations).

Timelines for compliance:

The provisioning of 5% for Standard Assets during construction phase shall be achieved in a phased manner as per the following timeline:

(i) 2 per cent – with effect from March 31, 2025 (spread over the four quarters of 2024-25)

(ii) 3.50 per cent – with effect from March 31, 2026 (spread over the four quarters of 2025-26)

(iii) 5.00 per cent – with effect from March 31, 2027 (spread over the four quarters of 2026-27)

Will there be any material impact of above guidelines on REC, PFC?

A short answer of above question is No, there will not be any material impact on these lenders profitability or ROE, these measures will only increase a bit of provisions thus making a small impact on capital adequacy ratio. Both lenders maintain capital adequacy ratio over 23% which is very good against industry standards and both of them are well capitalized and there non performing assets are low, in fact both lenders added no new NPA in last 12 months.

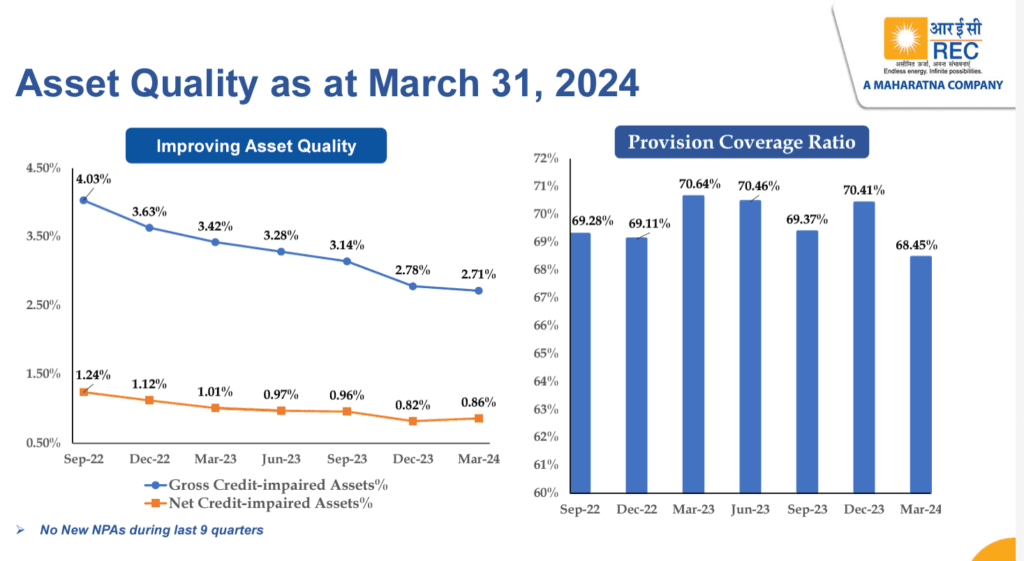

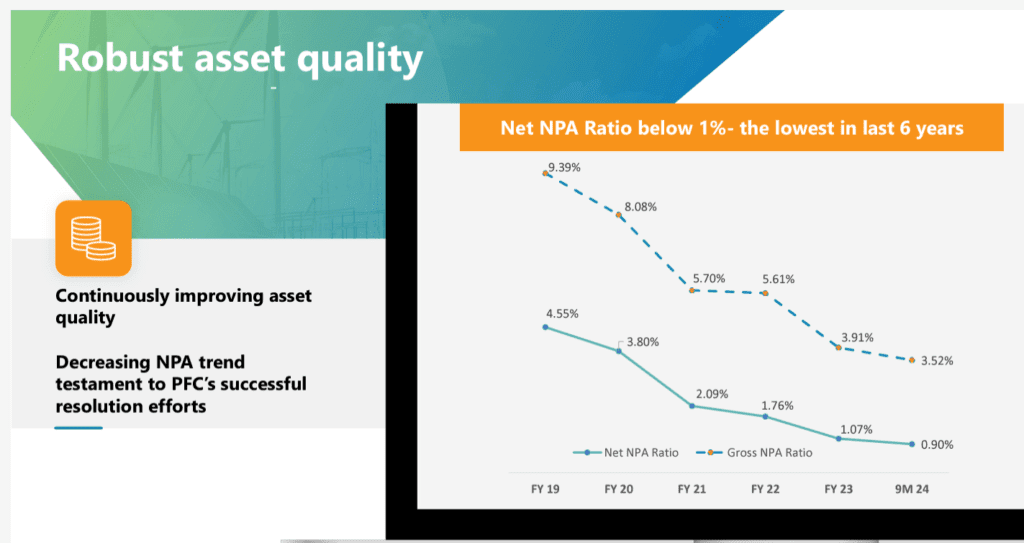

Net NPA of both lenders is below 1%, it is at 0.86% for REC and 0.90% for PFC. Gross NPA of REC is at 2.71% and the same is at 3.52% for PFC, both lenders are seeing constant improvement in asset quality from last 5 years so a small increase in provisioning will not impact them, as RBI guidelines suggest that when projects reach operational stage provisions will fall to 2.5% and once it is in positive operating cash flow level the provision further fall to 1%, most of the projects that these lenders lend are government backed so secure and reach net positive cash flow stage in timely manner.

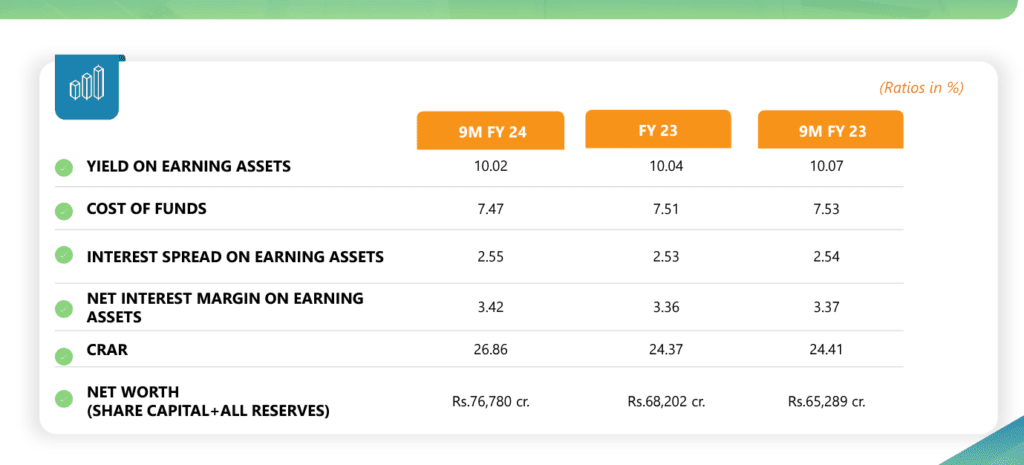

On concerns in terms of capital adequacy ratio these new provision requirements may lower both lenders tier-1 capital ratio by 200-300 basis points impacting their lending ability but in my view both lenders have strong capital adequacy ratio (in excess of 23% for tier-1 capital) and can absorb the impact of 2-3% change. Moreover RBI proposed these measures to be implemented in 3 parts till 2027 providing enough time to lenders like REC, PFC to adjust and prepare well.

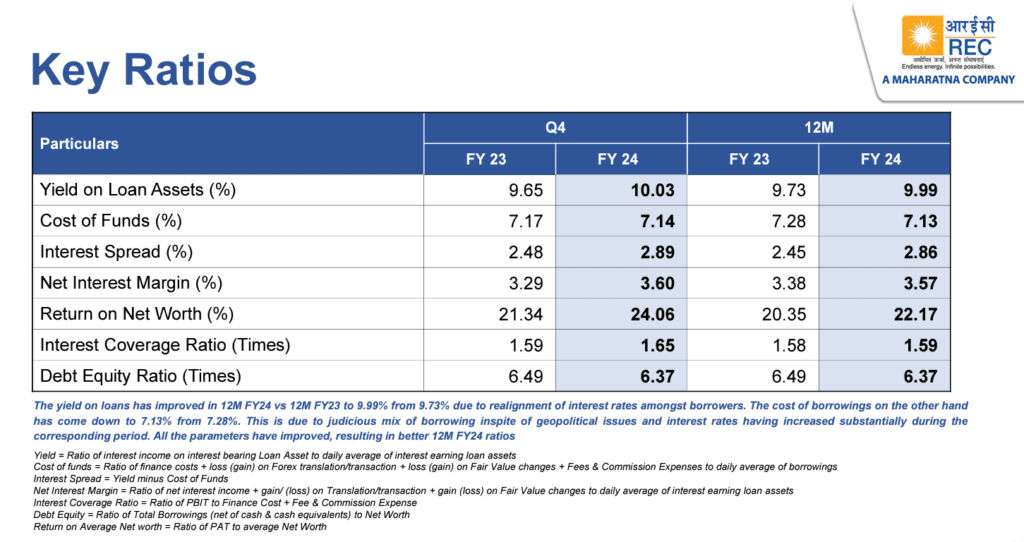

On fear that increased provisioning requirement will expectedly decrease REC and PFC’s Tier-1 capital ratio by 200-300 basis points, so a lower capital ratio indicates a weaker financial position and higher risk for investors. As these lenders raise a lot of money from bonds and weaker financial position may prompt bond buyers to ask for higher yield but in my view the buffer that these lenders have in CAR is enough to shut these concerns. Already cost of money for these companies is on lower side in terms of industry average.

On top of that Maharatna status of REC gives it multiple business advantages including greater operational & financial autonomy, Allows strategic investments by incorporating JVs, Subsidiaries and M&A activities in India and abroad and accelerating growth and supporting Govt’s vision for power sector. REC recently issued Yen green bonds of 61.1bn yen and both lenders enjoy highest AAA rating so cost of money and borrowing is not a concern.

Valuation and view on Technical

• With a market cap of 136,440cr REC Ltd trades at a 2.69 times book value, the dividend yield of the Co is at 3.1% and stock trades at a P/E of 11x against its 5 years average of 3-10x. Stock have 60% buy ratings, 20% outperform rating and 20% hold rating, zero sell or underperform ratings.

• PFC’s market cap is at 144,379cr, it trades at a 2.32 times price to book value with a dividend yield of 3%. The stock trades at a p/e ratio of 11x against 5 year average of 3-10x. It has 80% buy ratings and 20% outperform ratings from analysts.

Charts of both the companies looks similar, both in strong up movement, after a strong movement in Jan- Feb month stocks took a breather and consolidated in a range, after making a base stocks gave a breakout few days back on a high volume higher momentum run up but this news spoiled the momentum. Both stocks should be watched for breaching given support or resistance line to take further cues.

Conclusion

Given the governments high focus on infra and rising infra spends from private sector both these lenders are to benefit most. Power needs of the country is rising day by day demanding establishment of more and more investment in power infra giving adequate revenue visibility to these lenders. With a total loan book of more than 5 lac crore which is growing at 15-17% these lenders will remain primary choice of investors to play the India story. Keeping these stocks in watchlist and adding both in long term portfolio during significant corrections can be a good idea but please take advice from registered financial advisors before making any such calls.

Read more about REC LTD, click here

Read more about our stocks coverage, click here