• Ongoing Russia Ukraine conflict and rising tensions in many other parts were giving jitters to financial markets time to time but now heightened tension between Iran Israel which could possibly turn into full scale conflict is worrying markets.

• Tensions rose between Iran Israel when an airstrike happened in Iranian consulate in which some officers including 2 generals were killed, though Israel haven’t claimed the responsibility but Iran threatened to revenge it.

• Shadow war between two nations broke open when some fractions of Iranian armed forces launched hundreds of suicide drones and cruise missiles on Israel last night, which were intercepted by Israeli Iron dome defense system.

• Shadow war between Iran Israel was going on after terrorist group Hamas attacked Israel on Oct 7 calming many lives and Israel retaliated with iron fist killing many terrorists and capturing many others. Israel claimed that Iran is backing Hamas.

↗ Markets which were already on correction mode post higher than expected US inflation numbers are now looking panicky post heightened geopolitical setup. On one side stubborn inflation will not let Federal reserve cut rates as markets were factoring in and on the other geopolitical setup further worsens the macro situation, let’s analyze what it means for Indian stock market and should participants panic?

Iran Israel conflict, possible scenarios

As tensions are at all time high in middle east region and many nations are taking sides, some are also trying to calm the situation as even a small step from either side could worsen the situation.

Iran to revenge fired more than 300 drones and missiles and world is now watching what will be the response of Israel. Markets are also monitoring the situation closely, last week was bumpy for the markets all around, Indian stock market’s key index fell one percent on Friday as FPIs were net sellers to the tune of nearly $1 billion due to rising uncertainties and the FPI selling is expected to continue in coming week too.

If full scale conflict happen between these two nations, the primary impacted commodity will be crude oil as Iran is world’s third largest OPEC oil producer. Though The United States has imposed sanctions on Iran’s oil trade, making it illegal for U.S. companies and individuals to deal with Iranian oil, also discouraging other countries from buying Iranian oil. But, despite sanctions, Iran is selling oil to some countries, particularly China.

As China is world’s largest oil importer so it buys Iranian oil at discount and have developed certain transportation and payment methods to avoid western sanctions e.g. “dark fleet” tankers that operate outside regulations to move oil making tracking and enforcement of sanctions more difficult.

Scenario 1:

Though tensions are on all time high but there is high possibility that worst is behind, as Israel is fighting Hamas from months and have deployed most of its resources there, Israel defense is more powerful than its offence and for fighting a full fledged war with a country like Iran it will need support of its western partners but reports suggest that the Biden administration cautioned Tel Aviv to avoid escalation in middle east.

Further, the reports suggested that US won’t take part in any counter-offensive launched by Israel and advised Israel against it. Both Iran Israel are capable nations and have large military power so US wants to de-escalate the situation to contain the risk of a wider regional war. If US will not take part possibility is other western allies will also avoid it and there may not be any direct conflict between both nations. Israel may continue to punish the proxy groups backed by Iran avoiding a direct conflict.

Scenario 2:

If Iran Israel go forward with directly fighting each other, Iran will not stop supplying oil to China as it will need the oil money to fund the war more than ever, we have seen it in the case Russia Ukraine that how Russia is pumping more oil to allies to fund the war. Iranian oil is anyway not available to most countries in the world so for the total supply it doesn’t matter much but what matter is disruption on trade routes including the “Strait of Hormuz”, a critical trade route for oil.

The importance of this trade route can be guessed as the U.S. Energy Information Administration (EIA) suggests that in 2023, an average of 21 million barrels per day (b/d) of oil transited the Strait of Hormuz. This represents roughly 21% of global petroleum liquids consumption. Another important trade route “the Suez canal” may also get impacted, though this route is not that significant for oil transportation as only around 4.2 million barrels(b/d) of oil pass but many other imp cargo passes by it so any disruption will be bad for inflation.

Impact of Iran Israel conflict on our market

Though oil is already on 6 month high and much of risk is also factored in it but any advancement in Iran Israel conflict and scenario 2 playing out can push it to $100 bpd or beyond. Expensive oil is bad for our CAD (current account deficit) widely tracked by market. In this case a big sell off can come due to panic selling but if things stop here sell off will be not that big. Oil is in a down trend and sustaining above $90 is crucial for if to break from it.

Iran Israel conflict is not a complete surprise for the stock market as they are shadow fighting each other from months but due to markets are at an all time high and valuation for a few is stretched, any negative news will invite a panic selling.

In any case my advice to investors is, keep India story in mind, macro picture is getting better for India and any selloff should be seen as opportunity to add quality companies. Don’t sell your quality stock in panic instead add them if they’re available at attractive price. IT, FMCG, large banks, Chemical companies will be the primarily tracked sector for market apart from defense and Energy theme. TCS have started Q4 with a bang as it managed to top the street expectations.

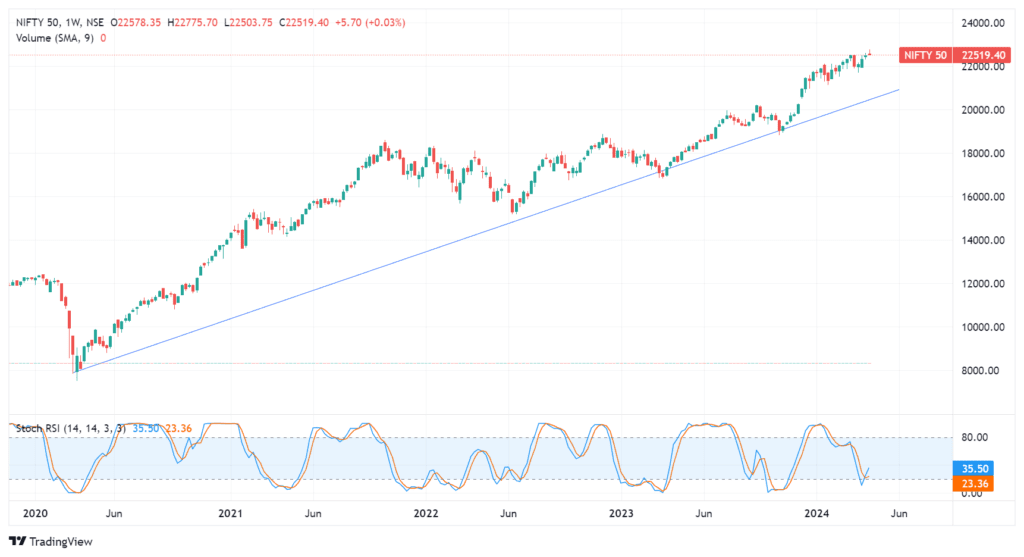

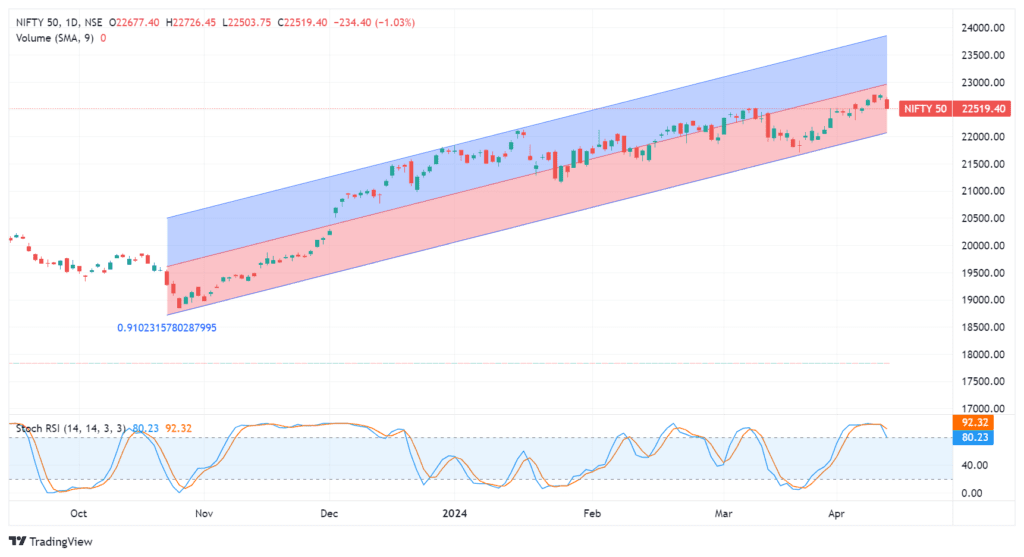

In case of a smaller corrections, Nifty will take support near 22150, 22000 range (lower band of current trend channel) but if fall deepens then Nifty 50 can touch 20850-20950 range (long term support on weekly chart).

Further cues that market will watch closely in upcoming week

It will be a busy week for investors as the third week of April amid geopolitical headwinds will mark the beginning of the general election in India. Several stock market triggers including the January-March quarter results for fiscal 2023-24 (Q4FY24), general elections 2024, the Israel-Iran conflict, domestic and global economic macroeconomic data, crude oil prices, and global cues are likely to keep investors on their toes and will guide market direction this week.

On the macroeconomic front, India’s wholesale price index (WPI) based inflation, trade deficit data, among other indicators will be closely tracked by investors. The ongoing Q4FY24 earnings season will be a major factor in driving the stock market movement. Companies such as Wipro, Infosys, Bajaj Auto, Mastek, HDFC Asset Management Company, Jio Financial Services, CRISIL, Angel One will be in focus as they will come out with their Q4 numbers later in the week.

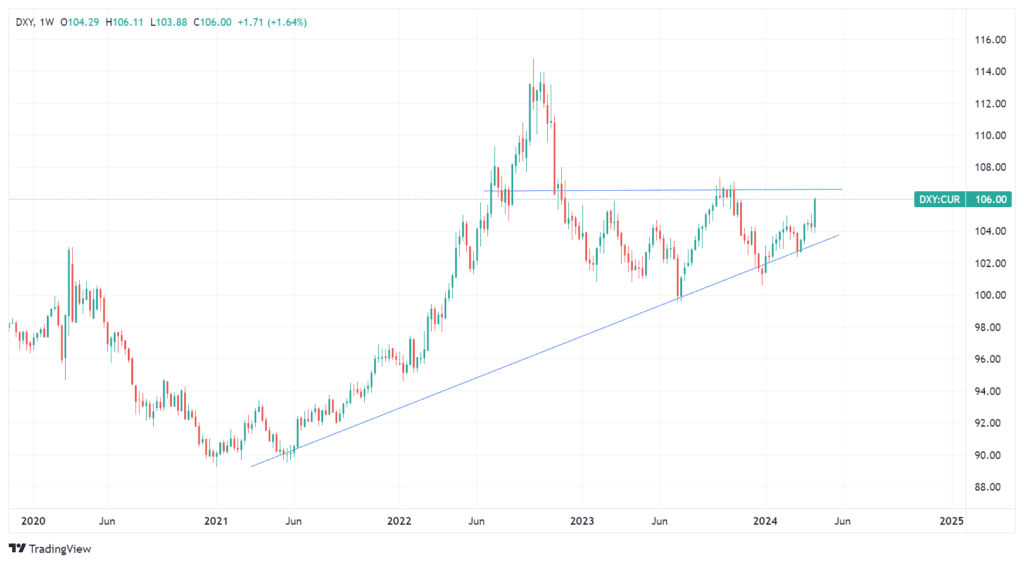

Global economic data including China economic growth rate, US retail sales, US Manufacturing Production Index, US Initial Jobless Claims and quarterly results will also be eyed by investors in coming week. USD index is near all time high and will be closely monitored by the investors along with 10y US bond yield.

Read more about Iran Israel conflict, click here