- Bharti hexacom is the first public issue from Bharti group from over a decade is open for subscription from April 3.

- On the second day of subscription issue though fully subscribed but received a dull response from investors as the issue was booked only 1.12 times.

- Retail portion has been subscribed 1.15 times, NII portion has been subscribed 1.71 times while the QIBs portion has been subscribed only 82%.

- Why I’m not that impressed with the company despite having strong parentage and steady market share gain in regions it operate, Is it valuation or competition or something else? Read along.

Bharti Hexacom: A little about the company

Bharti hexacom is a communications solutions provider offering consumer mobile services, fixed-line telephone and broadband services to customers in the Rajasthan and the North East telecommunication circles in India, which comprises the states of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura. They offer their services under the brand ‘Airtel’. Company claims to have a gamut of digital offerings to enhance customer engagement and differentiated customized offerings through family and converged plans under Airtel Black proposition, which has resulted in the continuous improvement of its revenue market share during the last three Fiscals.

The company was originally incorporated in 1995 as ‘Hexacom India Ltd’ but in2004, the name of the company was changed to “Bharti Hexacom Ltd” (BHL) when Airtel acquired a majority equity interest in the company. Airtel owns 70%, while the Government of India through Telecommunications Consultants India Ltd (TCIL) owns 30% of the company’s equity share capital.

Bharti Hexacom’s operations

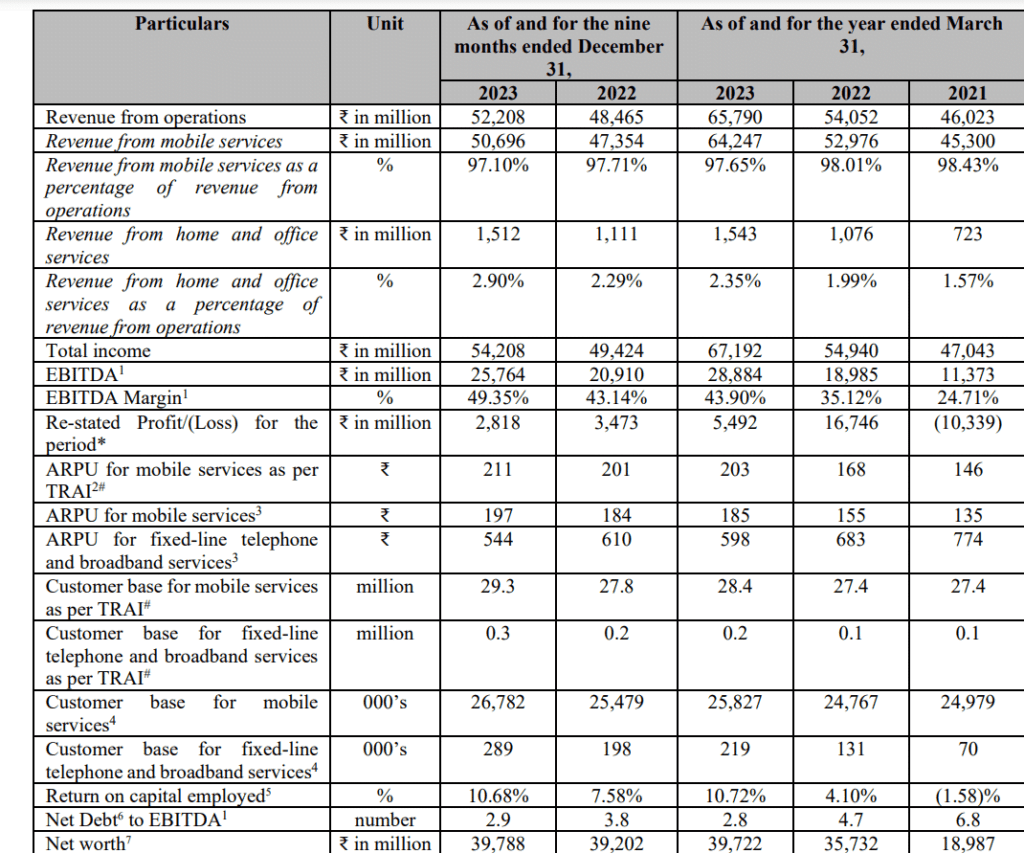

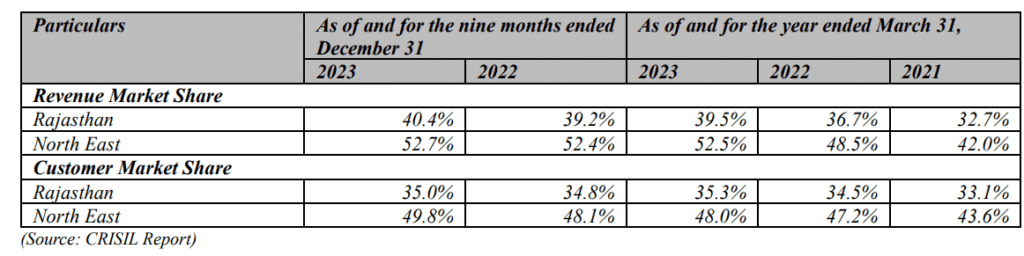

As of December 31, 2023, the company was present in 486 census towns and had an aggregate of 27.1 million customers across both the circles. The customer market share has grown consistently in Rajasthan from 33.1% as of March 31, 2021 to 35.0% as of December 31, 2023 and in the North East from 43.6% to 49.8% between the same dates.

• Company has the highest number of Visitor Location Register (“VLR”) customers (6.4 million) and a VLR market share of 52.3% in the North East circle and the second highest in the Rajasthan circle with 23.2 million customers and a VLR market share of 38.7%.

• Bharti Hexacom holds telecommunication licenses and spectrum in its two circles. It has spectrum portfolio with varied pool of mid band spectrum (1800/2100/2300 MHz bands). None of the existing spectrum expires before the year 2030, and the validity of the spectrum pool ranges between the years 2030 and 2042.

• The company’s revenue market share in the North-East circle was 52.7% and in the Rajasthan circle it was 40.4% during the 9MFY24. In North-East Circle, it was number one during 9MFY24, FY23 and FY22, while in Rajasthan Circle it was at second position during the 9MFY24.

Company relies on a robust network infrastructure with a mix of owned and leased assets. As of December 31, 2023, co utilized 24,874 network towers, of which it owned 5,092 towers, and the remaining 19,782 towers were leased from tower companies. Company offers 5G plus services on the widely chosen non-standalone(NSA) network architecture and at a low cost of ownership enabling it to save a significant amount of capital towards sub-GHz spectrum for 5G roll out and additional capital expenditure required to be spent on network infrastructure to deploy the same.

Bharti hexacom financials

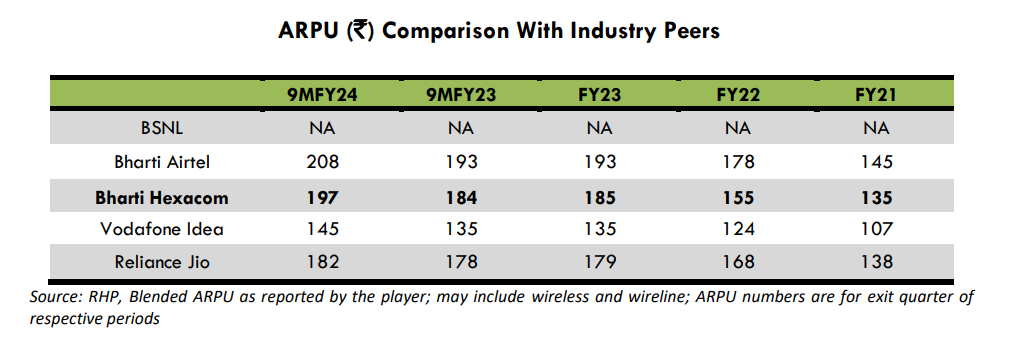

Company’s revenue and EBITDA margin is improving constantly. There’s is all around improvement in many fronts including ARPU (average revenue per user) and it now stands at 211 as per TRAI for mobile services and is also one of the highest in industry after Hexacom’s parent company Airtel. Company’s customer base is growing year after year. There is de-growth in profit figure due to one time accounting adjustments but on the gross level there is good growth. Company’s net debt to EBITDA now stands at 2.9, down from 3.8 yoy, which is a good sign.

What I like about the company

• Strong parentage and very experienced promoters, Bharti group is in telecommunication business from decades so they know every nuances of it plus it gives Bharti Hexacom freedom to get funds for Capex and opex purposes without much hassle. That’s why it is a complete offer for sale issue as the company is not in the need of any fresh fund inflow to meet its planned growth as of now.

• Company’s Established Leadership and Large Customer Base in its areas of Operations. Company is at number one position in the North East circle during the nine months ended December 31, 2023 and Fiscals 2023 and 2022. In the Rajasthan circle, the market share gap between us and the market leader has narrowed between Fiscal 2021 and the nine months ended December 31, 2023 and we stood at the close second position during the nine months ended December 31, 2023.

• Presence in markets with high growth potential, According to the CRISIL Report, Rajasthan had a teledensity of 79.5% as of Fiscal 2023, which lags the national average of 84.5% due to its lower rural teledensity of 57.2%. Rajasthan’s customer base is expected to grow at 1.4% to 1.5% between Fiscals 2023 and 2028 reaching 69.0 million to 69.5 million with a teledensity of 82% to 83% following pan-India trends with rising rural teledensity.

• The gross revenue of the Rajasthan circle is expected to grow at 7% to 8% between Fiscals 2023 and

2028 to reach ₹ 183 to 185 billion, supported by a rise in teledensity in the region, especially in rural regions, higher tariffs and an increase in internet penetration in the state.

• North east’s teledensity is low too and exposure of wireless due to challenges in laying and maintaining

wireline infrastructure given the region’s hilly terrain and extreme weather conditions. Bharti hexacom has big opportunity in region as it is a dominant player here. The customer base in the North East is expected to grow at 1% to 1.5% between Fiscals 2023 and 2028 reaching 13.2 to 13.5 million with a teledensity of 81% to 82%. The North East circle telecom industry is expected to grow at 6% to 7% between Fiscals 2023 and 2028 to reach ₹39 to 41 billion, supported by rising teledensity, higher internet penetration and a potential increase in ARPU in the region.

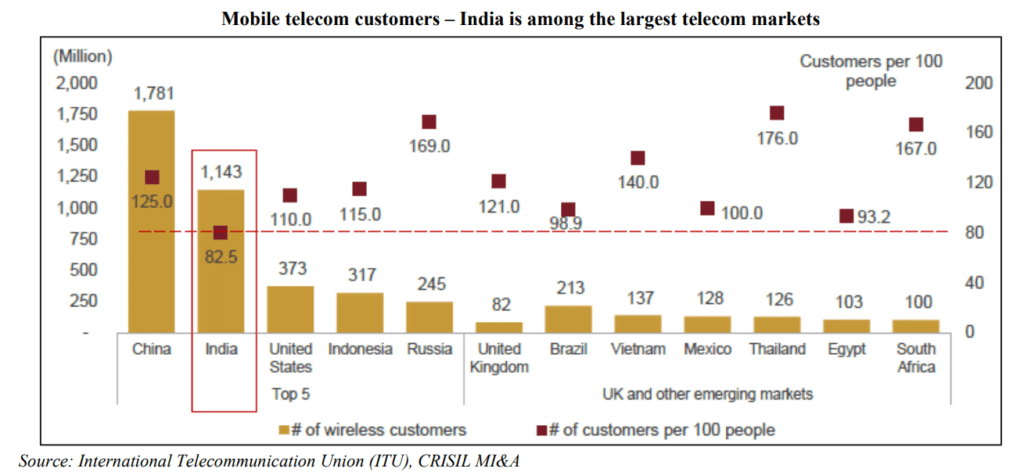

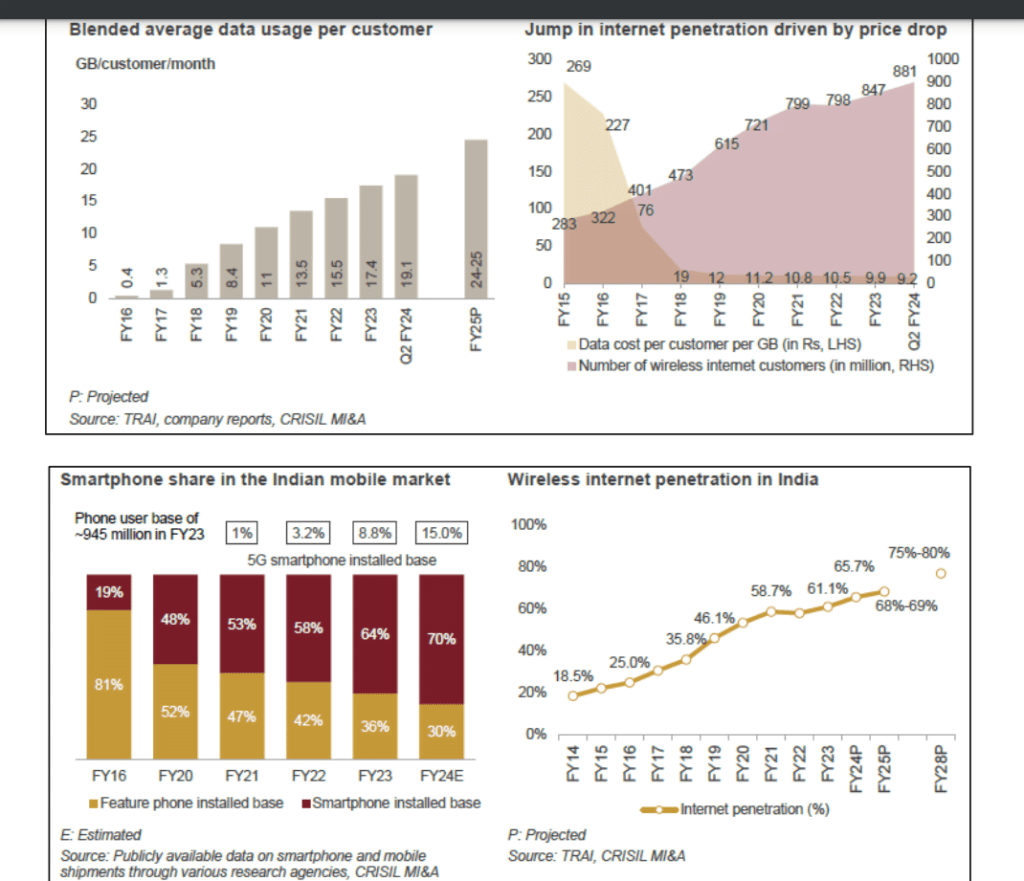

• India very large telecom market with 1,143 million wireless customers, second only to China but customer rate per 100 people is low compared to other developed and emerging economies, presenting a huge growth opportunity. Market is expected to grow above average in India due to increased internet penetration and growing data usage. ARPU is on constant rise due to increase in spending power and growing household income in the country.

• Telecom sector, though very tough competition among large players already operating in the industry but has a high entry barrier for new players due to very large capital requirements and heavy infrastructure needs. There were many smaller companies in the sector before 2014-15 but post new rules were introduced, e.g. when spectrum auction began for new networks many were not able to bid for it either they merged with large players or stopped functioning.

• Second best ARPU among industry peers

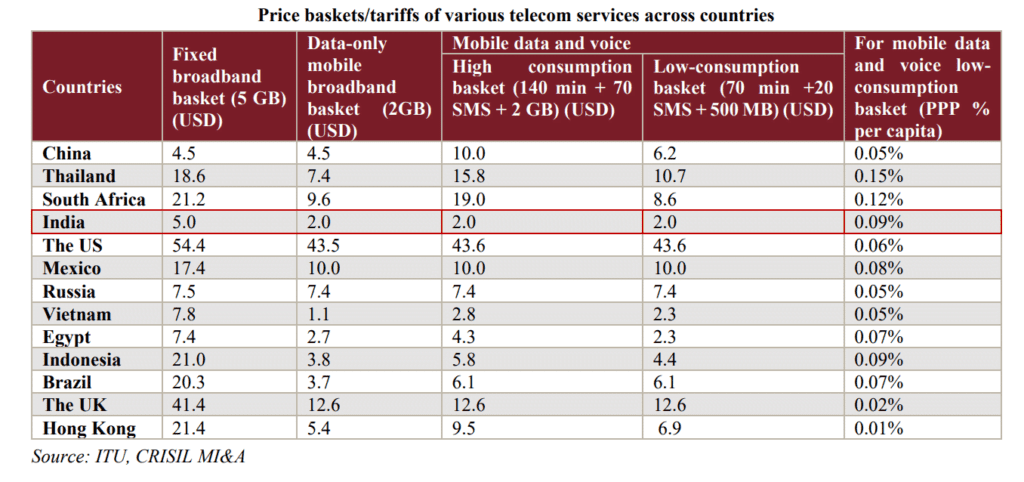

• Potential for price increases given under-indexation of Indian players versus global peers.

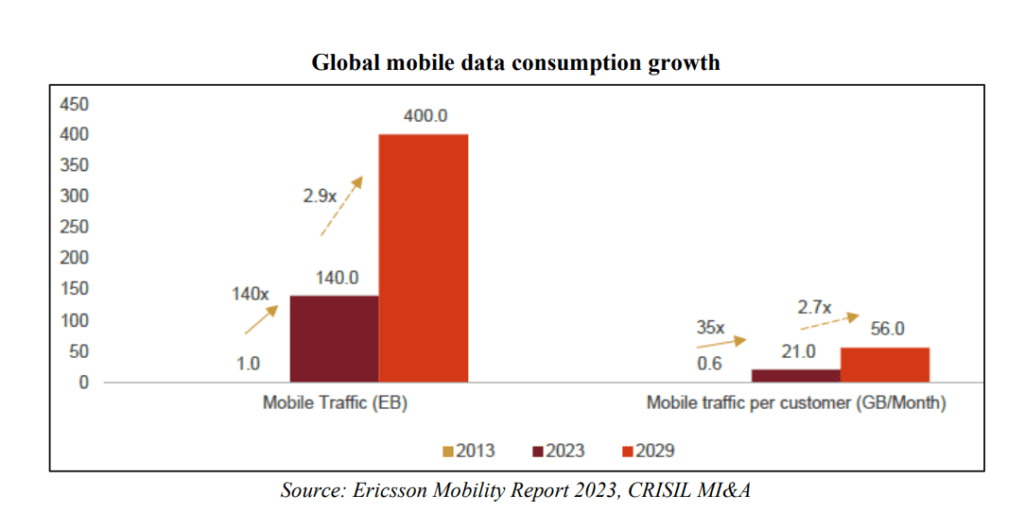

• Rising Smartphone penetration coupled with 5g use case brings huge opportunity for companies like Bharti hexacom.

Key risks

• Despite having many positives the most obvious risk with Bharti hexacom is that operates in limited regions, any policy change, disruptions or any other challenge will badly effect company’s business.

• The company is operating in a highly regulated telecommunications market. Its licenses and spectrum allocations are subject to terms and conditions, ongoing review and varying interpretations, each of which may result in modification, suspension, early termination, expiry on completion of the term or additional payments that could adversely affect its business due to regulatory ceilings on pricing.

• Reduction in revenue they earn for their telecom services, due to regulatory ceilings on pricing, or owing to pricing pressure, reduction in average revenue per user (“ARPU”), may have an adverse effect on their business, financial condition, results of operations and prospects.

Valuation

Apart from limited area operation the valuation is another key factor that is weakening the case for IPO subscription. Bharti hexacom is priced at upper to premium category and given the availability of other listed players that are providing country wide services, buying them instead is a better idea due to balanced geographic risk and larger opportunity size. Bharti hexacom, at the upper price band it is valuing at P/E ratio of 52.3x of its FY23 earnings with a market cap of ₹ 2,85,00 crore post issue of equity

shares and return on net worth of 13.8%.

Company’s parent Bharti Airtel trades at a p/e of 60 FY25(E) while current p/e is at 82.6 and return on net worth of 15.8%. Company’s Financials were badly impacted due to Nigerian currency de-valuation but going forward it is forecasted that company will post a revenue growth of 11-14% CAGR due to broader operation zone and all above listed tailwinds in telecom sector. So, isn’t it better to own shares of Bharti Airtel instead of Bharti Hexacom?

Conclusion is given the limited area of operation Bharti Hexacom will not be able to reap the benefits of fast growth in telecom sector in many regions and if any significant change happens in the area it operates or it losses the leadership position to competition it will be tough for Bharti Hexacom to maintain its financial performance. Given the indebtedness of the company any unfavorable condition will badly impact it’s Financials so in my view the IPO should have been on some discount.

For low to medium risk taking investors it is better to wait for some price correction post listing and in meantime keep watching for quarter 4 numbers for further clues in the growth front. High risk taking investors can ‘bet’ in the issue keeping the above mentioned risks in mind.

To know about the performance of IPO’s that debuted in the last 3 months, click here.

Click here to know more about Bharti Hexacom