Total 23 IPO hit dalal street in this 3 months of 2024, some of them provided very good return as they doubled investors money post listing in just 3 months and some are still lagging behind. Let’s take a look at each newly listed company to analyze their business and financial performance. 2024 has been a good year for stock market as both key indices and broader market performed well encouraging more and more companies to list on secondary market, read along to find is there an opportunities or risk in these companies.

IPOs in 2024 so far, an overview

Many new companies came to access primary market this year as market conditions remain upbeat and investor’s risk appetite is on positive side. Reforms like T+3 settlement for new issues and increased disclosure requirements bode well with investors. Overall markets are hoping for the Fed to start the rate cut cycle and expecting other central banks to follow the lead. Inflation is down significantly from previous year high and expected to fall further in coming months.

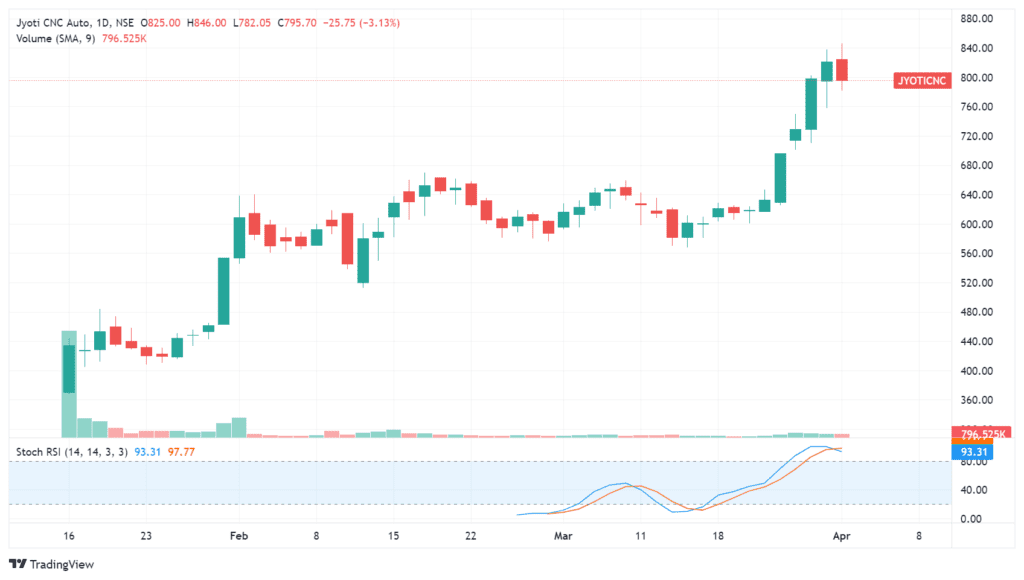

First IPO of the year- Jyoti CNC automation

Jyoti CNC Automation Limited is one of the largest CNC machine tool manufacturer of the nation. They have widespread product basket containing series of CNC machines, which includes Turning Centers, Turn-Mill Centers, Vertical Machining Centers (VMC), Horizontal Machining Centers (HMC), 5 Axis Machining Centers and Multi-tasking Machining Centers along with Industry 4.0 and Artificial Intelligence (AI) Solutions. It has a well establishes network in India with an installation base of more than 1,30,000+ machines across 60+ countries.

Jyoti delivers customized solutions to our customers across diverse set of industries including Aerospace and Defense, Automobile and Auto components, Agriculture, Die & Mould, Electronic Manufacturing Services (EMS), Infrastructure, Healthcare, Oil and Gas, Power, Railways, Space Research and other General Engineering industries. Company is having a well-established sales and service network across India and also sells the state of art products to France, Germany, Italy, Switzerland, Belgium, Portugal, Netherland, Romania, Turkey, UK, USA, Mexico, Canada and other African, Middle East and Asian countries with an installation base of more than 1,30,000 + machines across 62 countries.

Jyoti CNC IPO came on Jan 9, 2024 at the issue price of ₹331 and the issue size was ₹1000cr. The stock got listed at a price of approx ₹370 and today trades at ₹793. So, since listing(in last 6 months) sock more than doubled. It definitely is a hit 👍

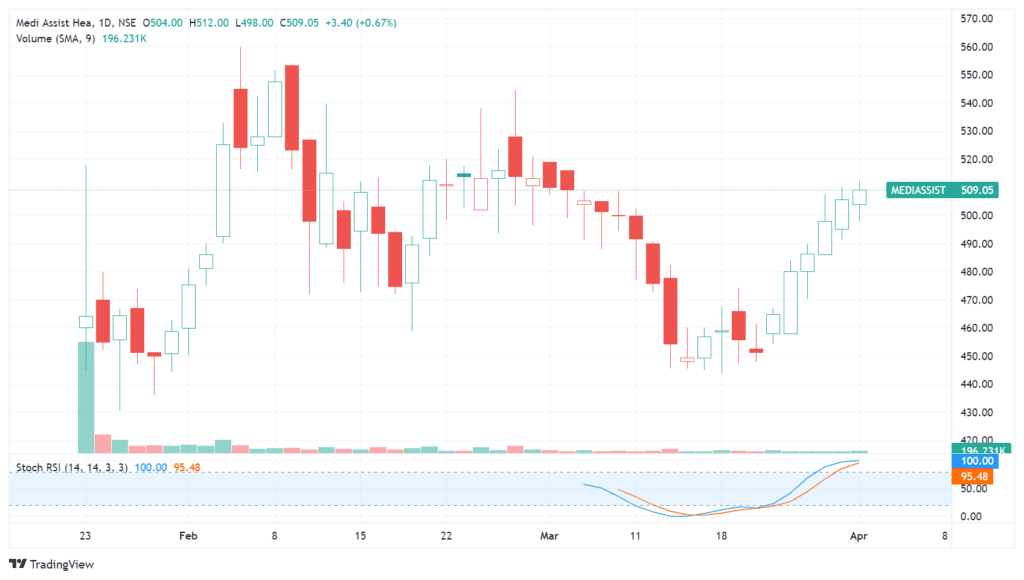

Medi assist healthcare services IPO

Medi assist was founded in 2000 provides third party administration services to insurance companies through its wholly owned subsidiaries, Medi Assist TPA, Medvantage TPA and Raksha TPA. Its Indian provider network comprises 18,000+ hospitals across 1,069 cities and towns and 31 states (including union territories) as on September 30, 2023.

Medi Assist partners with group accounts (employers) to administer their employee health insurance plans, in India. Additionally, it partner with Insurers to administer health insurance plans for retail customers (individual insurance Policyholders) and publicly funded health schemes (Government Schemes).

Company has nine Subsidiaries of which four are direct Subsidiaries and five are indirect Subsidiaries. Medi Assist TPA (subsidiary) is responsible for the majority of its sales contributing 89.87% of revenue. Medi assist launched its 1,171cr IPO issue on Jan 15 at at ₹418 and the stock debuted on exchanges at ₹450. Stock is currently trading at ₹509 so from listing it has provided a return of approx 20%. 👍

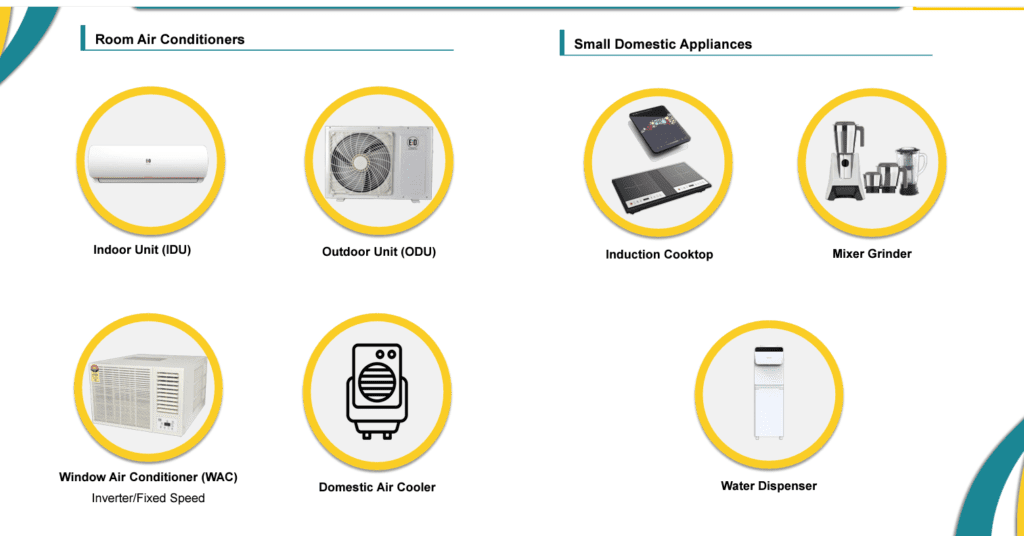

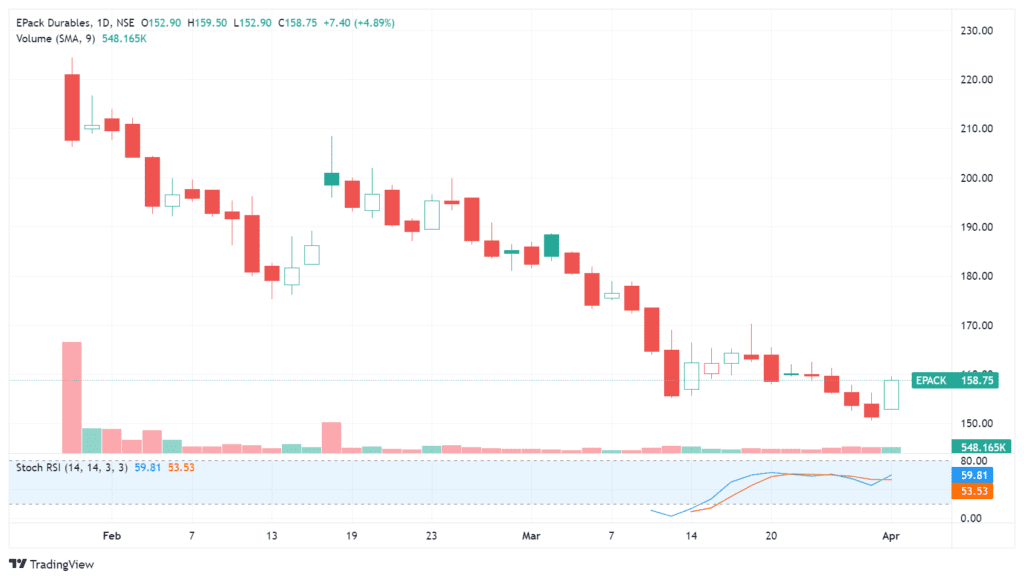

EPack durables ltd IPO

EPACK Durable is the second largest room air conditioner Original Design Manufacturer (“ODM”) in India, in terms of number of indoor and outdoor units manufactured in Fiscal 2023 through its ODM route. The expertise of EPACK Durable lies in manufacturing a diverse portfolio of Room Air Conditioners and Small Domestic Appliances (SDAs). It cater to all aspects of Room Air Conditioners and Small Domestic Appliances value chain, including extensive ODM/OEM services across our product line.

The backward integrated facilities are one of company’s main strength. The company has three manufacturing facilities strategically located in Dehradun, Bhiwadi, and Sri City.

Apart from above shown products, company also manufactures various small components like heat exchangers, pcb assembly, universal motors, induction coil, copper fabricated products etc. Company launched it’s 640cr of IPO issue on Jan,30, 2024 at a price of ₹230. Stock got listed on exchanges at negative to flat price range. Now stock is trading at ₹158 so since listing it has given a negative return of approx (-)30%, a flop show till now 👎

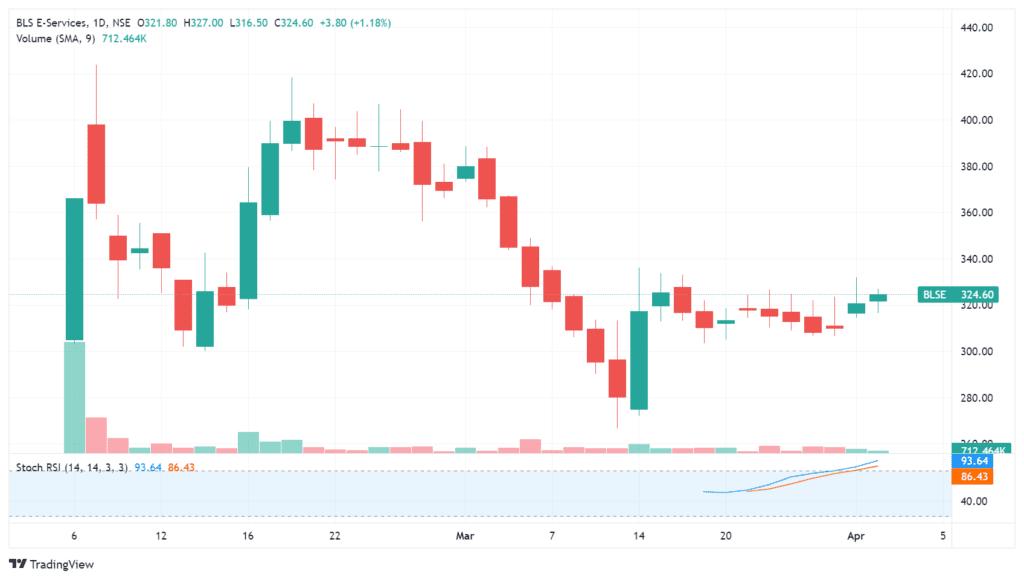

BLS E-services IPO

A small 310cr issue of BLS E-services opened for subscription on Feb 1 at a issue price of ₹135. BLS E-Services is rendering various citizen centric services in various states of India. BLS has developed its own dedicated, comprehensive and web-enabled services portal to access various services provided by the Government and Service partners. It provides end-to-end integrated solution to various services availed through this portal. By using BLS platform, various services of the Government can be availed at the click of a button. BLS also provides for online verification of various certificates issued by multiple Departments.

BLS is committed to provide Government to Citizen (G2C) & Business to Customer (B2C) Services to citizens through Common Service Centres (CSC) using digital platform that is prompt and effective which leads to saving of efforts and time of citizens. Various public services from different government departments are delivered through our CSC Centers close to doorsteps of the citizens.

BLS S-services IPO debuted on d-street by providing investor blockbuster return, it began its secondary market journey at ₹335 giving more than 2.5x return to those who applied and got the subscription of the IPO but after making a high of ₹400 stock corrected back to listing price and still trading in same range. Overall it’s hit IPO for those who got subscription but not for those who bought after listing. 👍

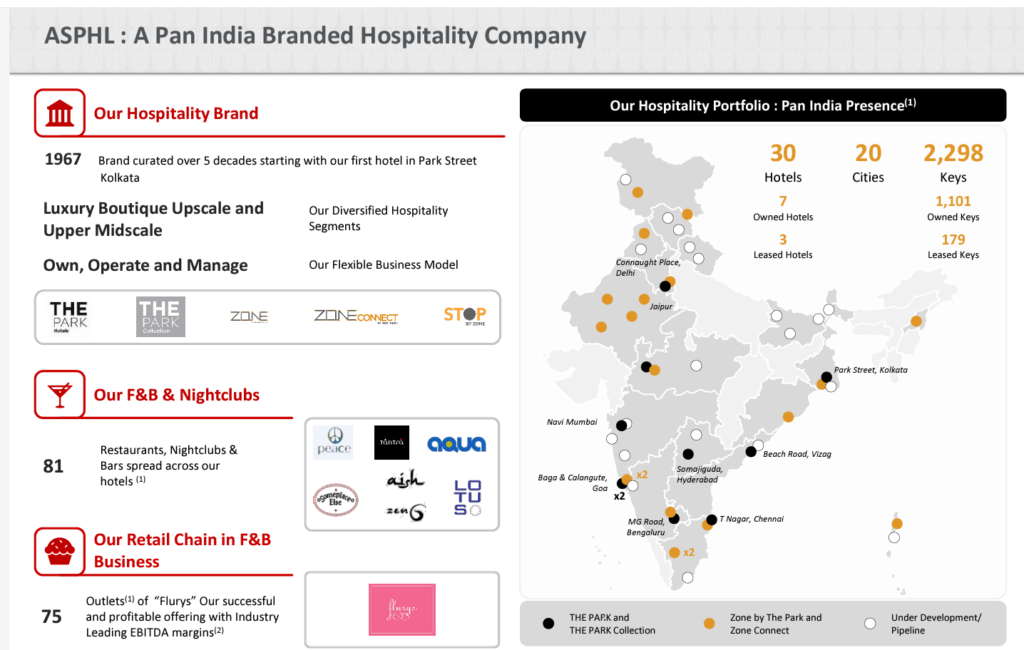

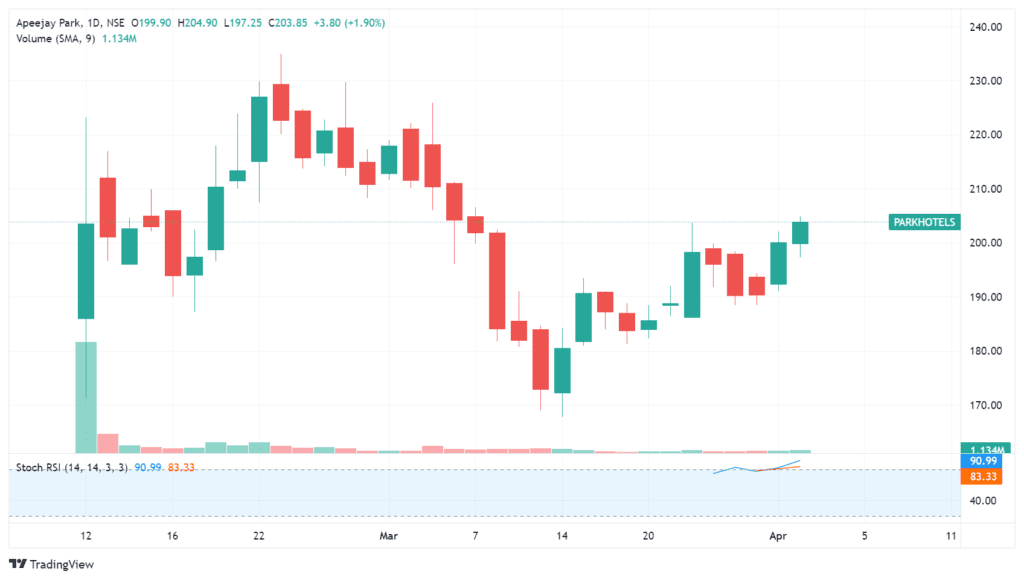

Apeejay Surrendra Park hotels IPO

1967 founded hotel chain which began it’s journey from Kolkata, “the city of Joy”. The Park opened its doors as India’s first luxury Boutique hotel. It took its name from the eponymous street in downtown Kolkata. The brand operates under the names, “THE PARK”, “THE PARK Collection”, “Zone by The Park”, “Zone Connect by The Park” and “Stop by Zone”. At present, ASPHL operates 30 hotels, including properties owned, leased, and managed, under five above mentioned distinct brands. Going by the asset ownership they rank as the eighth largest in India in terms of chain-affiliated hotel room inventory.

The IPO attracted strong interest across all investor categories as the issue was oversubscribed of 60x. ASPHL raised Rs.920 crore through the IPO, with a fresh issue of shares worth Rs. 600 crore and an offer for sale worth Rs.320 crore. Utilizing the IPO proceeds, the company repaid Rs. 550 crore in long term debt, elevating ASPHL to a net cash positive. The company is implementing various strategic initiatives including Emphasis on creating entertainment destinations within the business in urban centers, it has proven instrumental in sustaining high occupancy rates during weekdays and throughout weekends.

Against the issue price of ₹155, the stock began its secondary market journey by listing at ₹200 and still trading in a same range. Stock provided a listing day return of more than 35%. 👍

Other IPO’s that debuted in the last few months

| IPO name (issue size) | issue price(₹) | listing(₹) | CMP(₹) |

| Rashi peripherals (640cr) | 311 | 321(👎) | 336(👎) |

| Jana small fin bank(570cr) | 414 | 390(👎) | 424(👎) |

| Entero Healthcare sol(1600cr) | 1258 | 1225(👎) | 924(👎) |

| Juniper hotels ltd(1800cr) | 360 | 400(👍) | 509(👍) |

| GPT health care(525cr) | 186 | 214 | 182(👎) |

| Exicom tele systems(429cr) | 142 | 263(👍) | 208(👍) |

| R K Swamy ltd(423cr) | 288 | 262(👎) | 278(👎) |

| Gopal snacks(650cr) | 401 | 362(👎) | 358(👎) |

| Popular vehicles & services(601cr) | 295 | 288👎) | 257(👎) |

Conclusion

These 3 months of 2024 are somewhat mixed in terms of IPOs’ performance, with 14 major listings(issue size 500cr+) more than half debuted below their issue price and still trading below it. This exercise is to review the performance of recent D-street listings and examine the fear of euphoric IPO market. So there is no euphoria due to reasons ranging from market closely analyzing the company’s financial performance, valuation and also regulator’s crackdown on IPO financers in recent months.

Read more about our IPO coverage, click here.