EMC(Formerly known as Electrical Manufacturing Company Limited), once among India’s fastest growing EPC companies and a world-class provider of end-to-end power systems solutions across the world was up for sale through E-auction due to liquidation process under regulation 32A and 33(1) of the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016.

• While many were in race to acquire EMC Ltd but Salasar techno emerged as the highest bidder in the acquisition process. Company paid 1,780mn or 178cr for the acquisition.

• “We are pleased to announce that we have received an LOI for the acquisition of EMC Ltd. for Rs.

1,780 Mn, a strategic move that will strengthen our presence and position in the EPC industry,

underscoring our commitment to growth and innovation” said Salasar’s management in a exchange release.

Salasar acquiring EMC, what got us excited

A brief introduction of Salasar and EMC ltd-

What got us excited in this acquisition is the synergy that EMC’s assets will bring for Salasar, looking at EMC’s assets, its operations and expertise and revenue size pre things went southward era for the company, it can be said that it is a case of small fish eating a big fish. Its like EMC’s assets are made for Salasar as most of their operations are similar and jointly they will have a good chunk in this large opportunity size EPC(engineering, procurement and construction) market.

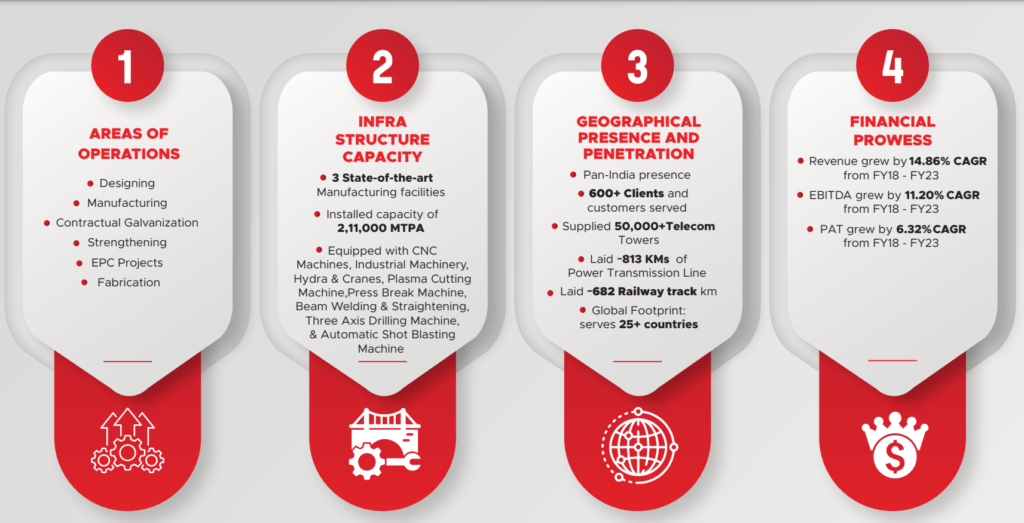

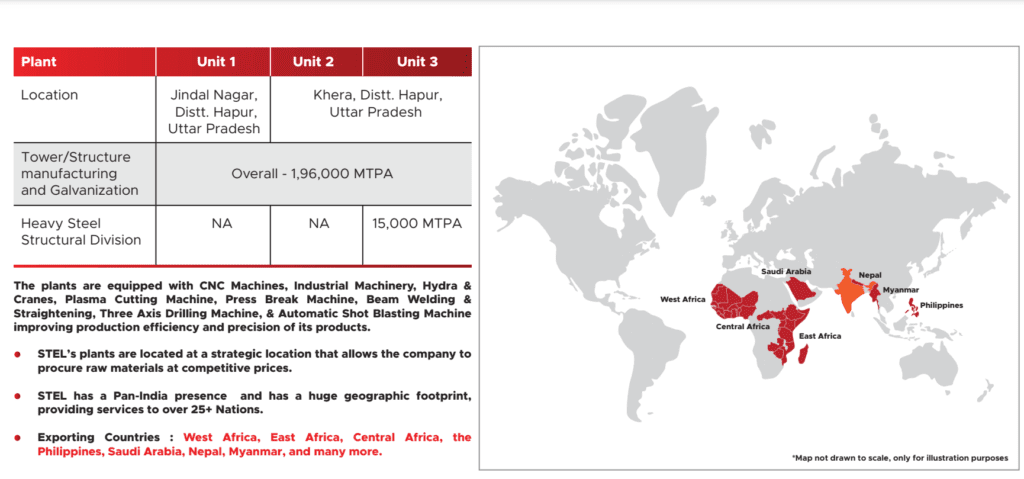

Salazar techno engineering Ltd is a prominent player in the field of providing engineering and infrastructure solutions, Established in 2006 as a tower manufacturer, Salasar Engineering Limited, has emerged as a fast-growing Steel structure manufacturer & EPC infrastructure company, providing services across telecom, energy and railways sector.

• The company provides 360-degree solutions through engineering, designing, fabrication, galvanisation, and deployment services for the telecom and solar sectors.

• The company is also engaged in erecting towers and transmission line towers in the EPC segment and provides steel solutions in India with global operations throughout Asia and Africa.

Revenue split for the company–

Manufacturing – Steel Structures and Others: 72% in Q2FY24 vs 65% in Q2FY23

EPC – Power Transmission: 23% in Q2FY24 vs 13% in Q2FY23

EPC – Railway Electrification: 5% in Q2FY24 vs 22% in Q2FY23

Now about EMC Ltd and how this acquisition is a big leap for Salasar

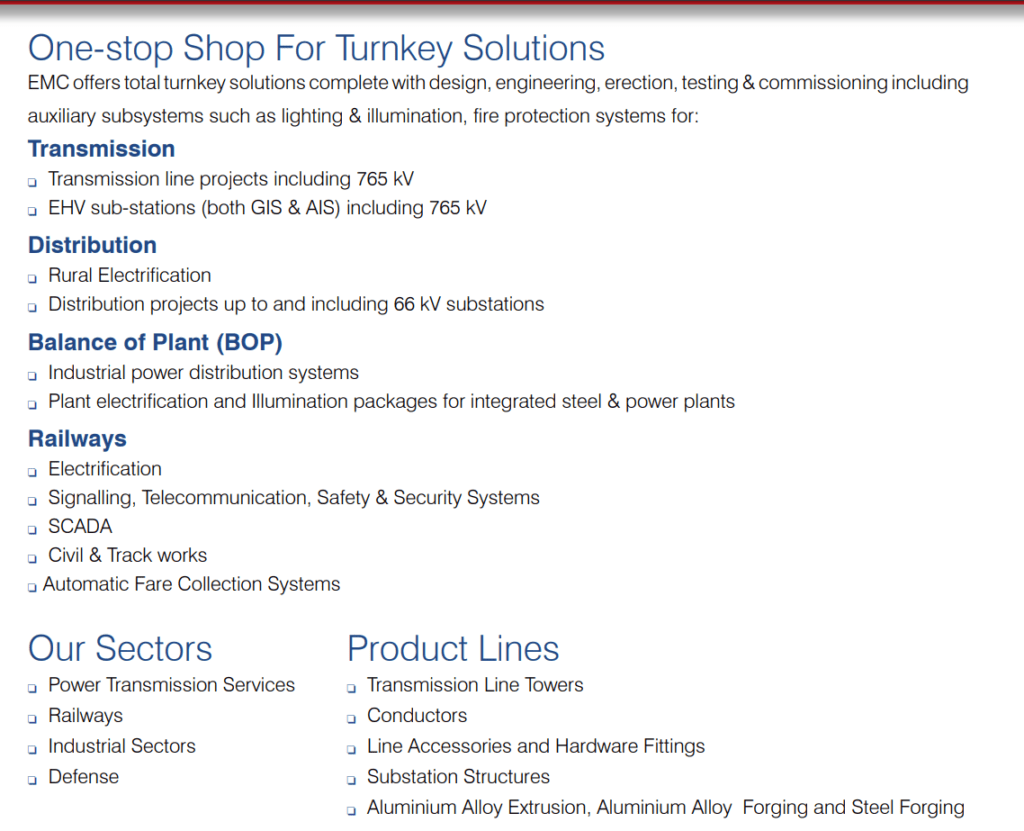

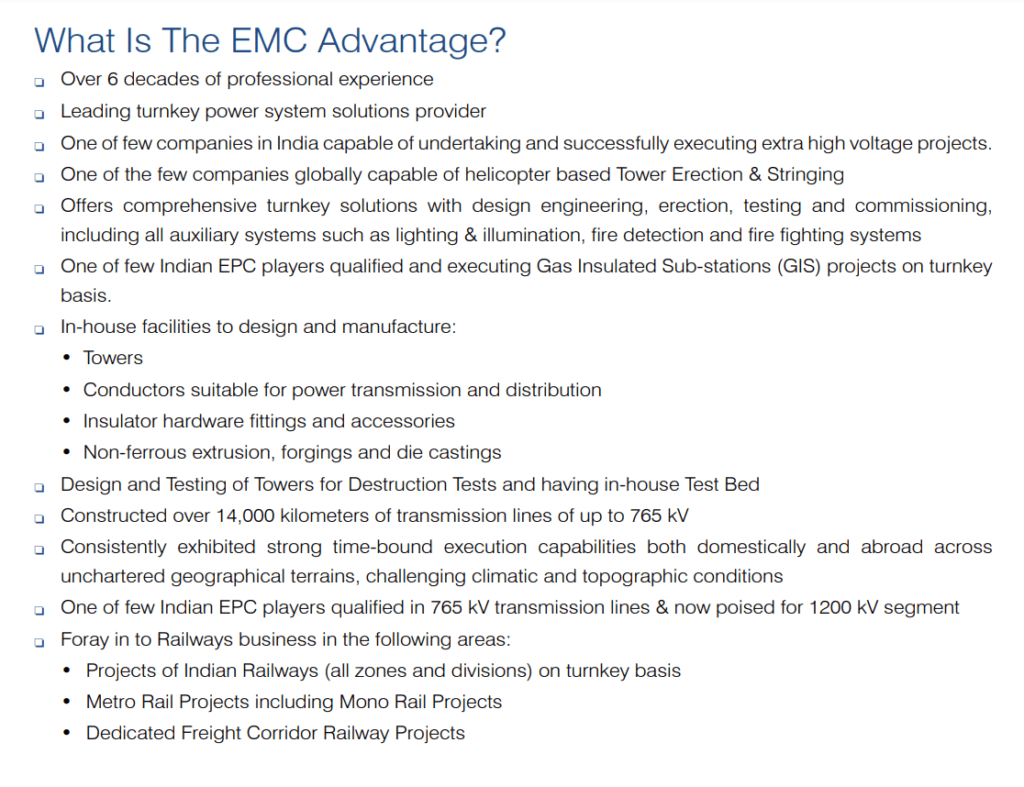

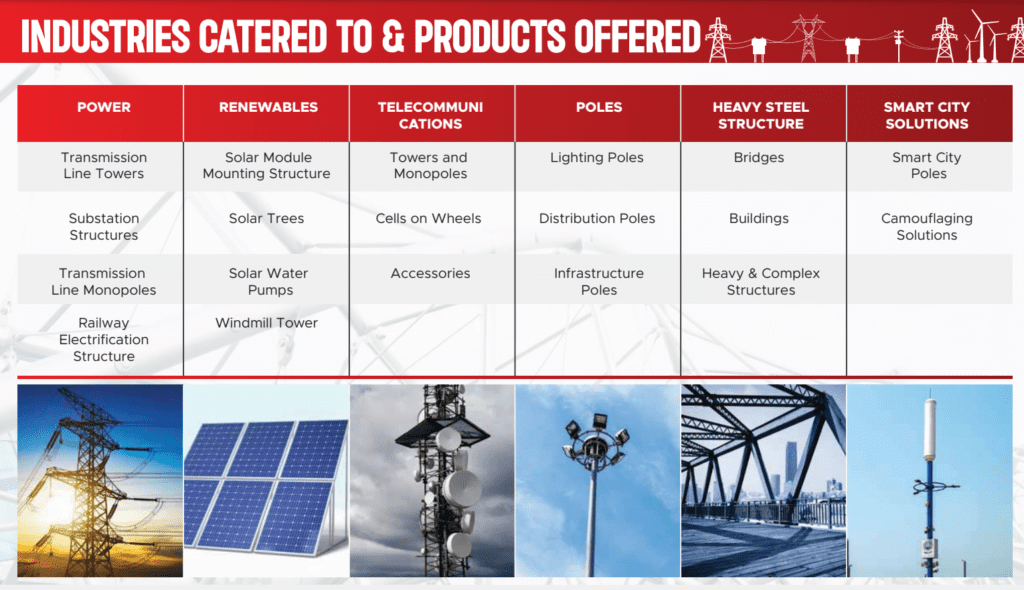

EMC Limited (Formerly known as Electrical Manufacturing Company Limited) with over five decades of experience is one of India’s fastest growing EPC companies and a world-class provider of end-to-end power systems solutions across the world. The company belongs to the elite group of companies qualified to execute 765 kV transmission line projects that offers complete turnkey solutions in the field of power transmission systems and associated sub-systems and now looking to enter 1200 kV segment.

• Transmission Line Towers

In India, the Company’s tower manufacturing facilities (upto 765 kV) are located in – Beliaghata, Kolkata – West Bengal, Raipur – Chhattisgarh and Naini (Allahabad) – Uttar Pradesh. In addition to this, the Company also has close associations with various Value Added Partners facilities who provide exclusive capacity to the Company.

• Tower Testing Station

Tower testing station is located at Naini, Allahabad and capable to handle tower testing up to 500 kV including destruction tests.

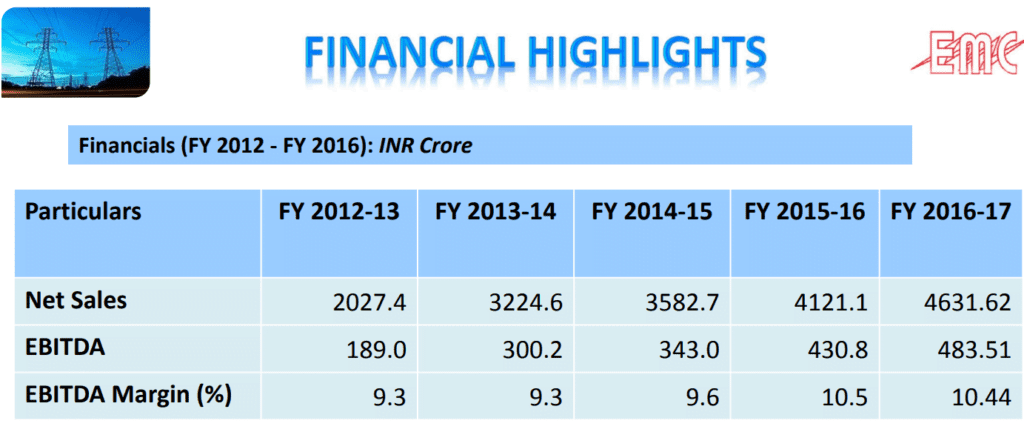

EMC was doing ₹4700cr sales in 2016-17 and ₹483cr of EBITDA with 10.44% EBITDA margin. I took 2016-17 figure because post that things started getting wrong for the company and its debt backed infra projects spending started causing trouble for it. Salasar is an ₹3000cr market company and will do approx ₹1200cr of sales in FY2024, so it is a big leap for Salasar to acquire EMC.

Synergy between both companies

This acquisition will present several advantages for Salasar, including:

› Enhanced Market Presence: The acquisition will strengthen Salasar’s foothold in the

EPC sector, particularly in the power transmission and substation segments, thereby

expanding its market reach.

› Enhanced Portfolio: With EMC Ltd.’s expertise in turnkey projects, Salasar can offer a

broader range of services to its clients, catering to their evolving needs

comprehensively.

› Operational Synergies: The synergies between Salasar and EMC Ltd. will lead to

operational efficiencies, cost optimization, and streamlined processes, enhancing

overall productivity and profitability.

Commenting on the acquisition Salasar’s top management said, “Through this acquisition, we aim to capitalize on the synergies between the two companies and leverage EMC Ltd’s expertise to enhance our service offerings. The addition of EMC Ltd’s capabilities will position us as a qualified bidder for executing 765 kV transmission line, substations, and industrial power system projects—a healthy margin business segment with limited competitors.

This strategic move enables us to meet the evolving needs of our clients more comprehensively and deliver unparalleled value in the power transmission and substation sectors.

Furthermore, this acquisition reinforces our commitment to strategic growth in the EPC industry especially in the power sector. We are confident that this strategic move will position us as a stronger and more competitive player in the market, enabling us to seize new opportunities and drive sustainable growth for our stakeholders.”

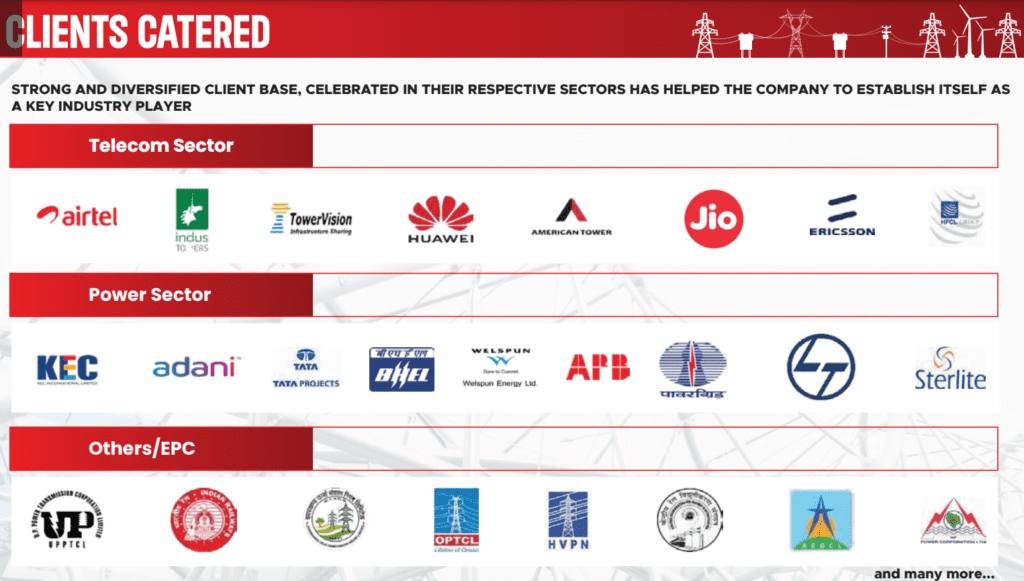

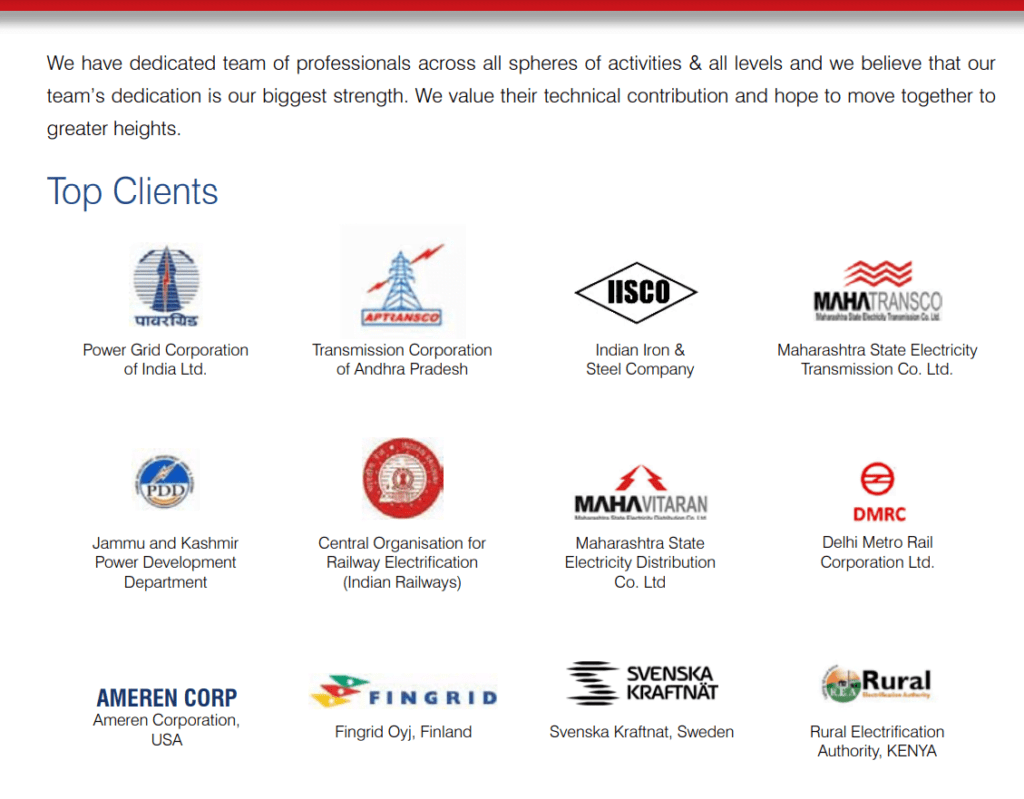

Apart from power and EPC sector this acquisition will help Salasar strengthen its presence in railway, complete tower solution and renewables sector. Both company served almost similar set of clients so post acquisition now serving them will be easy as they will get enhanced services under one roof.

Future outlook for the company

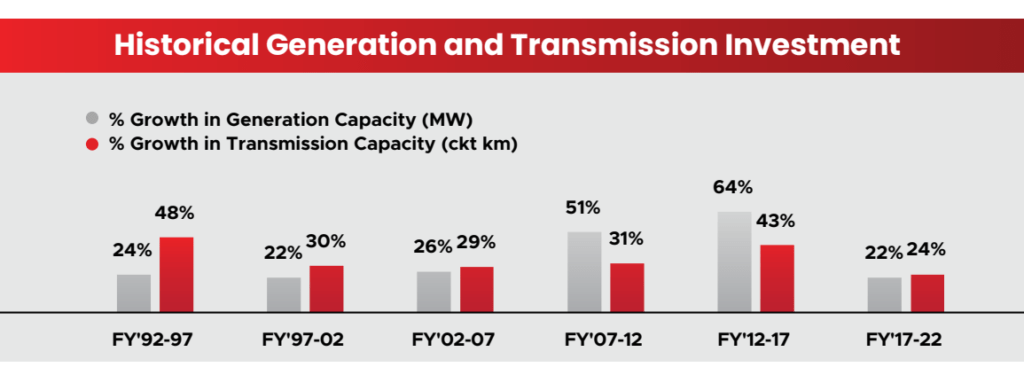

The government’s ongoing emphasis on infrastructure development creates opportunities for

the company to participate in major projects and contribute to the growth of the sector.

• With steel prices stabilized, the company can offer more competitive pricing to customers, potentially leading to increased market demand and sales.

• India is also the third-largest producer and consumer of electricity globally, and as per the Central Electricity Authority’s (CEA) estimates India’s power requirement will reach 340 GW by 2030, driving the need for modernization & upgradation of the existing power transmission and distribution system.

Power & energy sector in India is growing at a very fast pace due to increased urbanization and growing power demand. The government’s ambitious plan to achieve a capacity of 500 GW in non-fossil energy by 2030 is set to significantly bolster the renewable sector driving the demand for solar panels and windmills, creating ample opportunities for growth and expansion in the renewable energy industry.

• ICRA expects an investment of ~Rs. 2.7 Trillion over the five year period from FY24 to FY29 in the power transmission segment at an all India level and an estimated Rs. 6-8 Trillion of market opportunity is expected in transmission till FY29.

• As per the rolling plan (March’22) prepared by Central Transmission Utility of India (CTUIL) upto 2026-27 for Inter-State Transmission System (ISTS) envisages an investment of about ₹1,24,148 crore during FY 2023-27.

• Further, the Inter-Regional (IR) transmission capacity is expected to grow from present level of 1,12,250 MW to about 1,18,740 MW in next 2-3 years.

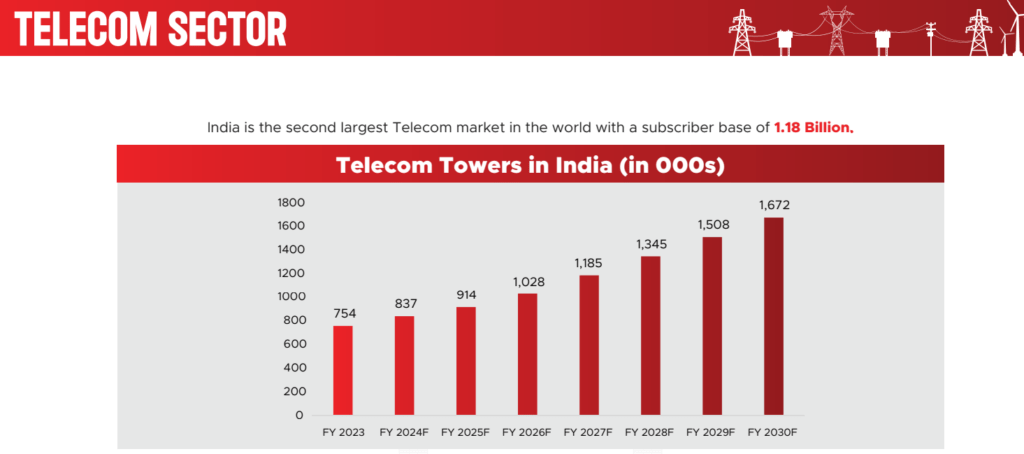

In Telecom tower segment as the rollout of 5G begins, demand for telecom towers in next 10 years is expected to be greater than in the last 25 years. India is the second largest Telecom market in the world with a subscriber base of 1.18 Billion.

• Total telecom tower base in India is expected to reach nearly 16.70 lakhs by FY 2030, from current base of 7.54 lakhs towers, this would result in addition of 1.30 lakhs towers per annum, up from current yearly addition of 60 to 70 thousand telecom towers per annum.

• Furthermore, the government’s commitment to strengthen the nationwide 4G infrastructure provides significant growth potential.

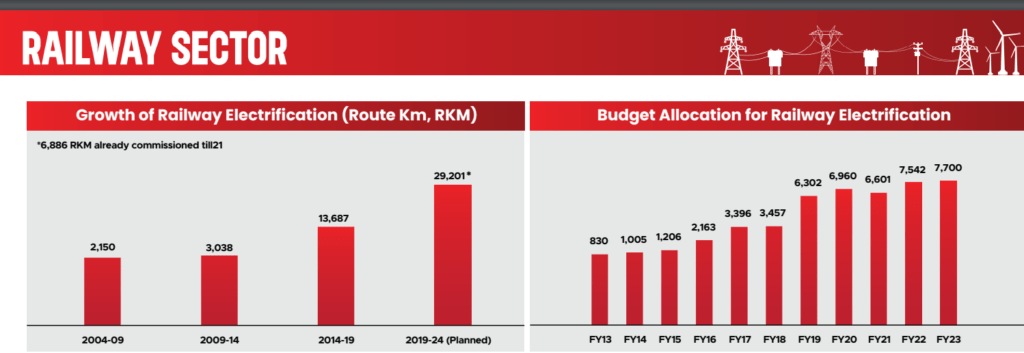

In Railway sector Within the allocated funds of 2.4 Lakh crore to the Ministry of Railways, a significant portion of 1.07 Lakh crore has been designated for CAPEX purposes.

• Close to 30 Billion units of electricity shall be required for railway electrification on annual basis by 2024 creating a massive opportunity for overhead line equipment suppliers to supply for the equipment like conductors, transformers, and distribution utilities.

• Sub-station capacity to enhance leading to opportunities for transmission and distribution utilities creating a multitude of opportunities for EPC contractors.

Salasar techno’s orderbook

Company’s order book was at ₹2325cr at the end of December quarter, few days back company informed exchanges that it has secured orders worth ₹1,033cr from Tamil Nadu Generation on and Distribution Corporation Limited (TANGEDCO), under this order company will provide turnkey services and development of distribution infra to 7 districts of Tamil Nadu. With this company’s cumulative order book stands at 3,358cr.

With the acquisition EMC Ltd, Salasar techno will now be able to bid for large contract value orders further expanding its current order book.

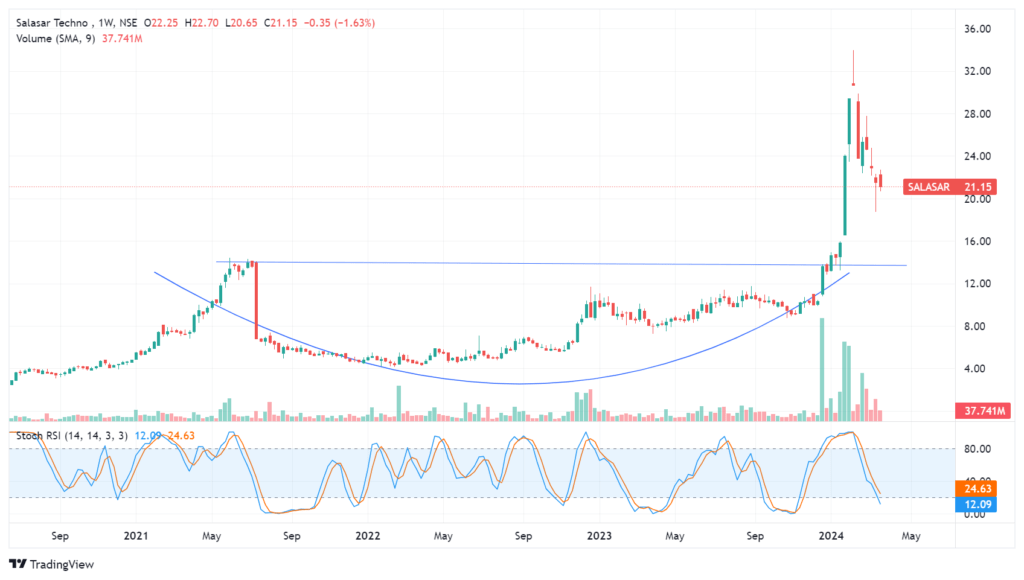

Stock of the Salasar techno is already up 3x in last one year. From ₹12 to ₹36 stock moved in one way direction in last few months but corrected back to ₹19 and now consolidating in the range of ₹19 to 22. Major support for the stock is on ₹15-16 range and resistance at ₹23.5(50 DMA of stock). Stock will turn bullish once it cross and sustains above its 50DMA.

Read more about Salasar tech

Read about Paytm saga, click here