• The 15% rally in NVIDIA drove the stock to USD 775 to an all time high for the stock. The company added a whooping $250bn in a day, for context India’s most valuable company Reliance’s total mcap is $241bn.

• The optimism is because of strong earnings that company is giving quarter after quarter. The AI chip leader is driving everyone’s attention due to its bumper earning this quarter.

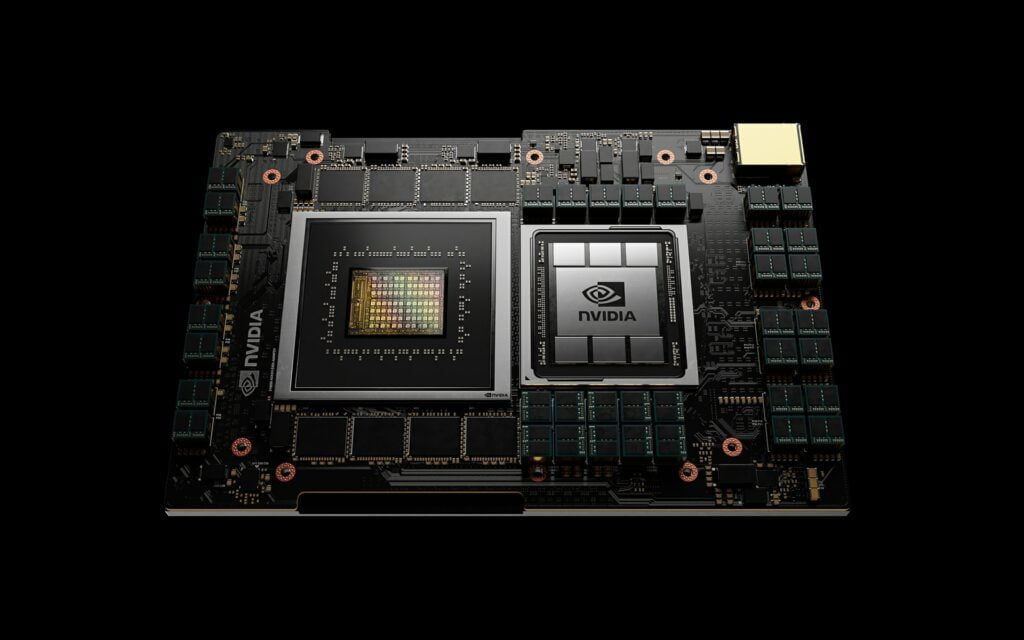

• Nvidia’s AI chips are in huge demand as they’re used to train the large AI models that companies like Meta, Microsoft etc are making.

A little about NVIDIA

The leader in gaming industry ‘NVIDIA’ powers many of the world’s most popular gaming PCs, its GeForce graphics processing units (GPUs) is a force to recon with. The company also sells its own gaming laptops, desktops, and peripherals under the GeForce brand.

Professional visualization: Nvidia’s Quadro GPUs are used by professionals in a variety of industries, including architecture, engineering, and media and entertainment, for tasks such as 3D modeling, rendering, and simulation. Company is a leader in VR, with its GPUs being used in VR headsets from a number of manufacturers.

Data center and cloud computing: Nvidia’s Tesla GPUs are used in data centers and cloud computing environments for a variety of tasks, including artificial intelligence (AI) training and high-performance computing (HPC). Company’s Mellanox networking products are used in data centers and cloud computing environments to provide high-performance networking.

Automotive: Nvidia’s DRIVE platform provides the hardware and software for self-driving cars. The company is working with a number of automakers on self-driving car projects.

AI and deep learning: Nvidia is a leader in AI and deep learning, with its GPUs being used for a variety of AI applications, such as image recognition, natural language processing, and robotics. Its ‘Tegra’ processors are used in a variety of mobile devices, such as smartphones, tablets, and gaming consoles.

Nvidia’s q4 earning and future forecast

- Revenue: $22.1 billion, up 22% from the previous quarter and a whopping 265% from the same quarter last year.

- Earnings per share (EPS): GAAP EPS: $4.93, up 33% from the previous quarter and a massive 765% increase year-over-year.

- Segment Highlights–

- Gaming: Revenue grew 22% sequentially to $2.49 billion, driven by strong demand for GeForce RTX 40 series GPUs.

- Data Center: Revenue soared 27% sequentially to a record $18.4 billion, fueled by growth in AI and HPC applications.

- Professional Visualization: Revenue increased 17% sequentially to $527 million due to continued demand for Quadro GPUs.

- Guidance–

- For the first quarter of fiscal year 2025, Nvidia guided to revenue of $24 billion, plus or minus 2%, This represents a 234% year-over-year increase and the it is way ahead than market expectations. Company predicts 76.3% of gross margin.

Jensen Huang, Nvidia’s co-founder and chief executive, commenting on future of AI chips said that an epochal shift to upgrade data centers with chips needed for training powerful A.I. models and it is still in its early phases. That will require spending roughly $2 trillion to equip all the buildings and computers to use chips like Nvidia’s. He further added, “Accelerated computing and generative A.I. have hit the tipping point,” and “Demand is surging worldwide across companies, industries and nations.”

What wall street brokers are saying about the stock

Wall Street is largely bullish on the stock of the US giant, and it received many target upgrades post-earnings release. The median price target on the stock rose 19% following the report.

| Name | Rating | Target price |

| Goldman Sachs | Buy | upgraded to $875 from $800 |

| Jeffries | Buy | upgraded to $780 from $610 |

| Bank of America | Buy | upgraded to $925 from $800 |

| UBS | Buy | $800 |

| JP Morgan | Overweight | $850 upgraded from $650 |

| Citi | Buy | $820 |

| Loop capital | Buy | $1200 |

Different perspectives on the stock

- Bullish: NVIDIA’s strong fundamentals and growth potential justify its high valuation. The company is well-positioned to benefit from long-term trends in AI, gaming, and data centers. Huge investment, time and significant effort is needed to launch chips as capable as Nvidia’s. Some of its key products which are used by giant tech companies are-

- Google uses custom-designed Tensor Processing Units (TPUs) for training large language models and other AI tasks. TPUs are specifically optimized for Google’s TensorFlow framework and offer significant performance benefits.

- Meta uses Nvidia AI chip for the Meta Training and Inference Accelerator (MTIA).

- Microsoft Primarily employs Nvidia GPUs, specifically the powerful H100 and H200 series, for training and running large language models like GPT-4. The high performance and extensive software support of Nvidia GPUs make them a valuable asset for Microsoft’s AI efforts.

- Bearish: Critics worry that the stock price is inflated and could be due for a correction. They point to the high valuation, competition, and potential for a broader market downturn as risks.

Know more about NVIDIA products

Risk Disclaimer: The information above is just for discussion, not trading advice. Please consult with a registered investment advisor before making any buy-sell decision.