In the latest ‘Adani Energy Solutions news’, co is taking great strides to have future-ready offerings. The company saw the biggest market cap erosion after American short seller Hindenburg released a report on the group alleging corporate governance issues. Though the group categorically denied any such allegations and later got a clean chit from India’s top court, most of the group stocks have made a smart recovery except two of the group socks. Let’s analyze improvements in Adani Energy Solutions financial conditions since the report came and big triggers that will work in favor of stock.

Adani group, the power-to-port to port conglomerate, has reduced its debt and promoter’s pledged shares to strengthen its balance sheet and has taken various other steps to consolidate its footing in the segments it operates. Due to these efforts, Adani Enterprise, Adani Ports, Adani Green Energy, ACC, Ambuja Cement, etc, are trading at par or above the range when Hindenburg released its report.

The stock of Adani Energy Solutions is still down 70% from an all-time high. Adani Energy Solutions is the largest private power transmission company, though current valuations may look stretched. But the company is betting big on sectors that are the future of the energy business, and the kind of plans they have for the future, revenues and profitability will surge. These will be possible triggers for these stocks to regain lost glory.

Adani Energy Solutions news and other updates

The Adani Group company is engaged in the power transmission and distribution business which includes establishing, commissioning, setting up, operating and maintaining electric power transmission systems in India. The company’s operations are primarily divided into two parts-

Power Transmission makes 31% of company’s revenue, in this segment Co operates various high voltage AC/DC transmission lines and substations. Power Distribution makes approx 62% of the company’s revenue, under this segment Co’s subsidiary & distribution arm, Adani Electricity Mumbai Limited (AEML), which is India’s largest private sector power distribution utility distributes electricity in Mumbai.

Company’s current project portfolio

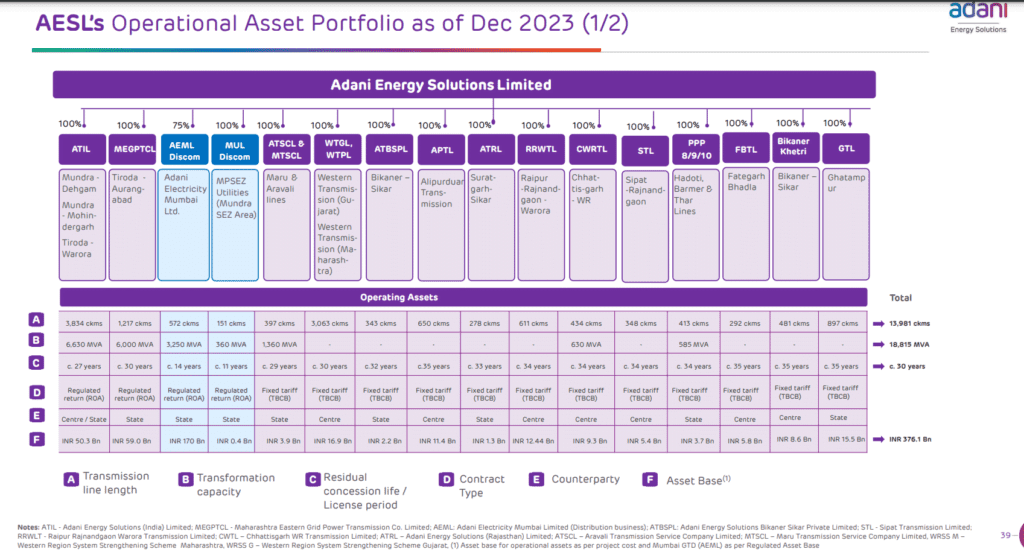

Adani Energy Solutions operates a transmission network of 21,187 circuit KM(including some under-construction assets) as of October 2024. Co’s operation efficiency is best in industry as distribution losses were the lowest (5.18% in AEML in FY24-25, down from 5.98% yoy). Co raised $1.1bn fund from strategic investors including QIA and GQG (₹3200cr from QIA and ₹6014cr from GQG at ₹1045/share).

With approx 21,000 ckm transmission network length, 30,000MVA transformation capacity, and 45,700cr asset base company’s operational asset portfolio is solid. Apart from that company’s under-construction portfolio in the transmission and distribution segment is also solid. In Adani Energy’s under-construction portfolio, there is a 3072 ckm transmission line and 21,571 MVA transformation capacity and 17,100 crore worth of asset base.

Post Hindenburg report release Adani group is constantly improving its debt profile. The company’s debt-to-equity ratio is at 2.93, down from 4.25 after Q3 last year. The company’s net debt to EBITDA stands at 3.8 in H1FY24, down from 4.2 in FY22.

Similarly, Co’s gross fixed assets are growing at a CAGR of 22% and stand at 46,934cr. Adani Energy Solutions is a power infrastructure company and operates in a high-working-capital-needs industry, so elevated debt is normal for the sector. Co’s cost of debt has reduced over the years, and the maturity period is up.

The company seeks a 25% market share in the mammoth smart metering segment

Adani energy solution is betting big on smart metering operations. The company’s smart metering orderbook is already at 22.8 million smart meters translating into a total order value of over 27,000cr. Company has long-term strategic tie-ups with Airtel, Esyasoft, and AdaniConnex to strengthen AESL’s smart metering platform and enable the smooth roll-out.

So what is a smart meter, how big is this market and how fast is it poised to grow?

Smart meter is an advanced electricity meter, which empowers consumers by providing real-time insights to optimize electricity usage and reduce bills. Smart meter communicates real-time, data-driven information, which allows distribution companies to better understand the grid management and consumption pattern leading to improved grid performance and quality of services to the customers. The shift to smart meters lays the foundation for a future smart grid infrastructure in India.

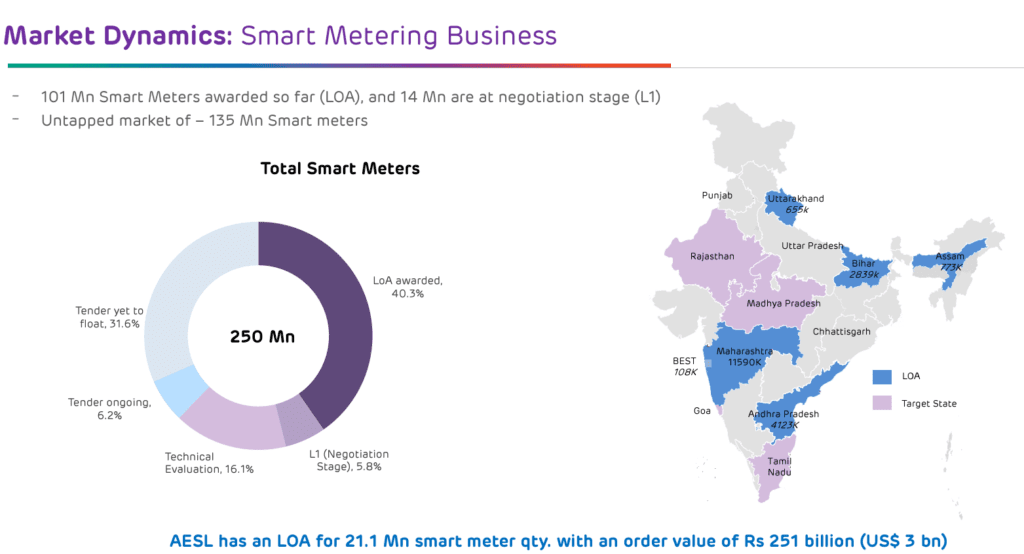

Adani Energy solutions is primarily in smart electricity meters as smart electricity meters roughly make 58% of total smart meters market. Though gas and water smart meters also represent a big segment(almost 30%) of the total market but company’s focus area is electricity smart meters. Adani Energy Solutions predicts smart meter market to reach $27bn( approx 2.2lac cr) as the government plans to install 250 million smart meters in India by the year 2026.

- In 250mn total orders, 101mn have been already awarded(40.3%) and approximately 14 Mn are at negotiation stage (L1, 5.8-6%)

- Till now, in 101mn total orders awarded Adani Energy Solutions won 21.1mn (approx 21%). The company wants to raise it to 25% for upcoming orders, a total market share of 25% is a very conservative target, In my view.

- Still an untapped market of 135mn smart meters in which Adani group is looking to bag contracts for approx 34mn smart meters comprising of $4.8bn (approx. 38,000cr) in value.

- So In 2026, Adani energy solution’s total order book from smart metering segment will be at approx $8bn (₹65,000 crore).

- In a very fast-growing smart meters market, Adani Energy Solution has initial movers advantage, also to complete the order fast and efficiently company has invested a lot in selecting the right tech partners across the value chain right from the meter manufacturer to HES and MDM (Head End System, Meter Data Management) systems, telco, the integration of software vendor, the cloud hosting service provider, and right up to the consumer app.

Adani Energy Solutions presence is in 5 states in smart metering segment and the company plans to widen it. Q1 was the first quarter for the co when it registered 76cr of revenue and 16cr of PAT from smart metering business, PAT margin was at 21%. In coming quarters revenue from this segment will grow significantly.

The company in its Q1 press release stated, “The new business segment is evolving well and will become sizeable in terms of contribution to AESL’s overall growth and profitability. It will offer massive synergies to the distribution business”.

Apart from smart metering, Adani Energy Solutions is betting big on cooling solutions through its wholly-owned subsidiary Adani Cooling Solutions Limited (ACSL), in the cooling solution system it plans to deliver centralized, energy-efficient, sustainable, and low-carbon cooling solutions through the development of the District Cooling System (DCS). ACSL aims to become a market leader in the DCS market by capturing 40% of the addressable market in India.

What is DCS?

- The rising temperature, coupled with the increasing demand for space in industrial & commercial budlings alongside the growing utilization of heat-emitting technical equipment has fueled interest in sustainable & energy efficient cooling solution.

- District cooling is the modern, centralized and energy-efficient way to air condition cluster of buildings. In a district cooling system, a central cooling plant supplies chilled water through a network of insulated underground pipelines to the buildings, through a heat exchanger absorbing heat from the buildings space and providing air conditioning.

- By aggregating the cooling needs of multiple buildings, District Cooling Systems (DCS) create economies of scale, this approach results in 25-30% reduction in primary energy consumption, leading to cost savings and reduced carbon emissions.

- Furthermore, unlike standalone AC systems that heavily rely on environmentally hazardous refrigerants, District Cooling Systems (DCS) utilize eco-friendly refrigerants by harnessing natural water sources such as lakes, rivers, and seawater for efficient heat rejection.

Industry Landscape

- District cooling in India is increasingly being considered a necessity by the government for urban master plans and smart city projects

- The India Cooling Action Plan (ICAP) estimates that India’s cooling demand will surge eightfold in the next two decades. This growth is fueled by the rising demand for space cooling, urban heat, government investments in smart and sustainable cities

- As per International Energy Agency (IEA), India will likely become the world’s largest consumer of space cooling by 2050, accounting for 28% of total electricity demand and 44% of peak load

- The surge in cooling demand mandates sustainable and energy efficient colling solutions for the commercial real estate, industrial, data centers, and airports

Stock price movement, valuation of Adani energy solutions

The stock is trading at a p/e of 97 (considering FY24 EPS as there were some one-offs from some asset divestment). The stock of the company is locked in a range after falling more than 80% from all-time highs after a report was released by Hindenburg. There are many gap areas to be filled so stock faces multiple resistances in its movement. The first hurdle for the stock is to cross 1150-1250 range until then it will remain trading between 888-900 on the lower side and 1100-1150 on the upper side.

Read more of our stock-specific research, click here