Dividend and share buyback, when companies offer them there is a lot of confusion among new investors whether they should participate in it. Here, I will try to provide information based on data that what should investors look before becoming a part of these corporate actions. With quarterly results companies announce dividends and share buyback to reward shareholders but should one purchase stocks just to get these? Lets find out

Dividend and share buyback, a little about them

Dividend

Distribution of profits by any company among shareholders is known as dividend. A profit or surplus of cash is distributed among shareholders as dividend to reward them, it can be portion of profit as companies re-invest rest in business to fulfil expansion project or other cash requirement of companies. Dividends are great way to create wealth by having a steady stream of income in long term and it is always good to have dividend paying stock in one’s investing portfolio but one need to be selective while choosing dividend stocks. Below are the points one should take care while buying stock for stable dividend income.

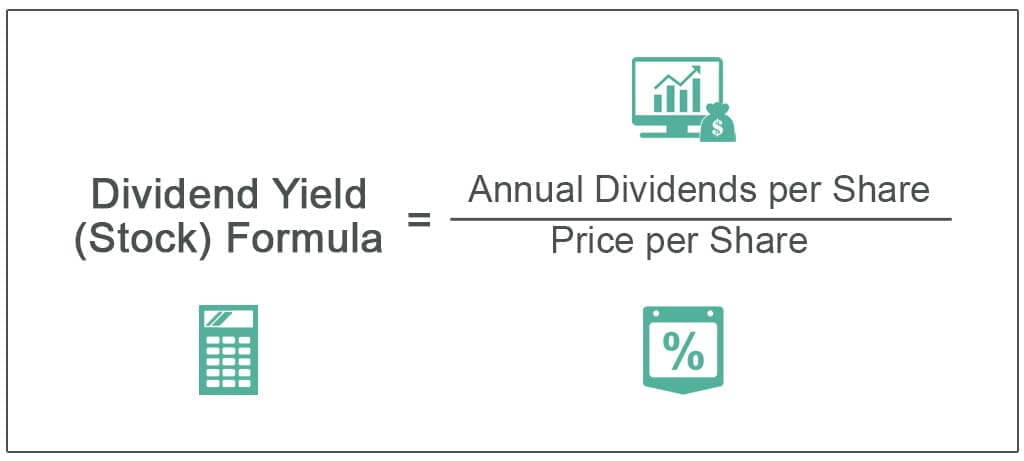

- Check for dividend yield, basically it is the ratio between current dividend of the company and company’s current share price. It implies how much income you can earn via dividend while investing in a stock. e.g. If you buy a stock which is trading at ₹100 and it pays an annual dividend of ₹5 then dividend yield is 5%.

- Differentiating between growth and value stocks, usually larger companies with stable income tend to pay dividend to their investors, while growth stocks that are expanding exponentially and rapidly growing their revenues and earnings tend to reinvest their cash in further expansion rather than paying dividends.

- It is wise to check a company’s fundamentals before investing in it for dividend. Higher yield may look attractive but not always good. Checking if company is generating strong profit/cash to pay it’s dividends or it is using reserve to do so. Higher yield may be due to promoter needing cash or company doing so to attract investors amid declining company fundamentals and if it is the case, it is a negative sign in such case yield is not sustainable unless the company turns itself around and continues to support elevated payouts.

What is a good dividend yield?

Experts suggest anything between 2.5% to 6% is good dividend yield. It should depend upon your investing goal and investment horizon. Even if you are an aggressive investor you should have at least few good dividend paying stock in your portfolio along with good growth stocks. For retiring or low-risk-taking investors the number of solid-yielding stocks should be more. Before investing you must look at yields of at least the past 10 years to get an idea of the sustainability of current yield.

Share buybacks

A practice where company purchases its own shares with it’s accumulated cash from their existing shareholder is known as buyback. Buyback reduces the number of outstanding share from the market as repurchased shares are absorbed by the company increasing the relative ownership stake of each investors. It can be done via tender offer or open market purchase. Buyback price usually is higher than the current market price.

In tender offer company puts an offer price to buyback it’s shares at that particular rate. Existing shareholders can tender their shares between an specified date and amount is credited to shareholders primary bank account.

In an open market offer companies openly purchases it’s shares from sellers through exchanges, this happen at a prespecified period and can last for months to ensure there is no significant price movement due to the sudden buying activity.

Why a company opt for a share buyback?

There are several reasons for companies to buy their own stock-

- To maximize the shareholder value – Share repurchase reduce number of outstanding share from market thus improving financial ratios. Repurchase reduces assets on balance sheet(cash) so return on asset(ROA) increases, it also reduce outstanding equity increasing return on equity(ROE) and investors see higher ROA and ROE as positive.

- Undervalued stock – Stocks may get undervalued due to many short term reactions e.g. bad results, change in management, any negative news flow regarding the company or general weakness in the market. In such cases, the company may find its shares undervalued and decide to purchase its own shares. Besides this, share buybacks also works as booster for investor sentiment as it show the confidence of company in itself presenting a positive picture of the company’s prospectus and on its current valuation.

- A tax effective option to reward shareholders – When company has excess cash and it is not going to use it in funding projects in foreseeable future, it may decide to reward shareholders instead of piling idle cash in bank account. In such case buybacks are a tax effective way for both, shareholders and companies.

- Sometimes companies use buybacks to reduce dilution caused by ESOPs (employee stock option plan), though ESOPs are are not very popular in India but it is gaining ground with startups issuing them to reduce wages in cash crunch situations. When the ESOPs are exercised it increases the number of share outstanding and reduces companies financial ratios. You can read about different types of ESOPs issued by Indian companies here.

Buyback reduces number of outstanding shares increasing Earning per share(eps) as net income tends to remain same but outstanding shares decrease post repurchasing and this increase the ratio significantly.

Best Dividend yield stocks

Large-caps

We are handpicking stocks with strong fundamental, positive brokerage view and consistent dividend pay out record because some firms pay large dividend to fulfil promoter needs and that exhaust cash flows to make regular pay out tough.

| Name | CMP | Div-yield(%) | Brokerage View Avg. Target | p/e | ROE(%) | 5y CAGR (%) |

| Vedanta | 275 | 24.33 | Buy H-551(100%) M-356(30%) | 9.5 | 20.4 | (-)4.13 |

| NMDC | 106.70 | 13 | Buy H-180(68.7%) M-139(30.6%) | 6.1 | 29 | (-)7.94 |

| ONGC | 165.5 | 6.5 | Buy H-225(36%) M- 183(11%) | 5.3 | 16.9 | (-)11.7 |

| Oil India | 256 | 5.66 | Buy H-339(32%) M- 282(11%) | 3 | 20.4 | (+)8.80 |

| Oracle Fin | 3551 | 6.34 | Buy 4000(12.63%) | 17 | 25 | (-)13.8 |

| Powergrid | 242 | 4.86 | Buy H-275(14%) M-245(1.5%) | 11 | 19.3 | (+)55.83 |

| Hcl Tech | 1095 | 4.4 | Buy H-1580(44%) M-1153(5.3%) | 20 | 23.3 | (+)134.87 |

| Piramal Ent | 726 | 4.3 | Buy H- 1139(57%) M- 1011(39%) | 9.1 | 5.7 | (-)70.17 |

| Hero Motocorp | 2605.9 | 3.84 | Buy H-3650(40%) M-2883(11%) | 18.6 | 17.2 | (-)28 |

| Bajaj Auto | 4538.9 | 3.08 | Hold H-5378(18%) M-4513(-0.5%) | 21.2 | 20.5 | (+)61.2 |

| Tech Mahindra | 1046.3 | 3.06 | Buy H-1300(24%) M-1101(5%) | 21.2 | 17.6 | (+)57 |

| ITC | 420.45 | 2.74 | Buy H-485(15%) M-432(2.7%) | 28.7 | 24.8 | (+)48.2 |

| Infosys | 1245.2 | 2.73 | Buy H-1900(53%) M-1515(22%) | 21.5 | 31.8 | (+)110.9 |

Above mentioned stocks have proven track record of giving consistent performance. I have provided dividend yield, brokerage target(high and median), p/e and 5year stock price CAGR.

Top dividend paying Mid and Small caps

Mid and small caps paying good dividend can be a icing on the cake scenario but careful evaluation is needed before making an investment decision. These are high risk-high return stocks due to their high nature of volatility, so here are trying to shortlist few of them that can present good investing opportunity.

| Name | CMP | Div-Yield(%) | Brokerage view Avg. Target | p/e | ROE(%) | 5y cagr(%) |

| Styrenix performance | 807 | 13 | NC | 5.9 | 37.0 | (-)8.61 |

| Banco Products | 270 | 7.4 | NC | 8.6 | 16.8 | 20.55 |

| Polyplex corp | 1404 | 7.4 | NC | 8.4 | 17.9 | 195.9 |

| Swaraj Engines | 1809 | 5.08 | Buy H-2000(10.5%) M-1887(4.3%) | 16.45 | 41.2 | (-)11.8 |

| Rites | 403 | 4.22 | Hold H-412(2.2%) M-367(-8.85%) | 17.7 | 21.1 | – |

| Glenmark life | 536 | 4 | Buy H-685(27%) L-603(12.4%) | 14.7 | 22.3 | – |

| Redington | 175 | 3.8 | Buy H-248(42%) M-207(18.3%) | 9.6 | 23.8 | 166.51 |

| Cosmo first | 645 | 3.6 | NC | 5.49 | 38.6 | 276.75 |

| RCF | 106.8 | 3.6 | NC | 5.7 | 16.6 | 44.5 |

| Manali Petrochem | 74 | 3.4 | NC | 10.3 | 47.1 | 117.7 |

| Ircon international | 79.2 | 3.1 | NC | 9.93 | 13 | – |

| Angel one | 1320 | 2.7 | Buy H-1825(39%) M-1678(28%) | 12 | 47.5 | – |

| Godawari Power | 367.6 | 2.7 | NC | 5.51 | 52.1 | 199 |

Companies with record of regular buyback

Cash-rich companies often take buyback roots to reward investors. Buyback prices are usually higher than the current trading price. It is also a means for companies to show confidence in its growth prospectus by setting a higher price for their shares. However the reason for the buyback should be thoroughly investigated before making any investment decision as sometimes companies may use it to inflate the share price.

Indian IT companies consistently engage in buybacks due to their high cash generation capabilities and low reinvestment requirements. Other companies also choose to buy back shares from time to time, mostly when they feel their shares are trading at a discount, and sometimes to consolidate their ownership of the company.

New tax rules for share buyback in union budget 2024

The recent budget introduced significant changes to the tax treatment of share buybacks in India, effective October 1, 2024. Earlier companies were subject to a 20% tax (plus applicable surcharge and cess) on the distributed income during a buyback but now the buyback proceeds received by shareholders are treated as dividend income and taxed according to their respective tax slabs.

Earlier shareholders did not face any additional tax on the buyback proceeds but now they will be liable according to their tax slab. Now the 20% tax on buybacks paid by companies has been abolished instead they have a new compliance burden as now they are required to deduct tax at source (TDS) on buyback proceeds at a rate of 10% for resident individuals and 20% for non-resident individuals 9same as dividend).

Now the buybacks are not as attractive for shareholders as it used to be earlier. Now the shareholders have to analyze the amount of benefit they get from participating in the buyback proceed, e.g. for investors in the highest tax bracket a low premium buyback will not be attractive.

Click here to read in detail about large cap Indian IT companies.

Disc: Stocks mentioned above are good dividend yield stocks with an extensive checkmarks passed but are not an investment advise, one should contact reg. financial advisor before making any such decisions.