Fed’s interest rate hike despite the US banking crisis 2023 shows the confidence of Fed in the banking system, as chairman Powell suggested that they have enough weapon to use if things go southward, let’s analyze why this hike can be a blessing in disguise for markets in the long run.

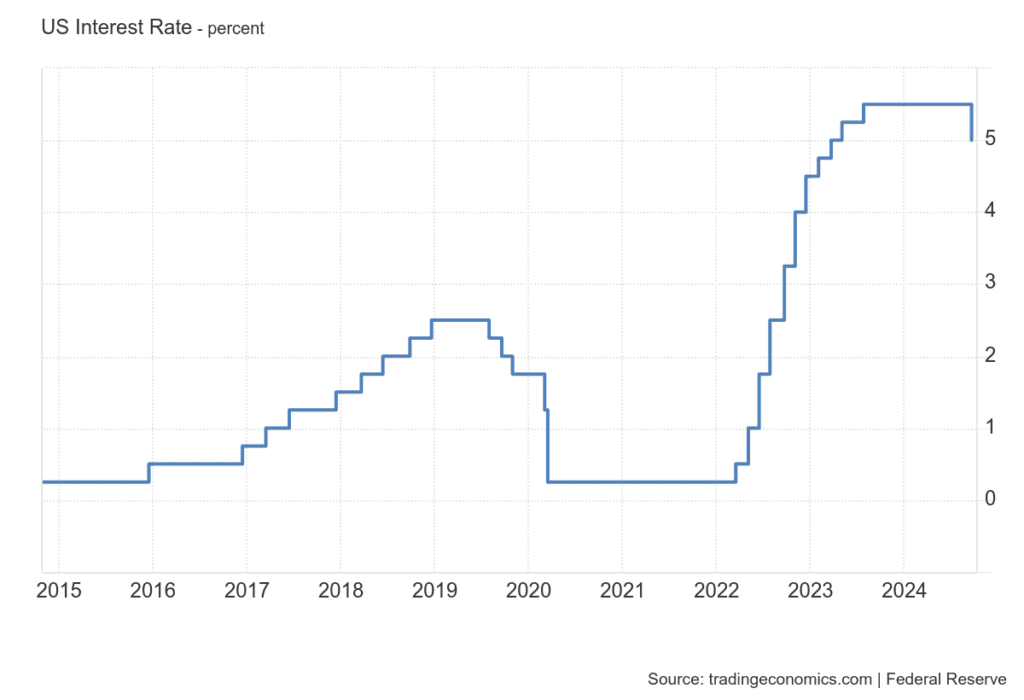

In recent policy meeting federal reserve members anonymously did an interest rate hike of 25 bps bringing rates to 4.75-5%. Many analysts including some very reputed ones were anticipating a pause as in the past few days many banks in USA are Showing signs of trouble and a few even filed for bankruptcy but the Fed decided to go ahead with a rate hike as stubborn inflation is still a bigger concern for fed.

Silicon valley Bank, the first bank to go broke in March 2023 was a surprise even for fed, chair Powell during a press conference said that after seeing SVB go burst, we were surprised. After SVB many small regional banks started showing signs of stress and the market was fearing contagion, many were comparing it to 2008 financial crisis which started with Lehman Brothers going broke, but this time both government and the fed seeing the severity of the matter reacted very quickly to rescue taking matter in their hand. The fed took several steps to calm investors, e.g. insuring depositors, providing dollar liquidity to banks etc.

Things were fragile in USA sending shockwaves to whole globe, markets were jittery, analysts were in process to analyze how deep it could be for US banks, simultaneously, credit Suisse issue happened in Europe, though CS was struggling with governance issues for quite some time but things got out of hands when Abu Dhabi based investors (one of the biggest investor of CS) denied providing any more help to the bank, his words of denial were enough to send shockwave through the markets.

CS was in a tight liquidity condition, but before CS problem could spill over it was rescued by the Swiss central bank and UBS(one of CS main competitors) by merging with UBS.

Now, let’s take a step back and analyze how things are going this bad for banks, it all Started in 2020 when covid pandemic hit the world, Covid ‘a problem like never before’ that paralyzed the Whole world be it developed or emerging. Extraordinary problems require competent solutions so going by the rule book central banks worldwide decided to go for QE(quantitative easing) bringing liquidity to the economies to maintain growth. In the process, central banks in developed economies brought interest rates to near zero, though the case was different for emerging economies.

Was there too much liquidity in the system?

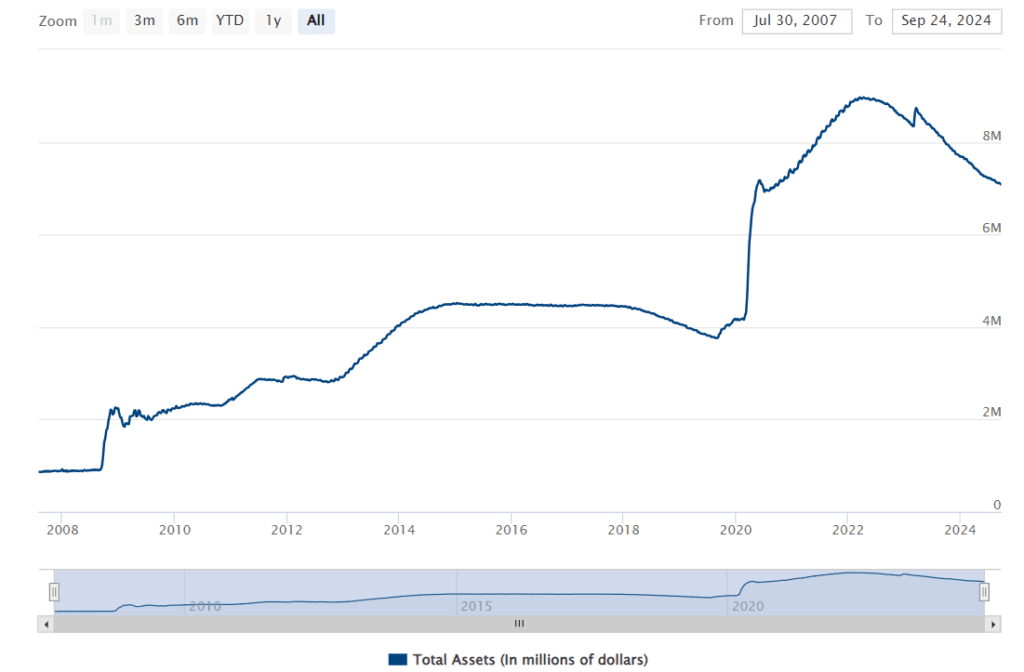

Infusing liquidity and reducing rates were the best option to support growth since the economies were stalled due to COVID-19. In the process fed expanded its balance sheet by almost 4 Trillion, that was too much cheap money in the system (cheap because lending rates were near zero), the situation was such that once there were very less daily wage workers to do the regular work as the monetary stimulus provided was higher than their daily wage.

In the start of 2020 Fed’s balance sheet was approx 4 trillion but it once covid strike happened it rose to almost 9 trillion with in a year. Such an amount of liquidity in the system was one of the reason that inflation rose to a decadal-high level. The peak of federal reserve’s balance sheet was in April 2022 when it announced quantitative tightening (QT) and now balance sheet stands close to 7 trillion.

This kind of rise in liquidity in the system and monetary benefits that govt provided the people stalled the work in factories causing a crunch in supplies. Supply was also disrupted due to the restrictions on trade routes in different parts of the world (due to COVID-19 restrictions). This created a huge gap between demand and supply. This was the time when covid situation started improving due to availability of various vaccines.

when restrictions started to ease pent up demand rose causing a huge surge in it but there was no or little supply against it. Usually, this kind of situation arises after every quantitative easing event. Gaps in demand supply, unavailability of labor, and restrictions on trade routes were enough to bring up the inflation. In the starting phase fed was convinced that inflation is “transitory” and would ease once supply bottlenecks open. Back then, the fed was seeing no rate hikes till 2024.

Then what went wrong?

Fed was right in it’s assumption, looking at different parameters inflation does seemed transitory but there was one event that no one anticipated, “change in geopolitics” or Russia Ukraine conflict, the world barely conquering a pandemic will go in a war was no one’s anticipation. Russia invading Ukraine and things moving bitter between China-US were the biggest cause behind already rising inflation.

From ‘transitory’ to ‘stubborn’, inflation rose as Russia-Ukraine region being the commodity capital of the world sent commodity prices skyrocketing, be it crude, natural Gas, metal or wheat prices, everything went through roof causing decades high inflation in many parts of the world. Such prolonged war after cold war ruined every equation for already stressed central banks around the world. Most central banks were forced to hike rates as early as 2022.

Also in earlier financial crises restrictions like COVID-19 were never faced, this time there was a complete lockdown for some time and a partial for another few months. During restrictions the world was shut so does the manufacturing and other key activities. Once the restrictions getting eased the velocity of pent up demand was like never before.

The remedial rate hikes, were they too much too fast?

Most central banks raised rates to tame inflation (to bring slowdown in economy), but rates rose too swiftly, and many experts blamed this for the rout in banking rector and fear of a deep recession rose its head simultaneously. when rates are raised too fast one can not provide the time needed for adjustments. Everything requires time to show its effect, once rates are rising cost of money rises too and higher rates shake the spending power of the public bringing slowdown in the economy.

Slow economy means less demand and low demand means fewer jobs needed (this forces companies to cut Jobs), this is the primary purpose of rate hikes but many believe rate hikes are being done in haste snatching adjustment time. for example, banks have their money invested in long-term bonds while they lent money for short terms and when rising rates made long-term bonds less attractive(though they were government bonds) and depositors came to take money, banks were forced to sell their long-term bonds at throw away price.

So the 2023 banking crisis was on their central banks?

The answer is mostly no, though rate hikes were the fastest in history but central banks warned beforehand that their inflation assumption was wrong and they will have to take extraordinary measures to control inflation before it get out of hand. Banks that fell were those that did a poor job of managing risk. They had no hedge to safeguard their depreciating asset and most of them were small banks. Their assessment of developing situation was poor causing them to suffer when things became tough. As the saying goes,” you must have an umbrella in the rainy season as no one knows when it will rain” but in this case they did not.

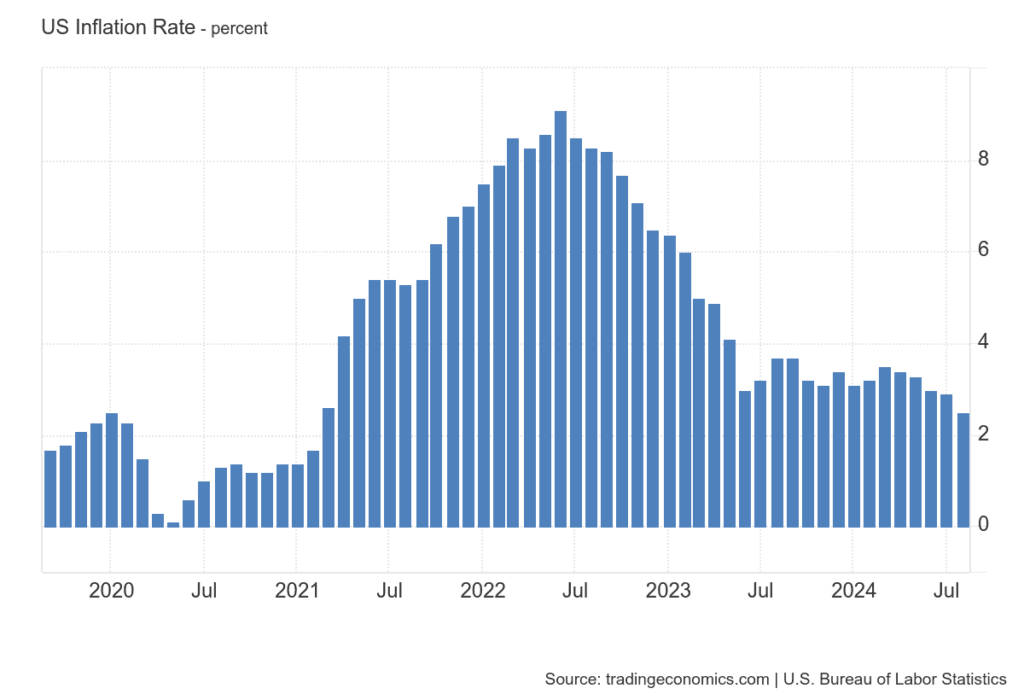

Fed did a good job in taming inflation

Inflation rose as high as 9.1% in the United States somewhere in June 2022, situation was grim back then as such high inflation was causing a widespread problem especially to low-income groups, there was a sense of uncertainty about Fed’s ability to effectively tackle inflation without bringing recession in the economy but Fed played well to bring inflation down to 2.5% in August 2024 without hurting economy too much. We already predicted 2 rate cuts in 2024.

The above graphs show how the severity of the situation. When the inflation was at 9.1% interest rates were 1.75%, then fed started raising rates and brought the rates to 5.25-5.5% due to this inflation fell to 3-3.5% but the fight saw many obstacles in between (geopolitics, supply chain etc). Fed kept the rates at 5.25-5.5% for more than a year to bring the inflation below 2% and when the inflation reached its lowest level in years to near 2.5% in August 2024 and a visible slowdown in labor market, Fed finally did a cut.

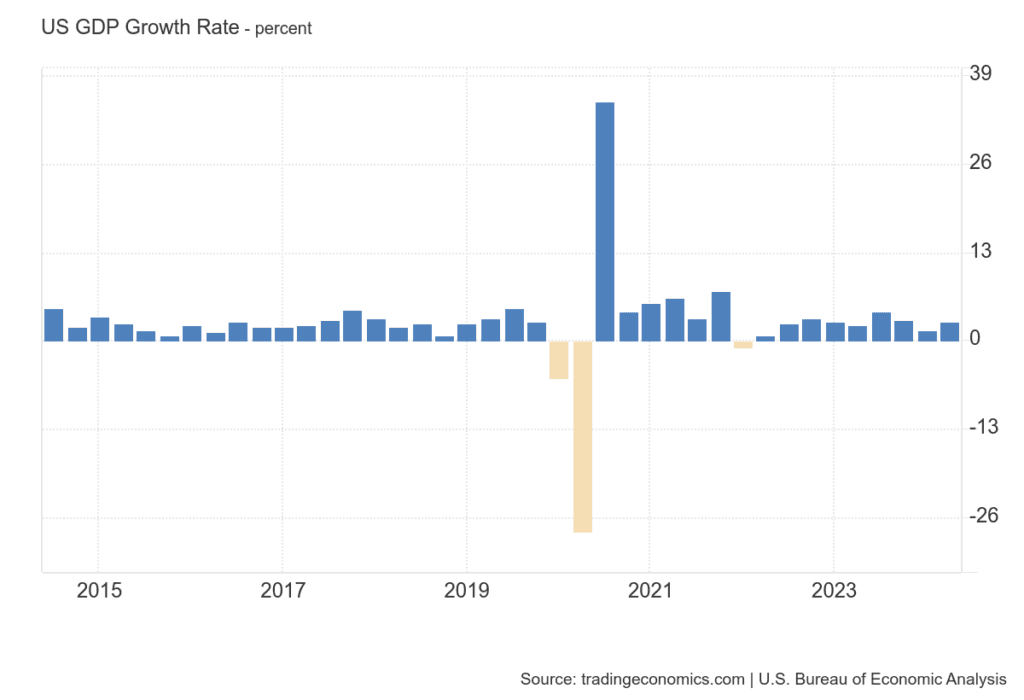

Fed in its recent policy meeting slashed rates by 0.5% or 50bps to balance out the growth as there were visible signs of slowdown in many sectors and chats of hard landing were getting pace. The timing of a cut was perfect as most of the institutional investors are assured of a soft landing and expect the US economy to remain vibrant. The good thing is in this fight there were only one period of negative growth in the US and this shows Fed managed the inflation situation well (though the fight is still not complete but now light on the end of the tunnel is visible).

Conclusion

Though the turmoil in banking sector remained high but the central banks and for the fact of the matter governments were proactive to avoid any catastrophe back then. Unlike in 2008 central banks acted within hours and Credit Suisse state-backed merger is proof of the same. Fed chair Jerome Powell in a press conference assured that they were keeping a close watch on the situation and fed was fully capable of stabilizing any turbulence that may have arisen. Fed’s inflation fight was well managed too giving confidence to the markets.