An act of bravery that made defense stocks fly high, India’s precision strike on Pakistan’s terrorist camps, launchpads, and hideouts to avenge the Pahalgam terror attack brought Pakistan’s unwarranted aggression into the picture.

India again replied with the utmost precision, targeting multiple Pakistani airbases and defense infrastructures. This decisive victory of India resulted from the domestic defense industry backing the Indian armed forces’ valor.

This, in return, brought global attention to Indian defense players and made defense stocks rally. Since the mutual understanding of the ceasefire between both countries after the Pakistani side requested India to do so, the Indian defense stocks have rallied up to 25%. Now, everyone in the country and outside wants a piece of them. My Focus on defense stocks is old, and today, I am discussing one such stock that has made investors rich and the country proud.

The name is Solar Industries. Solar Industries India Ltd stock is up 14x in less than 5 years, turning 1 lakh to 14 lakhs. The company has gained recognition in niche areas of defense and industrial explosives.

About Solar Industries India Ltd

Solar Industries is one of the largest domestic manufacturers of bulk and cartridge explosives, detonators, detonating cords, and components that find applications in the mining, infrastructure, and construction industries. The company manufactures high-energy explosives, delivery systems, ammunition filling, and pyros fuses for the defence sector. SIIL is rapidly growing its footprint in the defense market with niche products like drones, UAVs, ammunitions, bombs & warheads, and rockets and missiles.

✓ One of the World’s leading manufacturers of Explosives & Initiating Systems

✓ One of the most valued Explosives companies in the world

✓ Worldwide presence with 40 manufacturing facilities

✓ Global footprint in 82+ countries with manufacturing facilities in 9 countries

✓ First private sector company in India to set up an integrated facility for Defence products

like High Energy Material, Propellants for rockets, Warheads, and Rockets

✓ First private sector company to set up a complete integrated facility for Pinaka rockets

✓ First private sector company to receive a ready-to-use ammunition order from the Defence sector

✓ First private sector company to receive Defence export orders for ready-to-use

Ammunitions

✓ First private sector company to indigenously develop, receive & supply an order for a Drone

Based Loitering munitions.

✓ First private sector company to indigenously develop three new explosives, SEBEX-2,

SITBEX-1 and SIMEX-4

Solar Industries Portfolio

Industrial explosives

The company is a leading manufacturer of industrial explosives, e.g., non-permitted, permitted, and seismic explosives. Non-permitted explosives contain product lines like the Superpower series, the Solargel series, the Solar Prime series, and the Ecopower series. They are high-strength booster-sensitive packaged emulsion explosives suitable for use in most types of blasting applications using small, medium, and large diameter holes, and they represent the latest development in slurry explosives technology.

Permitted explosives contain the Supercoal series of products. The Company also has a vast variety of other explosives primarily used in defense and other similar industries. They are electronic detonators, non-electronic detonators, plain detonators, cord relay, cast booster, detonating cords, aluminium elemented detonators, etc. For example, electronic detonators are highly accurate, programmable at the site.

Defense product portfolio of Solar Industries

This is where Solar Industries stands out. Its progress in the defense sector is a story in itself, from a humble beginning to a preferred partner of our armed forces for sophisticated weapons like Pinaka rockets, loitering munitions, and other UAVs, bombs, warheads, and anti-drone systems.

In its drones and UAs portfolio, the company has loitering munitions like Nagastra 1, its advanced version Nagastra 2, Rudrastra (hexacopter), and recently introduced anti-drone system Bhargavastra. Also, the company possesses an array of weapons to weaponize drones.

The company recently demonstrated the capabilities of Bhargavastra, a hard-kill, low-cost anti-swarm drone system that is designed to counter growing drone threats in modern warfare. The micro rockets used in this counter-drone system underwent rigorous testing at the Seaward Firing Range, Gopalpur, achieving all designated objectives.

A Unified Solution for Countering Unmanned Aerial Vehicle Threats: ‘Bhargavastra’ boasts of advanced capabilities for detecting and eliminating small, incoming drones at distances of upto 2.5 km. It employs unguided micro rockets as the first layer of defence capable of neutralising swarm of drones with lethal radius of 20 meters and guided micro-missile (already tested earlier) as the second layer for pin point accuracy, ensuring precise and impactful neutralisation.

SDAL also informed the media that the system is modular and can have an additional soft-kill layer, including jamming and spoofing, to provide an integrated and comprehensive shield for all branches of the armed forces.

Apart from drones and UAs, the company also manufactures different categories of ammunition, e.g., multi-mode hand grenades, medium caliber, 81mm AT/AM smoke grenades, and a bund blasting device. Apart from that, SDAL also manufactures HMX, RDX, and TNT. It also makes different weight air bombs, torpedoes, and warheads for rockets and missiles.

Solar defense’s another major revenue source is its rockets and missiles portfolio. Under a different category of Pinaka rockets, it manufactures Pinaka MK1, Pinaka enhanced, and Pinaka guided. The Ministry of Defense in February placed orders worth 6,084 crore for Pinaka rockets, which include the supply of Area Denial Munition (ADM), Type-1 (DPICM), and High Explosive Pre-Fragmented (HEPF) Mk-1 (Enhanced) rockets respectively for PINAKA Multiple Launcher Rocket System (MLRS). SDAM informed that 86% of this contract is to be executed within 10 years.

Later, at the end of February, the company received another order worth 2,150 crore. It was an export order for different defense products and will be executed in another 6 years. Solar Defense has more than 13,000 cr worth of defense orders in hand, which will be executed in the next 10 years. The company has witnessed a staggering 1,300% rise in its order book in just one year, and the future growth (may not be of the same magnitude due to high base) is expected to be phenomenal.

Competitive Edge

Solar Industries is the only private Indian company licensed to manufacture warheads, giving it a clear competitive advantage. The company recently signed an MOU with the Government of Maharashtra to invest ₹12,700 crores over the next 10 years for a mega project focused on defense manufacturing.

The company’s leadership in UAs and loitering munitions (Nagashtra 1 and 2) gives it a clear edge over others. In the recent India-Pak conflict, Indian loitering munitions dominated the skies and destroyed the targets at will. Reports suggest that after this, the government is planning to fast-track the procurement of more loitering munitions, and a major chunk of orders may come to Solar Industries.

The company’s recent successful test of ‘Bhargavashtra’, the anti-drone system, presents a good revenue opportunity for it, as after the recent conflict, and with growing use of drones in modern warfare, a robust anti-drone system is a need of the hour, apart from domestic orders, these milestones will attract export customers for the company.

Valuation of the defense stock and Stock price outlook

Valuation is one of the concerns that may stop investors from entering the stock at current levels. At FY25 full year estimated EPS of 136-140, the company is trading at a P/E of 100-102, which is expensive. Even in terms of sales to market cap (FY25 full year sales E*), it is trading at a 16x, which is an outrageous valuation.

Though the valuation is expensive, the market is valuing the company as such, as there is no other private player with similar capabilities. With India aiming to become self-reliant in defense manufacturing, Solar Industries is a central player in the country’s defense ambitions. This transformation is backed by both domestic and international tailwinds.

The growing need for ammunition and weapon systems amidst global geopolitical tensions offers a long-term growth opportunity. Solar Industries’ orderbook will keep growing, as a result, the company will see a 25-30% topline growth in the coming years, and it will maintain the OPM of 25+%.

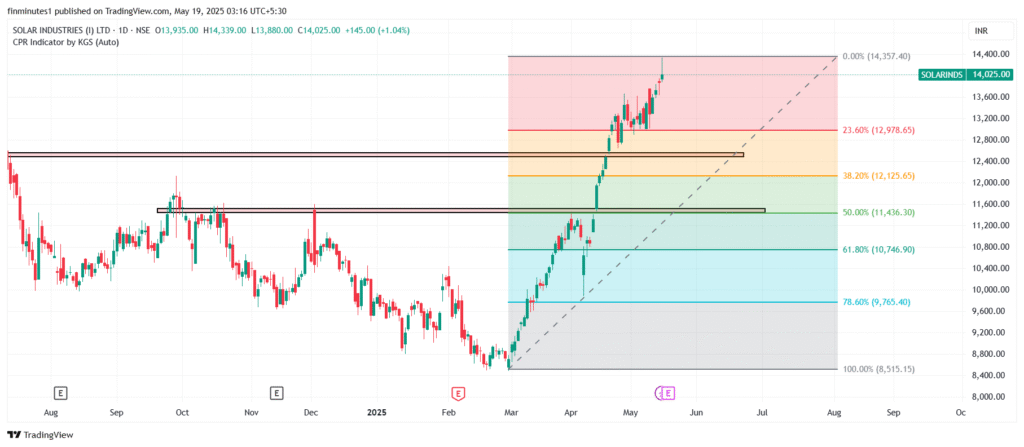

Instead of buying at current levels, investors should look for an entry opportunity in the 11500-12500 range (a strong support range for the stock if it cools off after the recent rally), which will also coincide with the 50% Fib retracement (if the stock falls from current levels, exhaustion at current levels is visible due to formation of shooting star candlestick pattern but confirmation is required ). Please note, levels are based on the chart and not a trading or buy/sell advice.

On more of our stock research, we have recently done a detailed analysis of Eternal (parent company of Zomato), do read.

Conclusion

While valuation may be stretched at current levels, Solar Industries is a company worth watching. A glowing example of private sector participation in India’s defense industry, Solar Industries is positioning itself as a crucial player in the future of India’s military-industrial complex and the global defense ecosystem.

The company’s proven track record, combined with its ambitious product pipeline and favorable macro trends, paints a compelling growth story. For investors seeking exposure to a high-potential defense stock, Solar Industries presents a unique opportunity. Apart from making the country proud, the company has made investors rich in the past, and it will keep doing so in the future.